Is Johor’s property market a golden goose or just a wild goose chase?

You see headlines screaming about sky-high potential, but your bank account is giving you the side-eye, asking: ‘Is it all just hype?’

Let’s ditch the drama. We’ve crunched the latest data from Malaysia’s property authority to give you the no-fluff guide to what’s really going on with Johor’s property prices in 2025!

Key Takeaways

- Prices are Rising: Transaction volume and value in Iskandar Malaysia increased by 16% and 36%, respectively, year-over-year, indicating strong and sustained market momentum.

- Key Drivers: The upcoming Rapid Transit System (RTS) Link and the Johor-Singapore Special Economic Zone (JS-SEZ) are supercharging demand and investor confidence.

- Hotspots: Johor Bahru and Iskandar Puteri remain prime areas, with significant interest in both landed properties and high-rises, driven by new infrastructure developments.

- The Overhang is Easing: While a concern in past years, the number of unsold residential units is steadily declining, indicating a healthier and more balanced market.

Johor Property Price, Really Good or Not?

1. Is It a Good Time to Buy Property in Johor?

The short answer? All signs point to a resounding “yes,” but it’s crucial to know what you’re getting into. The market is not only heating up but maturing. Gone are the days of pure speculation.

Concrete fundamentals, including massive infrastructure projects and deep economic collaboration with Singapore, anchor today’s growth.

According to Samuel Tan, CEO of Olive Tree Property Consultants, the Johor property market is firmly on a “positive growth trajectory”. This is optimism, and it’s backed by a 36% year-on-year surge in transaction value in Iskandar Malaysia.

This momentum is fueled by what experts refer to as “structural pivot points.” It’s a fancy way of saying the change is real and here to stay. With the upcoming RTS Link set to connect Johor Bahru and Singapore, the daily commute for over 100,000 people will be revolutionized, making Johor a genuinely viable alternative for those working in Singapore.

Adding to this is the Johor-Singapore Special Economic Zone (JS-SEZ), which is already attracting billions of dollars in foreign investment, creating jobs, and further fueling demand for housing. Many analysts believe that the convergence of infrastructure, investment, and policy support signifies the optimal time to explore the market.

2. What Are the Average House Prices in Johor?

Price is only half the story. The number of sales reveals where the action truly is. The state of Johor recorded an astonishing 20,246 residential property transactions between May 2024 and March 2025, signalling an incredibly active and liquid market.

While the Johor state-wide median property price is RM475,000, this number varies wildly depending on the district. Understanding both the price and transaction volume is key to seeing the complete picture of what’s happening on the ground. Below is a detailed breakdown by area.

| Location | Property Transactions (May ’24 – Mar ’25) | Median Property Price | Median Price per sq. ft. (psf) | Typical Transaction Range |

|---|---|---|---|---|

| Johor Bahru | 2,587 | RM590,000 | RM447 | RM414,000 – RM766,156 |

| Iskandar Puteri | 1,393 | RM700,000 | RM465 | RM480,000 – RM938,540 |

| Kulai | 1,390 | RM499,000 | RM310 | RM380,000 – RM626,900 |

| Tebrau | 1,785 | RM653,166 | RM426 | RM408,150 – RM905,000 |

| Pasir Gudang | 1,268 | RM390,000 | RM345 | RM300,000 – RM503,000 |

| Kluang | 1,273 | RM265,000 | RM179 | RM179,250 – RM459,389 |

| Batu Pahat | 863 | RM385,000 | RM220 | RM220,000 – RM545,000 |

| Muar | 520 | RM480,000 | RM228 | RM317,500 – RM740,000 |

| Kota Tinggi | 365 | RM365,400 | RM254 | RM246,600 – RM520,000 |

| Segamat | 240 | RM236,250 | RM136 | RM132,500 – RM382,500 |

| Mersing | 178 | RM249,900 | RM153 | RM198,600 – RM255,900 |

| Tangkak | 141 | RM315,000 | RM175 | RM155,000 – RM537,500 |

| Pengerang | 125 | RM330,000 | RM199 | RM150,000 – RM450,000 |

| Yong Peng | 117 | RM325,000 | RM181 | RM195,000 – RM499,000 |

| Labis | 61 | RM250,000 | RM123 | RM135,000 – RM385,500 |

This enormous value difference shows Johor is not just one market, but many. Areas closest to the Singapore border, such as Iskandar Puteri and Johor Bahru, command the highest prices due to their proximity to infrastructure and investment opportunities.

Yet, travel just an hour or two out to towns like Segamat or Kluang, and you will find some of the most affordable landed property in the state, offering fantastic value for first-time buyers or those seeking a quieter lifestyle. This variety is Johor’s biggest strength.

3. What’s Affecting Property Prices in Johor?

A single factor doesn’t drive the current market, but a powerful convergence of at least five key forces all pushing in the same direction. Understanding these drivers is important to comprehending why the Johor property forecast for the next 5 years appears so promising.

a. The “Strong Neighbour” Effect (Singapore)

The enduring strength of the Singapore dollar makes Johor property values attractive to Singaporeans. This is not about getting more for their money, but it has ignited demand for second homes, investment properties, and even primary residences for those who commute.

Michael Lai of OCBC Bank astutely observes this trend as a “repositioning of Johor as a binational retail hub,” highlighting the deep, cross-border economic integration that directly fuels the property market.

b. The RTS Link: A Game-Changer for Connectivity

Scheduled to begin operations in 2027, the Johor Bahru-Singapore Rapid Transit System (RTS) Link is a piece of infrastructure that serves as an essential transportation link. With the ability to ferry 10,000 passengers per hour, it significantly reduces travel time, making daily cross-border commuting effortless.

Properties within a 5-kilometer radius of the RTS stations have already seen prices appreciate by up to 20%. As Henry Butcher Malaysia notes, this project alone “will enhance cross-border connectivity, solidifying Johor’s position as an attractive destination.”

c. The Rise of the Industrial Juggernaut

Johor is fast becoming the brightest star in Malaysia’s industrial portfolio. The state’s push to become a data center hotspot is drawing massive foreign investment from giants like Microsoft, and industrial land values in key areas are climbing steadily.

The game is no longer building warehouses, but creating high-value jobs that attract more people with purchasing power to the state, all of whom require housing.

d. Special Economic and Financial Zones (SEZ & SFZ)

The JS-SEZ and the Special Financial Zone (SFZ) in Forest City are like rolling out the red carpet for businesses. These zones offer a raft of incentives, including significantly lower tax rates (as low as 5% for some companies) and streamlined business processes.

These “catalysts for investment opportunities” are specifically designed to attract high-tech manufacturing, financial services, and corporate hubs, further embedding Johor into the global economy and driving demand for both commercial and residential real estate.

e. Supportive Government Policies

From the national to the state level, various policies are creating a stable and encouraging environment for homebuyers. The extension of the stamp duty exemption for first-time homebuyers on properties priced up to RM1 million through 2025 is a prime example.

Furthermore, the revamped Malaysia My Second Home (MM2H) program, with its more accessible tiers, is once again drawing high-value foreign residents to Johor, adding another layer of demand to the market.

4. How Do Prices Compare in Different Johor Districts?

Not all of Johor is created equal, and your budget can go a lot further depending on the district you choose.

Here’s a comparative look at seven key districts to help you understand the landscape (data from May 2024 to March 2025).

- The Crown Jewel (Iskandar Puteri): With a median price of RM700,000, this modern city is attracting luxury buyers, families, and high-net-worth individuals. Its appeal lies in premium developments and world-class amenities.

- The Bustling Hub (Johor Bahru): The state’s capital and primary gateway, its median price is RM590,000. It’s the center of the action with the most transaction volume (2,587 deals), driven by its proximity to Singapore and the RTS.

- The Rising Suburb (Tebrau): A favorite among locals, Tebrau has a slightly higher median price of RM653,166 but boasts huge transaction volumes (1,785 deals). It’s a mature area with a great balance of amenities and accessibility.

- The Northern Workhorse (Kulai): A balanced area with strong demand from families and industrial sector workers. It saw 1,390 transactions with a median price of RM499,000, offering a blend of value and growth.

- The Industrial Engine (Pasir Gudang): Known for its industrial parks, housing here is driven by job growth. It offers great affordability, with a median price of just RM390,000, and is experiencing high transaction activity.

- The Inland Value King (Kluang): For those seeking ultimate affordability, Kluang is a standout. With a median price of only RM265,000, it represents the heart of Johor’s value, perfect for first-time homebuyers.

- The Southern Port (Gelang Patah): Located strategically near major ports, this area recorded a median price of RM500,000. It’s an essential link in Johor’s logistics chain, attracting related investment and homebuyers.

5. Is the “Property Overhang” Still a Concern in Johor?

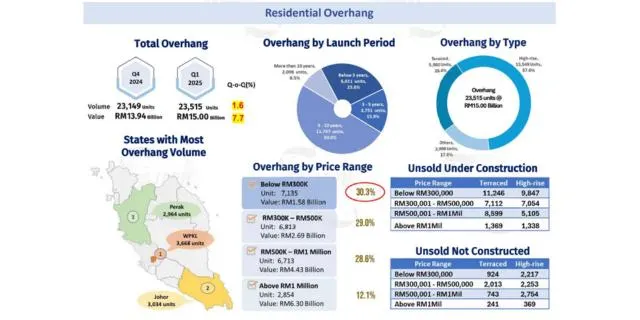

Let’s address the fear in the heads of all buyers and investors: the fear of oversupply. For years, headlines warned of a “ghost city” filled with unsold properties, particularly high-rise apartments. While this was a very real issue, the market has undergone a significant transformation, and the overhang is now much less of a threat.

The numbers tell the story. The total number of unsold completed residential units in Johor stood at 3,034 in Q1 2025, representing a significant improvement from the over 5,000 units seen in previous years. This decline is the result of several positive forces working in tandem.

First of all, demand is absorbing the supply. Henry Butcher Malaysia’s report highlights explicitly the RTS Link as a primary reason for the increased take-up rate of high-rise units, which have historically formed the bulk of the overhang. As commuting to Singapore becomes simpler, these once-overlooked units are now seen as prime assets.

In other words, developers have become smarter. As highlighted in The Edge Malaysia, developers are no longer focused on “speculative high-density projects.” Instead, they are prioritizing right-sized, well-located homes that match actual buyer demand, a clear sign of market correction.

Following that, supportive policies such as the stamp duty exemption have made it easier for first-time buyers to enter the market and absorb existing stock.

While challenges remain, the consensus among experts is clear: the overhang is being actively managed and is no longer the critical threat it once was, pointing to a much healthier and more sustainable property market in Johor.

So, what’s the final word? The data confirms it: Johor’s property market revival is the real deal, built on solid foundations like the RTS Link and JS-SEZ, not just fleeting hype.

Whether you’re an investor seeking growth near Johor Bahru or a homebuyer looking for value in Kluang, the diverse landscape offers real opportunities.

This is no longer a momentary upswing, but a structural shift that makes Johor one of the most compelling property stories in Malaysia today.

6. Frequently Asked Questions (FAQs)

Are Johor properties still cheaper than in Kuala Lumpur or Penang?

Yes. On average, residential properties in Johor remain more affordable than those in the Klang Valley (Kuala Lumpur) and are competitive with Penang, particularly in terms of value and amenities. The average house price in Johor stood at RM437,280 in Q4 2024, compared to RM794,467 in Kuala Lumpur.

What is the property price forecast for Johor in the next few years?

While exact figures are speculative, expert outlooks are very positive. Analysts from Henry Butcher and CBRE | WTW project sustained growth through 2025 and beyond, driven by the RTS Link completion, growing foreign investment from the JS-SEZ, and strong domestic demand. Expect above-average appreciation, especially for properties in well-connected areas.

Where are Singaporean and other foreign buyers typically investing in Johor?

Foreign interest is strong in luxury and lifestyle-oriented developments. Reports highlight high market demand in areas like Taman Molek, Leisure Farm, East Ledang, Sunway Iskandar, and Forest City. The Johor Bahru central business district and the wider Iskandar Puteri region are also extremely popular due to their proximity to the RTS and other new infrastructure.

What is the average rental yield for residential properties in Johor?

Johor offers one of the most attractive rental yields in Malaysia. In prime Johor Bahru locations, the average gross rental yield is approximately 6.25%, which is significantly higher than the national average and other major cities, such as Penang or Selangor. This makes it a compelling option for those seeking investment properties with strong rental income potential.

Are landed houses or high-rise condos a better investment in Johor now?

Both have strong potential. Landed properties in established townships remain the preferred choice for many local families and upgraders. However, high-rise condominiums and serviced apartments near the RTS Link stations are seeing the fastest price appreciation and highest rental demand due to their strategic value for commuters.

Where can I find the most affordable properties in Johor?

Generally, areas further from the Johor Bahru city centre, such as Kluang (median price RM265,000), Segamat (RM236,250), and Mersing (RM249,900), offer the most affordable entry points for residential properties in Johor.

Are Johor property prices in a bubble?

While rapid price growth can raise concerns, the consensus is that strong fundamentals, not just speculation, drive the market. Experts point to the declining property overhang, a construction boom that is responding to genuine demand, and significant interest from local first-time homebuyers as signs of a healthy, rebalancing market. While vigilance is wise, a bubble is not the current outlook.

The data is clear, and the time is now. Johor’s property market is booming. Don’t miss this opportunity. Connect with us today to find your ideal Johor property before prices climb even higher!

Continue Reading:

- Johor’s NEW Property Fees 2025: What Every Buyers Should Know

- Johor vs Penang: Who’s Shaping Malaysia’s AI Future?

- Top 5 New Housing Developments in Johor: Innovations and Investment Opportunities 2025

Reference and Citation

- Bambooroutes. (2025, June 17). Are Johor property prices going up in 2025? Retrieved from

https://bambooroutes.com/blogs/news/johor-price-forecasts - Brickz. (2025). JOHOR – RESIDENTIAL. Retrieved from

https://www.brickz.my/transactions/residential/ - CBRE | WTW Research & Consulting. (2024, December). 2025 Market Outlook: Malaysia Real Estate. Retrieved from

https://cbre-wtw.com.my/2025-malaysia-real-estate-market-outlook/ - Delmendo, L. C. (2025, May 2). Malaysia’s Residential Property Market Analysis 2025. Global Property Guide. Retrieved from

https://www.globalpropertyguide.com/asia/malaysia/price-history - Devan, P. (2025, March 6). Johor Bahru housing Property Monitor (4Q2024): Market on a positive growth trajectory. The Edge Malaysia. Retrieved from

https://theedgemalaysia.com/node/745765 - Henry Butcher Malaysia. (2025). Malaysia Property Outlook 2025. Retrieved from

https://www.henrybutcher.com.my/assets/pdf/newsletter/6791f2d27b2f2_01-2025.pdf - Kaur, S. (2025, May 5). Johor emerges as hotspot for investment and real estate. New Straits Times. Retrieved from

https://www.nst.com.my/property/2025/05/1211572/johor-emerges-hotspot-investment-and-real-estate - Lai, M. (2025, May 5). Pitfalls & Pitch Calls: Johor’s reawakening: How the JS-SEZ is powering a property revival. The Edge Malaysia. Retrieved from

https://theedgemalaysia.com/node/753786 - NAPIC-JPPH. (2025). Property Market Q1 2025 Snapshots. Retrieved from

https://napic2.jpph.gov.my/storage/app/media//3-penerbitan/Shahrul/SnapShot/Q1%202025/1.%20Property%20Market%20Q1%202025%20Snapshots.pdf - The Star. (2025, May 9). Property market steady especially in Johor. Retrieved from

https://www.thestar.com.my/business/business-news/2025/05/09/property-market-steady-especially-in-johor