Global Market Insights - Malaysia

Malaysia continues to present a compelling narrative for global investors, underpinned by a resilient economic framework and a dynamic property market. As we move through 2025, understanding the interplay between macroeconomic stability and real estate trends is crucial for making informed investment decisions. This guide synthesizes high-authority data from key national institutions to provide a clear, data-driven perspective on the opportunities within Malaysia's real estate sector.

Table of contents

- What Will You Learn From This Country Investment Guide?

- What Makes Malaysia an Attractive Investment Destination?

- How is the Economy in Malaysia Performing Right Now?

- What's Happening in the Malaysia Property Market in 2025?

- How Much Can You Earn from Property Investment in Malaysia?

- Where Are the Best Places to Invest in Malaysia Right Now?

- What Do Our Local Experts Say About the Market?

- Can Foreigners Buy Property in Malaysia? What Are the Rules?

- Tools, Tips & FAQs for Foreign Buyers

- Frequently Asked Questions

Key takeaway

- Malaysia remains a stable and promising market for property investment, supported by a growing economy, strategic location, and government openness to foreign ownership.

- Urban hotspots like Kuala Lumpur, Johor Bahru, and Penang offer solid rental yields (4% - 6%) and strong long-term ROI potential.

- Infrastructure projects such as the Johor Bahru - Singapore RTS and mass rail lines continue to drive demand in key corridors.

- Foreign investors can legally own property, with clear guidelines and lower entry costs compared to neighbouring countries.

What Will You Learn From This Country Investment Guide?

This guide provides a comprehensive overview of the key factors shaping Malaysia's investment landscape. You will gain insights into:

- The core economic strengths that make Malaysia an attractive destination for capital.

- A detailed analysis of Malaysia's current economic performance, including GDP, inflation, and labour market statistics.

- Potential returns on investment, including a look at gross rental yields in key locations.

- Expert analysis on the best places to invest and what our local specialists are seeing on the ground.

- A clear, simplified explanation of the rules and processes for foreigners looking to buy property in Malaysia.

What Makes Malaysia an Attractive Investment Destination?

Malaysia's appeal is built on several foundational pillars that assure investors of stability and growth potential. The nation has successfully navigated global uncertainties by leveraging its robust domestic economy and strategic development policies.

A. Stable Macroeconomic Environment

Over the past five decades, Malaysia has transformed from a commodity-based economy into a thriving manufacturing and service hub. This evolution provides a stable foundation for growth. Projections for 2025 show the economy expanding by a healthy 4.0% to 4.8%, supported by resilient domestic demand and continued realization of multi-year infrastructure projects.

B. Low, Predictable Inflation

A key indicator of economic health is a nation's ability to manage inflation. Bank Negara Malaysia has demonstrated a firm hand, with headline inflation projected to remain moderate, averaging between 1.5% and 2.3% in 2025. This controlled environment, driven by moderate demand and cost conditions, provides the predictability that long-term investors seek.

C. Healthy Labour Market

A strong labour market is the engine of domestic demand. In July 2025, Malaysia's labour force participation rate held steady at 70.8%, while the unemployment rate remained low at 3.0%. Favourable labour conditions and positive income-related policy measures continue to underpin private consumption, directly fueling the housing market.

D. Competitive Currency

The Malaysian Ringgit (MYR) has shown resilience and appreciation against the currencies of major trading partners. The Ringgit strengthened by 5.1% against the US dollar in the second quarter of 2025, driven by Malaysia's favorable economic prospects and ongoing structural reforms. A stable and competitive currency is vital for protecting the value of foreign investments.

E. Clear Ownership Framework

For international investors, clarity is key. Malaysia offers a transparent and welcoming environment for foreign property ownership. Foreigners can purchase most types of residential and commercial properties, subject to state-set minimum price thresholds. This transparent conveyancing process, coupled with the widespread availability of English-language contracts and a professional ecosystem of agents and lawyers, makes investing in Malaysia straightforward and secure.

How is the Economy in Malaysia Performing Right Now?

The economic data from the first and second half of 2025 paint a picture of steady, resilient growth, reinforcing Malaysia's position as a stable investment destination in Southeast Asia.

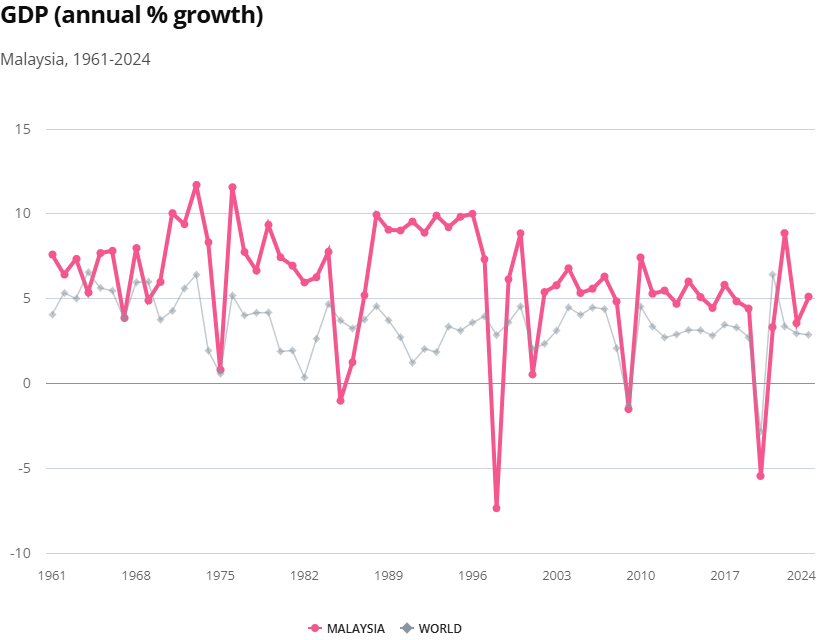

A. GDP Growth

The Malaysian economy expanded by a consistent 4.4% in both the first and second quarters of 2025. This growth was primarily driven by robust domestic demand, particularly higher household spending supported by a positive labour market, and stronger investment activities.

B. Inflation

Headline inflation remained moderate, easing to 1.3% in the second quarter of 2025. This moderation was largely due to lower prices for fuel and slower price increases for food-related items. The national inflation rate for July 2025 stood at a controlled 1.2%.

(Graph reference: World Bank)

C. Unemployment

The labour market continues to improve, with the unemployment rate declining further to 3.0% in July 2025 from 3.3% a year prior. The number of employed persons continued its upward trend, reaching 16.95 million, a clear indicator of a thriving job market.

What's Happening in the Malaysia Property Market in 2025?

The real estate sector is reflecting the country's strong economic fundamentals with increased activity and a strategic recalibration of supply to meet current demand.

A. National Momentum

The residential market showed impressive dynamism in the first half of 2025, with over 115,000 transactions recorded, valued at RM58.1 billion. This represents a significant 7.4% year-on-year increase in value. Demand is heavily concentrated in properties priced below RM500,000, and terrace homes continue to be the backbone of market activity.

B. Supply Realignment

Developers are strategically adjusting to market needs. In Q1 2025, residential completions fell to 3,614 units, while new construction starts rose significantly to 14,761 units. This shift from completion to initiation signals a market that is building for future demand rather than speculative oversupply.

C. Serviced Apartments

There has been a conscious pullback in the serviced apartment sector to close the supply-demand gap. Q1 2025 saw only 356 completions against a new planned supply of 498, indicating a disciplined approach to market absorption.

D. Kuala Lumpur Deep Dive

The subsale market is the primary engine of activity in the capital, with 9,633 subsale transactions in the first half of 2025. Rents are also on the rise, with the Kuala Lumpur average rent reaching RM2,901, a 6.1% year-on-year increase. This is well above the national average of RM2,020. The launch of only 12 new projects in H1 2025 signals a developer focus on "quality over quantity."

E. Klang Valley Insights

While 92% of the unsold overhang in the Klang Valley sits in high-rise properties, demand for the right high-rise product remains strong. Transacted volume and value for high-rise properties still grew by 7% and 19% year-over-year, respectively, where there is a strong product-market fit.

F. Key market tables

Table A: Malaysia residential pipeline (NAPIC) IQI Global

| Quarter | Completions | New Starts | New Planned Supply |

|---|---|---|---|

| Q1 2025 | 5,494 | 5,458 | 5,164 |

| Q2 2024 | 10,024 | 4,905 | 8,147 |

| Q3 2024 | 11,160 | 18,601 | 10,096 |

| Q4 2024 | 7,072 | 10,047 | 16,698 |

| Q1 2025 | 3,614 | 14,761 | 4,024 |

Metric 1

Metric 2

Metric 3

Metric 4

Metric 5

Table B: All-sector construction pulse IQI Global

| Quarter | Completions | New Starts | New Planned Supply |

|---|---|---|---|

| Q1 2025 | 7,168 | 21,391 | 11,024 |

| Q2 2024 | 24,404 | 20,164 | 29,481 |

| Q3 2024 | 23,749 | 32,233 | 32,103 |

| Q4 2024 | 26,814 | 32,448 | 27,853 |

| Q1 2025 | 9,329 | 28,344 | 8,342 |

Metric 1

Metric 2

Metric 3

Metric 4

Metric 5

Table C: H1 2025 market snapshot IQI Global

| Indicator | H1 2025 |

|---|---|

| Residential transactions | 115,000+ units |

| Transaction value | RM58.1b |

| YoY change | +7.4% |

| Avg subsale price (Q1) | RM521,614 |

| Avg new home price (Q1) | RM582,887 |

| KL avg subsale price | RM801,557 |

| KL avg new home price | RM708,462 |

Metric 1

Metric 2

Metric 3

Metric 4

Metric 5

Metric 6

Metric 7

How Much Can You Earn from Property Investment in Malaysia?

The combination of rising rents and competitive subsale prices creates a fertile environment for solid rental yields, especially in key urban corridors. The following table provides an illustrative estimate.

| Location & asset | Purchase price | Monthly rent | Gross yield |

|---|---|---|---|

| KL city fringe 1-bed condo near LRT | RM450,000 | RM2,300 | 6.1% |

| KL mature suburb 3-bed condo (Mont Kiara corridor) | RM850,000 | RM3,800 | 5.4% |

| Johor Bahru 2-bed near RTS (pre-completion) | RM500,000 | RM2,500 | 6.0% |

| Penang island 2-bed in growth node | RM500,000 | RM2,700 | 5.0% |

Metric 1

Metric 2

Metric 3

Metric 4

The average rent in Kuala Lumpur stands at RM2,901 with a +6.1% year-on-year growth, reinforcing the strong rental case for well-located properties.

New Projects in Malaysia

Where Are the Best Places to Invest in Malaysia Right Now?

A. Kuala Lumpur Core & City-Fringe

As Malaysia's economic heart, Kuala Lumpur offers the strongest rental depth and most sustained rent growth. Investors should target Transit-Oriented Developments (TODs) around MRT/LRT stations and proven lifestyle hubs.

B. Johor Bahru RTS Corridor

The upcoming RTS Link to Singapore is accelerating demand for high-rise properties in Johor Bahru. The focus here is on walkable sites near the RTS stations and within mature townships.

C. Penang Island & Batu Kawan

Penang's growth is driven by the Penang Transport Master Plan and continued industrial expansion, especially in the tech sector. Its unique blend of lifestyle, heritage, and economic activity underpins both end-user and rental demand.

D. Klang Valley Select Pockets

While a wider overhang exists, the right product in the right location continues to see rising values. Astute investors are looking at premium enclaves and TODs with demonstrated high absorption rates.

What Do Our Local Experts Say About the Market?

Market analysis from leading real estate technology group Juwai IQI provides a granular look into the demographic and transactional shifts shaping Malaysia's property landscape. According to local market experts, while the overall picture is positive, successful investment strategies in 2025 will be those that recognize the nuanced trends shaping different segments and locations.

Muhazrol Muhamad, GVP and Head of Bumiputra Segment at Juwai IQI, provides a high-level overview: "Malaysia's property market reached a decade-high in 2024. While Q1 2025 saw a slight cooldown, with transactions down 5.6% in volume and 12.9% in value, this appears more like a breather than a downturn. Demand is softening in the sub-RM500k segments, while the RM500k-RM1 million and above RM1 million categories showed resilience, indicating sustained buying power among higher-income groups."

Kashif Ansari, Co-Founder and Group CEO of Juwai IQI, reinforces that terrace homes and affordable properties remain the bedrock of the market. "Terrace homes and affordable housing are the backbone of the Malaysia property market in 2025. This segment is the most popular as it meets the needs of young buyers and M40 households… We expect demand for these properties to continue rising throughout 2025, in line with growing household income and urban expansion."

Ansari further notes that large-scale infrastructure projects are key drivers. For instance, homes near new public transport stations are expected to command a price premium of up to 10%.

A deep analysis of over 127,000 transactions by Juwai IQI reveals a significant trend: younger Malaysians are overwhelmingly choosing vertical living.

"Gen Z are buying into the skyline, while Millennials and Gen X keep their feet on the ground," says Ansari. He explains that lifestyle and affordability are the primary drivers.

"Units are often more affordable for first-time buyers. They are easier to maintain, and they often come with facilities like gyms, pools, and security that young families value."

| Generation | Units (condo / apartment) | Landed |

|---|---|---|

| Gen Z | 84% | 16% |

| Millennials | 75% | 25% |

| Gen X | 75% | 25% |

| Boomers | 77% | 23% |

| Builders | 93% | 7% |

Metric 1

Metric 2

Metric 3

Metric 4

Metric 5

Juwai IQI points to two key markets showing exceptional performance. In the high-rise segment, Johor has emerged as the clear outperformer. This success is not accidental; it is directly tied to significant infrastructure investment, the economic buzz surrounding the upcoming RTS Link, and strong pre-launch sales from savvy developers tapping into this growing demand.

Meanwhile, if there is one indicator proving the fundamental economic strength of the nation's capital, it is the Kuala Lumpur rental market. While national rental rates have stabilized, KL's market has continued to surge forward, acting as a barometer for regional economic health.

As Ansari explains, "The rental market acts as a leading indicator of regional economic strength. The rental growth in Kuala Lumpur reflects expanding job opportunities and foreign investment, reinforcing its role as the nation's largest growth engine."

This outperformance is stark when compared to other regions:

| Location | Avg. Rent (Q1 2025) | Quarter-on-Quarter Change | Year-on-Year Change |

|---|---|---|---|

| Kuala Lumpur | RM2,901 | +1.9% | +6.1% |

| Malaysia | RM2,020 | -1.6% | +5.2% |

| Selangor | RM1,822 | -0.9% | -3.1% |

Metric 1

Metric 2

Metric 3

Even the luxury rental segment in KL (the top 10% of the market) remains resilient, with an average rent of RM5,295 in Q1 2025. This indicates unwavering demand from high-income professionals and the expatriate community.

Can Foreigners Buy Property in Malaysia? What Are the Rules?

Yes. The framework is straightforward and transparent. Foreigners can purchase most residential and commercial properties, provided they meet the minimum price threshold set by each state.

- Allowed Properties: Most strata condominiums and many landed properties above the minimum price threshold.

- Common Exclusions: Properties on Malay Reserved Land, lots reserved for Bumiputera individuals, and designated low-cost housing.

- Financing: Many Malaysian banks offer mortgages to non-residents, typically with a margin of finance up to 70%.

- Taxes: Buyers are subject to legal fees and stamp duty. Upon selling, a Real Property Gains Tax (RPGT) applies, with rates varying based on the holding period. It is always advisable to consult with a solicitor to confirm current rates and thresholds.

Tools, Tips & FAQs for Foreign Buyers

A. Tools

- Investment Checklist: Always verify the property title, tenure, build-up area, maintenance fees, and developer track record.

- Yield Calculator: Target a gross yield of 5-6% for urban condos near transit and stress-test the numbers to account for potential vacancies.

- Exit Plan: Understand your minimum holding period and the applicable RPGT bracket before you commit.

B. Tips

- Prioritize Transit-Oriented Development (TOD) locations to minimize vacancy risk.

- Consider the subsale market for potentially faster rental income and a lower entry price per square foot.

- Track macroeconomic signals like Malaysia GDP growth and CPI from sources like Bank Negara Malaysia to time your market entry.

C. Practical Tips

- Prioritise TOD locations and mature amenities to reduce vacancy risk.

- Consider subsale for faster rent-up and lower entry price per sq ft.

- Track macro signals like GDP, CPI, and labour trends to time entries.

Frequently Asked Questions

A. Is now a good time to invest in Malaysian property?

Data from H1 2025 indicates a market in healthy realignment. With rising rents in key urban areas, strong transaction growth, and a disciplined supply pipeline, it is an opportune time for selective investment. [IQI Global, Global Market Insights - Malaysia].

B. What property types are most in-demand in Malaysia for 2025?

Terrace homes and properties priced below RM500,000 are the most liquid segments for local buyers. For foreigners, urban condominium units between RM600,000 and RM800,000 are popular as they capture strong rental demand. [IQI Global, Global Market Insights - Malaysia].

C. What is a 'TOD' and why is it important for property investment in Malaysia?

A Transit-Oriented Development (TOD) is a residential or commercial area designed to be walkable and centered around high-quality public transport. For investors, TODs are crucial as they reduce vacancy risk and attract tenants who prioritize connectivity.

D. As a foreigner, what's the first step to buying a property in Malaysia?

The first step is to engage with a professional real estate adviser to shortlist areas based on your goals. Following that, obtain in-principle financing feedback from a bank and have a solicitor review the Sale and Purchase Agreement (SPA) and property title before making any financial commitment.

E. Are property prices in Kuala Lumpur still affordable?

While prices are rising, Kuala Lumpur remains highly competitive compared to other major Asian capitals like Singapore and Hong Kong, offering strong value and higher rental yields. For example, the average subsale price in Q1 was RM521,614, a figure that is accessible to a wide range of investors. [IQI Global, Global Market Insights - Malaysia].

F. How stable is the Malaysian Ringgit for foreign investors?

The Ringgit has demonstrated stability and appreciated against major trading partners in 2025, supported by strong economic fundamentals and proactive monetary policy from Bank Negara Malaysia. The latest forecast from MBSB Research anticipates the Ringgit will continue to strengthen. [MBSB Research, Ringgit Weakened in Jul-25].

G. What is Real Property Gains Tax (RPGT) in Malaysia?

RPGT is a tax levied on the profit made from the sale of a property. The rate varies depending on how long you have held the property and your residency status. It's a key factor to consider in your exit strategy.

Need help to get started

Let our agents help you find the ideal land for you

Disclaimer:

The information provided is for general market insight only and does not constitute financial, investment, tax, or legal advice. IQI does not solicit or compel any purchase or investment. Property values and rental returns may fluctuate; please conduct your own due diligence and consult licensed professionals before making any decisions.

References & Citations

- Economic and financial developments in Malaysia in the second quarter of 2025 – Bank Negara Malaysia (August 15, 2025)

- Malaysia's economy remains on a strong footing and is projected to grow between 4% - 4.8% in 2025 – Bank Negara Malaysia (July 28, 2025)

- Consumer price index, July 2025 – Department of Statistics Malaysia (August 1, 2025)

- Labour force statistics report, Malaysia, July 2025 – Department of Statistics Malaysia (September 1, 2025)

- More than 80% of Gen Z buy condos, while older Malaysians still favour landed homes – Juwai IQI (September 3, 2025)

- Ringgit weakened in Jul-25 as US dollar performed well last month – MBSB Research (August 4, 2025)

- The World Bank in Malaysia – World Bank Group (April 1, 2025)

Why Do Smart Investors Choose IQI as Their Real Estate Partner?

Get your financial planning right by using our simple mortgage loan calculator to find out estimates of monthly instalments, applicable interest rates and the principal amount that best suit your financial capacity

Exclusive market insights

powered by on-ground teams in 30+ countries

Data-driven strategies

using our proprietary IQI Atlas system for returns, yields, and forecasting

Award-winning agents

trained to serve local and international investors with integrity and expertise

Secure investment processes

with verified partners, legal guidance, and full transparency

Diverse project portfolios

across residential, commercial, and international markets