As we enter 2025, the demand for real estate is becoming increasingly active. With more people are either on the hunt to buy homes or exploring investment opportunities.

With Malaysia’s property sector prepares for substantial growth, IQI Global noticed a significant uptick in 2024 compared to the previous year.

Operating in over 30 countries, IQI is renowned for its cutting-edge innovations in prop-tech.

Leveraging our extensive market expertise, IQI is committed to keeping you informed on the latest trends and opportunities, empowering you to make well-informed investment decisions.

Here’s IQI Global overall market insight for the year of 2024.

IQI 2024 Home Market Insight

Project Sales: A Remarkable Growth

In 2024, IQI Global has experienced a solid increase in total project sales, with 11,691 properties sold, marking a 19% growth from 9,819 in 2023.

This surge demonstrates the strong demand for new properties in Malaysia, particularly in key urban areas including Kuala Lumpur, Johor Bahru and Penang.

According to the National Property Information Centre (NAPIC), the first half of 2024 saw property transaction values soar to RM105.65 billion, an 8% increase in transaction volume compared to 2023.

1. Kuala Lumpur

Kuala Lumpur stands out as one of Malaysia’s key urban centers.

The city is leading the IQI property sales, which is driven by a blend of new projects, ongoing urban redevelopment, and infrastructure growth. These projects include residential, commercial, and mixed-use developments.

With the ongoing Bandar Malaysia project, IQI observes a rising trend among homebuyers who are focusing on urban locations like the Klang Valley.

This area showcases a modern, multifunctional development with residential, commercial, and recreational spaces.

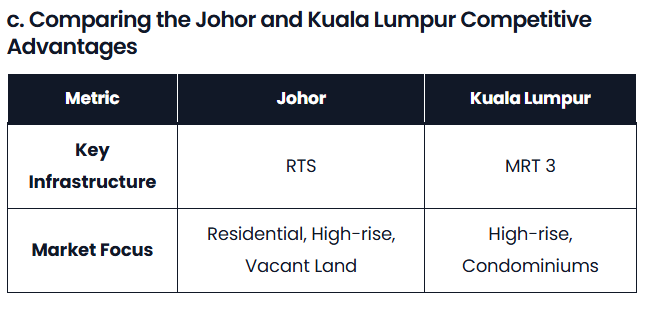

These projects, along with the expansion of the MRT and LRT systems, are making Kuala Lumpur a livelier and more connected city, attracting interest from both local and international buyers.

As a result, developers are increasingly focusing on sustainable projects that promote integrated living spaces, appealing to property buyers from both local and international markets.

Moreover, Kuala Lumpur’s reputation as a hub for international business and tourism attracts high-net-worth individuals eager to invest in the city’s premium real estate sector.

2. Johor Bahru

Johor has already solidified its position as one of the fastest-growing states for IQI project sales, driven largely by its strategic location and strong cross-border connections.

In 2024, Johor has seen a surge of demand in the property sector, with more international buyers and investors looking to settle in Johor Bahru.

The Iskandar Puteri project for example, continues to be a key catalyst for IQI Johor’s property market growth.

As a planned economic region, Iskandar Puteri focuses on sectors like education, healthcare, logistics, and tourism, attracting both domestic and international investors.

Other than that, during the 2025 Malaysia Budget presentation, the MADANI government announced plans to revitalise the long-neglected Forest City.

This project is likely to boost the local economy and generate a significant number of jobs, particularly in the duty-free zone, and is expected to attract both local and international investors.

Additionally, Johor’s proximity to Singapore, a leading global financial center, presents unique opportunities for developers and investors alike.

The nearly completed RTS Link will facilitate travel between Malaysia and Singapore, enhancing accessibility. This development not only improves travel but also opens numerous earning possibilities, potentially in Singapore dollars.

The ease of cross-border movement is likely to result in a steady stream of workers, professionals, and investors from Singapore, driving up the demand for affordable housing, commercial properties, and rental options in Johor.

3. Penang

Penang’s government has really taken the lead in urban development, pushing for modern infrastructure and revitalisation projects that are transforming the area. So, it makes total sense that Penang is one of the top property hotspots for IQI.

Projects such as the Penang Transport Master Plan (PTMP)—which includes new highways, light rail transit systems, and an underwater tunnel—boosted connectivity and urban growth.

Penang is also rapidly growing as a key player in Malaysia’s tech scene. The state is home to a thriving electronics and semiconductor industry, making it a key destination for tech professionals and multinational companies.

Developers in Penang are also reportedly shifting their focus on sustainable living solutions, with many new projects offering eco-friendly features and energy-efficient designs.

Subsale Market: Continued Demand for Pre-Owned Homes

IQI Global’s data also reveals an active subsale market in 2024, with a total of 9,546 pre-owned homes sold.

Additionally, 22,895 rental properties were transacted, indicating a healthy demand for both ownership and rental opportunities.

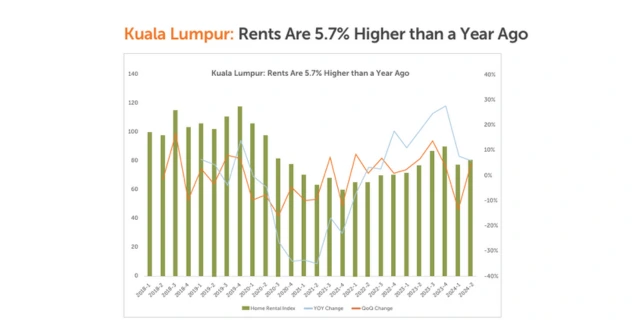

1. Kuala Lumpur

As Malaysia’s number one capital, Kuala Lumpur maintains a significant influence in the subsale and rental property sectors.

The city boasts appealing rental yields, thanks to its vibrant business and cultural environment, which drives strong demand for both commercial and residential real estate, supported by a high influx of expatriates, professionals, and corporate tenants.

For investors, Kuala Lumpur represents a compelling choice for subsale properties, as they seek to capitalise on the city’s continuous growth and development.

The improving infrastructure and robust economy provide promising opportunities for long-term investment gains.

2. Johor Bahru

Johor also continues to see an influx of buyers and renters looking for affordable properties with easy access to Singapore.

The demand for housing in Johor is largely driven by its proximity to Singapore’s thriving economy, as well as the region’s growing infrastructure projects.

Whether for investment purposes or relocation, Johor remains an attractive destination for both homebuyers and renters.

3. Penang

As for Penang, the state continues to be one of the most sought-after states for subsale properties due to its status as a thriving tech hub and a major tourist destination.

The state’s unique blend of modern urban development and rich cultural heritage makes it a highly desirable place to live and invest in.

Rental demand is also high, especially in areas near Penang’s key commercial districts like Bayan Lepas, where both locals and expatriates are looking for quality homes.

Why the Surge in Subsale Properties?

IQI market reports that buyers often prefer subsale homes as they offer more affordable pricing compared to newly launched developments.

Additionally, subsale properties are available for immediate occupancy, which is a key factor for those looking for faster living arrangements or investment returns.

Why Are Rental Rates Higher in Certain Areas?

Rental demand tends to be higher in locations with ample job opportunities, office spaces, and access to industrial zones.

In hub-focused states like Kuala Lumpur, Johor Bahru or Penang, for example, factories and corporate offices draw in workers from various industries, creating a natural demand for rental properties.

International Investments: Expanding Horizons

IQI Global has expanded its reach to 30 countries worldwide, strengthening its position as a global player in real estate.

The international market continues to grow, with significant opportunities emerging in several key countries.

Top 3 Countries for International Investments

1. Canada

Canada has become an attractive destination for international property investors. In 2015, IQI Global announced IQI Canada; offering abundant of opportunities for buyers, investors, and sellers alike.

Back during its launched in April 2015, the Canadian property market experienced a significant surge of 17%, and today, it continues to attract foreign investors.

The market has demonstrated resilience and adaptability, fueled by immigration, population growth, and a robust economy.

The country actively encourages foreign residents and workers to support its economy, and many Canadians working abroad are fuelling the demand for real estate.

As a result, Canada continues to be a preferred market for foreign property investors.

2. Australia

Australia remains a popular destination for international students, particularly from Asia, thanks to its affordable education system.

Since its establishment in 2019, IQI Australia has been dedicated to offering property services to both local and international clients, helping them navigate the ever-evolving Australian real estate market.

In 2024, the strong demand for student housing—both for rental and purchase—has played a key role in boosting the overall property market. This demand is driven by the growing influx of international students seeking accommodation.

Moreover, the trend of parents investing in properties for their children has further contributed to the surge in demand, particularly in major cities such as Sydney, Melbourne, and Brisbane.

3. Vietnam

Vietnam is rapidly emerging as a cost-effective and stable market for property investments, particularly in the hospitality and tourism sectors.

With three strategically located offices across the country, IQI Global has closely observed the growing demand for real estate in Vietnam.

With strong economic growth and U.S. investments (such as Trump’s initiatives), Vietnam’s property market offers a range of opportunities.

The country’s abundant natural resources, vibrant culture, and flourishing tourism industry further enhance its appeal, offering investors promising prospects across various real estate segments.

With its dynamic growth and evolving infrastructure, Vietnam continues to be an attractive destination for savvy property investors.

In conclusion, IQI property market in 2024 continues to show a consistent upward trajectory compared to 2023, as highlighted by the strong sales in both new developments and subsale properties.

IQI Global remains committed to providing valuable insights derived from our extensive network of property buyers and agents.

Whether you are an investor or a homebuyer, the trends we have highlighted reflect a market that offers substantial opportunities in both local and international markets.

We recommend that all financial decisions be made with careful consideration, keeping in mind the ever-changing market dynamics.

IQI Global, as a leading prop-tech agency, continues to deliver insights that help our clients stay ahead in the competitive property landscape.

Disclaimer: These insights are derived from IQI’s property buyers and reliable internal research. Any financial decisions are at the discretion of individuals. IQI acts as a property agency providing insights from buyers and agents.

Now is the time to invest in the booming real estate market! Let IQI connect you with your desirable property location to ensure a smooth transaction. Contact us today!

Continue Reading: