Tax season for employees in Malaysia is just around the corner, are you ready? Fret not, as we will provide you with a full guide on Malaysian income tax refunds.

How to claim income tax refunds

- 1. Why must we pay income tax

- 2. Why can we apply for income tax refund claims

- 3. When do we need to submit our tax claims

- 4. How and where to submit our income tax refund claims

- 5. How to check our refund status

- 6. How long will it take to process income tax refunds

- 7. How the money from tax refunds will be paid

- 8. Tips for tax newbies

- 9. Contacts for additional support

1. Why must we pay income tax

Tax revenue received by the government is used to maintain and manage our country’s current public facilities. It is also put towards the development of our infrastructure; such as hospitals and schools.

Furthermore, government funded healthcare and welfare systems are reliant on taxpayer money. Altogether contributing to the wellbeing of our country’s citizens.

You might also be curious as to what forms of income are tax liable.

a. Employment income

This is the gross income that is attributable to employment in Malaysia. This includes self employment and business income and denotes that all income from any business source accruing in Malaysia is tax liable.

b. Investment income

This form of income is derived from an individual’s investments; such as interest, rentals and royalties.

However, do note that there are further nuances that play a role. Read more about the details here.

2. Why can we apply for income tax refund claims

We are eligible for an income tax refund if we pay an excess of taxes to the Inland Revenue Board (LHDN).

For example, let’s say you are subjected to a Monthly Tax Deduction (MTD), but the monthly deduction does not account for additional tax reliefs or unplanned expenses you later incur. You will then be eligible for a tax refund.

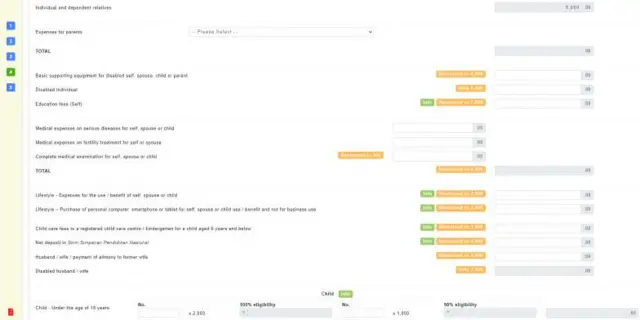

Tax reliefs on the other hand refer to tax deductions where the overall taxable income amount is reduced.

It is paramount that we take the time to understand the eligibility and process of claiming tax returns. As it ensures that we are able to reduce our tax burden and get back money that is rightfully ours.

This is a key feature to take into consideration when planning our personal finances.

3. When do we need to submit our tax claims

Tax refunds are typically processed at the end of the tax year, and so the deadline for a tax refund claim via manual submission is 30th April 2024. The e-filing deadline is 2 weeks later, on 15th May 2024.

If you want to know more about the details of personal tax relief and refunds check out this article.

4. How and where to submit our income tax refund claims

Here is a step-by-step guide on how to claim your tax refund in Malaysia.

After determining you are eligible for a tax refund you can choose to file your tax return either online or manually.

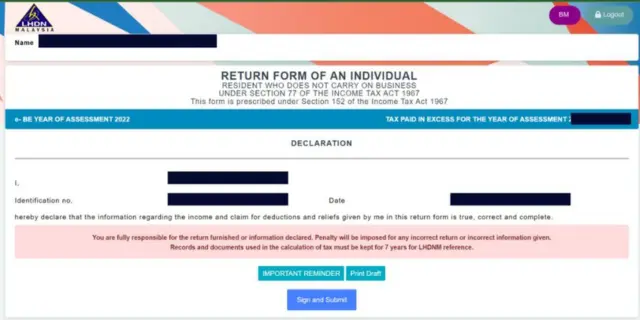

a. Online – e-filing

- Visit the MyTax website and log in. Find the relevant income tax form for the year on the ezHasil services menu.

- Fill in the form accordingly.

Check your summary.

Declare, sign and submit.

b. Manual

- Fill out the relevant income tax form that is downloadable from the hasil.gov.my website.

- Send the form to the Tax Information & Record Management Division, LHDN.

5. How to check our refund status

If you are wondering how to check the status and progress of your tax refund, here is a guide.

- Visit the LHDN website and log in to your e-filing account with your user ID and password.

- After you have successfully logged in, you can check the status of your refund by clicking on the “Services” tab followed by “Refund Status”.

- You will be required to enter your tax reference number and IC number.

- After inputting your details you will be able to view your tax refund status.

- Once your refund has finished processing, you will be able to look at your payment details. This includes the date and amount of cash refunded.

An alternative way of monitoring your status is to phone the LHDN customer service hotline and query them on the progress. Remember to also have your tax reference and identification number on hand when you do so.

Using these methods, we will be able to easily refer to and monitor the status or progress of our refund.

6. How long will it take to process income tax refunds

LHDN Client’s Charter states that your tax refund will be processed within:

- 30 working days if submitted via e-filing;

- 90 working days if submitted manually via post or in person.

a. What to do if you have not received your refund?

Unfortunately there are rare cases where our refund is not processed within the aforementioned time period. In that case, you can contact the HASiL office that handles your file.

7. How the money from tax refunds will be paid

After your refund has been processed, money will either be paid directly into your bank account or as a cheque that will arrive in your mail.

8. Tips for tax newbies

Are you new to the whole income tax process? Here are a few pointers.

a. Don’t have a MyTax account?

This article illustrates the procedures of creating one.

Find out how to obtain a Tax Identification Number (TIN) here.

b. Materials and supporting documents

We must update our details before every submission and ensure that they are accurate. Failing to do so may result in a desk or field audit by LHDN.

Take note that it is important to retain proof of purchase of items material to our tax reliefs for at least 7 years for auditing purposes.

We do not have to submit supporting documentation along with the income tax return form.

Be mindful that without proper records and documentation you might incur a fine or imprisonment under section 119A, ITA 1967.

c. No computer or internet access?

LHDN branches offer special computer counters to enter our claims on the spot.

d. Be wary of LHDN scam calls, texts or emails.

Refrain from providing personal information like credit card numbers or bank details over such channels. Report any incidents of fraud to LHDN and MCMC.

9. Contacts for additional support

Lodging tax forms and statements can be a confusing and arduous process at first. When in doubt or need further assistance, you could contact:

LHDN customer service hotline at 1-800-88-5436

HASiL Care Line at 03-89111000

Or do further search on the LHDN website.

Unlock your potential with IQI, dive into a world of continuous learning and growth opportunities. Join us today!

Continue reading: