Written by Nelson Li, Head of IQI Hong Kong

Office Sector

Hong Kong’s Grade A office market posted a strong performance in October, with net absorption reaching 293,300 sq ft—driven by continued consolidation and a flight-to-quality as tenants capitalise on attractive lease terms.

Notably, Migao Group Holdings expanded its footprint, leasing over 10,000 sq ft at Cheng Kong Center II in Central.

Vacancy rates continued to ease overall, dipping to 13.1%, with notable declines in Wanchai/Causeway Bay (10.5%) and Tsimshatsui (7.5%).

Central saw a marginal rise to 11.5% due to tenant relocations within the submarket.

Office rents remained broadly stable month-on-month.

Central recorded its first rental increase since May 2022, edging up by 0.1%, alongside a similar gain in Tsimshatsui.

In a landmark transaction, Alibaba and Ant Group acquired the top 13 floors of One Causeway Bay, including signage rights and parking, for HKD 7.2 billion—Hong Kong’s largest office deal since 2021.

Residential Sector

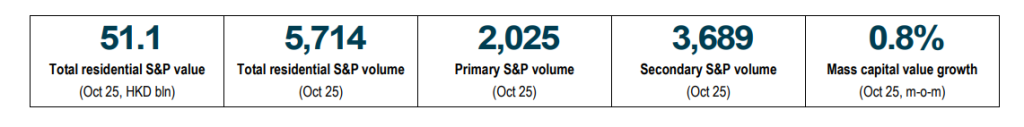

The residential market continued to gain traction in October, with total transaction volume up 1.3% month-on-month to 5,714 units—the highest monthly value of the year at HKD 51.1 billion.

Mass residential capital values climbed 0.8% month-on-month, following a 0.6% rise in September.

Mortgage conditions also improved, as several banks lowered prime rates by 12.5 basis points to 5.0%, easing borrower pressure and supporting broader market recovery.

On the primary side, Henderson Land’s “woodis” development in Wanchai sold out its first batch of 75 units, achieving prices between HKD 20,400 and 25,800 per sq ft.

In the luxury segment, a villa at Twelve Peaks on The Peak changed hands for HKD 352 million—equivalent to HKD 80,752 per sq ft.

Source: The Land Registry, JLL