When you’re planning to buy a home in Malaysia, one of the most important factors banks will look at is your Debt-To-Service Ratio (DSR). It plays a crucial role in determining your home loan eligibility, the amount you can borrow, and whether your loan application gets approved.

In this article, we’ll explain what DSR is, how it’s calculated, how it affects your home loan, and tips to improve it—so you can make informed decisions before applying for a mortgage.

Everything you need to know about DSR

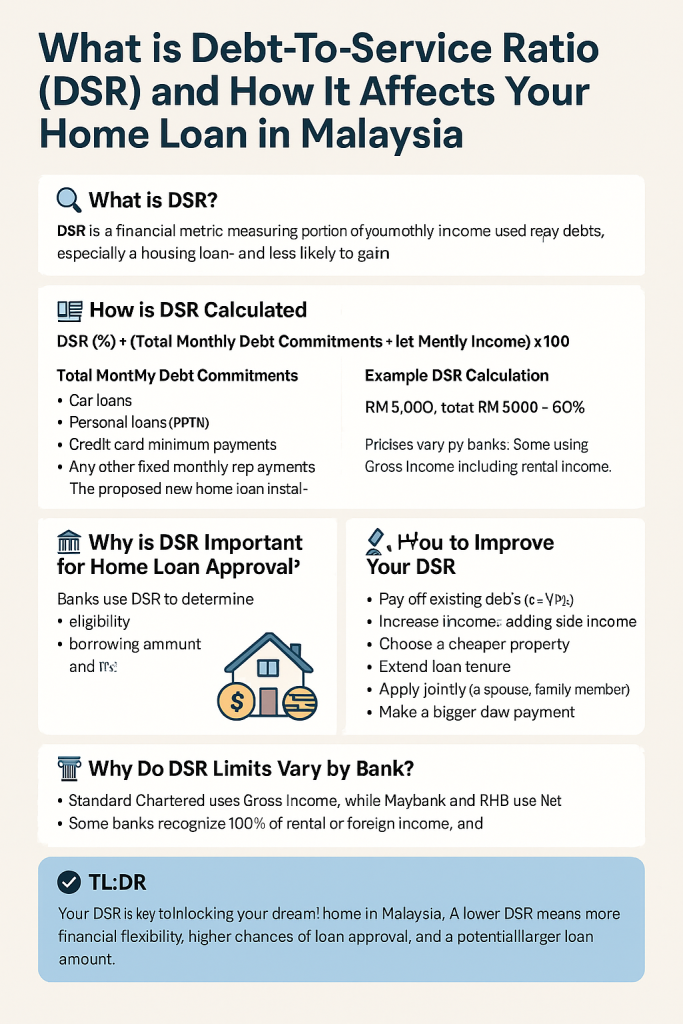

What is DSR?

DSR (Debt-To-Service Ratio) is a financial metric that measures the portion of your monthly income used to repay debts. It tells the bank how much of your income is already committed and whether you can afford new loan repayments—especially for a housing loan.

If your DSR is too high, it means you may be financially stretched and less likely to get loan approval.

How is DSR Calculated?

The general formula is:

DSR (%) = (Total Monthly Debt Commitments ÷ Net Monthly Income) × 100

Total Monthly Debt Commitments include:

- Car loans

- Personal loans

- Student loans (e.g. PTPTN)

- Credit card minimum payments

- Any other fixed monthly repayments

- The proposed new home loan installment

Net Monthly Income means your salary after deductions such as income tax, EPF, SOCSO, and other mandatory contributions.

📌 Note: Some banks use Gross Income instead, and may include other income like fixed allowances or rental income. Policies vary across banks.

DSR Calculation Example for First-Time Home Buyer

a) Profile

- Name: Aina

- Age: 28

- Employment: Executive at a private company

- Net Monthly Income: RM4,500 (after EPF & tax deductions)

b) Existing Monthly Debt Commitments

| Type of Debt | Monthly Payment |

|---|---|

| Car Loan | RM600 |

| PTPTN Loan | RM150 |

| Credit Card (Min) | RM200 |

| Total Commitments | RM950 |

c) Target Property

- Property Price: RM400,000

- Down Payment: 10% (RM40,000)

- Loan Amount: RM360,000

- Tenure: 35 years

- Estimated Monthly Mortgage (at 4% interest): ~RM1,500

d) New DSR Calculation

Total Commitments (including new mortgage):

RM950 (existing) + RM1,500 (housing loan) = RM2,450

DSR = (RM2,450 ÷ RM4,500) × 100 = 54.4%

Conclusion

She is likely eligible for the loan, provided her credit record (CTOS/CCRIS) is clean and other criteria are met.

Aina’s DSR is 54.4%, which is within the 60–70% range accepted by most banks.

Why is DSR Important for Home Loan Approval?

Banks use DSR to determine:

- Whether you’re eligible for a loan

- How much you can borrow

- Whether you’re high risk or low risk

Here’s how DSR affects your mortgage journey:

| DSR Range | Bank’s Likely Response |

|---|---|

| Below 60% | High chance of approval |

| 60% – 70% | Considered with scrutiny |

| Above 70% | High risk of rejection |

If your DSR is above the bank’s threshold, they may:

- Reject your application

- Approve a lower loan amount

- Ask you to apply with a joint applicant

Example DSR Calculation

Let’s say your net monthly income is RM5,000, and your total monthly debt (including your proposed housing loan) is RM3,000.

DSR = (RM3,000 ÷ RM5,000) × 100 = 60%

If the bank’s limit is 70%, you are likely to get approved. But if your total commitment exceeds RM3,500 (70%), you may face rejection unless adjustments are made.

Why Do DSR Limits Vary by Bank?

Each bank has its own DSR threshold and income recognition method, for example:

- Standard Chartered uses Gross Income, while Maybank and RHB use Net Income.

- Some banks recognize 100% of rental income or foreign income, others only partially.

- A bank may accept 70% DSR for high-income earners, but only 40% for low-income applicants.

That’s why your loan could be rejected by one bank, but accepted by another.

How to Improve Your DSR

Improving your DSR increases your chances of loan approval and may allow you to borrow more. Here’s how:

- Pay Off Existing Debts – Settle small loans or credit card balances.

- Increase Your Income – Consider adding side income or rental income.

- Choose a Cheaper Property – Lower mortgage payments = lower DSR.

- Extend Your Loan Tenure – A longer term reduces monthly installments.

- Apply Jointly – Combine income with a spouse or family member.

- Make a Bigger Down Payment – Borrow less and reduce monthly payments.

Final Tips Before Applying for a Home Loan

- Always calculate your DSR first to know your borrowing power.

- Check multiple banks—loan approval chances can vary widely.

- Maintain a clean CCRIS/CTOS report. While not part of DSR, it still influences approval.

TL;DR

Your DSR is key to unlocking your dream home in Malaysia. A lower DSR means more financial flexibility, higher chances of loan approval, and a potentially larger loan amount. Understanding and managing your DSR before you apply could be the difference between rejection and home ownership.

Let our expert agents at IQI Global help you calculate your DSR and get the best loan options.

Fill in your details below and we’ll match you with a certified property expert who can guide you for free!

Continue reading: