If you’re planning to buy a home in Malaysia, Loan-to-Value (LTV) is one of the most important terms you’ll come across. Whether you’re a first-time buyer or looking to invest in property, knowing how much banks are willing to lend compared to the property’s value can help you plan smarter.

All you need to know about Loan-to-Value

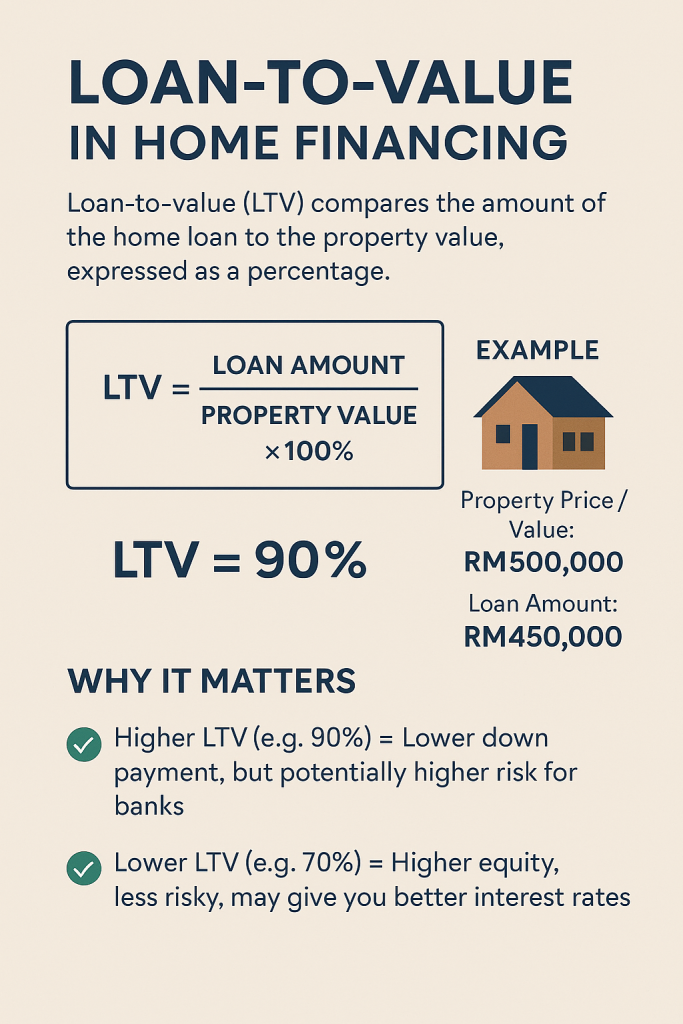

What Is LTV?

LTV stands for Loan-to-Value, and it’s a percentage that shows how much of the property price the bank will finance. The rest is your responsibility—usually paid as a down payment.

Loan-to-Value Formula:

📊 Loan-to-Value (LTV) Formula

Formula:

LTV (%) = (Loan Amount ÷ Property Value) × 100

Example: If you borrow RM450,000 for a home valued at RM500,000,

LTV = (450,000 ÷ 500,000) × 100 = 90%

LTV Limits in Malaysia

- First & Second Homes: Up to 90% LTV

- Third Home Onwards: Maximum 70% LTV (per Bank Negara’s policy to curb speculation)

The more homes you own, the lower your allowable LTV, meaning you’ll need to pay more upfront.

Why LTV Matters

LTV doesn’t just affect how much you can borrow—it also affects your interest rate, loan approval, and whether you’ll need mortgage insurance.

Lower LTV (e.g., 70–80%):

- Seen as lower risk by banks

- Can qualify for better interest rates

- Often doesn’t require insurance

Higher LTV (e.g., 90% or more):

- Higher risk for banks

- May come with higher interest rates

- May require insurance or stricter approval conditions

What About DSR (Debt Service Ratio)?

While LTV measures how much you can borrow based on property value, DSR (Debt-Service Ratio) measures how much you can borrow based on your income and existing commitments.

DSR Formula:

📉 Debt-Service Ratio (DSR) Formula

Formula:

DSR (%) = (Total Monthly Debt Obligations ÷ Monthly Income) × 100

Example: If you earn RM10,000 and have total debts of RM3,000 per month,

DSR = (3,000 ÷ 10,000) × 100 = 30%

Banks use this to ensure you won’t be overwhelmed by debt after your loan is approved.

Aisha’s Story: A Simple LTV + DSR Example

Aisha found her dream apartment for RM500,000. With a 90% LTV, she could borrow RM450,000. But the bank also looked at her DSR:

- Monthly income: RM10,000

- Other debt (car loan + personal loan): RM3,000

- DSR = (3,000 ÷ 10,000) × 100 = 30%

The bank allowed a 50% max DSR, so she had 20% (RM2,000) room left for her home loan.

Result? Although LTV allowed a RM450,000 loan, her DSR only supported about RM400,000 in monthly repayments—so she adjusted her budget.

Which Banks in Malaysia Offer the Best Terms?

- Maybank: Great for tools and DSR/LTV calculators online

- Public Bank: Known for low-interest rates and stable lending practices

- CIMB, RHB, and Hong Leong: Often offer seasonal promos and flexible packages

💬 Tip: Compare rates and LTV policies from at least 3 banks. Also check whether you’re eligible for first-time homebuyer incentives.

How to Improve Your Approval Odds

Before applying for a home loan:

| ✅ Do | ❌ Don’t |

|---|---|

| Pay all bills and loans on time | Apply for too many loans at once |

| Check your CCRIS report | Max out credit cards |

| Reduce existing debts | Be a guarantor unless necessary |

Summary: LTV at a Glance

| Term | Description |

|---|---|

| LTV | How much the bank will lend vs. property value |

| High LTV | Lower down payment, higher risk |

| Low LTV | Higher equity, better interest rate |

| DSR | Monthly debt obligations vs. monthly income |

| Best Practice | Balance LTV and DSR for approval success |

Tips to Improve Your LTV & Loan Outcome

- Boost your down payment — lower LTV = better interest rate.

- Reduce debts — improves both your DSR & loan approval chances.

- Keep an eye on CLTV — especially if you plan a second mortgage or home equity line.

- Compare lenders— Maybank and Public Bank frequently have flexible LTV/DSR calculators, while promos from CIMB, RHB, and Hong Leong may offer attractive rates.

Looking for advice or help on your home loan application? We want to hear from you by submitting your info down below, our agent will guide you step by step!

Continue reading: