Struggling to make sense of Malaysia’s ever-shifting rental market?

Understanding the Q2 and Q3 Home Rental Index for 2024 as home rental prices change can help investors make better decisions.

This article breaks down the latest trends, reports, and comparisons so you can decide whether property investment in Malaysia is suitable for you.

This article is based on the Q2 and Q3 2024 Home Rental Index Report by IQI Malaysia and the National Property Information Centre (NAPIC)

Q2 Vs. Q3 2024 Home Rental Market Report

- 1. Q1 Vs. Q2 Rental Market Analysis Based on Q3 Report 2024

- 2. Understanding the Data: What Drives Malaysia’s Rental Growth?

- 3. Residential Property Breakdown: A Closer Look at Q1 and Q2

- 4. Rental Trends: Key Observations from Q1 and Q2 of 2024

- 5. Kuala Lumpur Vs. Johor: Defender and Challenger in Malaysia Real Estate Leader

- 6. Comparison with Other Countries for Investors

- 7. Expert Tips for Property Investment in Malaysia

- 8. What Can We Expect in Q3, Q4 2024 and 2025?

1. Q1 Vs. Q2 Rental Market Analysis Based on Q3 Report 2024

The Malaysian property market in 2024 has seen a significant shift, with a steady increase in rental prices driven by various economic and infrastructural factors.

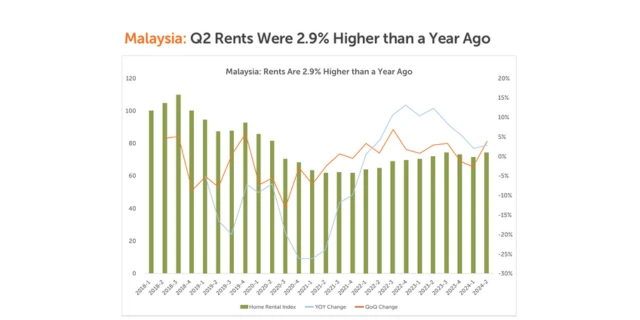

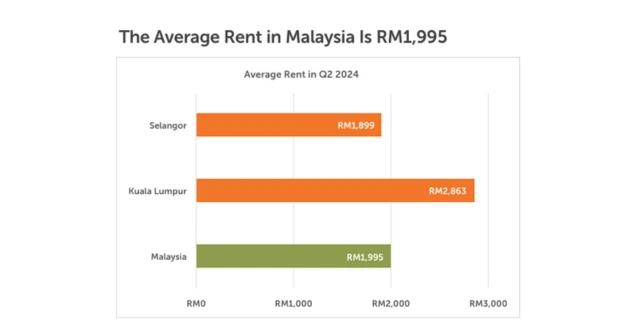

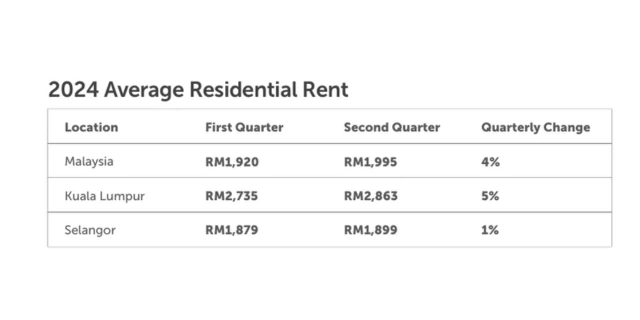

According to the IQI Malaysia Home Rental Index report for Q3 2024, the average rent in Malaysia increased by 2.9% YoY (Year-over-Year) in Q2 2024, with Selangor and Kuala Lumpur leading the charge in terms of rental hikes.

Here’s an in-depth breakdown of the data between Kuala Lumpur and Selangor:

2. Understanding the Data: What Drives Malaysia’s Rental Growth?

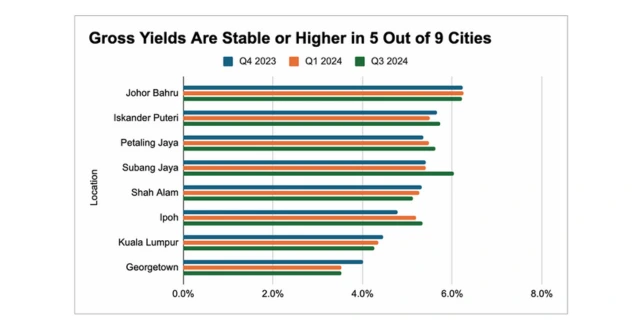

a. Higher Rental Yields

As the IQI report indicates, gross rental yields have remained stable across central Malaysian states, providing solid returns for investors.

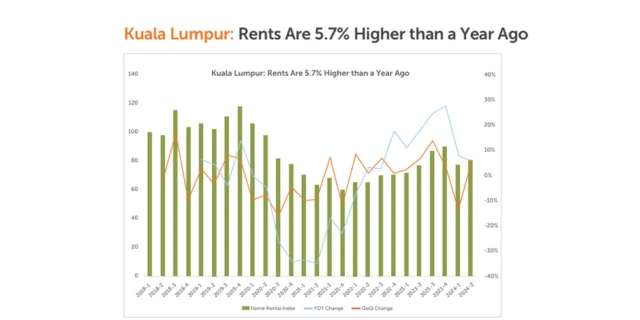

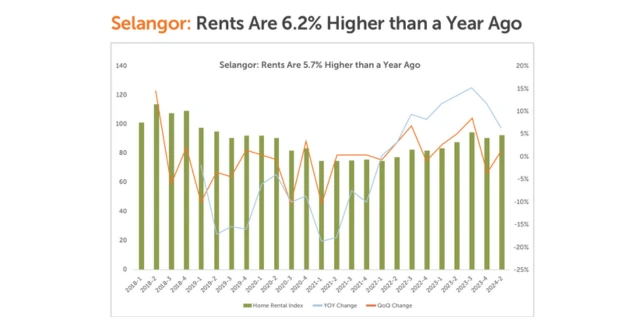

Cities like Kuala Lumpur saw rents increase by 5.7% in Q2, while Selangor recorded a 6.2% rise, proving the region’s resilience and appeal to property investors.

This indicates a growing demand for rental properties, especially in high-demand areas near key transport hubs.

b. Malaysia Overnight Policy Rate (OPR)

Malaysia’s OPR has been stable at 3.0% since July 2024.

This stability in borrowing costs supports property investments, making real estate financing more accessible.

Investors benefit from relatively lower mortgage payments, creating an attractive environment for rental property purchases.

With increased demand for rental units and steady OPR, the investment outlook is favorable for new and experienced investors.

3. Residential Property Breakdown: A Closer Look at Q1 and Q2

The residential property market dominated Malaysia’s real estate sector in the first half (H1) of 2024, accounting for 61.3% of total transactions.

Terraced houses and high-rise apartments saw the most significant demand, particularly in Johor and Selangor.

Here’s a breakdown of property types and their market performance:

| Property Type | Percentage of Total Transactions | Key Regions |

|---|---|---|

| Terraced Houses | 43.0% | Johor, Selangor |

| High-Rise Units | 14.3% | Kuala Lumpur, Selangor |

| Vacant Land Plots | 15.3% | Nationwide |

| Low-Cost Flats | 10.8% | Johor, Penang |

| Semi-Detached Houses | 7.9% | Johor, Penang |

Selangor and Kuala Lumpur remain dominant in terms of both volume and value of residential transactions.

According to the latest data, Selangor contributed 22.3% of total residential transactions, while Kuala Lumpur saw a 5.7% increase in rental prices.

4. Rental Trends: Key Observations from Q1 and Q2 of 2024

a. Kuala Lumpur

With a 5.7% increase in rents compared to last year, the city remains an attractive investment location, particularly with developments like the MRT 3.

b. Selangor

The demand for terraced houses and apartments remains high, with rents increasing by 6.2% YoY. Selangor’s growth is consistent, supported by its proximity to Kuala Lumpur and affordable living options.

c. Johor

Johor continues to attract foreign investors, especially from Singapore, due to its lower costs and infrastructure projects like the Johor-Singapore Rapid Transit System (RTS).

5. Kuala Lumpur Vs. Johor: Defender and Challenger in Malaysia Real Estate Leader

a. Key Infrastructure Developments in Kuala Lumpur: MRT 3 and Its Impact

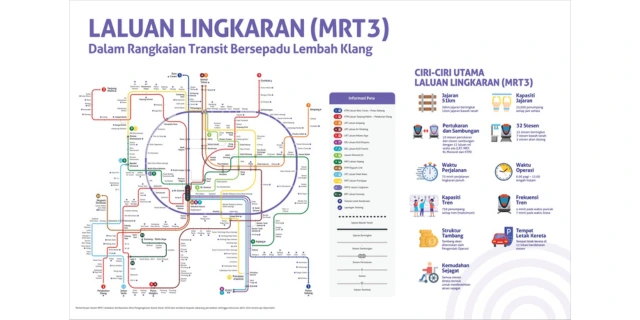

Another critical factor driving the rental market is Kuala Lumpur’s MRT 3 project.

As the MRT Circle Line (MRT 3) progresses, areas surrounding the stations are expected to experience higher rental demand.

The MRT 3 project is set to link several vital parts of the city, significantly improving urban connectivity and making it easier for tenants to access business districts.

This infrastructure boom and rising rental prices make Kuala Lumpur’s rental market a lucrative opportunity for property investors.

With properties near MRT 3 stations likely to see higher demand, investors should consider targeting these areas for their subsequent acquisition.

b. Johor’s Rising Potential: Iskandar Puteri and the RTS Link

Johor has emerged as a critical region for property investments, particularly in Johor Bahru and Iskandar Puteri.

Implementing the Rapid Transit System (RTS) link between Johor Bahru and Singapore has been a game-changer for the region. It has enhanced connectivity and made Johor a hot spot for real estate growth.

With Johor’s proximity to Singapore, investors are increasingly attracted to the rental market, where rents have steadily increased.

The RTS link is expected to handle 10,000 passengers per hour, reducing congestion and making commuting between Johor and Singapore more seamless.

Due to increased demand from local and international tenants, this enhanced infrastructure further cements Johor Bahru and Iskandar Puteri as prime rental and property investment areas.

c. Comparing the Johor and Kuala Lumpur Competitive Advantages

| Metric | Johor | Kuala Lumpur |

|---|---|---|

| Key Infrastructure | RTS | MRT 3 |

| Market Focus | Residential, High-rise, Vacant Land | High-rise, Condominiums |

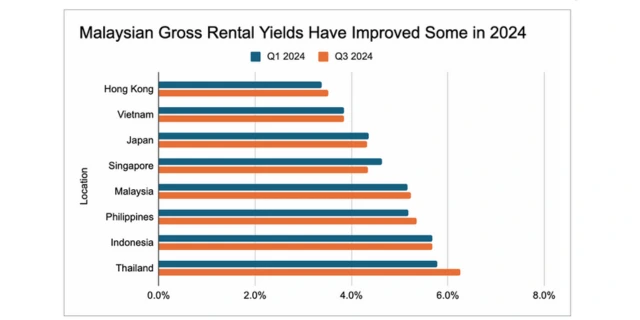

6. Comparison with Other Countries for Investors

Malaysia’s property market, especially in cities like Kuala Lumpur, offers significantly higher yields than regional competitors like Singapore and Thailand.

Here’s how Malaysia stacks up against other countries:

| Country | Rental Yield (%) | Foreign Investment Policy | Cost of Living |

|---|---|---|---|

| Malaysia | 5.16 – 5.24 | MM2H (favorable for foreigners) | Low |

| Singapore | 4.35 – 4.65 | Stringent foreign ownership laws | High |

| Thailand | 5.79 – 6.27 | Limited leasehold options | Moderate |

| Vietnam | 3.84 – 4.02 | Foreigners can buy only in select areas | Low |

Investors looking for high returns and fewer restrictions will find Malaysia a more favorable market, particularly with the MM2H program.

7. Expert Tips for Property Investment in Malaysia

Here are some strategies to consider:

- Focus on High-Growth Areas: Johor, Selangor, and Kuala Lumpur offer distinct advantages, with Johor benefiting from the RTS project while Selangor and Kuala Lumpur seeing increased demand due to the MRT 3.

- Look at Long-Term Trends: Malaysia’s rental market is gradually recovering from the pandemic, so properties bought now may see increasing returns.

- Consider Foreign-Friendly Policies: Programs like MM2H make Malaysia one of the most attractive countries for foreign property investors.

- Investment Timing: With Malaysia’s OPR holding steady at 3.0%, borrowing costs remain manageable, creating favorable conditions for property financing

8. What Can We Expect in Q3, Q4 2024 and 2025?

As we approach the end of 2024 and look ahead to 2025, several key factors will shape Malaysia’s real estate and rental market.

a. New Developments

With ongoing infrastructure projects like Kuala Lumpur’s MRT 3 and Johor’s RTS link expected to progress, we can anticipate a boost in demand for properties surrounding these areas.

New residential and commercial developments will continue to spring up strategically, creating further investor opportunities.

b. Budget 2025 Announcements

The Malaysian government’s upcoming Budget 2025 announcement is expected to introduce housing schemes and incentives to improve affordability and support first-time homebuyers.

Investors closely monitor potential benefits and financial schemes impacting property demand and supply.

c. Economic Growth and Stronger MYR

Malaysia’s economy is projected to strengthen as the global economy recovers and the US Federal Reserve lowers interest rates.

The Malaysian Ringgit (MYR) is expected to appreciate, leading to increased investor confidence.

A stronger currency and favorable economic conditions could enhance purchasing power, making property investments more attractive for local and international investors.

As we move into Q4 2024 and beyond, Malaysia’s property market is set to experience growth driven by new developments, a more robust economy, and upcoming government incentives.

With the rental market showing steady improvement and infrastructure projects like MRT 3 and the RTS link enhancing connectivity, opportunities for both local and foreign investors are ripe.

But with all these positive changes on the horizon, the question remains: As an investor, what’s your action plan to leverage these market shifts? And as a Malaysian, how do you feel about new developments and the growing interest from foreign investors?

Your decisions now could have a lasting impact on your financial future. What will be your next move?

Seize the moment! With rising rental yields, upcoming infrastructure projects, and a more robust economy, now is the perfect time to invest in Malaysia’s booming real estate market. Invest in Malaysia now and watch your wealth grow!

Continue Reading: