Are you halted by the complexities of the UK property market? Are you unsure where to invest your hard-earned money?

Manchester could be the answer with its booming economy and thriving property market.

This article will show why Manchester is a prime investment location and how you can benefit from its continued growth. Let’s explore why the future of UK property investment starts here.

This article’s content is provided by Sue Wong, a property expert and team leader at IQI Team Ace, who has had nearly two decades of experience in overseas property investment since 2005.

Manchester, Your Investment Hub

1. What is Manchester Famous For?

Manchester is a city steeped in history and brimming with modern energy. It’s the birthplace of the industrial revolution and home to world-renowned football clubs, Manchester United and Manchester City.

The city’s cultural scene is equally vibrant, with iconic institutions like the hit TV series “Coronation Street” (ITV) and The University of Manchester adding to its fame.

You might even recognize the Old Trafford or Etihad Stadium from major sporting events! This unique blend of heritage and progress makes it an exciting place to live and invest in.

2. London’s Overpriced, So Let’s Look North!

It’s no secret that London’s property market is becoming increasingly unaffordable. Savvy investors are now setting their sights on cities like Manchester, offering a more attractive entry point and excellent growth potential.

Imagine owning a charming red-brick house in Manchester for the price of a small flat in London – that’s the reality of the market today!

This northward shift is driven by the fact that Manchester offers a better value proposition for investors and residents.

3. Where is Manchester Located?

Manchester is strategically located in the heart of the United Kingdom, making it easily accessible from major cities. A quick 2-hour train ride will take you from London to Manchester, while a car journey takes around 3.5 hours.

This superb connectivity makes Manchester an attractive hub for businesses and residents, enhancing its appeal as an investment destination. Think about the convenience of living in a vibrant city with easy access to the rest of the UK!

4. Why Invest in Manchester?

a. Economic Growth

Manchester is experiencing an economic boom, positioning itself as a leading city in the UK. The continuous growth of Manchester has resulted in a thriving business ecosystem.

Major corporations and innovative startups increasingly choose to establish their presence in the city, fueling demand for commercial and residential spaces. This is what Manchester is: the economic boomtown of the UK!

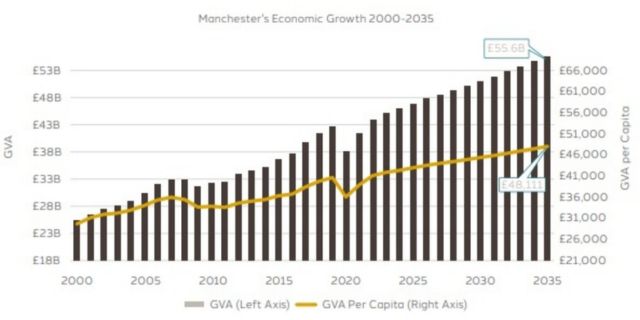

Here’s a closer look at Manchester’s economic growth story, visualized with historical data:

Manchester’s economy has grown significantly since 2000, expanding by 49% to reach £36.6 billion in 2020, thanks partly to successful economic initiatives like the Northern Powerhouse project. Projections estimate this growth will continue, reaching £53.7 billion annually by 2035.

This growth is also reflected in individual productivity, with Gross Value Added (GVA) per person increasing by 31% since 2000 and projected to rise a further 24% by 2035.

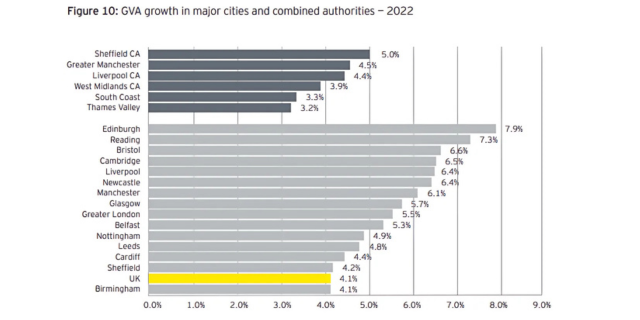

GVA growth in major cities and combined authorities — 2022

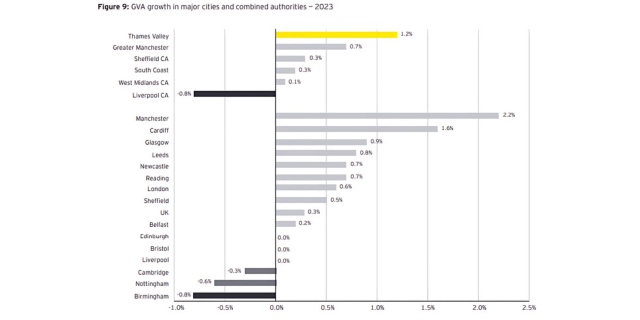

GVA growth in major cities and combined authorities — 2023

While the UK offers numerous property investment opportunities, Manchester consistently distinguishes itself as a prime location, outpacing even London in key metrics.

In 2022, Manchester’s GVA growth was at an impressive 6.4%, exceeding London by 0.5%, whilst Sheffield and Birmingham trailed behind at 4.1%, underscoring the city’s robust economic expansion.

What does that mean for investors? Unlike several cities such as Birmingham and Nottingham that saw a projected contraction in 2023, Manchester continues to see an impressive projected growth rate at 2.2% – the most vigorous projected growth among the major cities, significantly outperforming many other locations, including London at 0.6%, Leeds, Sheffield and other states at less than 0.9% of predicted growth.

This dynamic growth translates to a thriving property market, promising strong rental yields and capital appreciation and ultimately positioning Manchester as the clear frontrunner for savvy investors seeking to maximize their returns in the UK.

b. Rental Price

Key:

- PCM: Per Calendar Month

- % YoY: Percentage Year-over-Year change

- 3YR CAGR: Three-Year Compound Annual Growth Rate

| Region | Average Rent (PCM) | % YoY (Oct 2024) | % YoY (Oct 2023) | 3YR CAGR |

| UK | £1,270 | 3.9% | 9.1% | 8.3% |

| UK ex London | £1,013 | 5.1% | 9.3% | 8.0% |

| East Midlands | £883 | 3.3% | 9.5% | 7.3% |

| East of England | £1,217 | 5.4% | 9.7% | 7.7% |

| London | £2,188 | 1.3% | 8.7% | 8.9% |

| North East | £732 | 8.7% | 9.0% | 8.8% |

| North West | £897 | 5.9% | 10.6% | 9.4% |

| Northern Ireland | £801 | 10.5% | 2.5% | 6.8% |

| Scotland | £834 | 5.8% | 12.3% | 9.8% |

| South East | £1,357 | 4.5% | 9.2% | 7.7% |

| South West | £1,111 | 4.4% | 8.0% | 7.2% |

| Wales | £897 | 5.2% | 9.8% | 8.9% |

| West Midlands | £946 | 5.5% | 8.8% | 8.1% |

| Yorkshire and the Humber | £831 | 4.1% | 7.6% | 7.1% |

| City | Average Rent (PCM) | % YoY (Oct 2024) | % YoY (Oct 2023) | 3YR CAGR |

| Belfast | £819 | 11.5% | 3.1% | 7.5% |

| Birmingham | £985 | 4.5% | 8.9% | 8.3% |

| Bristol | £1,433 | 4.0% | 7.6% | 7.9% |

| Cardiff | £1,126 | 5.3% | 10.3% | 9.2% |

| Edinburgh | £1,350 | 4.8% | 14.4% | 10.5% |

| Glasgow | £989 | 2.9% | 12.7% | 9.7% |

| Leeds | £987 | 1.9% | 7.4% | 6.4% |

| Liverpool | £843 | 6.5% | 8.6% | 8.0% |

| Manchester | £1,124 | 4.2% | 11.4% | 10.1% |

| Nottingham | £948 | 0.0% | 10.4% | 6.8% |

| Sheffield | £837 | 3.1% | 6.9% | 7.2% |

| Southampton | £1,157 | 5.3% | 10.6% | 8.5% |

Source: Zoopla UK Rental Market Report (December 2024 Version)

The rental price is crucial for property investors, and Manchester shines in this area.

Manchester presents a compelling case that sets it apart. Manchester’s rental market demonstrates robust growth, with a 4.2% year-on-year increase in average rents as of October 2024, reaching £1,124 per month.

This outperforms cities like London, where rental inflation has slowed to a mere 1.3%, and even surpasses the national average of 3.9%.

Crucially, Manchester’s strong performance isn’t a recent anomaly. Over the past three years, it has enjoyed a compound annual growth rate (CAGR) of 10.1%, indicating sustained and healthy demand.

This impressive growth is fueled by a thriving economy and a growing population, resulting in a rental yield that often outpaces other significant cities.

Unlike some regions experiencing a slowdown, Manchester’s rental market is projected to remain buoyant, particularly in more affordable areas experiencing ‘catch-up’ growth, making it an attractive prospect for investors seeking capital appreciation and consistent rental income.

In comparison, cities like Nottingham are seeing a 0.0% growth, indicating investors should consider looking to Manchester instead.

c. Regeneration Projects

Manchester is undergoing a dramatic transformation, with over £7 billion invested in regeneration projects, according to Manchester City Council Annual Report 2024.

These projects, including the expansion of Manchester Airport and the development of the Northern Gateway, are creating vibrant new neighborhoods, improving infrastructure, and boosting the city’s overall appeal.

Investing in an area undergoing regeneration means you’re buying into a future of enhanced amenities, improved connectivity, and increased property values.

Here are the highlights of regeneration project that undergoing in Manchester:

- Manchester Airport: The £1.3 billion expansion will modernize the airport and improve the passenger experience. This project will merge Terminals 2 and 3, adding a major extension to Terminal 2. This means better service, more destinations, and increased economic activity, positively impacting property values in the surrounding areas.

- Northern Gateway: With an investment of around £650 million, this project will create 1.2 million sq m of employment space, generating 20,000 jobs directly and 2,000 indirectly. Alongside, it includes the development of 3,000 new homes. Such development means a significant boost to the local economy, creating demand for housing and increasing property values.

- Salford Quays £550 million Development The areas around Salford Quays will also undergo extensive changes, featuring: Imperial War Museum, The Lowry, Ordsall Hall, sporting activities and entertainment. The unique waterfront location also one of the attractive key point of this project. This mean the project aims to turn the area into a thriving hub, enhancing property values in this zone.

- Pomona Island £350 million Development Focuses on 22 acre regeneration on Manchester ship, between Salford Quays and Manchester city centre, with 2 plots for retail and leisure, and commercial. The project includes £350 million metrolink extension, connecting 6 stops to Trafford centre in 30 min. These developments highlight Manchester’s ambitious urban projects, driving substantial economic and residential growth.

- Chapel Street £1 billion Development: This extensive project will revitalize the underused railway arches along the Irwell River, creating new walking and cycling routes that connect Greengate and New Bailey.

- Greengate Square £400 million in Private Sector Investment: Features redeveloped spaces with events space, bubbling fountains, ambient lighting. Enjoy scenic views of the River Irwell and Manchester’s skyline, making the area more desirable and dynamic.

- MediaCity UK: Located at Salford Quays, this £550 million development houses major media companies like BBC North, ITV, and Kellogg’s, turning the area into a creative hub. It offers skills programs and career events to support local talent and works with charities like Salford Foodbank and Salford Foundation, enriching the community. The growing population drawn by jobs and business opportunities at MediaCity UK boosts the demand for housing, making property investment highly attractive.

d. Population Growth

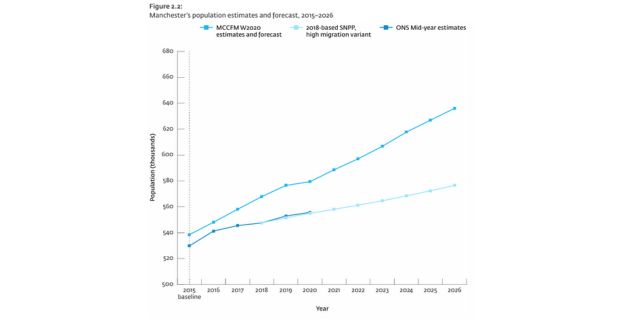

Manchester is experiencing a significant population surge, making it a prime location for property investment.

The figure by Manchester City Council illustrates this robust growth, with Manchester City Council’s Forecasting Model (MCCFM) charting an increase from approximately 539,000 in 2015 to around 625,000 by 2025.

Projections indicate this upward trend is set to continue, with models like MCCFM W2020 forecasting the population to reach close to 635,000 by 2026.

This rapid population expansion directly fuels housing demand, creating a compelling environment for investors seeking strong rental yields and capital appreciation.

i. Top 10 Cities in the UK with Highest Population in the Year 2025

| City Name | Population |

|---|---|

| London | 9,841,000 |

| Manchester | 2,833,000 |

| West Midlands | 2,705,000 |

| West Yorkshire | 1,956,000 |

| Glasgow | 1,719,000 |

| South Hampshire | 967,000 |

| Liverpool | 929,000 |

| Newcastle upon Tyne | 834,000 |

| Nottingham | 819,000 |

| Sheffield | 757,000 |

Source: Marcotrends

ii. Manchester – Historical Population Data (10 Years)

| Year | Population | Growth Rate |

|---|---|---|

| 2025 | 2,833,000 | 0.75% |

| 2024 | 2,812,000 | 0.75% |

| 2023 | 2,791,000 | 0.76% |

| 2022 | 2,770,000 | 0.73% |

| 2021 | 2,750,000 | 0.73% |

| 2020 | 2,730,000 | 0.74% |

| 2019 | 2,710,000 | 0.74% |

| 2018 | 2,690,000 | 0.71% |

| 2017 | 2,671,000 | 0.72% |

| 2016 | 2,652,000 | 0.72% |

| 2015 | 2,633,000 | 0.73% |

Source: Marcotrends

While the UK presents numerous appealing cities for property investment, Manchester distinguishes itself with a compelling combination of robust population growth and sustained demand.

Unlike locations facing uncertain demographic futures, Manchester boasts a decade-long track record of consistent population increase, projected to reach over 2.8 million by 2025 and underpinned by an annual growth rate averaging above 0.7%.

This sustained expansion, in contrast to fluctuating demographics seen in some regions, translates directly into a dependable and ever-increasing demand for housing.

This data-backed trend establishes Manchester not merely as a city experiencing a temporary boom, but as a location with fundamentally strong, long-term potential for property investment, offering investors a significantly more secure and predictable market compared to cities with less certain population trajectories.

For those seeking enduring portfolio growth rooted in reliable demand, Manchester’s demographic strength presents a distinctly advantageous opportunity within the UK landscape.

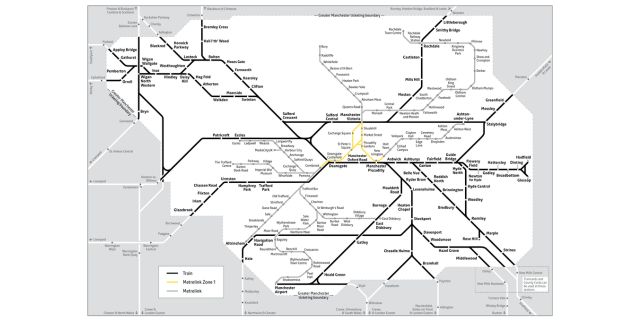

e. Unbeatable Connectivity

Manchester boasts excellent transportation links, making it a well-connected city within the UK and internationally. Manchester Airport, the UK’s largest airport outside London, offers flights to over 185 destinations.

The city’s comprehensive rail network, including major stations like Piccadilly, Oxford Road, and Victoria, ensures easy access to other parts of the country.

At the same time, Manchester has been recognized as the best connected city in the UK.

A detailed study from “Transport for Wales” analyzed 30 UK cities, evaluating them based on public transport stops, phone coverage, and broadband quality.

Manchester excelled in all areas, particularly in its extensive network of public transport options and superior phone and broadband coverage.

This means living in Manchester offers unparalleled ease of movement and digital connectivity.

Below is the list of the top 10 best connected cities:

Top 10 Best Connected Cities in the UK

| Rank | City |

| 1 | Manchester |

| 2 | Nottingham |

| 3 | Glasgow |

| 4 | Southampton |

| 5 | Hull |

| 6 | Belfast |

| 7 | Coventry |

| 8 | Cardiff |

| 9 | Leeds |

| 10 | Wrexham |

Source: North Property Group

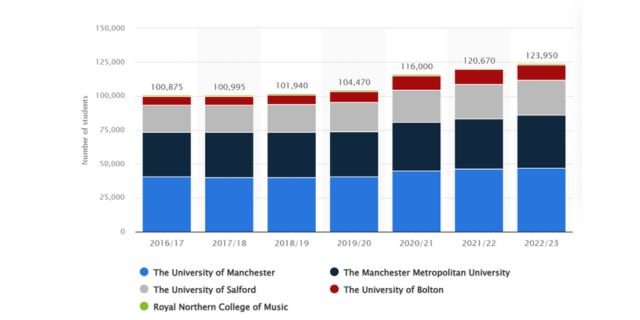

f. Education Hub

Manchester is home to renowned educational institutions, including the University of Manchester, Manchester Metropolitan University, the University of Salford, the University of Bolton, and the Royal Northern College of Music.

These institutions attract over 100,000 students, creating a strong demand for rental properties.

For property investors, this translates into a consistent pool of potential tenants and strong rental yields.

Many students prefer staying in well-located, modern apartments, which further boosts demand for new developments. Here are the statistic of the number of student in year 2022/23:

- University of Manchester: 46,860

- Manchester Metropolitan University: 39,095

- University of Salford: 26,260

- University of Bolton: 10,845

- Royal Northern College of Music: 890

- Total: 123,950

Manchester’s remarkable economic growth, high rental yields, extensive regeneration projects, growing population, and unbeatable connectivity make it a prime location for property investment.

Whether you’re a seasoned investor or a first-time buyer, Manchester offers a wealth of opportunities to grow your portfolio and secure your financial future.

Don’t miss out on the chance to be part of this dynamic city’s success story – the future of UK property investment starts in Manchester.

Frequently Asked Questions (FAQ)

1. Why should I consider investing in Manchester property?

Manchester presents a compelling investment opportunity due to its robust economic growth, strong rental yields, significant regeneration projects, rapid population growth, excellent connectivity, and status as a major education hub. Compared to London, Manchester offers a more affordable entry point with high growth potential and a better value proposition for investors.

2. Is Manchester really experiencing economic growth, or is it just hype?

Manchester is genuinely experiencing substantial economic growth. Its economy grew by 49% between 2000 and 2020, reaching £36.6 billion, and is projected to reach £53.7 billion by 2035. Manchester’s GVA growth has even surpassed London’s in recent years, and it consistently shows strong projected growth, unlike some other UK cities facing potential economic contraction. This real growth translates to a thriving property market.

3. How does Manchester’s rental market compare to other UK cities, especially London?

Manchester’s rental market is outperforming many other UK cities, including London. As of October 2024, Manchester saw a 4.2% year-on-year increase in average rents, compared to London’s slower growth of 1.3% and the UK average of 3.9%. Manchester also boasts a strong 3-Year CAGR of 10.1%, indicating consistent and healthy rental growth. This strong performance is driven by high demand and is projected to continue, offering attractive rental yields for investors, especially compared to stagnant markets like Nottingham (0.0% growth).

4. Where is Manchester located and how easy is it to get there?

Manchester is strategically located in the heart of the UK, making it very accessible. It’s about a 2-hour train journey from London and approximately 3.5 hours by car. Manchester boasts excellent transportation links, including Manchester Airport (the UK’s largest outside London) and a comprehensive rail network with major stations like Piccadilly and Victoria. Its central location and superb connectivity make it a highly desirable hub for businesses and residents.

5. What kind of regeneration is happening in Manchester and how does it affect property investment?

Manchester is undergoing extensive regeneration with over £7 billion invested in various projects. These projects include expanding Manchester Airport, developing the Northern Gateway, revitalizing Salford Quays and Pomona Island, and enhancing areas like Chapel Street and Greengate Square. These projects are creating new neighborhoods, improving infrastructure, and boosting the city’s appeal. Investing in areas undergoing regeneration can lead to increased property values, enhanced amenities, and better connectivity in the future.

6. Is Manchester experiencing population growth, and why is that important for investors?

Yes, Manchester is experiencing a significant population surge. The population has grown from around 510,000 in 2012 to approximately 550,000 by 2018, and projections estimate it will reach nearly 670,000 by 2030. This rapid population growth is crucial for property investors as it directly fuels housing demand, creating a strong environment for rental yields and potential capital appreciation.

7. Manchester is mentioned as an education hub. How does this benefit property investors?

Manchester is indeed a major education hub, home to renowned universities attracting over 100,000 students. This large student population creates a consistent and reliable demand for rental properties, especially apartments located near universities or with good transport links. This student tenant pool ensures strong rental yields and reduces vacancy periods for property investors targeting the student market.

8. Is property in Manchester still affordable compared to London?

Yes, property in Manchester is significantly more affordable than in London. The content explicitly highlights that investors can own a charming red-brick house in Manchester for the price of a small flat in London. This affordability, coupled with strong growth potential, makes Manchester a much more attractive and accessible entry point into the UK property market, especially for those priced out of London.

9. What are some of the key advantages of Manchester over other Northern cities like Birmingham or Leeds for property investment?

While other Northern cities also offer opportunities, Manchester is presented as consistently outperforming them. In 2022, Manchester’s GVA growth (6.4%) exceeded both London (0.5%) and other major cities like Birmingham and Sheffield. Furthermore, while some cities like Birmingham and Nottingham faced projected economic contraction in 2023, Manchester was projected to have the most vigorous growth (2.2%) amongst major cities. Manchester’s rental market growth is also stronger, and its comprehensive regeneration projects and connectivity further solidify its leading position in the North.

Sue Wong, a property expert and team leader at IQI Team Ace, provides the content of this article.

Sue Wong, a property expert with nearly 20 years of international real estate experience (since 2005), specializes in Malaysian, UK, Australian, Japanese, and Thai property markets.

Her passion for real estate and her background as a pharmacist gives her a unique perspective.

As a team leader at IQI, Sue is known for her friendly, trustworthy approach and commitment to helping clients and colleagues achieve their property goals. She enjoys travel, food, and connecting with people.

Should You have any enquiries regarding real estate in Malaysia, the UK, Australia, Japan, and Thailand, you may approach Sue for further assistance.

Whatsapp: +60 12-290-8483

Facebook: Sue Wong

Wechat: siewch1

Email: siewch.prop@gmail.com

IQI website: SUE WONG SIEW CHYONG

Are you looking for a Manchester or UK property investment solution? We can help you! Please fill in the form below and our representative will approach you soon!

Continue Reading: