Living a frugal lifestyle can bring a multitude of benefits to your financial well-being. It involves making intentional choices to save money and maximize resources without sacrificing happiness or quality of life. In this article, we will explore various strategies and tips for frugal living, focusing on key areas such as groceries, housing, transportation, entertainment, and more.

| Budgeting & Financial Planning |

Introduction

Frugal living can be defined as a conscious effort to optimize your spending and minimize waste by making informed financial decisions. It is not about depriving yourself but rather finding creative ways to stretch your resources and live within your means. By adopting a frugal lifestyle, you can gain financial freedom, reduce debt, and achieve long-term financial goals.

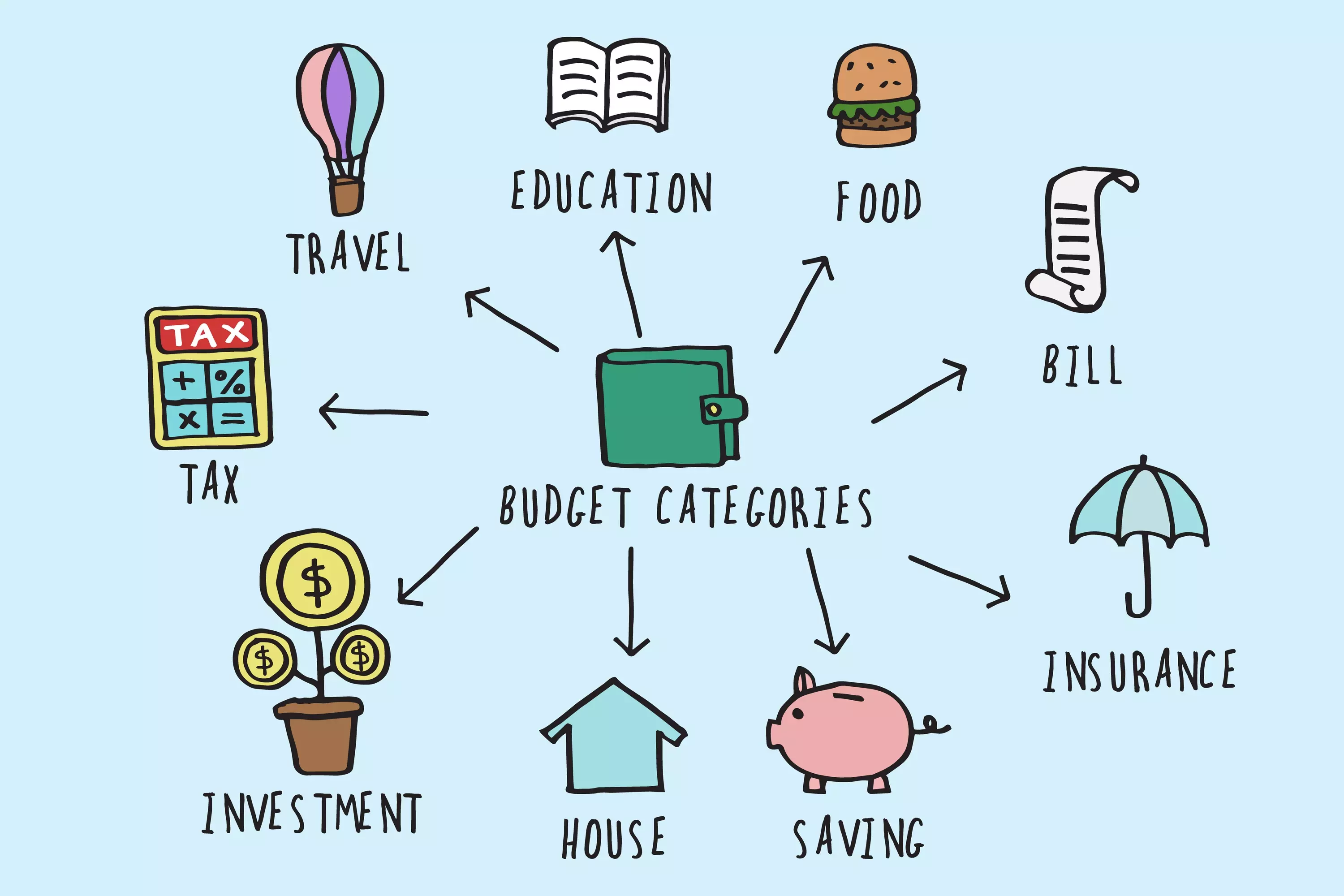

Budgeting and Financial Planning

The first step towards frugal living is creating a budget. A budget helps you track your income and expenses, allowing you to identify areas where you can cut back and save money. By setting financial goals, such as paying off debt or saving for a down payment, you can stay motivated and focused on your frugal journey.

Tracking your expenses is crucial in understanding your spending habits. Consider using budgeting apps or spreadsheets to monitor where your money goes. This awareness will help you identify unnecessary expenses and make informed decisions about where to allocate your funds.

Saving Money on Groceries

Grocery shopping is an area where significant savings can be made. Start by planning your meals in advance, creating a weekly or monthly menu. This will prevent impulsive purchases and reduce food waste. Take advantage of sales, coupons, and discounts to maximize savings. Buying non

perishable items in bulk can also result in substantial savings over time.

Frugal Housing Options

Housing is often one of the largest expenses in a budget. Consider your housing options carefully, weighing the costs of renting versus buying a home. Downsizing to a smaller living space can significantly reduce both housing and utility costs. Explore energy-saving strategies, such as insulating your home and using energy-efficient appliances, to further minimize expenses.

Cutting Transportation Costs

Transportation expenses can quickly add up, but there are ways to minimize them. Utilize public transportation whenever possible or consider carpooling and ride-sharing options. If you own a vehicle, maintain it properly to ensure optimal fuel efficiency. Additionally, explore alternative modes of transportation, such as biking or walking, for short distances.

Thrifty Entertainment Ideas

Entertainment doesn’t have to break the bank. Look for free or low-cost activities in your community, such as outdoor concerts, art exhibitions, or local festivals. Engage in DIY projects and hobbies that provide enjoyment without significant expenses. Take advantage of public libraries and community resources, where you can borrow books, movies, and even equipment.

Frugal Travel Tips

Traveling on a budget is possible with some strategic planning. Research budget-friendly destinations and consider traveling during off-peak seasons when prices are lower. Utilize travel rewards programs and deals to get discounted or free accommodations and flights. By being flexible with your travel plans, you can save a significant amount of money.

Saving Money on Utility

Reducing utility costs can contribute to significant savings. Conserve electricity by turning off lights and unplugging electronics when not in use. Install energy-efficient light bulbs and consider insulating your home to reduce heating and cooling expenses. Switch to energy-saving appliances that consume less electricity and water, ultimately reducing your utility bills.

DIY and Repurposing

Embrace the do-it-yourself (DIY) mentality to save money and unleash your creativity. Instead of automatically replacing broken items, explore repair options. Learn basic handyman skills to fix minor issues around the house. Upcycle and repurpose items that you might otherwise discard, giving them a new purpose and extending their lifespan.

Building a Frugal Mindset

Frugal living is not just about cutting costs; it’s about cultivating a mindset that prioritizes needs over wants. Practice delayed gratification by avoiding impulsive purchases and taking time to consider whether an item is essential or merely a desire. Find satisfaction in simplicity and focus on experiences rather than material possessions.

Building an Emergency Fund

Having an emergency fund is crucial to protect yourself from unexpected expenses. Aim to save at least three to six months’ worth of living expenses. Start small and consistently set aside a portion of your income. By building an emergency fund, you can face unexpected challenges without falling into debt or compromising your financial stability.

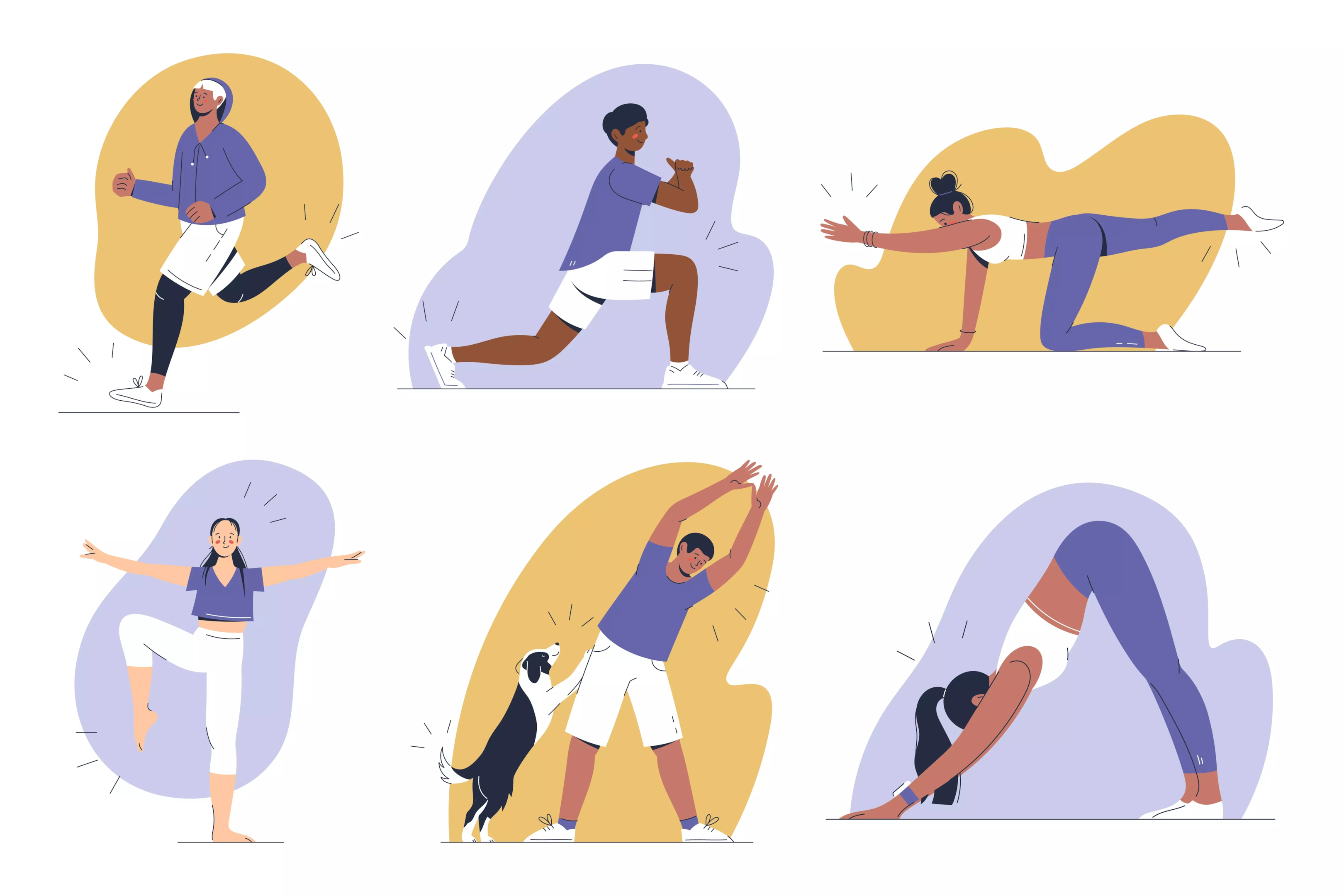

Frugal Health and Wellness

Taking care of your health doesn’t have to be expensive. Prioritize preventive healthcare to avoid costly medical bills down the road. Exercise and stay fit by exploring low-cost options such as walking, jogging, or utilizing free workout videos online. Explore homemade remedies and natural alternatives for common ailments and minor health issues.

Investing and Retirement Planning

Frugal living can also pave the way for a secure financial future. Start investing early, taking advantage of compound interest to grow your savings. Consider low-cost investment options like index funds and exchange-traded

funds (ETFs) that offer diversification and long-term growth potential. If needed, seek professional financial advice to optimize your investment and retirement planning strategies.

Conclusion

Frugal living offers a path to financial independence and a more intentional, fulfilling life. By implementing the strategies outlined in this article, you can save money on groceries, housing, transportation, and entertainment while still enjoying a high quality of life. Remember, frugality is about making conscious choices that align with your values and long-term goals. Embrace the frugal mindset and enjoy the benefits it brings to your personal and financial well-being.

Looking for a career change or a side hustle? Why not become a real estate negotiator? With the skills and knowledge you’ll gain from our comprehensive training program, you can help clients buy, sell, and rent properties while earning a great income. Don’t wait – start your journey as a real estate negotiator today!