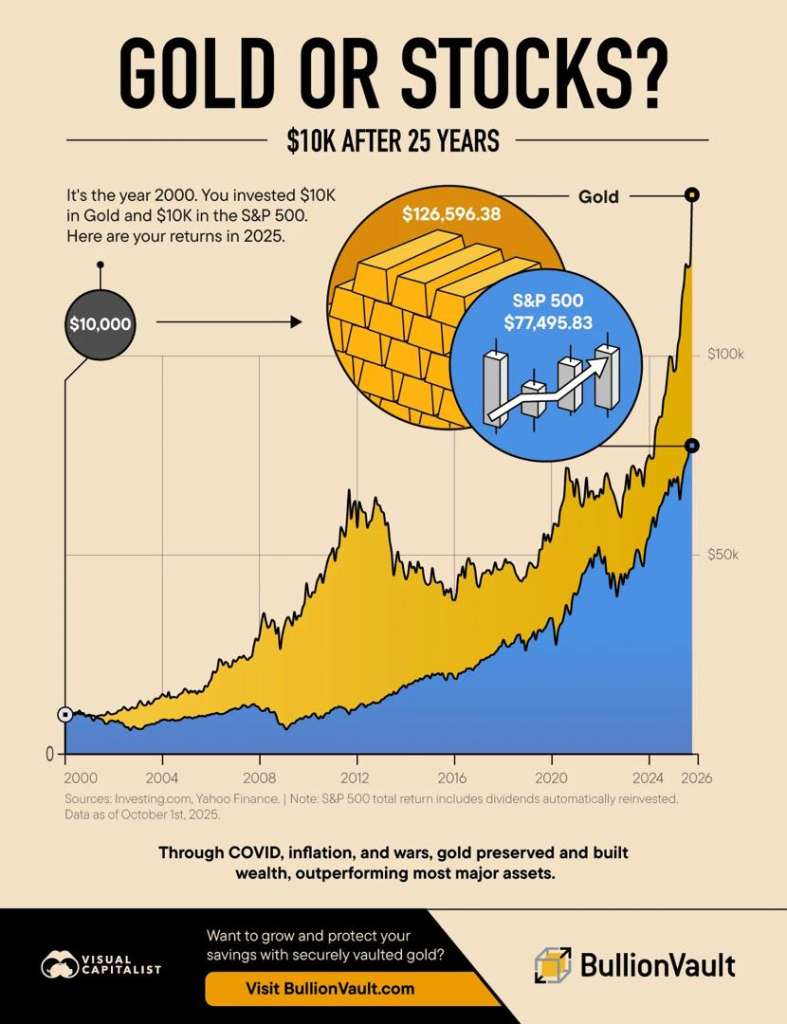

Global economy is still looking for growth as it navigates through uncertain and tempestuous times. Equities, real estate and commodities remain favorable for smart and sophisticated global investors. Bonds may remain under pressure. Dollars are likely to stay weaker as FED stays dovish amid slowing down in US economy.

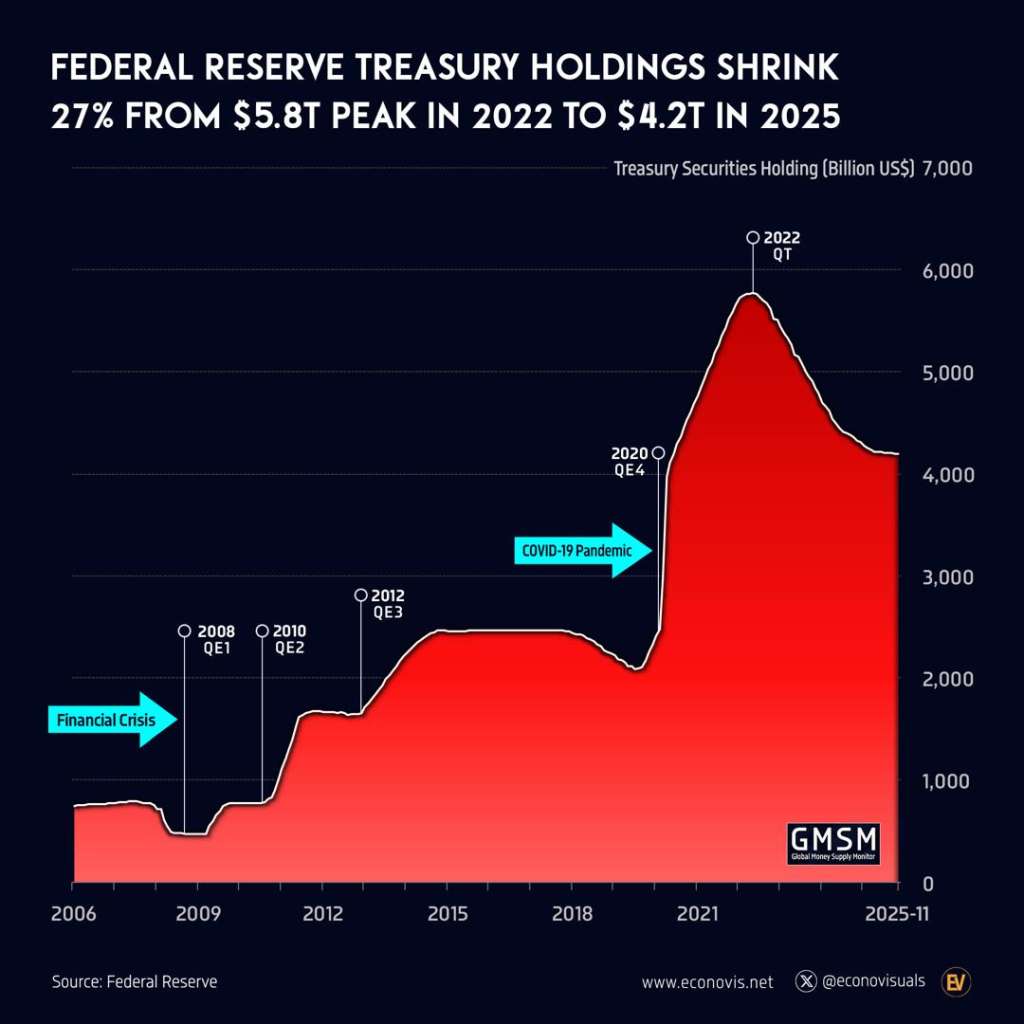

QE Comes Back in the Market

QE is coming. The Fed started cutting rates in Sep 2024 with the 30-yr yield below 4%. They’ve now cut 150 bps and the 30-yr is at 4.8%. The Fed may be done with inflation, but inflation isn’t done with the Fed. If long yields keep rising, they won’t admit a policy mistake – they’ll just bring back QE. In the end, all roads lead to easing.

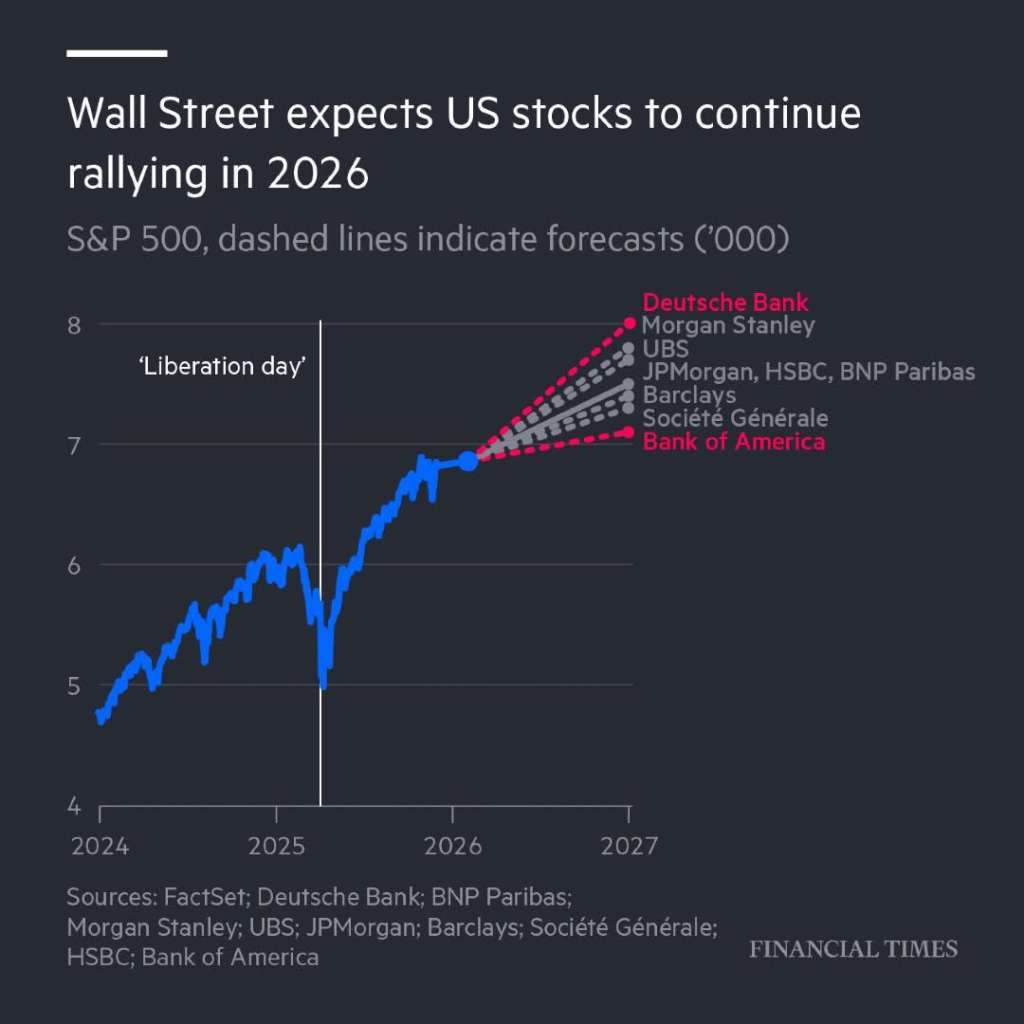

Wall Street is betting on another strong year in 2026, expecting double-digit stock gains despite fears around Big Tech’s massive AI spending and bubbling investor nerves over a possible AI-driven market surge.

Investors are Asking the Key Question: Gold or Stocks, which have held its value better since 2000.

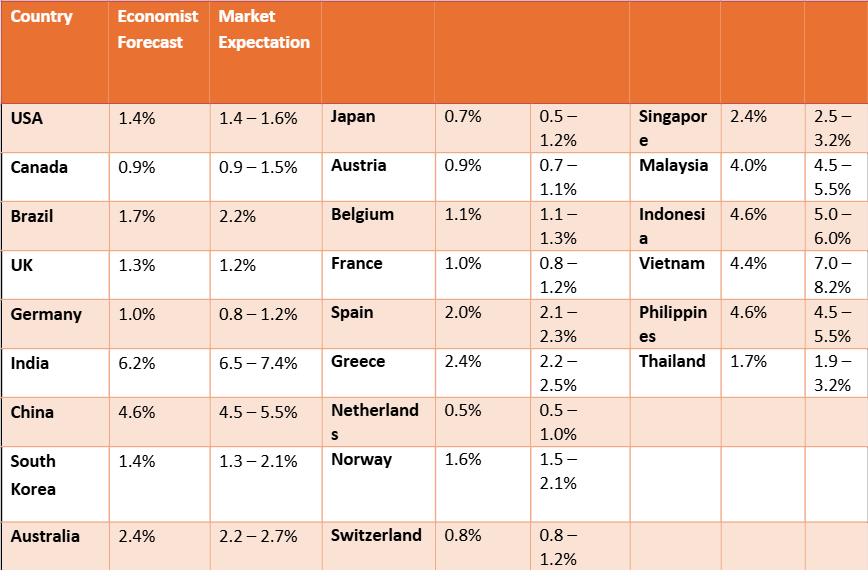

Growth Outlook of Various Economies in 2026.

As per economist magazine vs Market expectation: