All For Rent

Discover the latest project for rent

No listing yet

Learn

Tips and Guides

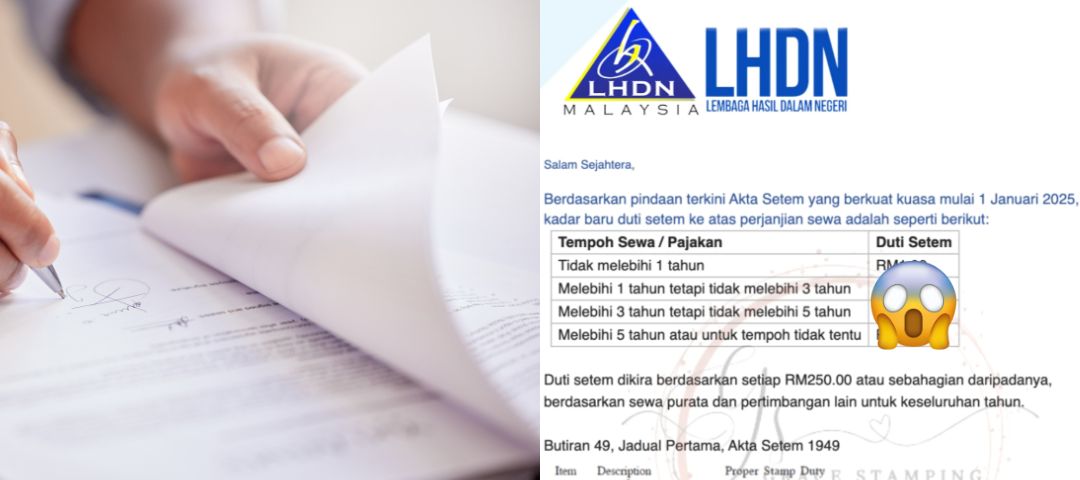

Stamp Duty Malaysia Increased in 2025! What You Need to Know!

Stamp Duty Malaysia Increased in 2025! What You Need to Know!

Are you feeling lost in the maze of stamp duty or property transaction costs in Malaysia? The ever-changing rules and calculations surrounding stamp duty can feel overwhelming, leaving you anxious about making a costly mistake. But fear not! This comprehensive guide will demystify stamp duty, providing you with the clarity and confidence to navigate your property journey in Malaysia. Stamp Duty Malaysia1. Tenancy Agreement Stamp Duty (NEW)2. Deadlines and Penalties for Late Stamping (NEW)3. Understanding Stamp Duty4. Why Should You Care About Stamp Duty?5. The Different Shades of Stamp Duty: Ad Valorem and Fixed Duties6. Who Foots the Bill? Determining Liability for Stamp Duty7. Stamp Duty Rates on Instruments of Transfer in Malaysia (2025)8. Stamp Duty on Loan Agreements9. Stamp Duty Exemptions and Remissions in Malaysia10. Paying Your Stamp Duty: The STAMPS System11. Significant Changes to Stamp Duty in 2025 and Beyond12. Frequently Asked Questions (FAQs) about Stamp Duty in Malaysia: 1. Tenancy Agreement Stamp Duty (NEW) When it comes to rental properties, stamp duty is calculated based on the monthly rental and the duration of the tenancy. As of January 1, 2025, the tenancy agreement stamp duty increased in 2025. The new rates for stamp duty on rental agreements are as follows: Rental PeriodStamp DutyNot exceeding 1 yearRM1.00Exceeding 1 year but not exceeding 3 yearsRM3.00Exceeding 3 years but not exceeding 5 yearsRM5.00Exceeding 5 years or for an indefinite periodRM7.00 Source: Finance Act 2024 Stamp duty is calculated based on every RM250.00 or part thereof, depending on the average rent and other considerations for the entire year. a. Example Calculation (Based on old calculation): Let's say you're renting a property for RM1,800 per month for 3 years. Calculate Annual Rent: RM1,800 x 12 months = RM21,600 Subtract the Exemption Threshold (if applicable): RM21,600 - RM2,400 = RM19,200 (The RM2,400 threshold is no longer applicable as of January 1, 2025) Divide by RM250 and Round Up: RM21,600 ÷ RM250 = 86.4, rounded up to 87 Multiply by the Applicable Rate (RM3 for 3-year tenancy, based on old rates): 87 x RM3 = RM261 Add Stamp Duty for Tenant's Copy: RM261 + RM10 = RM271 b. Important Note The tenant is responsible for paying the stamp duty on the tenancy agreement, not the landlord. 2. Deadlines and Penalties for Late Stamping (NEW) It's crucial to pay stamp duty within the stipulated timeframe to avoid penalties. Instruments executed within Malaysia: Must be stamped within 30 days of execution. Instruments executed outside Malaysia: Must be stamped within 30 days after it has been first received in Malaysia. a. Penalties for Late Stamping (Effective from January 1, 2025): DelayPenaltyNot exceeding 3 monthsRM50 or 10% of the unpaid stamp duty, whichever is higherExceeding 3 monthsRM100 or 20% of the unpaid stamp duty, whichever is higher Source: Finance Act 2024, The Sun b. Before January 1, 2025, the old penalty rates are: DelayPenaltyNot exceeding 3 monthsRM25 or 5% of the unpaid stamp duty, whichever is higherExceeding 3 months, not exceeding 6 monthsRM50 or 10% of the unpaid stamp duty, whichever is higherExceeding 6 monthsRM100 or 20% of the unpaid stamp duty, whichever is higher Source: LHDN Malaysia, Cleartax, Finance Act 2024 c. Consequences of Unstamped or Insufficiently Stamped Instruments: Inadmissible in Court: The document will not be accepted as evidence in a court of law. Cannot Be Acted Upon by Public Officer: A public officer will not act upon an unstamped or insufficiently stamped instrument. 3. Understanding Stamp Duty Stamp duty is a tax levied on legal documents, specifically those related to the purchase or transfer of real estate, as well as tenancy, etc. in Malaysia. It's governed by the Stamp Act 1949 and overseen by the Lembaga Hasil Dalam Negeri Malaysia (LHDN), the Inland Revenue Board of Malaysia. Think of it as a mandatory fee that validates your property-related documents, making them legally binding and admissible in court. It is not merely a formality but a cornerstone of secure and legal property transactions. 4. Why Should You Care About Stamp Duty? Understanding stamp duty is not just about ticking a legal box but making informed decisions. No matter you're a first-time homebuyer, a seasoned investor, or simply transferring property to a loved one, knowing the ins and outs of stamp duty can save you significant sums of money and prevent legal headaches down the road. It directly impacts your financial planning and ensures a smooth, legally sound property transaction. 5. The Different Shades of Stamp Duty: Ad Valorem and Fixed Duties In Malaysia, stamp duty comes in two primary forms: Ad Valorem Duty: This is the most common type for property transactions. The amount payable is calculated as a percentage of the property's value or the consideration stipulated in the instrument, whichever is higher. The higher the property value, the higher the stamp duty, although there are some exemptions that we will discuss later. Fixed Duty: This type of duty applies a predetermined amount, regardless of the property's value. It's typically levied on specific legal documents, such as certain types of agreements, as outlined in the First Schedule of the Stamp Act 1949. 6. Who Foots the Bill? Determining Liability for Stamp Duty The responsibility for paying stamp duty isn't arbitrary. The Third Schedule of the Stamp Act 1949 clearly outlines who is liable for specific instruments. In most property transactions, the buyer is responsible for paying the stamp duty on the instrument of transfer (MOT) and SPA. The borrower is responsible for paying the stamp duty on the loan agreement. 7. Stamp Duty Rates on Instruments of Transfer in Malaysia (2025) The cost of stamp duty on the transfer of property, excluding shares, stock, or marketable securities, depends on whether the buyer is a Malaysian citizen/permanent resident or a foreigner/foreign company. a. For Malaysian Citizens and Permanent Residents: Price TierStamp Duty RateFirst RM100,0001%RM100,001 to RM500,0002%RM500,001 to RM1,000,0003%Above RM1,000,0004% Source: iProperty Malaysia b. For Foreign Companies, Non-Citizens, and Non-Permanent Residents: Price TierStamp Duty RateAll Price Tiers4% Source: PwC c. Example Calculation Let's say you're a Malaysian citizen buying a property for RM600,000. Here's how the stamp duty is calculated: First RM100,000: RM100,000 x 1% = RM1,000 Next RM400,000: RM400,000 x 2% = RM8,000 Remaining RM100,000: RM100,000 x 3% = RM3,000 Total Stamp Duty: RM1,000 + RM8,000 + RM3,000 = RM12,000 8. Stamp Duty on Loan Agreements When you take out a loan to finance your property purchase, the loan agreement is also subject to stamp duty. a. Standard Rate Generally, a flat rate of 0.5% of the total loan amount applies. b. Reduced Rate For specific Malaysian Ringgit loan agreements or instruments without security and repayable on demand or in a single bullet repayment, a reduced rate of 0.1% may apply. c. Example Calculation If you take out a loan of RM540,000 (90% of the RM600,000 property), the stamp duty on the loan agreement would be: RM540,000 x 0.5% = RM2,700 9. Stamp Duty Exemptions and Remissions in Malaysia Fortunately, the Malaysian government offers several exemptions and remissions to ease the financial burden of stamp duty, particularly for first-time homebuyers and specific property transfers. a. First-Time Homebuyers Exemption (i-MILIKI): This initiative aims to encourage homeownership among Malaysians. Properties valued up to RM500,000: Full stamp duty exemption on both the instrument of transfer and loan agreement. This applies to Sale and Purchase Agreements executed between 1 January 2021 and 31 December 2025. Properties valued between RM500,001 and RM1,000,000: 75% stamp duty exemption on the instrument of transfer for SPAs executed by December 31, 2023. Starting from 2024, first-time homebuyers purchasing homes above RM500,001 will not benefit from any stamp duty exemption. b. Eligibility Criteria for First-Time Homebuyers Exemption: Malaysian citizen. Must not already own a residential property (including inherited or gifted property). Applicable to residential properties only (excluding SOHO/SOFO/SOVO types and serviced residences built for commercial use). c. Transfer Between Family Members: Parent and Child: Before April 1, 2023: 50% remission of stamp duty. From April 1, 2023: Full exemption for the first RM1 million of the property's value; 50% remission on the ad valorem stamp duty for the remaining value. This applies only to Malaysian citizens. Grandparent and Grandchild: From April 1, 2023: Full exemption for the first RM1 million of the property's value; 50% remission on the ad valorem stamp duty for the remaining value. This applies only to Malaysian citizens. Husband and Wife: 100% exemption. Siblings: No exemption. d. Other Exemptions and Remissions: Abandoned Housing Projects: Stamp duty exemption on instruments executed by a rescuing contractor or developer approved by the Ministry of Housing and Local Government, for loan agreements and transfer of revived residential properties in abandoned projects. This exemption is valid for instruments executed by December 31, 2025. Conversion of Conventional Partnership or Private Company to Limited Liability Partnership: Stamp duty exemption on all instruments of transfer of land, business, asset, and share. Micro Small and Medium Enterprises (MSMEs): Stamp duty exemption on loan/financing agreements executed between MSMEs and investors for funds raised on a peer-to-peer platform registered and recognized by the Securities Commission (SC). This is valid from January 1, 2022, to December 31, 2026. Stamp duty exemption on instruments for loan or financing up to RM50,000 (increased to RM100,000 for agreements executed from January 1, 2025) between MSMEs and participating banks or financial institutions under the National Small and Medium Enterprise Development Council. Stamp duty exemption on loan or financing instruments executed from January 1, 2025 to December 31, 2026 by MSMEs and investors through Initial Exchange Offering platforms registered with SC. e. Stamp Duty Order (Remittance & Exemption): You can check out the various stamp duty order for remittance & exemption from year 2002 until 2021 on LHDN Malaysia official website. 10. Paying Your Stamp Duty: The STAMPS System Gone are the days of manually stamping documents at the LHDN office. Now, you can conveniently pay your stamp duty online through the Stamp Assessment and Payment System (STAMPS) via the LHDN website (https://stamps.hasil.gov.my). This digital system streamlines the process, making it faster and more efficient. a. Step-by-Step Guide to Paying Stamp Duty Online via STAMPS: Register as a STAMPS User: If you are not already registered, create an account on the STAMPS portal. Log in to STAMPS: Access the system using your registered ID and password. Select "Sistem Duti Setem": Choose the stamp duty system from the available options. Choose "Penyeteman" and then select the type of instrument: For example, select "Perjanjian Sewa" for tenancy agreement and "Pindah Milik Tanah/ Harta" for the instrument of transfer (e.g., MOT). Fill in the Required Information: Provide details about the instrument, property, and parties involved. Upload Supporting Documents: You may need to upload scanned copies of the relevant documents (e.g., SPA, loan agreement, tenancy agreement). Make Payment: Pay the stamp duty online using FPX or other available online payment methods, such as CIMB BizChannel and Public Bank. Print Stamp Certificate: Once the payment is successful, you can print the stamp certificate. Affix this certificate to the original instrument as proof of payment. b. Important Note A stamp certificate is issued electronically for online applications through STAMPS. The certificate should be affixed or attached to the instrument, and the instrument is considered duly stamped. 11. Significant Changes to Stamp Duty in 2025 and Beyond The Malaysian government is implementing significant changes to the stamp duty regime, transitioning towards a self-assessment system. a. Key Changes Mandatory Stamping: From 2026, stamp duty will be mandatory for all instruments under the Stamp Act, including intercompany agreements. Self-Assessment System: This will be implemented in phases: Phase 1 (from January 1, 2026): Rental or lease, general stamping, and securities. Phase 2 (from January 1, 2027): Instruments of transfer of property ownership. Phase 3 (from January 1, 2028): All other instruments not covered in Phases 1 and 2. IRB Audit Power: The IRB will have the authority to audit agreements up to five years after the duty is paid or would have been paid. Increased Penalties: The maximum penalty is RM100 or 20% of the deficient duty, whichever is higher. If the matter goes to court, the fines can range from RM1,000 to RM10,000, and may have to pay a special penalty equivalent to the underpaid duty. b. Expert Insights Source: KPMG "The amendments will make stamp duty mandatory and grant the Inland Revenue Board (IRB) the authority to audit agreements up to five years after payment," says Soh Lian Seng, Head of Tax at KPMG in Malaysia. He further emphasizes the importance of accurate calculations and classifications under the self-assessment system to avoid hefty penalties. 12. Frequently Asked Questions (FAQs) about Stamp Duty in Malaysia: a. How much is stamp duty in Malaysia 2025? The stamp duty rates for property transfers in 2025 depend on the property value and the buyer's status (Malaysian citizen/permanent resident or foreigner). For Malaysian citizens and permanent residents, the rates are tiered: 1% for the first RM100,000, 2% for the next RM400,000, 3% for the next RM500,000, and 4% for the value exceeding RM1,000,000. For foreigners and foreign companies, a flat rate of 4% applies. For loan agreements, the general rate is 0.5% of the loan amount. Tenancy agreement stamp duty rates have also changed - refer to the "Stamp Duty on Tenancy Agreements" section above. b. Is there any stamp duty exemption for first-time homebuyers in 2025? Yes, first-time homebuyers purchasing properties valued up to RM500,000 can enjoy a full stamp duty exemption on both the instrument of transfer and loan agreement if the SPA is executed between January 1, 2021, and December 31, 2025. However, for properties valued between RM500,001 and RM1,000,000, the 75% exemption on the instrument of transfer was only valid for SPAs executed by December 31, 2023. c. What are the stamp duty rates for properties in Malaysia 2025? The rates are the same as mentioned in question 1. Refer to the tables provided in the "Stamp Duty Rates on Instruments of Transfer" section above. d. How to calculate stamp duty on a loan agreement in Malaysia 2025? The stamp duty on a loan agreement is generally 0.5% of the total loan amount. For example, if you take out a loan of RM450,000, the stamp duty would be RM2,250. However, certain exceptions and reduced rates may apply as mentioned in the "Stamp Duty on Loan Agreements" section. e. Is there any change in stamp duty in Malaysia 2025? Yes, there are several changes, including the introduction of a self-assessment system, mandatory stamping for all instruments under the Stamp Act (from 2026), increased audit powers for the IRB, revised penalty rates for late stamping, and changes to stamp duty rates for tenancy agreements. f. What documents are subject to stamp duty in Malaysia? Documents related to the sale, transfer, and lease of property, loan agreements, and other instruments listed in the First Schedule of the Stamp Act 1949 are subject to stamp duty. This includes Sale and Purchase Agreements (SPA), Memorandum of Transfer (MOT), Deed of Assignment (DOA), Loan Agreements, and Tenancy Agreements. g. How to pay stamp duty online in Malaysia LHDN? You can pay stamp duty online through the Stamp Assessment and Payment System (STAMPS) on the LHDN website (https://stamps.hasil.gov.my). You need to register as a user, log in, select the type of instrument, fill in the required information, upload supporting documents, and make the payment online. h. How to do tenancy agreement stamp duty? To pay stamp duty for a tenancy agreement in Malaysia, calculate the amount based on rental and lease duration: RM1 per RM250 of annual rent (≤1 year), RM2 per RM250 (1-3 years), and RM3 per RM250 (>3 years). Submit the agreement for stamping within 30 days via LHDN STAMPS online portal (https://stamps.hasil.gov.my) or at an LHDN branch with required documents (tenancy agreement, NRIC/passport, and property details). Payment can be made online or at the counter, and once approved, both parties should keep a stamped copy for legal reference. F Stamp duty is an integral part of property transactions in Malaysia. Understanding its nuances, from rates and calculations to exemptions and payment procedures, is crucial for a smooth and cost-effective property journey. By staying informed about the latest regulations and leveraging available exemptions, you can navigate the complexities of stamp duty with confidence and make informed decisions that safeguard your financial well-being. Remember, this guide serves as a starting point, please always consult with legal and financial professionals for personalized advice tailored to your specific circumstances. The upcoming changes in 2025 and beyond underscore the importance of staying updated and seeking expert guidance to ensure compliance and optimize your property transactions in Malaysia. Version: CN, BM Are you a first-time homebuyer or need expert guidance on purchasing a house? We are here to assist you! Fill out the form below, and our representative will approach you soon! [custom_blog_form] Continue Reading: Tenancy Agreement in Malaysia: Fees, Stamp Duty and More! i-MILIKI Stamp Duty Exemption for First-Home Buyers Is Ended But Here’s What Government Are Giving! Everything You Need To Know About The Memorandum Of Transfer (MOT) Citation, Reference and Related Information about Stamp Duty in Malaysia 2025 LHDN Malaysia Stamp Duty 2. iProperty Malaysia Memorandum of Transfer (MOT) and Stamp Duty in Malaysia. Sale and Purchase Agreement in Malaysia: What is SPA in property? Stamp duty and legal fees calculation for SPA when buying a house in Malaysia. 3. PwC 2024/2025 Malaysian Tax Booklet: Stamp Duty. 4. Cleartax Stamp Duty in Malaysia: Rates, Exemptions & Penalties. 5. DWG Malaysia What is Memorandum Of Transfer (MOT) in Malaysian Property? 6. 小晴天~房产报报看 How to calculate the new stamping fee 2025! Year 2025 | Late stamping fine adjustment. 7. Propertyguru Malaysia Tenancy Agreement In Malaysia: 6 Things You Should Know! 8. The Sun Tax Matter - Expect significant Changes to Stamp Duty from 2025. 9. KPMG Tax experts: Stamp duty reform must come with stronger enforcement, stiffer penalties

Continue Reading

Comprehensive Guide to Rent a House as a University Student

Comprehensive Guide to Rent a House as a University Student

Renting a house as a university student in Malaysia can be a challenging yet rewarding experience. You need to have some preparation before you move into your accommodation. Whether you plan to walk, drive, or use public transport, understanding your travel needs until signing the tenant agreement is essential for choosing a suitable accommodation. This comprehensive guide will walk you through everything you need to know about renting a house as a university student in Malaysia, ensuring you make the best choice for your needs and lifestyle. 5 Steps to Rent a House as a University StudentStep 1: Understanding Your Daily Travel RoutineStep 2: Conducting Market ResearchStep 3: Comparing and Filtering AccommodationStep 4: Contacting Agents and Viewing RoomsStep 5: Finalizing Your DecisionTips After Renting a House Step 1: Understanding Your Daily Travel Routine a) Walk to the University Walking to your campus can be a healthy and cost-effective option, but it is crucial to consider the distance and potential challenges. Renting a house near your university can save you time and energy. However, it would be best to prepare for unforeseen circumstances like bad weather, which can make walking inconvenient. Unpredictable weather can disrupt your routine and affect your punctuality. Additionally, consider the physical demands; walking long distances can be exhausting and impact your energy levels for classes, especially under hot and humid weather conditions. It is essential to consider your health and any physical limitations before you plan to do so. If you have any health issues, it might be wise to look for other options. b) Driving to the University If you plan to drive, you have more flexibility in choosing your accommodation. Renting a house slightly farther from your university might be feasible with a car. However, while driving offers convenience, it's crucial to consider potential drawbacks such as heavy traffic jams during peak hours, road accidents, road maintenance, and unexpected car breakdown issues. Ensure you account for travel time and unexpected delays. Owning a car offers flexibility but requires you to be diligent about upkeep and punctuality to avoid being late for classes. Always plan your travel time and have a backup plan in case of car problems. Do remember to factor in fuel expenses, parking, and car maintenance. c) Using Public Transport to the University Public transport is an excellent choice for reducing carbon emissions and saving money. It’s eco-friendly, cost-effective, and avoids the hassles of driving. However, it requires meticulous planning and punctuality. Familiarize yourself with the schedules and routes of buses, LRT, or MRT, and know the travel time, number of stations, and any necessary transfers. Missing a bus or train can disrupt your entire day, so always have a backup plan for delays. Proper preparation and knowing your journey details can ensure a smooth commute and timely arrival. Step 2: Conducting Market Research a) Rental Prices Conducting thorough market research is vital for university students to find suitable houses to rent. Start by understanding rental prices in various areas, as these can vary significantly depending on location and amenities. Student-focused accommodation might be more affordable, while exclusive neighborhoods may be pricier due to their amenities. Proximity to universities or public transport can also affect rental costs, with closer areas being more expensive but offering greater convenience. Conversely, areas farther away might be cheaper but involve added travel time and expenses. Understanding these variations will help you find a good deal that suits your needs and budget. b) Types of Room, Facilities, and Amenities Research the facilities and amenities offered by the accommodations. Look for features such as swimming pools, gyms, study rooms, or badminton courts. Determine whether the place is fully furnished, partially furnished, or unfurnished, as a fully furnished unit can save you the hassle of buying furniture. It's also essential to understand the room layout, which typically includes small, medium, and master rooms. Small and medium rooms often share a bathroom, while master rooms have private bathrooms. Additionally, consider the proximity to amenities like grocery stores, shopping malls, and public transport, as these can significantly enhance your daily convenience. Comparing different locations and their amenities will help you find the best fit for your lifestyle and budget. Use online platforms such as IQI Global or rental groups to gather insights and make informed decisions. c) IQI Global IQI Global allows university students to find suitable accommodation for the best rental experience. Whether you're looking for a cozy studio near campus or a shared apartment with friends, our platform offers a wide range of options to suit your needs and budget. With user-friendly search features, detailed property listings, and secure booking processes, you can easily find the perfect place to call home during your studies. Plus, our dedicated support team is always available to assist you with any questions or concerns, ensuring a smooth and hassle-free rental experience. Click here to view the IQI Global page Relevant Articles: Top 10 Malaysian Universities in the QS World University Rankings 2024 2. Moving House Tips: A Step-by-Step Guide on How to Move House from A-to-Z Step 3: Comparing and Filtering Accommodation a) Criteria for Comparison After identifying potential accommodations, compare the top options based on price, location, amenities, etc. Consider the strategic factors such as proximity to shopping malls, public transport, and restaurants. Narrow down your choices to the top five accommodations that meet your criteria. b) Making a Shortlist Create a shortlist of your best five desired houses and prepare for the next steps. This list will help you stay organized and focused during the viewing and decision-making. Step 4: Contacting Agents and Viewing Rooms a) Making Appointments Contacting agents and arranging room viewings is crucial for making an informed decision. Seeing the rooms in person allows you to assess their size, condition, and suitability. If you intend to share the accommodation with friends, bring them along for the viewing to ensure everyone is satisfied. It's better to view multiple options rather than settling on the first one you see. b) Questions to Ask During the property viewing, ask about rental agreements, extra fees, maintenance procedures, available amenities, property facilities, and the surrounding area. Raise any questions or concerns and ensure you understand your tenant's obligations. Step 5: Finalizing Your Decision a) Room Select and House Inspection Once you’ve viewed the rooms and weighed your options, it’s time to select the best fit. Carefully consider all aspects, including the room and house conditions, and choose the option that best suits your needs and budget. Before you move in, thoroughly inspect the property to ensure everything is in good condition. Report any issues with furniture or appliances to the agent to avoid future misunderstandings. Taking these steps will help ensure a smooth and satisfactory rental experience. a) Signing the Tenant Agreement Before signing the tenant agreement, view it carefully to ensure all terms and conditions, including your name, identification number, address, rental price, rental period, furniture listing, and security and utility deposit amounts, are correct. After signing, promptly clear all payments and request receipts from the landlord to avoid any future misunderstandings. Keep a copy of the tenant agreement for future reference. Congratulations! You have successfully rented a house as a university student in Malaysia! Tips After Renting a House a) Maintaining the Property Once you move in: Take care of the house and its facilities. Divide responsibilities among housemates to keep the space clean and safe. Promptly report any issues to the landlord. b) Timely Payments Always pay your rent before the deadline to avoid penalties. Keeping a good relationship with your landlord can be beneficial in the long run. Renting a house as a university student in Malaysia can be a smooth and rewarding experience with the right approach. With this comprehensive guide, you’ll be well-prepared to find a comfortable and convenient place that meets your needs and enhances your academic experience. Happy house hunting! Are you looking for a house to rent? We got you! Drop your information below and our representative will approach you as soon as possible! [hubspot portal="5699703" id="acf7e2e4-aec7-4973-b855-ddc53335307e" type="form"] Continue Reading: Things you should know about AEON Bank, Boost Bank, and GX Bank in 2024 Moving House Tips: A Step by Step Guide on How to Move House from A-to-Z Are You a -P or -J MBTI Personality Type? Unleash Your Hidden Talent as a Real Estate Agent Based On Your Type!

Continue Reading

Free Moving House checklist: Plan & Prepare For Your Next Move

Free Moving House checklist: Plan & Prepare For Your Next Move

Moving house. It's exciting! New space, new place to call home. Yet, it's so stressful. Why are so many things involved?! Take a deep breath, inhale, exhale... whether we like it or not, we can't escape from all the (sometimes tedious) parts of moving house. But we can make it easier for you, at the very least. Wear your seatbelts and get ready to scroll. This A-Z guide for moving house is going to be a ride, but we promise it'll help you. Let's start! Your Moving House Guide from A-ZBefore You Begin...Before MovingDuring MovingAfter Moving Before You Begin... Here's your checklist. Before we start getting into the nitty-gritty, we've prepared a thorough checklist to make it easier for you to keep track (because we all might forget that one thing). No.ItemDone? (✔️/✖️)Before Moving1.Get rid of unwanted items2.Get dimensions of every room3.Order packing supplies (labels, boxes, tape etc.)4.Make inventory list of items5.Pack non-daily items6.Separate valuables and important documents7.Pack essential household items8.Check with strata building management9.Notify relevant parties10.Find moving serviceAfter Moving1.Check your inventory2.Unpack and settle in3.Update your information Be sure to take a screenshot, write it in your notebook or keep it somewhere handy! Now let's get into each item of the list: Before Moving 1. Get rid of stuff you don't need Find out what you want to bring and what you're going to leave behind. If you're moving to a smaller space, or planning to buy new things for your home, it's time to get rid of unneeded items (even if that means leaving your string favourite plushie behind). You don't have to throw your stuff into the garbage - you can either donate them or sell them online! This is where the internet comes in handy. Here are some apps you can use to get your old stuff in new hands: CarousellFacebook MarketplaceMudah.my Additionally, people tend to forget the food that they have in the fridge. As you get closer to your move, finish as much food as you can to avoid mess, melts and heavy cans. 2. Get dimensions of every room The worst thing that can happen is to buy RM3,000 furniture and it not fitting right in your home. Be sure to check the space and rooms in your new home carefully to see what fits and what doesn't. Luckily for you, your phone most likely already has an app that will help you with measuring. Ditch the tape and use your phone! Measure app 3. Order packing supplies Moving requires a lot of supplies. You'll need lots of tape, markers, labels and bubble wrap. If you're moving on your own (or even if you're getting movers - more on that below), stock up on these items by purchasing them at the store or even online. Here are some apps or websites that provide packing supplies: ShopeeLazadaMR. DIY Some movers provide these items, so if you're using a mover, might as well kill two birds with one stone. For your clothes, you'll do well with luggage and big bags. Moving can be quite expensive, so save as much as you can while you go. 4. Make inventory list of items Don't lose your things! Make an inventory list of all your belongings before you move. It's not only useful to have when you lose things due to your own negligence. It can also come in really handy for insurance purposes, so it's easier to make claims. If you have enough phone storage, taking photos of your items (especially valuable or fragile ones) will be even better so you have additional proof of ownership and condition. Did you know that there's apps for inventory management? Now you do! Here's a useful app to help you with that: Itemtopia You can also use the built-in Notes app in your phone, or even Excel if that's what you're into. Just make sure everything is accounted for, and you'll be good to go. 5. Separate valuables and documents & pack non-daily items First things first, separate your valuables! Make sure to have dedicated boxes for your jewellery, luxury items and especially important documents. Be sure to carry them with you so you don't lose them, instead of leaving them with the movers. Next is two things: (1) pack things you don't normally use, and (2) pack them according to room. Photo albums, fancy dinnerware and books you don't normally read (or have given up on - I've been there) can be packed away for now. To reduce clutter, you can set up a 'packing station' to place all your packed items (so at least your space will be less of an eyesore). 6. Have essential household items with you Trust me, this is an essential step that most people overlook - make sure to bring your most essential things like towels, dishes, cutlery, clothes and medicine for the first few days. Unpacking can be very overwhelming, so be sure to keep these handy. Have them with you instead of leaving them to the movers. 7. Check with your strata building management If you're living in or planning to move into a strata building like condominiums, apartments, or flats, it's essential to communicate with the building management or JMB regarding any restrictions. A lot of JMBs do not allow large lorries or trucks to enter the premises outside of designated working hours to minimize disruption to other residents. Before scheduling any moving or delivery activities involving these heavy vehicles, do consult with your JMB and arrange a good date and time for your move. 8. Notify relevant parties Inform important parties about your move, including your landlord (if renting), utility companies, postal service, banks, insurance providers, and schools (if you have children). Utilities include water / gas / electric (often bundled), telephone / TV / internet (also often bundled), home security, and waste. 9. Arrange for moving services Research and book a reputable moving company well in advance. Get quotes from multiple movers, read reviews, and confirm details such as dates, costs, and services included. Consider additional services like packing and unpacking assistance if needed. Some movers you can consider: AlliedThe LorryThe Movers.myAKMOVERS During Moving 1. Move with the movers Once you've selected your moving company and set a date, it's time to get ready for the big day. While you won't be doing the heavy lifting, it's important to be around when the movers arrive to transport and unload your belongings, unless you've made special arrangements for them to work independently. 2. Conduct a Final Walkthrough An important part in moving house is to do a final walkthrough of your old home to make sure nothing is left behind. Check closets, cabinets, and other hiding spots, and ensure all utilities are turned off. 3. Secure Your Belongings During transit, secure your belongings to prevent damage. Take precautions to protect fragile items and valuables during the process of moving house. Consider purchasing moving insurance for added peace of mind. After Moving 1. Unpack and Settle In Once you arrive at your new house, start unpacking and setting up each room. Begin with essential items like bedding, kitchenware, and toiletries, then gradually unpack the rest. Take your time to organize each space according to your preferences. 2. Update Your Information Update your address with relevant parties, including banks, credit card companies, insurance providers, and government agencies. Register your new house address with the postal service and update your driver's license and vehicle registration if necessary. The good thing is you don't have to go anywhere to get your info updated for your utility bills. Just download these apps and update what you need to: myTNBAir SelangorIndah WaterMyUnifiMy Astro 3. Explore Your New Neighborhood Take some time to explore your new neighborhood and familiarize yourself with nearby amenities, such as grocery stores, restaurants, parks, and schools. Introduce yourself to neighbors and start building connections in your new community. 4. Enjoy Your New Home! Finally, take a moment to celebrate your new beginning and enjoy your new home! Take pride in your accomplishment while moving house and embrace the opportunities that come with starting fresh in a new place. We hope this guide helped make your moving house process easier. And if you're looking for a property negotiator for your next home, IQI Global is the place to be. [hubspot portal="5699703" id="544fffa2-4cd6-47c4-bc3c-a929a909c09c" type="form"] Continue reading: A Beginners Guide to Buying Home Insurance in Malaysia 10 Simple Steps to Buy a New House in Malaysia – Your Ultimate Guide Know the Difference: Residential vs Commercial Titles. Understand with Just 3 Easy Points!

Continue Reading

6 Points To Remember When You Rent Out A Room

6 Points To Remember When You Rent Out A Room

Do you want to lease out your property but are unwilling or unable to lease it out in its entirety? In this case, renting out a part of your property like a room is the best available option. It offers more flexibility for your own private use of the other rooms and it is much easier to manage when compared to leasing the entire house. You may also consider leasing out multiple rooms, which may be more profitable than leasing out an entire house to a single tenant. However, before you start renting out your spare room(s), make sure you complete these 6 points. 1. Prepare Your Property Once you have decided to rent out a room, you will need to go through your house thoroughly and make sure to “renter proof” it. After all, you will be letting potentially complete strangers live in your house; you need to ensure the safety of your belongings. Here are some steps you should take: Remove any valuables, private items or furniture that you don’t want to get damaged by accident. Put keyed deadbolts on each bedroom door. Remove self locking door knobs to prevent accidental lockout. Fix and repair anything that may need it, such as cracks in the walls, leaky taps or pipes and so on. 2. Determine The Non-Negotiables When you rent out a room, you are essentially getting yourself a housemate of sorts. Considering you will be living together, you need to set some ground rules. Be honest with yourself, if you can’t tolerate smokers, people who throw parties, or pets in the house, then state that clearly in your advertisement. 3. Set The Rent Price You will need to research and find out just how much others are charging for a room of a similar size in your area. You can go on the internet and get a rough estimation on how much you can charge based in your area and the type of room you rent. You will also need to decide the type of room you are willing to rent out. Remember, if the room comes with an attached bathroom then you can charge more. 4. Start With People You know It’s wise to start looking for tenants amongst people you already know. Talk to friends, family and acquaintances and ask them if they or anyone they know is looking for a room for rent. Since you already know them, a certain level of trust already exists so you can count on them to give payments on time and to look after your belongings and property with a certain level of responsibility and respect. 5. Filter Out Tricky Tenants It is important that you screen your tenant to make sure you can get along with them. Like we said before, you are pretty much getting a housemate for yourself so it would be better all around if you get along with them. How can you screen a potential tenant to know whether you will be able to live with them? Pay attention to how they communicate via phone or email. Or you could have a quick meet up and a short interview with them. Don’t be afraid to ask personal questions such as what they do or why they want to live here. Remember, a problematic tenant may cause many problems, which can be much worse than a few minutes of discomfort for asking personal questions. 6. Get Everything In Writing Once you have found a suitable tenant, make sure that you make and sign a proper written contract. Do not rely on a simple oral agreement, even if you do know them and trust them. This agreement will come in especially handy if, for some reason, you and your tenant have a disagreement. When creating a written lease it is best that you seek the services of a certified legal advisor, and make sure that the lease includes the following: How much the rent will be The date the money is due Whether the renter will pay utilities, and if so, which ones or what percentage How you will handle the food, fridge space, laundry, and common areas Any other concerns you have (cleaning, parking, quiet time, etc.) Having everything written down keeps everything well documented and helps avoid any confusion in the future. Want to know more about renting out property? Talk to us, send a message at hello@iqiglobal.com or call us at 012-299-6155 or 03-7450-6655. Liked what you read? Check out this article next: What is a lease agreement? Be a part of our award-winning team of investors, click here: https://goo.gl/UnFe3f

Continue Reading