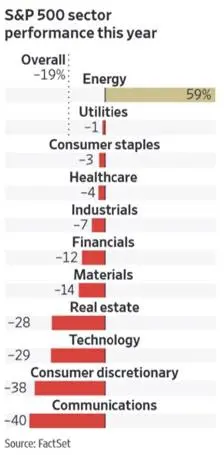

The markets are not settling down very soon as FED continues to hike rates in 2023. We witnessed equity and bond markets under much pressure in 2022. The S&P 500 $SPX ended 2022 on an absolute return basis down 23.9% adjusted for inflation, making it the 7th worst year for stocks in history. Many advanced economies are heading for a deep L-shaped recession, and the global economy will only recover in 2026/27.

According to J.P. Morgan, a new era of investing begins:

- When recessions occur, the ISM survey has been the best coincident indicator of a bottom in equities.

- 10%-15% y/y decline in S&P earnings in 2023.

- This year is expected to be the first time in three decades that most Asian economies will grow faster than China.

- Inflation pressures to subside in 2023 and allow the Fed to pause at 5% to see where things go and expect the 10-year U.S. Treasury to remain below 4%.

BLACKROCK: INVESTMENT THEME IN 2023

- We must widen the lens of possible scenarios because the new regime of higher macro and market volatility entails a broader range of outcomes.

- We see a fragmented world of competing blocs replacing an era of globalization and geopolitical cooperation. Geopolitics are driving economics now, instead of economics driving geopolitics.

- Earnings expectations are also still not fully reflecting the recession. However, markets are now pricing in more of the damage we see – and as this continues, it would pave the way for us to turn more positive on risk assets. We expect central banks to pause hikes when the economic damage becomes clearer – but keep rates at high levels.

MARKETS: LOOKING AHEAD – Rate hikes? Recession? Or Disinflation? Or Deflation?

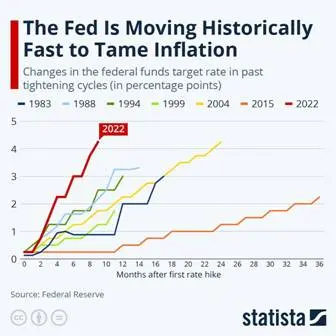

The Fed has raised rates by 425 bps in just 9 months of 2022. The last time it raised 425 bps was between 2004 & 2006. 2 YEARS. What matters more? ‘Rate hikes’ or ‘rate’ of rate hikes?

A few months ago, markets expected the Fed signalled its terminal rate to reach 4.6%. With the inflation outlook remaining uncertain in the USA, it is expected that FED will raise 75 bps by March -2023. Thus hurdle / terminal rate is hitting 5.25 to 5.50% by Q-1/2023. Hikes are expected on Feb 1/2023—50 bps and March 22/2023—25 bps and then giving a pause. FED wants a weak economy which is a polite way of saying that recession becomes inevitable OR recession becomes a reality.

Three things to bear in mind ahead of 2023:

- This is the most well-announced recession in history

- Every single strategist and/or PM expects equities to drop 10% in 2023

- Everyone expects a Fed pivot due to a landslide in equities in Q1

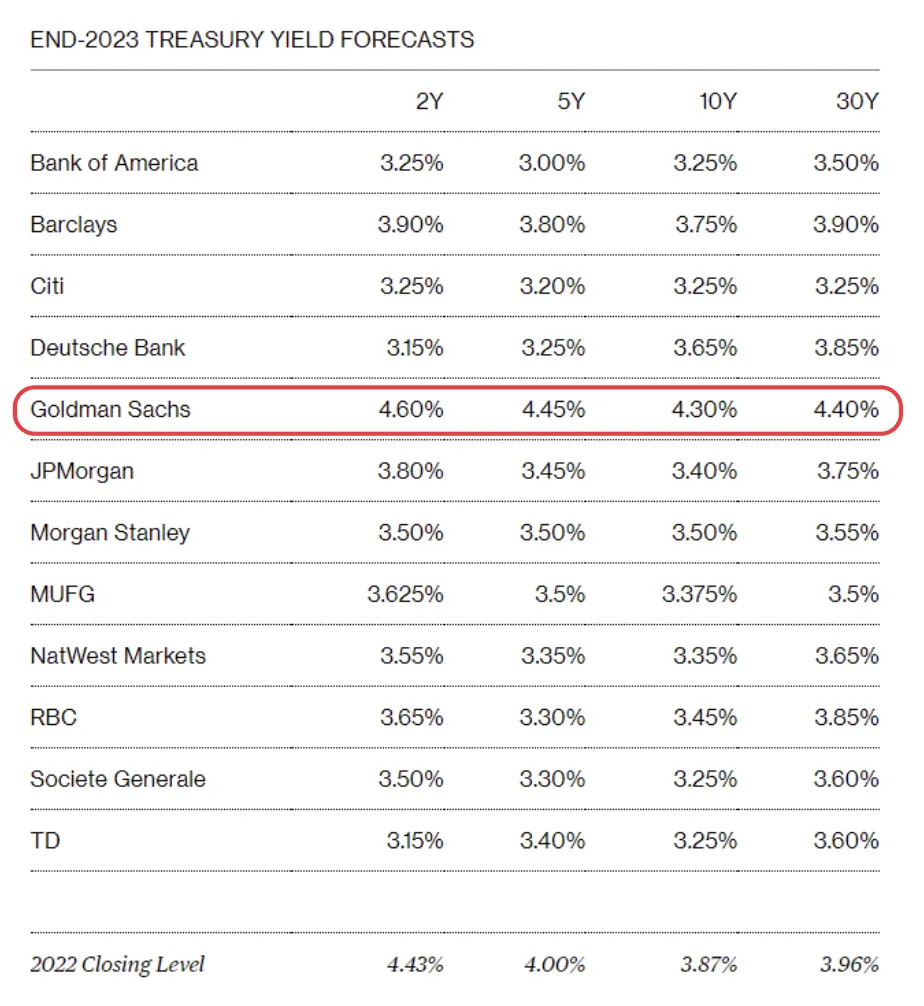

TREASURY OUTLOOK——MARKETS HAVE DIFFERENT THOUGHTS

Most investment banks expect 10y Treasury yields to close 40-50 bps below today’s levels. All except one. Goldman sees 10y Treasuries yielding 4.30% at year-end, with the Fed truly keeping rates ”higher for longer” and virtually no curve inversion = upside growth surprises.

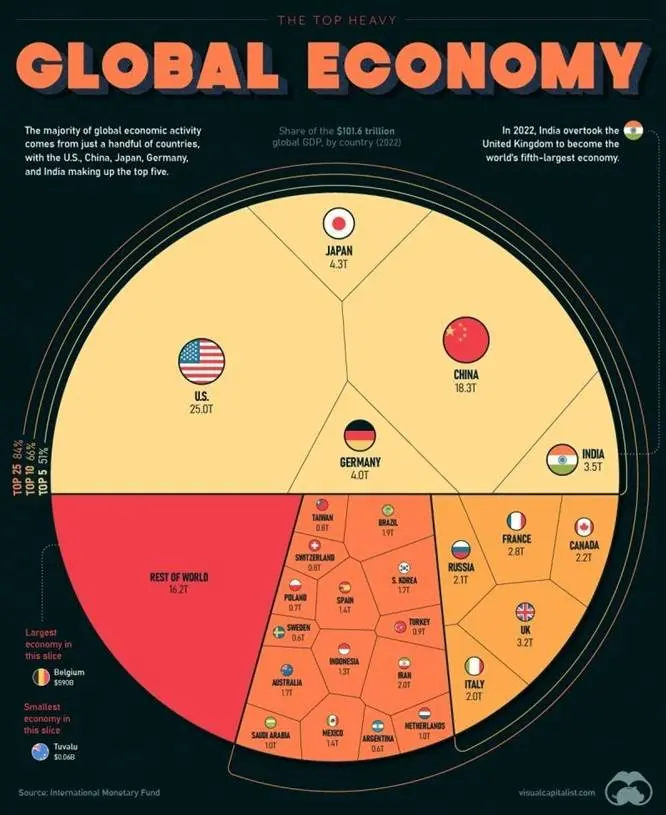

GLOBAL ECONOMY IN 2022: Top Heavy: Countries by Share of the Global Economy

As 2022 ends, we can recap many historical milestones of the year, like the Earth’s population hitting 8 billion and the global #economy surpassing $103 trillion. In this chart, we visualize the world’s GDP using data from the IMF, showcasing the biggest economies and the share of global economic activity that they make up. Just five countries make up more than half of the world’s entire GDP in 2022: the U.S., China, Japan, India, and Germany. Interestingly, India replaced the U.K. this year as a top-five economy. Adding another five countries (the top 10) make up 66% of the global economy, and the top 25 comprise 84% of the global GDP.

The article is written Shan Saeed, Chief Economist at Juwai IQI.

The article is written Shan Saeed, Chief Economist at Juwai IQI.

Stay ahead of the economy news with IQI! Interested to invest and step up your game? Leave your interest below!