Version: CN

Fixed Deposits (FD) and Fixed Deposit-i are widely trusted investment options in Malaysia, offering a secure way for people to grow their savings.

These choices have become popular because they are safe, reliable, and provide consistent earnings.

Let’s look at these options and understand their differences, along with the current FD rates in May 2024.

Your Guide to Fixed Deposits + Latest FD Rates

What is Fixed Deposit (FD) and Fixed Deposit-i (FD-i)?

What is Fixed Deposit (FD)?

Fixed deposits, commonly known as FDs, are traditional savings accounts offered by banks and financial institutions.

They function on a straightforward principle: you deposit a specific sum of money for a predetermined period, ranging from a few months to several years.

During this tenure, the deposited amount accrues interest at a fixed rate, which is typically higher than in regular savings accounts.

The interest rate remains constant throughout the agreed-upon period, providing investors with stability and predictability in their earnings.

What is Fixed Deposit-i (FD-i)?

Fixed Deposit-i, often referred to as Islamic Fixed Deposits, follows the principles of Islamic finance. These deposits are Shariah-compliant, adhering to Islamic laws that prohibit earning interest (Riba).

Instead of earning interest, investors in Fixed Deposit-i accounts enter into a Mudarabah or Wakalah contract with the bank.

Under Mudarabah, the bank pools funds from investors and engages in Shariah-compliant activities.

Profits generated from these activities are shared between the bank and the investors based on agreed-upon ratios.

Key Differences between FD and FD-i

| FD | FD-i | |

| Interest vs. profit-sharing | Earn a fixed interest rate on your deposit | Using a profit-sharing model |

| Shariah Compliance | Operate on interest, which might not align with Shariah principles | Shariah-compliant |

| Flexibility in Tenures | A variety of tenures, accommodating both short-term and long-term investment preferences | Provides diverse tenure options, allowing you to align your investment with your specific goals and needs |

| Investment Profit Allocation | Earnings are based on fixed interest rates | Operates on profit-sharing; returns fluctuate based on profits from Shariah-compliant activities |

Latest Fixed Deposit/FD rates for May 2024

1. Alliance Bank

Offer: Alliance Bank’s Fixed Deposit Promotion Offer.

Interest Rates: 3.80% per annum for 6 months

Minimum Deposit: RM10,000

Promotion Period: 1 April 2024-30 September 2024

Offer details and conditions: Exclusively for Alliance Bank new account holders; must be deposited in 30 days.

2. Hong Leong Bank

Offer: Hong Leong Bank’s HLB Connect eFD/eFD-i fixed deposit offer.

Interest Rates:

| Interest rate (%) | Lock-in period |

| 3.45 | 3 months |

| 3.65 | 6 months |

| 3.65 | 10 months |

| 3.60 | 12 months |

Minimum deposit: RM1,000.

Promotion Period: 1 May 2024 – 24 May 2024

Preferential Terms: Users must use HLB Connect Online or HLB Connect APP, and transfer money from other banks to Hong Leong Bank accounts by FPX.

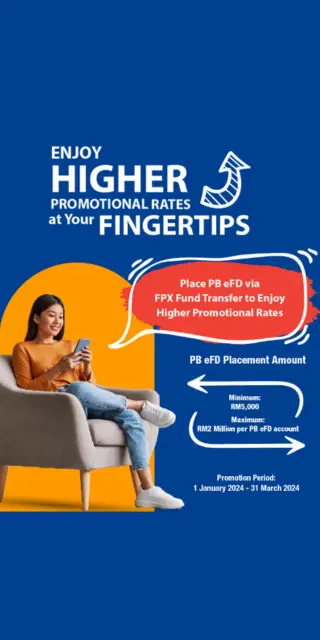

3. Public Bank

Offer: Public Bank provides “eFD via FPX.”

Interest Rates:

| Interest rate (%) | Lock-in period |

| 3.60 | 3 months |

| 3.65 | 6 months |

| 3.70 | 9 months |

| 3.75 | 12 months |

Minimum Deposit: RM5,000

Promotion Period: 1 April 2024 – 30 June 2024

Preferential Terms: Exclusively for online time deposit discounts, facilitated through Public Bank Online Banking (PBe Online Banking) using FPX fund transfers with new funds.

4. RHB Bank

1. RHB Term Deposit

Fixed Deposit Rate: 3.70% (minimum deposit of RM1,000); 3.80% (minimum deposit of RM10,000)

Lock-up period: 9 months

Offer period: 12 April 2024 – 30 June 2024

Offer Details & Conditions: The 3.80% discount is only available to RHB Premier users. It can be deposited through RHB Mobile Banking App or RHB Online Banking.

2. RHB e-Term Deposit

Fixed deposit interest rate: 3.70%

Lock-in period: 9 months

Promotion period: 17 April 2024 – 30 June 2024

Minimum deposit: RM1,000

Offer details and conditions: Deposit can be made through RHB Mobile Banking App or RHB Online Banking.

5. Affin Bank

Offer: Affin Bank provides “eFD/eTD-i“ campaign.

Interest Rates:

| Interest rate (%) | Lock-in period |

| 3.50 | 3 months |

| 3.65 | 6 months |

| 3.70 | 9 months |

| 3.75 | 12 months |

Minimum Deposit: RM10,000

Promotion Period: 2 May 2024 – 31 May 2024

Preferential Terms: All eFD/eTD-i must be made through fund transfers from existing Current Account Savings Account (CASA)/ Current Account-i Savings Account-i (CASA-i).

Finding the best FD rates in Malaysia involves careful consideration. As a potential investor, focus on the duration, minimum deposit, and any special terms each bank offers. By understanding these details, you can make a smart investment choice tailored to your needs. Stay informed, compare options, and choose wisely to maximize your earnings!

Looking for smart investment options? Interested in growing your wealth? Invest wisely in your future with a career with us – sign up here!