Written by Yousaf Iqbal, Head of IQI Canada

In November 2025, Canada’s housing market showed early signs of renewed momentum as national home sales rose and prices began to stabilise.

The national average home sale price reached about C$690,195, up modestly month-over-month and down only around 1.1% compared with last year — narrowing the year-over-year drop.

With sales climbing and listings somewhat pressured, the supply-to-demand balance remained within historically “normal” bounds.

Interest rates set by the Bank of Canada at 2.25% have kept borrowing costs moderate, creating a modest boost to affordability — though many markets remain expensive for first-time buyers.

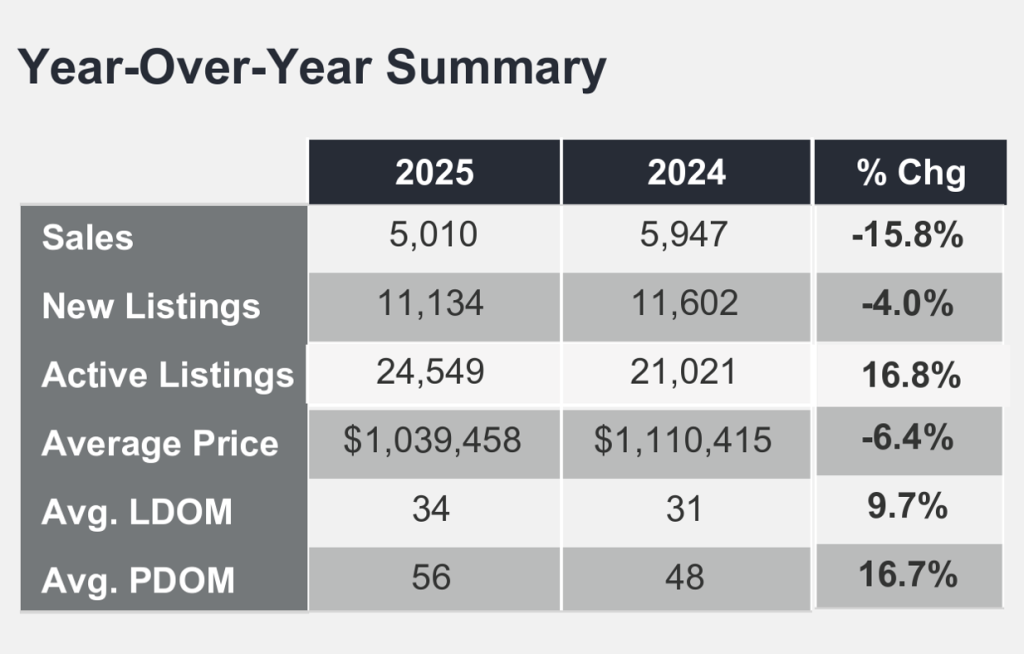

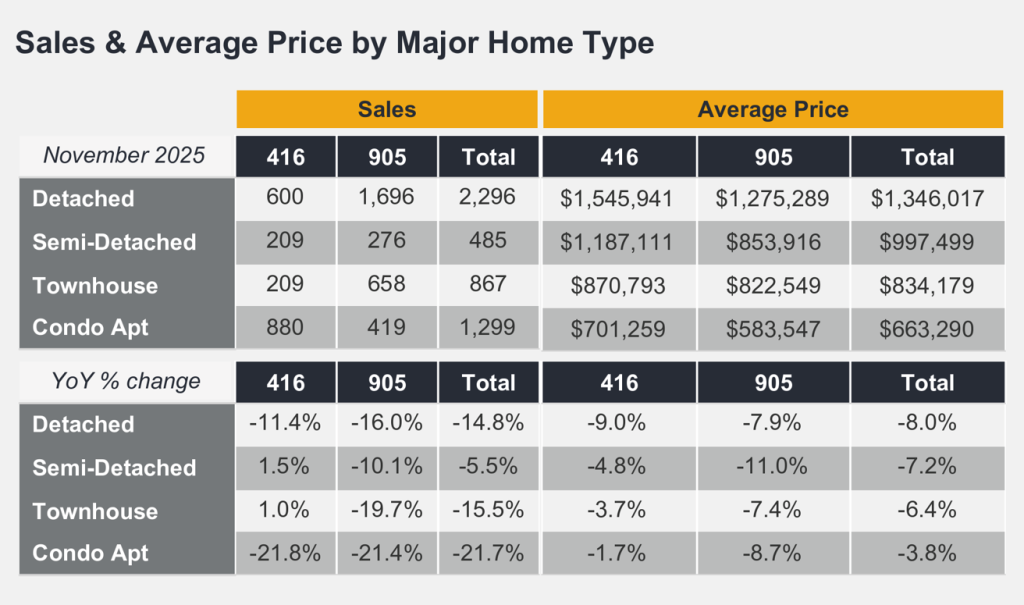

Toronto (GTA)

In November 2025, GTA home sales dropped 15.8% year-over-year to 5,010 transactions, with new listings down 4% to 11,134, as many buyers stayed cautious amid economic uncertainty. Prices continued to ease: the MLS® HPI Composite fell 5.8% annually, and the average selling price declined 6.4% to $1,039,458. On a seasonally adjusted basis, both sales and listings edged slightly lower from October, while prices held mostly steady. With borrowing costs lower and improving job data, confidence is expected to gradually build heading into 2026.

Vancouver

In November 2025, Metro Vancouver home sales dropped 15.4% year-over-year to 1,846, while active listings climbed 14.4% to 15,149, keeping conditions firmly in buyers’ territory. New listings edged down 1.4% to 3,674, though overall inventory remained well above long-term averages. The MLS® HPI benchmark fell 3.9% annually to $1,123,700, with detached, attached, and apartment prices all softening slightly from last year. Ample supply, slower sales, and steady borrowing costs continued to shape a quiet, buyer-friendly market heading into year-end.

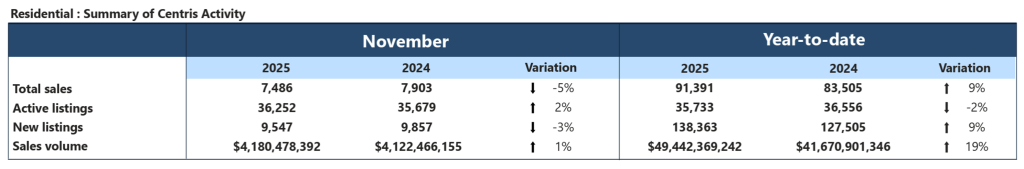

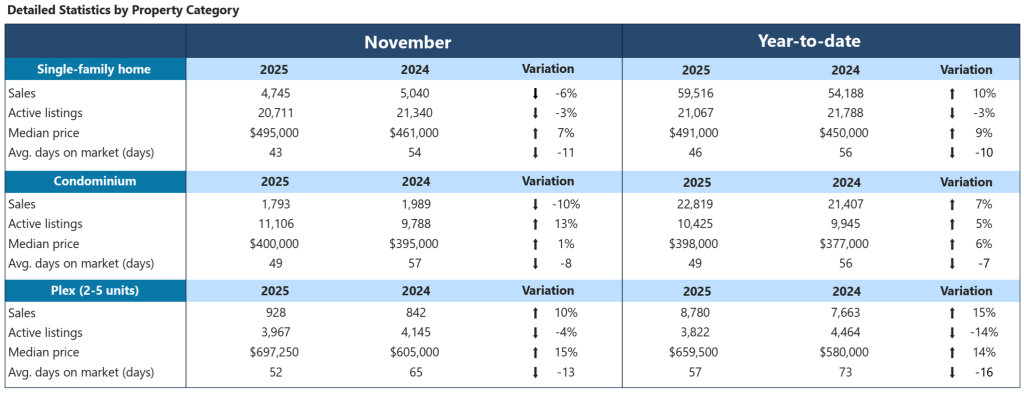

Quebec (province-wide)

In November 2025, home sales remained stable at around 16,000 transactions, with activity holding near last year’s levels despite regional differences.

Inventory increased modestly, driven mainly by rising listings in major centres like Montréal.

Median prices continued to trend upward province-wide: single-family homes rose to roughly C$635,000, condos held near C$425,000, and plex prices climbed to about C$855,000, supported by strong demand for multi-unit properties.

Overall, the market stayed balanced, with supply improving and prices remaining resilient heading into year-end.