| TL;DR For Year of Assessment 2025, individuals earning an annual income exceeding RM37,333 (approx. RM3,111/month) must file their income tax return via the MyTax Portal (https://mytax.hasil.gov.my). The strict deadlines are 30 April 2026 for standard employment income (Form BE) and 30 June 2026 for business or freelance income (Form B). First-time filers will need to register a Tax Identification Number (TIN) via e-Daftar and activate a Digital Certificate before logging in. To lower your tax bill (or potentially get a refund), be sure to maximize your claimable tax reliefs for lifestyle, medical, and savings expenses while avoiding the heavy penalties for late submission. |

Hey there, Malaysian! Have you completed your income tax filing yet?

Dealing with income tax can feel like trying to solve a math puzzle while blindfolded. Your palms sweat, you worry about clicking the wrong button, and the fear of getting a penalty letter from LHDN keeps you up at night.

We get it. But here’s the good news: filing your taxes in Malaysia is actually much simpler than it looks once you break it down. Whether you are a fresh graduate doing this for the first time or a seasoned pro needing a refresher on the latest 2025 reliefs, this guide is your safety net.

Let’s turn that anxiety into confidence and maybe even get you some tax refund money back!

Key Takeaways:

- Filing vs. Paying: Just because you file a tax return doesn’t mean you will have to pay tax. It depends on your chargeable income.

- Digital First: LHDN now uses a single-gateway platform called MyTax.

- Residency Rules: You are a tax resident if you stay in Malaysia for at least 182 days in a calendar year.

- Reliefs are Key: You can reduce your tax bill significantly by claiming expenses like medical insurance, internet bills, and parents’ medical care.

How to File Your Income Tax in 2026

- 1. What is Filing in Income Tax?

- 2. Who Needs to do Tax Filing?

- 3. Do Freelancers Pay Income Tax in Malaysia?

- 4. How to File Your Income Tax Online?

- 5. How do I Register for LHDN for the First Time?

- 6. How do I Submit my Income Tax Filing? (Step-by-Step)

- 7. How do I file a return after the due date?

- 8. Extra tips: Filing income tax as a foreigner

- Frequently Asked Questions (FAQ)

1. What is Filing in Income Tax?

Simply put, filing your income tax (or filing your tax return) is the act of officially reporting how much money you made last year to the government. In Malaysia, this is managed by the Inland Revenue Board of Malaysia (LHDN).

Think of it as a yearly report card. You tell LHDN, “Hey, I earned this much, but I spent this much on necessities (reliefs), so I should only be taxed on the balance.” This process is primarily conducted online through the e-Filing system.

Most importantly, Malaysia uses a Self Assessment System (SAS). This means the law trusts you to calculate your own income and tax. LHDN won’t automatically send you a bill; you must calculate it yourself and submit the form.

2. Who Needs to do Tax Filing?

You might be asking, “Do I really need to do this?”

According to LHDN rules, you generally need to register and file a tax return if you meet any of these criteria:

- You are an individual earning an annual employment income exceeding RM34,000 (after EPF deduction).

- However, specific guidance for Assessment Year 2025 suggests the threshold is around RM37,333 per year.

- You run a business (even if you made a loss).

- You are an individual subject to the Monthly Tax Deduction (MTD/PCB).

- You sell or buy real estate.

Let me give you an example: If Ali earns RM4,000 a month, his annual income is RM48,000. He must file his taxes. If Siti earns RM2,500 per month (RM30,000 per year), she falls below the threshold and may not strictly need to file, though it is good practice to do so for loan applications.

i. What is the Minimum Salary to Pay Income Tax in Malaysia?

This is a very common question! There is a difference between filing (reporting) and paying.

- Filing Threshold: You file if you earn approx. RM3,111 per month or more (RM37,333/year).

- Paying Threshold: You typically only start paying tax if your Chargeable Income (your salary minus tax reliefs) exceeds the base limit.

For many single individuals, after deducting the standard personal relief of RM9,000, you generally won’t pay tax on the first few thousand Ringgit due to tax rebates. But you must still file the form!.

3. Do Freelancers Pay Income Tax in Malaysia?

Yes, absolutely.

Being a freelancer, gig worker, or self-employed individual does not exempt you from tax. In fact, you fall under the “Individual carrying on business” category.

- Which Form? While salaried employees complete Form BE, freelancers must complete Form B.

- The Deadline: You get a bit more time! The deadline for freelancers is 30 June (whereas employees must file by 30 April).

- The Benefit: As a freelancer, you can deduct specific business expenses (like internet or equipment) used to generate income, which salaried employees usually cannot do.

4. How to File Your Income Tax Online?

Gone are the days of manual paperwork. The primary method to file your tax online is through the ezHASIL or MyTax Portal.

How to get started:

- Visit https://mytax.hasil.gov.my.

- You will need your Tax Identification Number (TIN).

- You will need a password and a “Digital Certificate” (we will cover how to get this in the next section).

- Once logged in, you choose e-Form to select the correct return (e-BE or e-B).

5. How do I Register for LHDN for the First Time?

If you have never filed taxes before, don’t panic. You need to “introduce” yourself to LHDN via the e-Daftar system.

Step-by-Step Registration Guide:

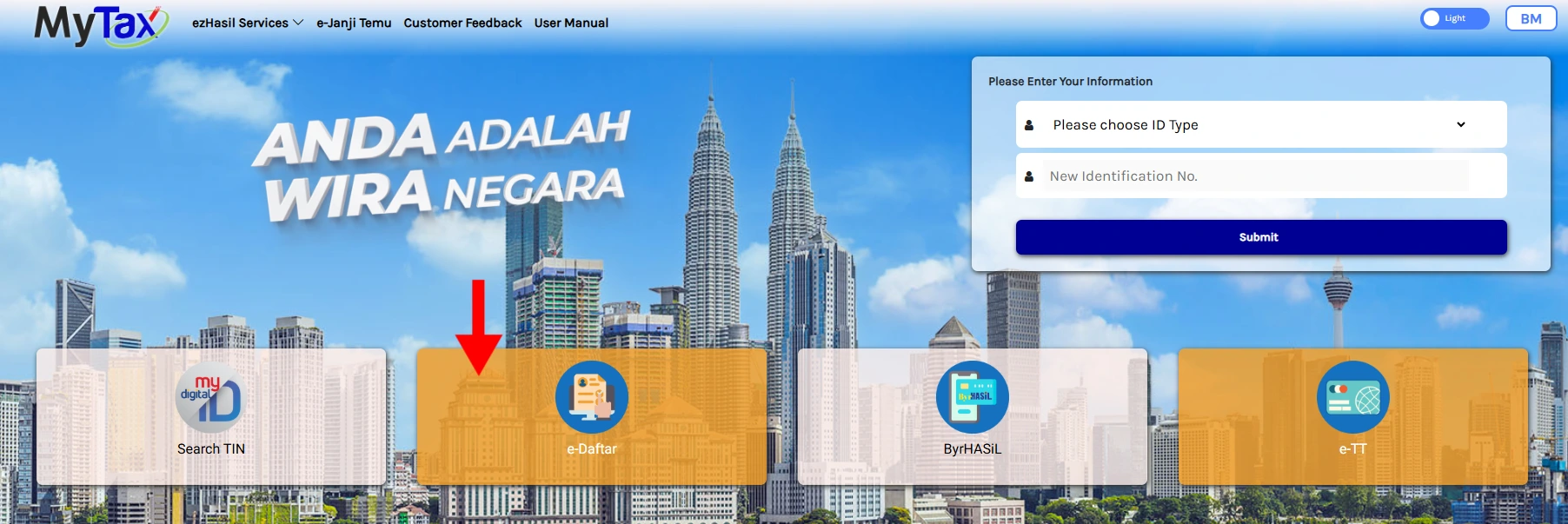

- Go to MyTax: Navigate to the MyTax Portal, then click e-Daftar.

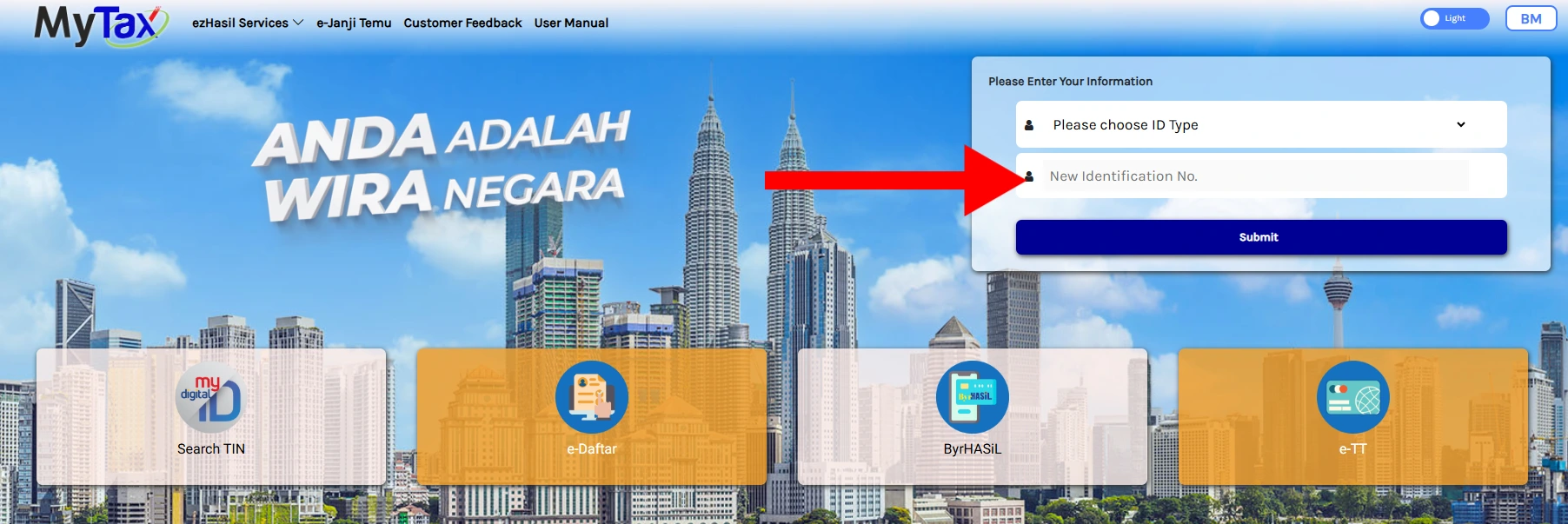

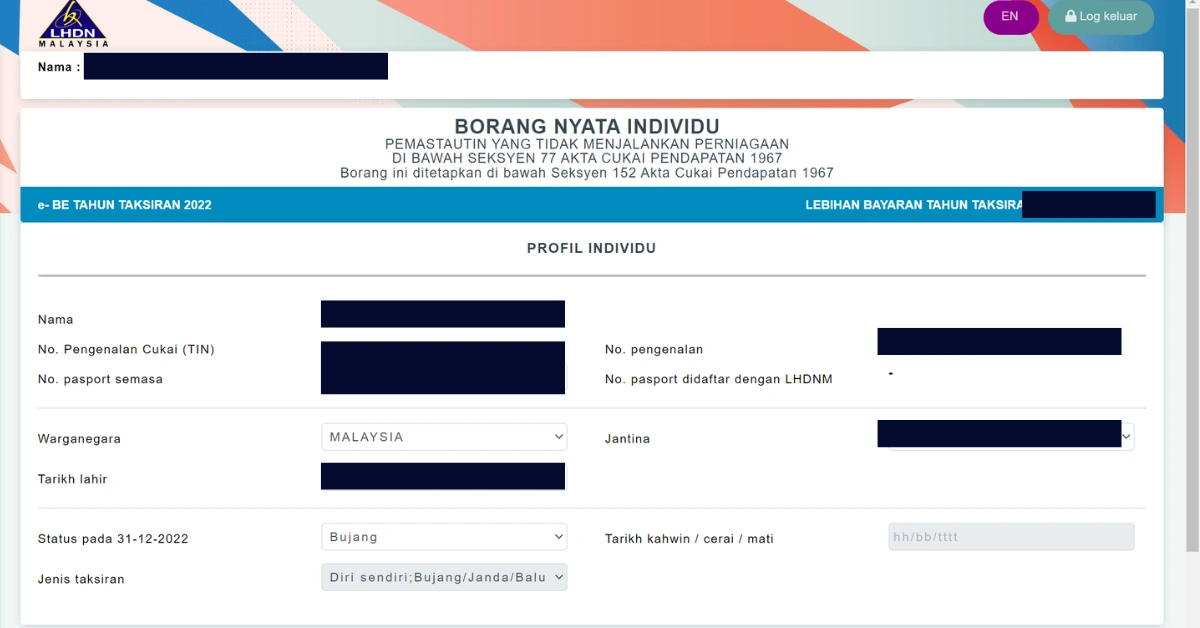

2. Fill the Form: Enter your MyKad (IC) number to check if you already have a TIN. If not, fill in the registration form with your personal details (Name, Address, Employer).

Upload Documents: You will need a digital copy of your MyKad (front and back). Foreign nationals will need their passports.

Wait for Approval: It usually takes a few working days to receive your Income Tax Number via email.

First-Time Login:

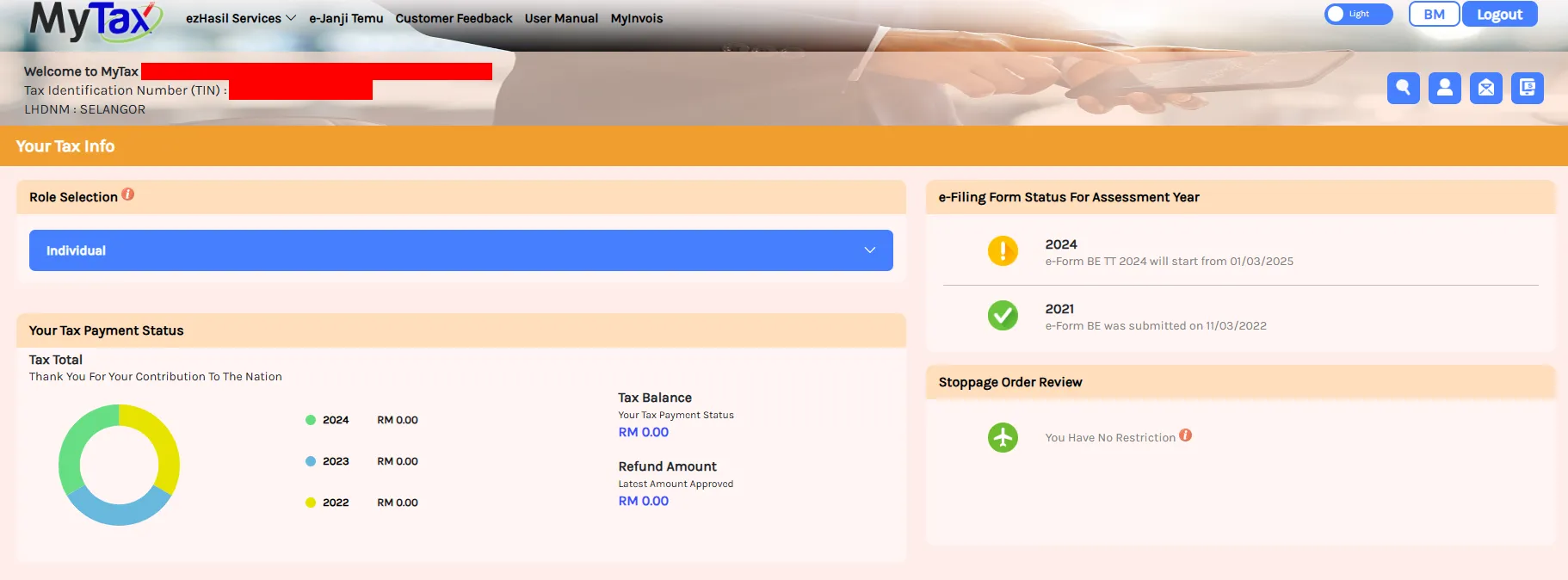

Once you have your Tax Number, go back to MyTax.

Select “First Time Login”.

Enter your PIN (if you visited a branch) or follow the online e-KYC / e-CP55D verification method to generate your password and activate your Digital Certificate.

6. How do I Submit my Income Tax Filing? (Step-by-Step)

You are registered and have your password. Now, let’s do the actual filing for YA 2025.

Step 1: Choose the Right Form

Log in to MyTax, click e-Filing, then e-Form.

- Select Year of Assessment 2025.

- Choose e-BE if you only have a job (Salary).

- Choose e-B if you have a side business or freelance income.

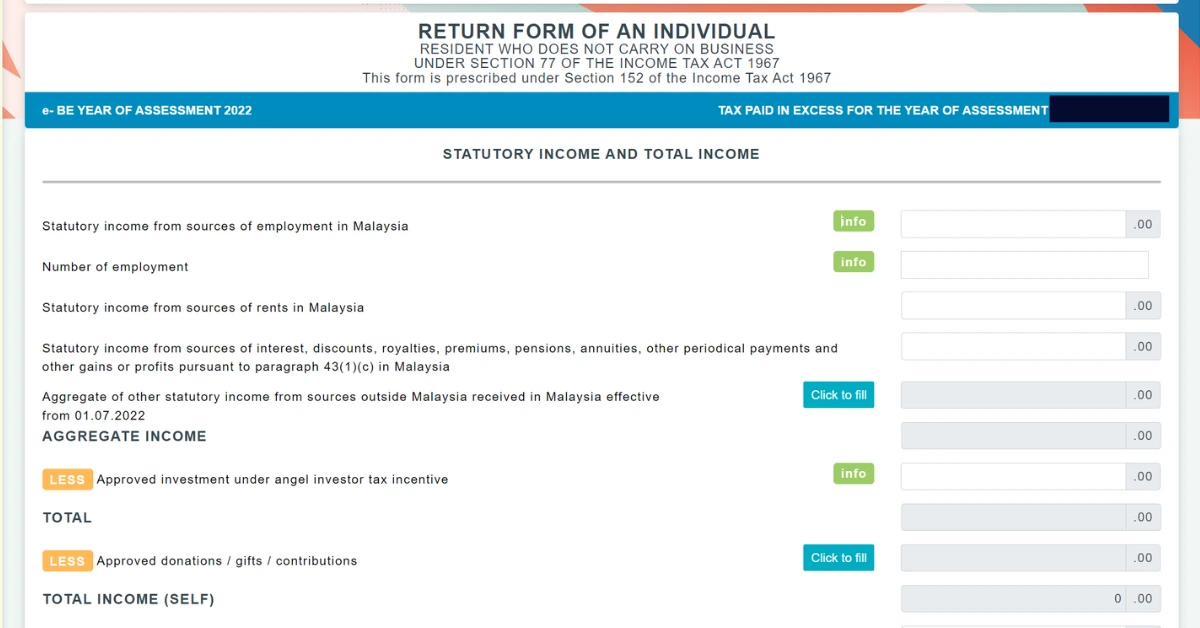

Step 2: Check Your Income (Statutory Income)

LHDN often pre-fills data if your employer submitted it correctly. However, you must verify it against your EA Form (the salary statement your boss gives you). Ensure the numbers for Salary, Bonus, and PCB (monthly tax deductions) match exactly.

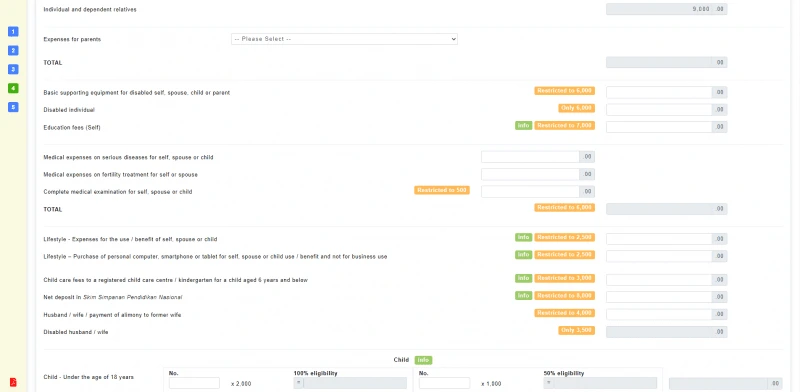

Step 3: Maximize Your Reliefs

This is the fun part where you lower your tax!

- Individual Relief: RM9,000 (Automatic).

- Medical Expenses: Up to RM10,000 for self, spouse, or child (including vaccination and serious diseases).

- Lifestyle: Up to RM2,500 for buying an iPhone, books, or gym membership.

- EV Charging: Up to RM2,500 for electric vehicle charging equipment

- Note: Always keep receipts for 7 years!

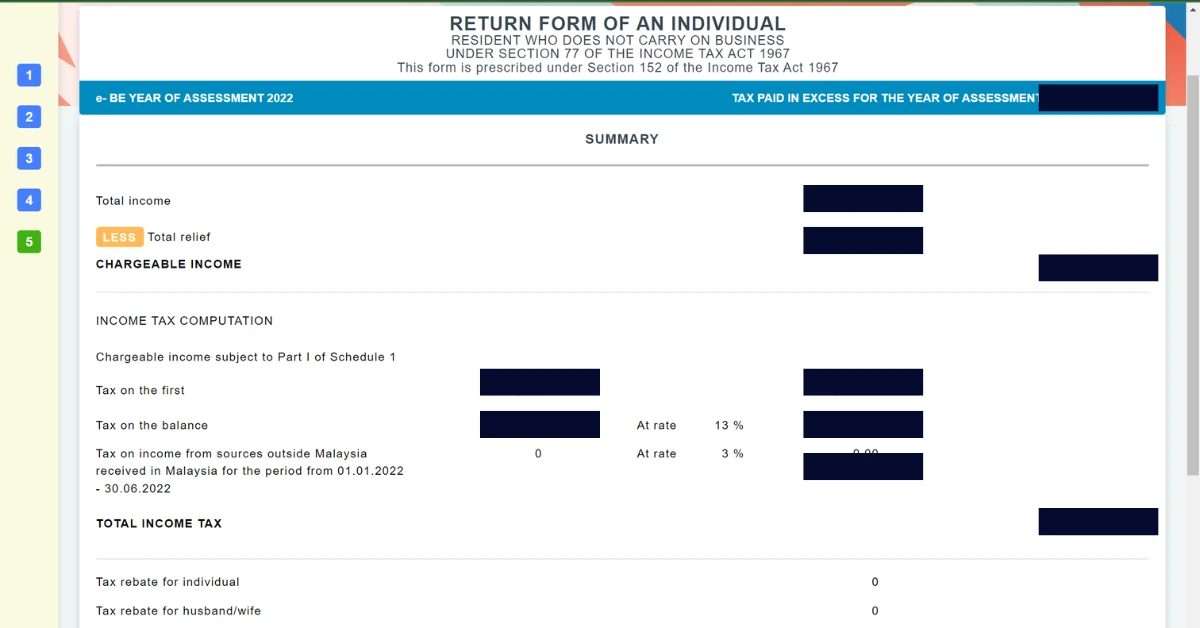

Step 4: Summary & Calculation

The system will auto-calculate your Chargeable Income.

Let me explain tax rates simply: Malaysia uses a progressive tax rate.

- First RM5,000 earned: 0% tax.

- RM5,001 – RM20,000: 1% tax.

- RM20,001 – RM35,000: 3% tax.

- It goes up from there, reaching 30% if you earn over RM2 million.

Here’s the data table for personal income tax:

| Chargeable income* (RM) | Tax (RM) | Rate % |

|---|---|---|

| 5,000 | 0 | 1 |

| 20,000 | 150 | 3 |

| 35,000 | 600 | 6 |

| 50,000 | 1,500 | 11 |

| 70,000 | 3,700 | 19 |

| 100,000 | 9,400 | 25 |

| 400,000 | 84,400 | 26 |

| 600,000 | 136,400 | 28 |

| 2,000,000 | 528,400 | 30 |

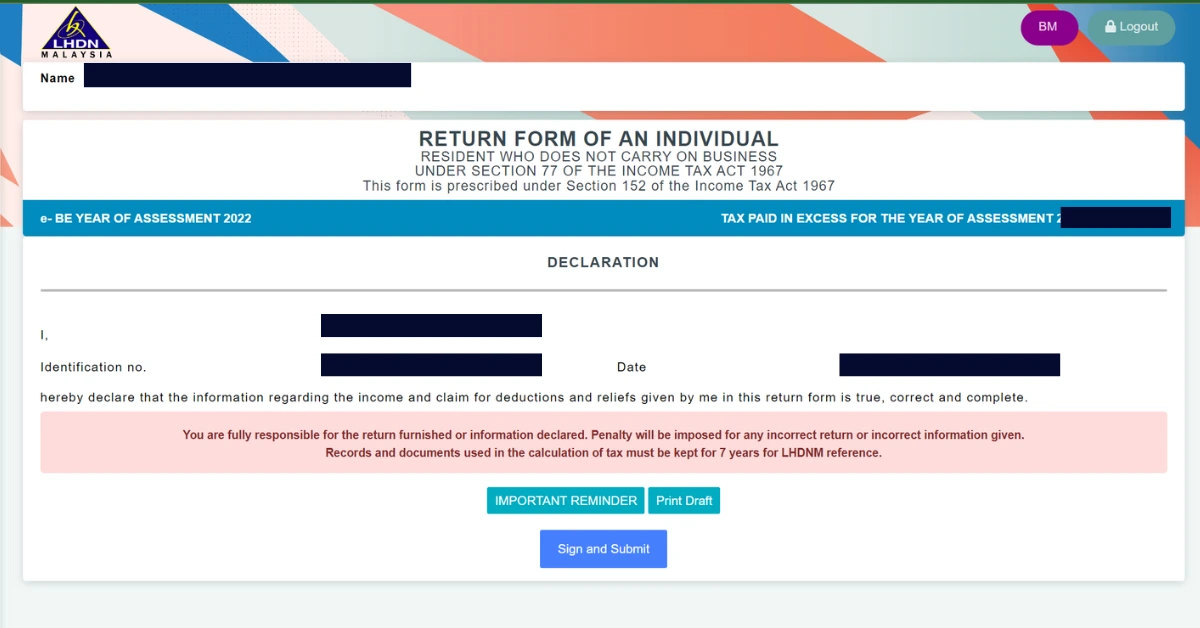

Step 5: Sign and Submit

If the summary shows “Balance of Tax Payable,” you owe LHDN money. If it shows a negative balance, congratulations! You are getting a tax refund. Click “Sign and Submit,” enter your ID, and print the acknowledgement receipt.

7. How do I file a return after the due date?

So, you missed the 30 April (or 30 June) deadline. Breathe. You can still file, but there will be a cost.

- Late Filing Penalty: If you file late, LHDN may impose a penalty ranging from RM200 to RM20,000, or even imprisonment (though imprisonment is rare for simple late filings).

- Late Payment Penalty: If you owe tax and pay late, you will be hit with a 10% penalty on the unpaid balance. If you still don’t pay after 60 days, an additional 5% is charged.

- How to Fix It: Log in to e-Filing immediately and submit the form. The system will calculate the penalty automatically in most cases. Pay it ASAP to avoid it snowballing.

8. Extra tips: Filing income tax as a foreigner

If you are an expat working in Malaysia, welcome! The rules are slightly different for you.

- Tax Resident Status: If you are in Malaysia for 182 days or more in a calendar year, you are a “Tax Resident.” You pay the same progressive rates (0-30%) as Malaysians and receive tax relief.

- Non-Resident: If you are here for less than 182 days, you are a “Non-Resident.” You are taxed at a flat rate of 30%, and you generally cannot claim tax reliefs.

- Exemptions: Working here for less than 60 days? Your income might be tax-exempt.

- Special Zones: “Knowledge Workers” in regions such as Iskandar Malaysia may qualify for a 15% special tax rate.

Frequently Asked Questions (FAQ)

How do I get my tax refund if I paid too much?

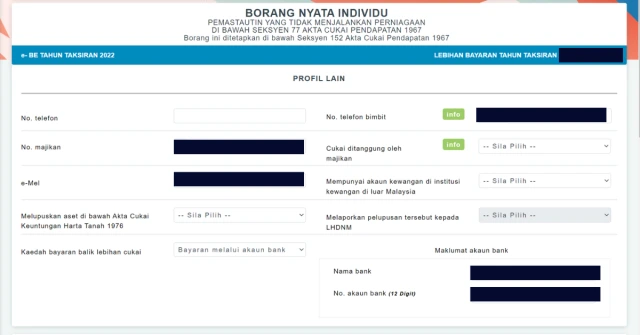

Refunds are processed automatically after you submit your e-Form. It usually takes 30 working days if filed via e-Filing. Ensure your bank account number is updated in the MyTax profile.

I forgot my MyTax password. What should I do?

Don’t worry. Go to the MyTax portal, click “Forgot Password,” and reset it using your registered email or phone number. If that fails, you may need to visit an LHDN branch to reset it manually.

Do I need to keep my receipts if I file online?

Yes! You do not need to upload receipts when filing, but you must keep all physical or digital receipts for at least 7 years. LHDN can audit you anytime, and if you can’t prove the expense, you will get fined.

What if I entered the wrong amount in my submission?

You can submit an Amended Return Form (BE) online within the same filing period. If the period is over, you must write a formal letter to LHDN detailing the mistake and providing proof.

Can I claim relief for a new smartphone I bought?

Yes, under the Lifestyle Relief, you can claim up to RM2,500 for purchasing personal computers, smartphones, or tablets for yourself, spouse, or child.

Is the Monthly Tax Deduction (MTD/PCB) enough?

Often, yes. This is called “MTD as Final Tax.” If your employer deducts PCB correctly and you have no other income, you technically might not need to pay extra. However, filing is still recommended to claim reliefs that your employer didn’t factor in, which could get you a refund.

How do I pay my income tax balance?

You can pay via the ByrHASiL application on the MyTax portal using FPX online banking. You can also pay via credit card, or at bank counters (Maybank, CIMB, Public Bank, etc.).

Tired of your 9-5 job? Join over 25,000 real estate agents worldwide, and expand your career globally!

Continue reading:

- List of Personal Income Tax Relief 2025 Malaysia

- What is Tax Identification Number Malaysia (TIN) and how can you obtain it?

- The Ultimate Guide on How to Claim Income Tax Refund Malaysia

Reference

- Athena, M. (2025, April 11). Understanding Tax Relief For EPF Members. KWSP Malaysia. Retrieved from

https://www.kwsp.gov.my/en/w/article/how-to-file-income-tax - Cheong, A. P. Y. (2024, March 18). How To File Your Taxes For The First Time. RinggitPlus. Retrieved from

https://ringgitplus.com/en/blog/income-tax/how-to-file-your-taxes-for-the-first-time.html - Crowe. (2025, December 16). Malaysia Personal Income Tax Relief for YA 2025. Retrieved from

https://www.crowe.com/my/insights/malaysia-personal-income-tax-relief-for-ya-2025 - HSBC Expat. (n.d.). Tax in Malaysia. Retrieved from

https://www.expat.hsbc.com/expat-explorer/expat-guides/malaysia/tax-in-malaysia/ - LHDN Malaysia. (2025, November 20). How to file your Tax? Retrieved from

https://www.hasil.gov.my/en/individual/introduction-individual-income-tax/how-to-file-your-tax/ - LHDN Malaysia. (2025). Tax Rate Assessment Year 2023, 2024 & 2025. Retrieved from

https://www.hasil.gov.my/en/individual/individual-life-cycle/income-declaration/tax-rate/ - LHDN Malaysia. (n.d.). Frequently Asked Question (Individual). Retrieved from

https://www.hasil.gov.my/en/individual/others/frequently-asked-question-individual/ - Nicholas. (n.d.). Guide to Filing Taxes in Malaysia (e-Filing). Talenox. Retrieved from

https://help.talenox.com/en/articles/3780650-guide-to-filing-taxes-in-malaysia-e-filing - Oyster Team. (2025, May 20). Malaysia income tax: An in-depth guide for 2025. Retrieved from

https://www.oysterhr.com/library/malaysia-income-tax - PwC. (n.d.). 2025/2026 Malaysian Tax Booklet. Retrieved from

https://www.pwc.com/my/en/publications/mtb/personal-income-tax.html - Tan, T. (2025, September 17). MyTax Malaysia (e-Daftar): Complete Guide to Registration and First-Time Login. PeopleX HR Tech. Retrieved from

https://www.peoplex.ai/tips/tax/mytax-malaysia-e-daftar-complete-guide-to-registration-and-first-time-login/ - Victor, A. (2025, February 12). A Guide on How to Pay Income Tax in Malaysia 2025. Maybank. Retrieved from

https://www.maybank2u.com.my/maybank2u/malaysia/en/articles/taxes/personal-tax/how-to-pay-income-tax-in-malaysia.page