Have you received your CP58 form?

Contrary to popular belief, CP58 is not a tax form – it’s an income statement that records all your incomes, whether it be cash or non-monetary incentives.

If you haven’t heard of this form, don’t worry – a lot of people haven’t.

But if you are working as a real estate agent, it’s best that you know (in case tax agents start looking for you).

So what is the CP58 form exactly? Read on to learn more!

What to Know About the CP58 Form

What is CP58?

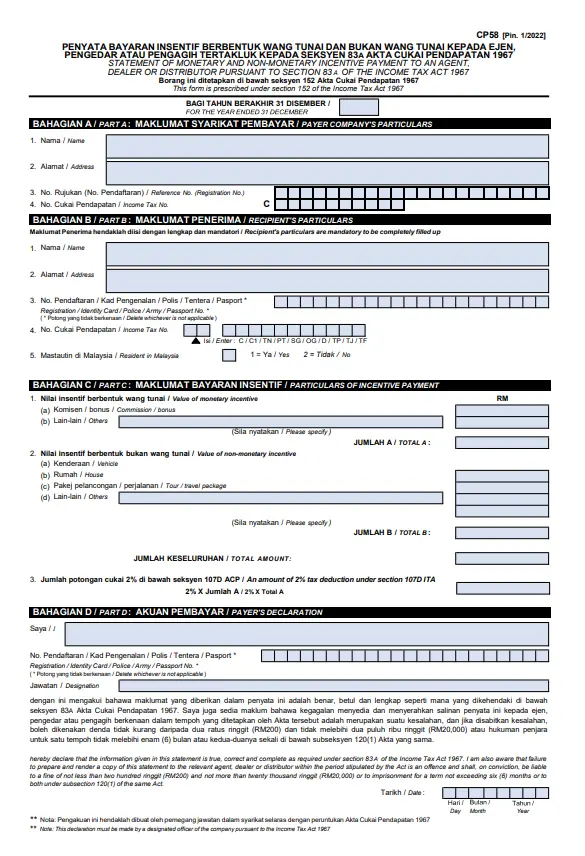

CP58 is essentially an income statement that records all incomes, whether in the form of cash or non-monetary incentives, provided by companies to their agents, dealers, or distributors.

These incentives can range from bonuses and allowances to non-monetary perks like houses, cars, or flight tickets.

Similar to the EA Form issued to employees in the private sector, CP58 serves as a comprehensive record of remuneration for non-employee recipients.

Do I need to fill out CP58?

Thankfully, you don’t have to – but your company does.

According to the Inland Revenue Board of Malaysia (IRBM, or more commonly known as LHDN) …

If you received more than RM5,000 in cash or non-monetary incentives annually, your company has to produce a CP58 form for you.

If you received less than RM5,000, you will only receive the form upon request.

When should I receive my CP58 form?

Your company should provide you the CP58 form by 31st March of the year immediately following the year in which the incentives were paid.

Companies failing to meet this deadline may face legal consequences outlined in the Income Tax Act 1967.

Any payer company which fails to prepare the form CP 58 as required under Section 83A of Income Tax Act 1967 shall be guilty of an offence under Section 120(1)(b) and shall, on conviction, be liable to a fine of not less than RM200 and not more than RM20,000 or to imprisonment for a term not exceeding 6 months or to both.

The responsibility of preparing the CP58 form falls on the payer company—a.k.a the company that disburses monetary or non-monetary incentives to its agents, dealers, or distributors.

How to submit the CP58 form

Here’s where it gets interesting – it’s not mandatory to submit the CP58 form to the IRBM.

However, in case of tax audits, you will want to keep a copy handy for at least 7 years.

What is exempted from the CP58 form?

The following items do not need to be included in the CP58 form:

- Credit rebates.

- Subcontract payments.

- Handling fees.

- Trade and bulk discounts.

- Promotional items/gifts not stated in the contract with the agents.

- Incentives given to the public or customers to encourage them to introduce more customers, eg. referral fee.

- Free items that are not based on performance eg. umbrellas, pens, notebook, and calendars.

- Preferential rates given as special treatment for independent agents who buy and sell goods on their own.

- Special discount rates to independent agents.

Where to get the CP58 form

You can get the CP58 form on the IRBM website here.

For thorough guidelines on how to fill up the CP58 form, click here.

Conclusion

To sum it up, the CP58 form is an income statement that lists out all your earnings in the year. Your company must provide it to you by 31st March each year – make sure to hold on to it for 7 years!

In IQI, we prioritize fast commission payouts and incredible incentives for those who work to receive them. Join a company that ensures you gain as much as you can in your career!

Continue reading: