Written by Lily Chong, Head of IQI Australia

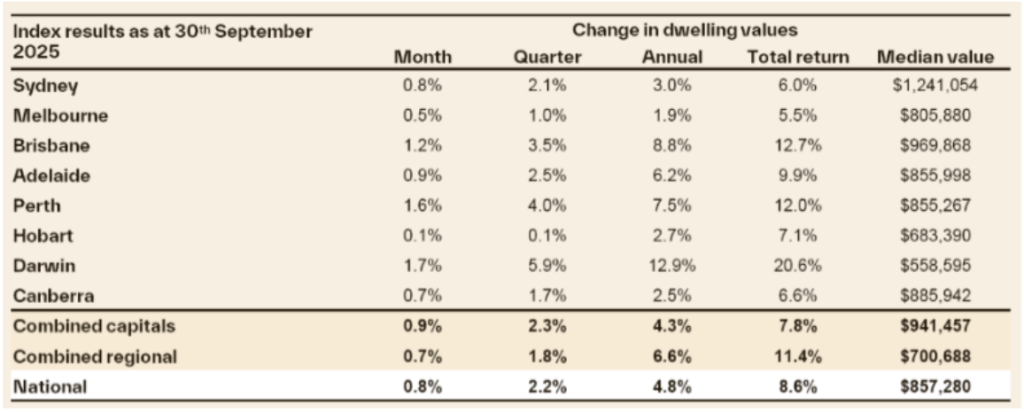

Australia’s housing markets are gathering strong momentum as we head deeper into spring, with September delivering the sharpest monthly rise in national dwelling values since October 2023. The Cotality Home Value Index (HVI) lifted 0.8% over the month, driven by a solid 0.9% gain across the capital cities.

On a quarterly basis, national dwelling values rose 2.2% in the September quarter—up from 1.5% in June and more than double the 1.1% growth in March. In dollar terms, this equates to an $18,215 increase in the median dwelling value over just three months.

Growth remains broad-based, with every capital city and regional market recording gains over the month, quarter, and year. However, the pace of growth is again showing clear divergence:

- Perth (+4.0%) and Brisbane (+3.5%) led the capitals through the September quarter, supported by strong unit market demand.

- Darwin (+5.9%) surged ahead, marking the fastest quarterly growth rate of all capitals.

- Most cities are still seeing stronger gains in house values, though Brisbane, Perth and Hobart stand out with unit prices outpacing houses due to ongoing supply shortages.

According to Cotality’s Research Director, Tim Lawless, supply constraints are driving much of this momentum:

- Darwin listings are 53% below average

- Perth listings are 45% below average

- Brisbane listings are 31% below average

At the same time, quarterly sales activity is running above average, highlighting the mismatch between supply and demand. Across value segments, the lower and middle tiers are now leading the upswing. September quarter growth was strongest in the middle of the market (+2.7%), followed by the lower quartile (+2.6%), while the upper quartile rose 1.8%. This shift suggests that improved borrowing capacity is supporting buyers at slightly higher price points.

Advertised stock levels remain tight, with capital city listings sitting 18% below the five-year average at the end of September. Meanwhile, sales activity was 7.3% above average, adding further fuel to the market.

Selling conditions have strengthened noticeably, with auction clearance rates holding around 70% since mid-August—well above the average levels seen earlier in the year (63% in June and 62% in March).

Source: Cotality