We’ve heard stories about EPF Account 3: yup, you can take out money from EPF anytime now.

However, is it the right move? A method of ‘forced savings’, EPF is meant to give you a safety net after you retire. But what if you need some emergency funds now?

The questions are in the air, and most importantly: Should you open an EPF Account 3? Should you take out any money out of your EPF in the first place?

Read on to find out the best call.

What you need to know about EPF Account 3

1. Latest EPF account structure

As mentioned previously, Malaysia’s Employees Provident Fund (EPF) introduced a new account structure in April – adding in another account known as Account 3 or Akaun Fleksibel.

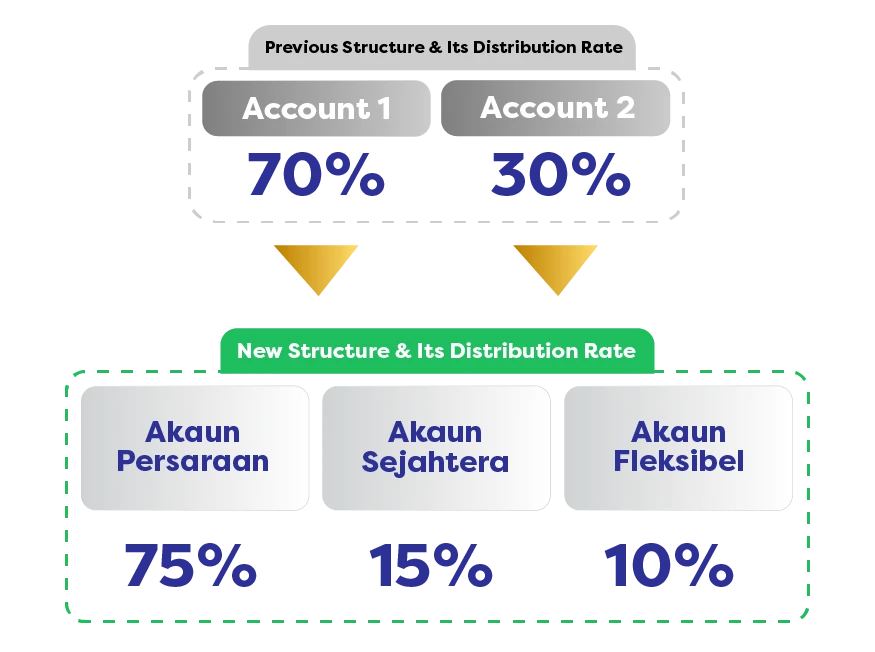

Before this, there were only two accounts that you and I would contribute to in our EPF savings: Account 1 (Akaun Persaraan) and Account 2 (Akaun Sejahtera).

Previously, our contributions took up 70% in Account 1, and 30% goes into Account 2.

Starting May 2024, there will be a total of three accounts, with a distribution of 75% to Account 1, 15% to Account 2, and 10% to Account 3.

A good surprise is that there is now an additional 5% contribution to your main account, Account 1 – which means you get more at retirement (every percentage counts!).

Differences between EPF Account 1, 2 and 3

| Account | Percentage | Description | Conditions |

| Account 1 (Akaun Persaraan) | 75% | – Main account for your retirement – Can voluntarily make additional contributions to your family members’ EPF accounts | – Money from this account can only be taken out upon retirement – If you have saved more than your Basic Savings for your current age, you can invest 30% of your excess savings |

| Account 2 (Akaun Sejahtera) | 15% | – Caters to various life cycle needs | Can only be withdrawn for purposes such as housing, education, and medical |

| Account 3 (Akaun Fleksibel) | 10% | – Enhance members’ income security while addressing their current life cycle needs | Savings in this account can be withdrawn at any time |

2. What is EPF Account 3, and how does it work?

Account 3, also known as Akaun Fleksibel, is an alternative for individuals to manage their finances in light of the pandemic’s economic challenges.

Account 3 will start with a zero balance, and allows flexible withdrawals.

Which means, you can withdraw from Account 3 at any time, just like you do with MAE, CIMB Clicks or any savings account you have.

There is no limit to the amount of withdrawals you make, unlike Account 2, which you can only withdraw from for specific purposes.

Will having Account 3 affect the dividend rates?

If you make a withdrawal, it will affect the dividend rate just like the previous system.

Simply put: the more you withdraw, the lower the rate.

So, if you never take out any money from your Account 3 – even if you’ve chosen to enable it – it will not affect your dividend rate.

What is going to happen to the savings inside my existing EPF accounts?

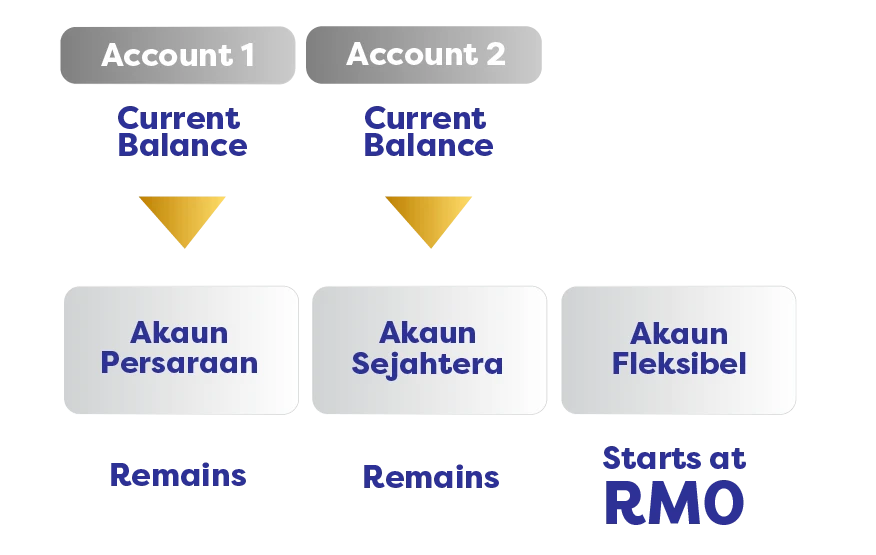

In general, nothing is going to happen to them.

This is because all of the existing savings inside your Account 1 and Account 2 will still be there while the new Account 3 will start at RM0.

When can you start withdrawing from Account 3?

If you opt in between May 11 and August 31, you can start withdrawing after May 13.

The money will be credited into the third account with the option to withdraw after May 13.

You can apply through the EPF app KWSP i-Akaun or the Self-Service Terminals at any EPF branches in Malaysia.

It will take up to 24 hours to transfer the funds from your other accounts into Account 3.

Are there conditions to withdraw?

There are no conditions to withdraw, but bear in mind that you can only withdraw a minimum of RM50. This can be done anytime.

If you are a contributor aged 55 and below, you have until 31 August to choose to enable Account 3 or not.

3. How to transfer from EPF Account 2 to Account 3

Did you know you can move your savings in EPF Account 2 to your Account 3?

It’s available as a one-time transfer. However, you cannot simply withdraw any amount you like – the amount will depend on the savings you have in Account 2.

Here’s how it works:

| Amount in Account 2 | Savings amount |

| > RM3,000 | – 1/3 of your Account 2 savings goes to Account 3 -1/6 of your Account 2 savings goes to Account 1 |

| < RM3,000 | All savings will go into Account 3 |

| > RM1,000 but < RM3,000 | – RM1,000 will be transferred to Account 3 – The rest remains in Account 2 |

You can apply for this one-off transfer through the KWSP i-Akaun app, or at Self-Service Terminals at any EPF branch nationwide.

Can I transfer savings from EPF Account 3 to Account 1 or Account 2?

If you’d like to save all of your EPF contributions, you have the option to move your savings from Account 3 to Account 2 and/or Account 1.

However, this is only a one-way transfer, and you cannot take back the money you have transferred.

If you want to do so, you will have to visit an EPF branch and submit an application to perform the transfer.

Now the big question is….

4. Should you opt in to Account 3?

It’s…. complicated. Let’s address a few issues that might arise:

Will you end up with less money during retirement?

Something to remember is that the more you withdraw from your EPF, the less you’ll benefit from the compounding effect (a.k.a. the less savings you’ll have once you retire).

Although you are receiving an additional 5% in your Account 1, opening an Account 3 means:

- less money in your Account 2 (from 30% to 15%!)

- if you withdraw more, the EPF dividend rate will reduce in the long run

What if you need to use the money in your Account 2?

Another thing to keep in mind is, as mentioned – your Account 2 will have lesser contributions. Simply put, you have less money in your Account 2 moving forward.

Most people use their Account 2 savings for needs such as medication, home deposit and education. If you’re planning to use the money for that… you’ll probably have less for it.

But, there is a way to use EPF Account 3 correctly…

Actually, you can be savvy about it (pun not intended). EPF consistently pays out a 5% dividend, and if you park your other savings into Account 3 just like you would with your regular savings account, you get even more!

In the end, the choice lies in your hands. The CEO of EPF, Ahmad Zulqarnain advised against touching or limiting withdrawals as much as possible.

Sean Lee, IQI’s investment strategist gives you even further insights on whether or not to opt in to Account 3 in the latest Property Zone episode. It’s worth the watch:

Will you opt in to Account 3?

Looking for other ways to invest for your future? Property investment is the way to go! Get in touch with our professionals below and see how you can boost your savings with property.

Continue reading: