Newsletter

Keep yourself update with our current news for Juwai IQI

Juwai IQI Global Real Estate Newsletter for February 2026

Looking ahead to February 2026, market sentiment continues to strengthen as confidence builds on the more stable footing established at the start of the year.Easing financial conditions, clearer interest rate direction, and resilient economic activity are helping investors and homebuyers move from caution to action. Across many markets, transaction activity is gradually improving as affordability pressures begin to ease.While performance will remain uneven between regions, long-term drivers such as population growth, infrastructure investment, urban expansion, and sustainability-focused development continue to support demand. These fundamentals are especially important in real estate, where quality assets in the right locations are gaining renewed attention.February reinforces the view that 2026 is shaping up to be a year of steady momentum, disciplined decision-making, and long-term value creation.Discover more here:Download

6 February

Hong Kong Market Shows Office Stability and Residential Momentum

Written by Nelson Li, Head of IQI Hong Kong Office Sector Hong Kong’s Grade A office market posted a strong performance in October, with net absorption reaching 293,300 sq ft—driven by continued consolidation and a flight-to-quality as tenants capitalise on attractive lease terms. Notably, Migao Group Holdings expanded its footprint, leasing over 10,000 sq ft at Cheng Kong Center II in Central. Vacancy rates continued to ease overall, dipping to 13.1%, with notable declines in Wanchai/Causeway Bay (10.5%) and Tsimshatsui (7.5%). Central saw a marginal rise to 11.5% due to tenant relocations within the submarket. Office rents remained broadly stable month-on-month. Central recorded its first rental increase since May 2022, edging up by 0.1%, alongside a similar gain in Tsimshatsui. In a landmark transaction, Alibaba and Ant Group acquired the top 13 floors of One Causeway Bay, including signage rights and parking, for HKD 7.2 billion—Hong Kong’s largest office deal since 2021. Residential Sector The residential market continued to gain traction in October, with total transaction volume up 1.3% month-on-month to 5,714 units—the highest monthly value of the year at HKD 51.1 billion. Mass residential capital values climbed 0.8% month-on-month, following a 0.6% rise in September. Mortgage conditions also improved, as several banks lowered prime rates by 12.5 basis points to 5.0%, easing borrower pressure and supporting broader market recovery. On the primary side, Henderson Land’s “woodis” development in Wanchai sold out its first batch of 75 units, achieving prices between HKD 20,400 and 25,800 per sq ft. In the luxury segment, a villa at Twelve Peaks on The Peak changed hands for HKD 352 million—equivalent to HKD 80,752 per sq ft. Source: The Land Registry, JLLDiscover more here:Download Now!

7 January

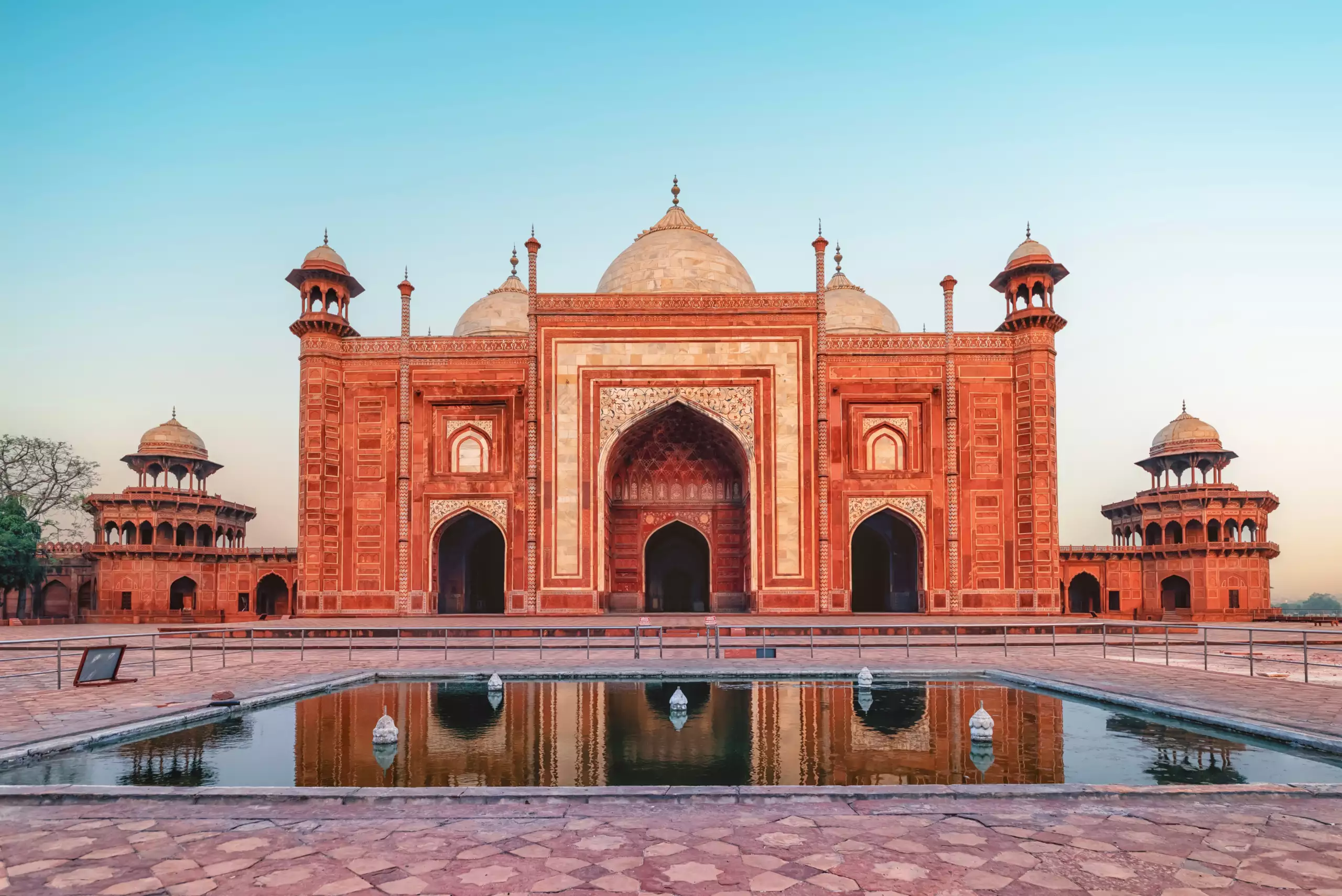

India’s Retail Market Emerges as a Regional Growth Leader

Written by Manu Bhazan, Country Head of India India’s retail sector is entering a period of structural transformation, driven by rising disposable incomes, rapid urbanisation, and growing demand for premium consumer experiences. These forces are positioning India as one of the strongest retail growth markets globally. India’s Tier 1 cities led retail rental growth in the APAC region. Galleria Market recorded a 25 percent year-on-year increase, followed by Connaught Place at 14 percent and Kemps Corner at 10 percent. Across 16 tracked retail locations, average rental growth reached 6 percent, outperforming both global and APAC averages. In contrast, Khan Market saw a more modest 3 percent increase, signalling a shift in retailer preference toward emerging, consumption-led neighbourhood hubs. Galleria Market’s ascent was also reflected globally, climbing to 26th in APAC rankings in 2025, up from 31st last year, with annual rents of $169 per sq ft. Connaught Place ranked alongside it at 26th, supported by strong leasing momentum. High streets remain central to India’s retail landscape, accounting for over 50 percent of year-to-date leasing activity. Supported by sustained GDP growth, urbanisation, and an expanding middle and affluent class, consumer spending on dining, fashion, wellness, and lifestyle categories continues to rise. Combined with limited high-quality retail supply, these dynamics have positioned India’s retail sector as a clear regional outperformer. Discover more here:Download Now!

7 January

Philippine Real Estate Shows Strength Across Residential, Office, and Logistics

Written by Emmanuel Andrew Venturina, Head of IQI Philippines The Philippine property sector ended 2025 on a strong note, with residential prices rising 6–8% year‑on‑year in Metro Manila and demand in suburban townships expanding by double‑digit growth thanks to new infrastructure links. Developers reported robust pre‑sales, with top projects in Quezon City and Taguig achieving 70–80% take‑up within months of launch. The office market showed signs of recovery, with net absorption in Metro Manila reaching 450,000 square meters in 2025, up 15% from the previous year. Grade‑A offices in Bonifacio Global City and Ortigas maintained occupancy above 90%, driven by IT‑BPM expansion and traditional corporate tenants. Logistics and industrial assets remained the standout performer. Vacancy rates in modern warehouses dropped below 5%, while rents grew 7–9% annually in hubs such as Cavite and Laguna. E‑commerce growth and supply chain diversification are expected to sustain this momentum into 2026. Retail also showed resilience, with prime malls reporting foot traffic recovery to 95% of pre‑pandemic levels. High‑street rents in Makati rose 4% year‑on‑year, while experiential formats outperformed traditional retail. Discover more here:Download Now!

7 January

Pakistan Real Estate Outlook 2026: Emerging Opportunities

Written by Junaid Hamid, Head of IQI Karachi Pakistan Pakistan’s real estate market is entering a new growth phase heading into 2026, supported by urban expansion, infrastructure development, digital adoption, and policy reforms. These structural shifts are reshaping demand across residential and commercial segments. Rapid urbanisation in Karachi, Lahore, and Islamabad continues to push housing demand higher, particularly in areas linked to new transport and infrastructure projects. Well-connected suburbs are emerging as key value drivers, offering long-term appreciation potential. The affordable and middle-income housing segment is becoming increasingly important as Pakistan’s middle class expands. Compact layouts, gated communities, and flexible payment plans are improving access to homeownership, positioning this segment as a core growth engine through 2026. Sustainability and smart living features are also gaining traction. Energy-efficient designs, smart security systems, and modern urban planning are increasingly expected across both mid-tier and premium developments, supporting long-term asset value. Technology is transforming how properties are marketed and sold. Online listings, virtual tours, and property platforms are improving transparency and attracting tech-savvy buyers and overseas Pakistanis, while giving digitally enabled developers a competitive edge. Beyond residential, commercial and mixed-use developments are gaining momentum. Demand for co-working spaces, retail centres, and integrated projects is rising alongside startup growth and an expanding urban workforce. By 2026, Pakistan’s real estate sector is expected to be more structured, technology-driven, and inclusive. Investors and buyers focused on infrastructure-led locations, middle-income housing, and credible developers are best positioned to benefit from the market’s next growth phase. Discover more here:Download Now!

7 January

Vietnam’s Market Shows Diverging Trends Between HCMC and Hanoi

HCMC Apartment Prices Triple Over the Past Decade Apartment prices in downtown Ho Chi Minh City have nearly tripled over the past ten years, driven by sustained demand and limited new supply, according to a report by property listing platform Batdongsan. The average price rose from VND31 million (US$1,175) per square metre in 2015 to VND92 million this year. This appreciation trails only land prices, which surged 4.8 times over the same period. In the third quarter, the average price in District 1—the city’s most expensive area—reached VND413 million per square metre. Newly launched units are priced between VND200 million and VND500 million, with annual growth of 10–30%. Hanoi Apartment Market Cools, Flippers Struggle Meanwhile, Hanoi’s apartment market is facing a slowdown. Speculators are finding it difficult to sell units even after lowering prices, as buyers hold out for more affordable options amid an increase in new supply. This contrasts sharply with just three months ago, when newly launched apartments were quickly snapped up by eager buyers. Discover more here:Download Now!

6 January

Canada’s Housing Market Shows Early Signs of Stabilisation as Sales Recover and Prices Steady

Written by Yousaf Iqbal, Head of IQI Canada In November 2025, Canada’s housing market showed early signs of renewed momentum as national home sales rose and prices began to stabilise. The national average home sale price reached about C$690,195, up modestly month-over-month and down only around 1.1% compared with last year — narrowing the year-over-year drop. With sales climbing and listings somewhat pressured, the supply-to-demand balance remained within historically “normal” bounds. Interest rates set by the Bank of Canada at 2.25% have kept borrowing costs moderate, creating a modest boost to affordability — though many markets remain expensive for first-time buyers. Toronto (GTA) In November 2025, GTA home sales dropped 15.8% year-over-year to 5,010 transactions, with new listings down 4% to 11,134, as many buyers stayed cautious amid economic uncertainty. Prices continued to ease: the MLS® HPI Composite fell 5.8% annually, and the average selling price declined 6.4% to $1,039,458. On a seasonally adjusted basis, both sales and listings edged slightly lower from October, while prices held mostly steady. With borrowing costs lower and improving job data, confidence is expected to gradually build heading into 2026. VancouverIn November 2025, Metro Vancouver home sales dropped 15.4% year-over-year to 1,846, while active listings climbed 14.4% to 15,149, keeping conditions firmly in buyers’ territory. New listings edged down 1.4% to 3,674, though overall inventory remained well above long-term averages. The MLS® HPI benchmark fell 3.9% annually to $1,123,700, with detached, attached, and apartment prices all softening slightly from last year. Ample supply, slower sales, and steady borrowing costs continued to shape a quiet, buyer-friendly market heading into year-end. Quebec (province-wide) In November 2025, home sales remained stable at around 16,000 transactions, with activity holding near last year’s levels despite regional differences.Inventory increased modestly, driven mainly by rising listings in major centres like Montréal. Median prices continued to trend upward province-wide: single-family homes rose to roughly C$635,000, condos held near C$425,000, and plex prices climbed to about C$855,000, supported by strong demand for multi-unit properties. Overall, the market stayed balanced, with supply improving and prices remaining resilient heading into year-end. Discover more here:Download Now!

6 January

Juwai IQI’s CEO Provides a Malaysia Forecast for 2026

Written by Dave Platter, Global PR DirectorMalaysia’s residential property market is entering 2026 with a rare combination of rising prices, tightening supply and improving buyer confidence, a contrast to conditions in many global markets. According to Juwai IQI Co-Founder and Group CEO Kashif Ansari, 2025 was largely a year of absorption, as long-delayed projects finally reached completion.Developers delivered 23.4% more new homes than in 2024, yet the market absorbed the additional supply smoothly.Even the long-standing serviced apartment overhang declined by 11% year-on-year, signalling healthier underlying demand. Looking ahead, new supply is easing. Construction starts have fallen 2%, while pre-construction pipelines are down nearly 18%, pointing to fewer launches in the years ahead.This tightening is occurring just as demand fundamentals strengthen. Nearly half of Malaysia’s population is under 30 or aged between 30 and 44, prime life stages for household formation and home upgrading. Price performance has also been resilient. Malaysia has not recorded an annual price decline since at least 2021, underscoring the market’s stability. Johor Emerges as a Regional Standout If 2025 was about clearing excess supply, 2026 is shaping up to be a more competitive market.With fewer new projects in the pipeline, buyers targeting well-located homes along key infrastructure corridors may face tighter conditions and potential bidding pressure. Johor stands out as a regional outperformer. Home purchases in the state rose 13% in the first half of the year, while prices increased 5.7% year-on-year. Cross-border demand from Singapore continues to strengthen, including interest from Malaysians currently living there. The upcoming RTS link is expected to further transform the market, and Juwai IQI estimates the new Special Economic Zone could add RM19.8 billion to Malaysia’s GDP over the next decade. Price Growth Expected in 2026 Mr. Ansari forecastsnational price growth of 2–4% in 2026, supported by constrained supply, steady demand, and improving household incomes. The primary downside risk would be an external shock severe enough to impact global employment and consumer confidence. Absent such a disruption, 2026 is on track to be Malaysia’s strongest year for residential real estate since 2019. Discover more here:Download Now!

5 January