Version: BM

In 2025, Malaysia’s property market opened with cautious confidence, as highlighted in NAPIC’s Q1 2025 report. Buyers, developers, and investors are recalibrating strategies around affordability, supply management, and resilience.

For local investors, this environment offers opportunities to secure quality assets in high-demand areas. At the same time, they must balance rental yields with capital appreciation potential.

For foreign investors, Malaysia remains attractive with clear ownership frameworks and relatively low entry costs. Key growth pockets include Kuala Lumpur, Johor Bahru, and Penang, but regulatory and market nuances require careful navigation.

Whether you seek rental income, capital growth, or portfolio diversification, these insights will help pinpoint where to invest. We help you identify resilient sectors and position your strategy for today’s evolving landscape.

What You Need to Know: 2025 Malaysia Property Market

- Transaction Activity: A More Focused Momentum

- Residential Market Overview

- Serviced Apartments: Stepping Back to Move Forward

- Overall Construction: Solid Starts, Slower Deliveries

- Are We Seeing a Realignment or a Quiet Recovery?

- Is This a Good Time to Invest in Malaysia property?

- FAQs: Malaysia Property Market

Source: NAPIC JPPH

Transaction Activity: A More Focused Momentum

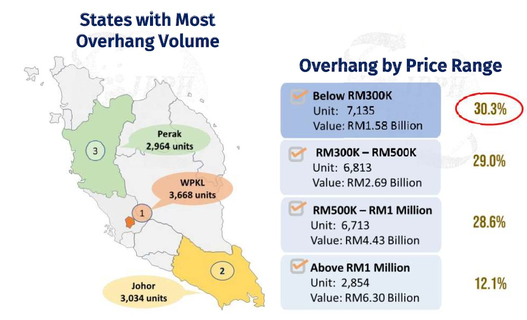

NAPIC’s report shows that properties priced under RM 500,000 continue to attract strong demand, particularly in growth-focused locations like Selangor and Johor.

This reinforces the appeal of mid-market inventory across Malaysia, especially for first-time buyers and local upgraders.

This suggests that home seekers are increasingly using property type filters and comparison tools on international sites and partner sites to assess value before making a move.

Transaction activity in Malaysia’s property market is expected to maintain a measured yet resilient momentum in 2025, particularly within the sub-RM500,000 segment. This price band continues to attract strong demand, driven by first-time buyers and local upgraders seeking affordable yet well-located homes, with Selangor and Johor emerging as key growth markets.

Moving forward, affordability pressures and ongoing infrastructure development will sustain interest in mid-market properties, while investors should anticipate increasingly selective buyer behavior, with greater reliance on digital platforms, property comparisons, and data-driven decision-making.

For foreign investors, while direct participation in the sub-RM500,000 segment remains constrained by minimum price thresholds, opportunities exist in the adjacent RM600,000–RM800,000 bracket, particularly in urban and transit-oriented developments offering strong rental demand and long-term appreciation potential.

Source: NAPIC JPPH

Residential Market Overview

New Launches and Supply: Strategic and Aligned

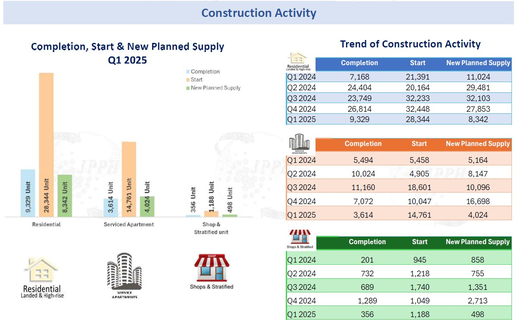

Residential construction has taken a more measured path.

Completions dropped significantly to 3,614 units in Q1 2025, compared to 7,072 in the previous quarter.

Yet new starts increased to 14,761 units, pointing to long-term optimism and more balanced pipelines.

| Quarter | Completion | Start | New Planned Supply |

|---|---|---|---|

| Q1 2024 | 5,494 | 5,458 | 5,164 |

| Q2 2024 | 10,024 | 4,905 | 8,147 |

| Q3 2024 | 11,160 | 18,601 | 10,096 |

| Q4 2024 | 7,072 | 10,047 | 16,698 |

| Q1 2025 | 3,614 | 14,761 | 4,024 |

This shift in strategy reflects a market that’s focused on accessing genuine demand and reducing mismatches between supply and expectations.

Residential Overhang: A Challenge Being Addressed

High-end homes remain oversupplied, but developers are responding by launching fewer luxury products and focusing instead on properties that are competitively priced and attractive to local buyers.

The shift also aligns with growing demand among foreigners exploring sales in Malaysia, particularly on platforms with clearer locations and pricing filters.

Source: NAPIC JPPH

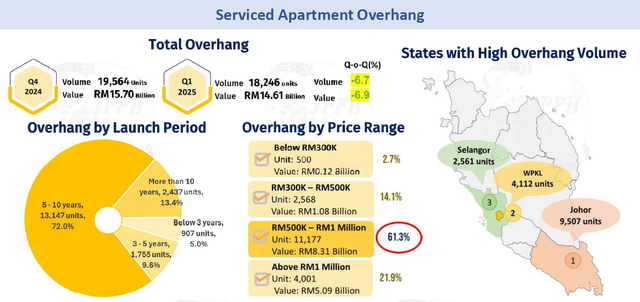

Serviced Apartments: Stepping Back to Move Forward

Serviced apartment completions dipped to 356 units in Q1 2025, down from 1,289 the previous quarter. New planned supply dropped to 498 units, reflecting a conscious pullback by developers.

| Quarter | Completion | Start | New Planned Supply |

|---|---|---|---|

| Q1 2024 | 201 | 945 | 858 |

| Q2 2024 | 732 | 1,218 | 755 |

| Q3 2024 | 689 | 1,740 | 1,351 |

| Q4 2024 | 1,289 | 1,049 | 2,713 |

| Q1 2025 | 356 | 1,188 | 498 |

Developers are clearly adjusting their expectations and delivery timelines, agreeing with market signals that the supply-demand gap must narrow before new launches resume.

Overall Construction: Solid Starts, Slower Deliveries

Completions across all sectors dropped to 9,329 units, but new starts remained high at 28,344 units, a sign that confidence in the medium term remains intact.

| Quarter | Completion | Start | New Planned Supply |

|---|---|---|---|

| Q1 2024 | 7,168 | 21,391 | 11,024 |

| Q2 2024 | 24,404 | 20,164 | 29,481 |

| Q3 2024 | 23,749 | 32,233 | 32,103 |

| Q4 2024 | 26,814 | 32,448 | 27,853 |

| Q1 2025 | 9,329 | 28,344 | 8,342 |

This reflects a strategic choice to find balance: completing only what’s viable in the short term while keeping a clear line of sight on longer-term goals.

Are We Seeing a Realignment or a Quiet Recovery?

At first glance, the lower completions and persistent overhang may suggest caution.

However, with stronger starts and lower speculative launches, the numbers suggest a comprehensive, data-driven reset.

As buyers become more informed and developers become more focused, the market is recovering the right way: by prioritising value, timing, and location.

Is This a Good Time to Invest in Malaysia property?

Yes, but the Q1 2025 Malaysia property market shows signs of stabilisation, with developers adjusting supply to meet real buyer demand. This environment creates opportunities for investors to enter before supply tightens further or prices rise, particularly in growth locations such as Selangor, Johor, and transit-linked urban areas.

While it can be a good time to invest, careful consideration is key — investors should focus on high-demand areas with strong rental prospects and engage a trusted agent to navigate current market dynamics and regulations.

FAQs: Malaysia Property Market

What is freehold property in Malaysia?

Freehold ownership grants perpetual rights, but not total control—under Malaysia’s Land Acquisition Act 1960, the government can acquire property for public use with fair compensation.

How much salary to buy a 300k house in Malaysia?

To afford a RM300,000 home in Malaysia, a net monthly income of RM3,500–RM4,000 is typically recommended. This is based on a 90% loan margin and a manageable debt service ratio (DSR).

Can you get Malaysian citizenship by buying property?

No. Malaysia does not offer citizenship through property purchase. Buying property does not qualify foreigners for citizenship or an automatic path to permanent residency. However, foreigners may apply for long-term stay under the Malaysia My Second Home (MM2H) program, but this is not citizenship.

Are you looking for ways to start investing in Malaysian real estate? nquire below and let our trusted professionals help you make the right move!

Continue Reading: