Newsletter

Keep yourself update with our current news for Juwai IQI

Hanoi Real Estate: Falling Rental Yields and Upcoming Developments

Hanoi's real estate market is facing challenges as rental yields have significantly fallen. While property prices have surged by 30–40% over the past year, rents have only risen by 8–10%, with many areas experiencing a plateau in rental income. This situation is making it increasingly difficult for property owners with mortgages to sustain their investments. The market outlook is further strained, with an abundant supply of high-end properties and secondary market prices remaining high, leading to a forecasted decline in yields.However, Hanoi’s real estate future looks promising due to major developments on the horizon. Authorities have approved a VND925 trillion (US$38 billion) sports complex project, developed by Vingroup, which willinclude a 135,000-seat stadium, the second largest in the world. This development is part of an OlympicSports Urban Area spanning more than 9,000 hectares, which is expected to significantly boost the city's infrastructure and attractiveness for both domestic and international investors.Download to see insights from other country marketsDownload

6 February

Bali Property Market 2025–2026: Prime Yields and Emerging Opportunities

Bali’s property market showed strong activity in 2025, driven by tourism recovery and heightened investor interest. Property prices continued to rise, particularly in commercial sectors such as hotels, offices, and retail, while villas and short-term rental properties remained highly sought after by both local and foreign buyers.The steady return of national and international visitors has boosted rental yields and investor confidence.Prime Markets and YieldsCanggu and Berawa remain the island’s most sought-after areas for short-term rentalsand lifestyle buyers, with expected gross annual rental yields of 10–15% in 2026.Uluwatu, Bingin, and Bukit continue to attract high-end buyers for luxury cliff-top andocean-view villas, offering yields of 12–17%. Seminyak and Petitenget maintain stabledemand, with rental returns around 8–12%, while Ubud’s cultural and wellness focusdraws longer-stay guests, also yielding 8–12%.Emerging AreasEmerging locations such as Tabanan, Pererenan, Kedungu, and North/East Bali are gaining attention for affordable entry points and strong appreciation potential. Investors in these zones can expect yields of 10–16% or higher, benefiting from lower purchase prices and growth opportunities.Market Trends and OutlookLooking ahead to 2026, price growth in established markets is forecast at 5–10%, with higher potential in emerging subregions. Villas remain the most profitable asset type, and many investors are adopting blended rental strategies, combining short-term bookings during peak periods with medium-term stays to maximise returns.Sustainable and boutique developments that cater to eco-conscious and lifestyle-oriented buyers are likely to take precedence as market sophistication increases.Bali’s combination of tourism strength, improving infrastructure, and diverse investment appeal keeps the market outlook positive, with prime areas leading rental returns and emerging regions offering compelling opportunities for capital growth.Download to see insights from other country marketsDownload

6 February

Greece’s Real Estate: A Long-Term Play Beyond Recovery

Greece's real estate market, entering 2026, has completed its post-crisis recovery and is now moving into a phase of sustainable, structurally driven growth. The country's appeal to foreign buyers is now centred around relative affordability, improved lifestyle offerings, and a growing depth to the market, moving away from distressed pricing and rapid rebounds. Over the past decade, residential prices have steadily risen, particularly after 2021, with the recovery fuelled by a resurgence in tourism, increased foreign demand, and renewed domestic confidence.Despite these gains, Greece still offers a discount compared to most Western European markets, maintaining its attraction to international investors.As the market shifts from catch-up growth to long-term expansion, price increases are expected to slow in 2026, driven by tighter supply, rising construction costs, and a focus on quality housing. Foreign interest continues to play a key role, with buyers drawn to locations that offer sustainable value rather than short-term incentives.Athens, particularly its southern suburbs, remains a hotspot for both lifestyle and investment buyers, while Thessaloniki, Crete, and select island destinations are gaining attention as diversified markets. Supply constraints and Greece’s positive macroeconomic outlook, alongside a resilient tourism sector, limit downside risks, making it a solid long-term investment choice in Europe.Download to see insights from other country marketsDownload

6 February

Housing Market Snapshot: Strong 2025, Softer Outlook for 2026

Australia’s housing market delivered solid gains in 2025, with national home values rising 8.6%, adding around $71,400 to the median dwelling price, the strongest annual growth since 2021.All capital cities and regional markets recorded increases, led by Darwin (+18.9%), while Melbourne saw the smallest rise at 4.8%.However, momentum began to cool in December, when the national Home Value Index recorded its smallestmonthly gain in five months (+0.7%). Sydney and Melbourne both declined by -0.1%, marking the first monthly fall in over a year. Cotality’s research director Tim Lawless attributes this softening to renewed concerns that interest rates may remain “higher for longer”, along with worsening affordability and cost-of-living pressures. Growth has increasingly been driven by the lower and middle segments of the market, as affordability pressures continue to steer buyers away from higher-priced homes. Upper-quartile values rose just 0.2% in December, compared with 1.1% growth in the more affordable segments. Regional markets remain more resilient, posting 9.7% growth for the year, outperforming the combine capitals at 8.2%. Western Australia’s regions (+16.1%) and regional Queensland (+12.6%) were the standout performers.Outlook for 2026 While 2025 closed strongly, the outlook for 2026 is more cautious. Uncertainty around inflation, interest rates, affordability and household debt is expected to weigh on confidence. That said, ongoing housing supply shortages should help prevent any significant downturn in home values.For investors and homeowners alike, Perth’s property market presents exciting opportunities. Whether you’reconsidering selling, buying, or investing, now is the time to explore your options. Contact our team atsales@iqiwa.com.au to discuss your property goals today.Download to see insights from other country marketsDownload

6 February

Juwai IQI Global Real Estate Newsletter for February 2026

Looking ahead to February 2026, market sentiment continues to strengthen as confidence builds on the more stable footing established at the start of the year.Easing financial conditions, clearer interest rate direction, and resilient economic activity are helping investors and homebuyers move from caution to action. Across many markets, transaction activity is gradually improving as affordability pressures begin to ease.While performance will remain uneven between regions, long-term drivers such as population growth, infrastructure investment, urban expansion, and sustainability-focused development continue to support demand. These fundamentals are especially important in real estate, where quality assets in the right locations are gaining renewed attention.February reinforces the view that 2026 is shaping up to be a year of steady momentum, disciplined decision-making, and long-term value creation.Discover more here:Download

6 February

Hong Kong Market Shows Office Stability and Residential Momentum

Written by Nelson Li, Head of IQI Hong Kong Office Sector Hong Kong’s Grade A office market posted a strong performance in October, with net absorption reaching 293,300 sq ft—driven by continued consolidation and a flight-to-quality as tenants capitalise on attractive lease terms. Notably, Migao Group Holdings expanded its footprint, leasing over 10,000 sq ft at Cheng Kong Center II in Central. Vacancy rates continued to ease overall, dipping to 13.1%, with notable declines in Wanchai/Causeway Bay (10.5%) and Tsimshatsui (7.5%). Central saw a marginal rise to 11.5% due to tenant relocations within the submarket. Office rents remained broadly stable month-on-month. Central recorded its first rental increase since May 2022, edging up by 0.1%, alongside a similar gain in Tsimshatsui. In a landmark transaction, Alibaba and Ant Group acquired the top 13 floors of One Causeway Bay, including signage rights and parking, for HKD 7.2 billion—Hong Kong’s largest office deal since 2021. Residential Sector The residential market continued to gain traction in October, with total transaction volume up 1.3% month-on-month to 5,714 units—the highest monthly value of the year at HKD 51.1 billion. Mass residential capital values climbed 0.8% month-on-month, following a 0.6% rise in September. Mortgage conditions also improved, as several banks lowered prime rates by 12.5 basis points to 5.0%, easing borrower pressure and supporting broader market recovery. On the primary side, Henderson Land’s “woodis” development in Wanchai sold out its first batch of 75 units, achieving prices between HKD 20,400 and 25,800 per sq ft. In the luxury segment, a villa at Twelve Peaks on The Peak changed hands for HKD 352 million—equivalent to HKD 80,752 per sq ft. Source: The Land Registry, JLLDiscover more here:Download Now!

7 January

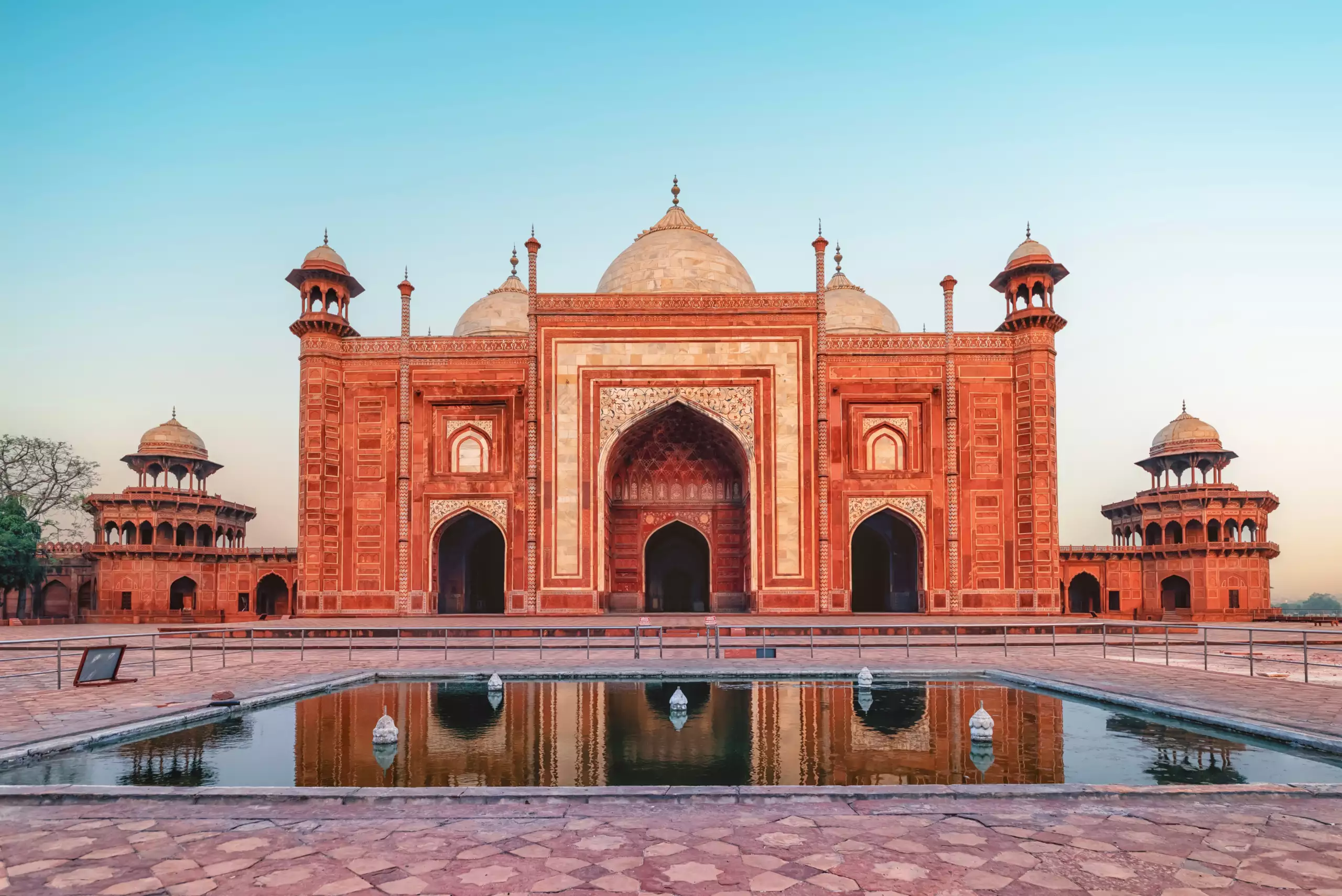

India’s Retail Market Emerges as a Regional Growth Leader

Written by Manu Bhazan, Country Head of India India’s retail sector is entering a period of structural transformation, driven by rising disposable incomes, rapid urbanisation, and growing demand for premium consumer experiences. These forces are positioning India as one of the strongest retail growth markets globally. India’s Tier 1 cities led retail rental growth in the APAC region. Galleria Market recorded a 25 percent year-on-year increase, followed by Connaught Place at 14 percent and Kemps Corner at 10 percent. Across 16 tracked retail locations, average rental growth reached 6 percent, outperforming both global and APAC averages. In contrast, Khan Market saw a more modest 3 percent increase, signalling a shift in retailer preference toward emerging, consumption-led neighbourhood hubs. Galleria Market’s ascent was also reflected globally, climbing to 26th in APAC rankings in 2025, up from 31st last year, with annual rents of $169 per sq ft. Connaught Place ranked alongside it at 26th, supported by strong leasing momentum. High streets remain central to India’s retail landscape, accounting for over 50 percent of year-to-date leasing activity. Supported by sustained GDP growth, urbanisation, and an expanding middle and affluent class, consumer spending on dining, fashion, wellness, and lifestyle categories continues to rise. Combined with limited high-quality retail supply, these dynamics have positioned India’s retail sector as a clear regional outperformer. Discover more here:Download Now!

7 January

Philippine Real Estate Shows Strength Across Residential, Office, and Logistics

Written by Emmanuel Andrew Venturina, Head of IQI Philippines The Philippine property sector ended 2025 on a strong note, with residential prices rising 6–8% year‑on‑year in Metro Manila and demand in suburban townships expanding by double‑digit growth thanks to new infrastructure links. Developers reported robust pre‑sales, with top projects in Quezon City and Taguig achieving 70–80% take‑up within months of launch. The office market showed signs of recovery, with net absorption in Metro Manila reaching 450,000 square meters in 2025, up 15% from the previous year. Grade‑A offices in Bonifacio Global City and Ortigas maintained occupancy above 90%, driven by IT‑BPM expansion and traditional corporate tenants. Logistics and industrial assets remained the standout performer. Vacancy rates in modern warehouses dropped below 5%, while rents grew 7–9% annually in hubs such as Cavite and Laguna. E‑commerce growth and supply chain diversification are expected to sustain this momentum into 2026. Retail also showed resilience, with prime malls reporting foot traffic recovery to 95% of pre‑pandemic levels. High‑street rents in Makati rose 4% year‑on‑year, while experiential formats outperformed traditional retail. Discover more here:Download Now!

7 January