The contents of this article were contributed by Dave Platter, Global Head of Public Relations at Juwai IQI and Forbes Council Official Member, connecting Juwai IQI’s leaders with top media outlets across the US, Europe, East Asia, Southeast Asia, and Australia-New Zealand.

Malaysia has solidified its position as the top ASEAN destination for international property investors, according to IQI Co-Founder and Group CEO Kashif Ansari. The country’s appealing property market and visa options are key strengths driving this achievement.

Data reveals that over 9,800 holders of MM2H, PVIP, or Sarawak/Sabah visas have contributed RM5.1 billion (US$1.1 billion) to the economy through local spending. This amount is comparable to funding 51,000 affordable housing units.

Foreign buyers, often part-time or full-time residents, play a significant role in boosting local economic growth and employment. Malaysia’s success in attracting these buyers is attributed to its stable property market and enticing visa programs tailored for businesspeople, digital nomads, and retirees.

Mr. Ansari’s remarks have been featured by eight leading Malaysian media outlets, including Astro Awani, Bernama, and the New Straits Times

Visa Approvals and Spending

Malaysia’s visa programs, including MM2H, Sarawak MM2H, and PVIP, have seen growing interest, with 2,973 approvals in 2023 and an estimated annual spending of RM134,000 (US$30,000) per resident.

These programs attract participants from countries such as China, the UK, Hong Kong, the US, and others

Competitive Advantages

Compared to its ASEAN rivals, Malaysia offers moderate financial thresholds for residency visas. Unlike some competing visa programs, Malaysia’s MM2H allows foreign residents to purchase homes. Additionally, the Sarawak and Sabah MM2H programs provide even more flexible requirements than the national scheme.

Property Market Stability

Malaysia’s stable property prices make it a safe investment destination. By comparison, Thailand faces oversupply issues, and Indonesia’s Jakarta shows minimal growth.

While Singapore leads in luxury property demand, its 60% stamp duty significantly deters foreign buyers. In contrast, Kuala Lumpur’s prime property prices remain stable, with slight upward potential.

2025 Outlook

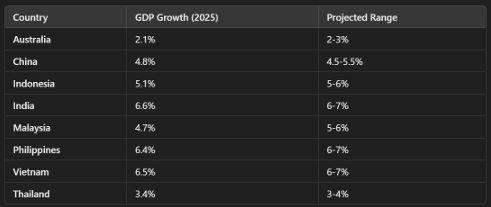

In his remarks, Mr. Ansari forecasted a 5% increase in foreign home purchases for 2025, which would translate to RM166 million in additional spending. Mainland China and Hong Kong are expected to remain the top sources of buyers.

Dave Platter is Global Head of Public Relations for Juwai IQI and a Forbes Council Official Member. Moving every few years as a child, he had to learn to connect. Today, he helps Juwai IQI’s leaders obtain media coverage in the world’s top outlets in the US, Europe, East Asia, Southeast Asia, and Australia – New Zealand.

To get the latest news and insights on real estate, click the image below and join our Whatsapp channel!