This article is contributed by Yousaf Iqbal, Head of IQI Canada

In March 2025, the Canadian real estate market reflected a mixed picture, shaped by ongoing economic uncertainties and regional variations. While national home sales experienced a slowdown, stable home prices and early signs of recovery in key urban centers signal cautious optimism for the months ahead. Interest rate adjustments and improved affordability continue to influence buyer sentiment.

Greater Toronto Area (GTA)

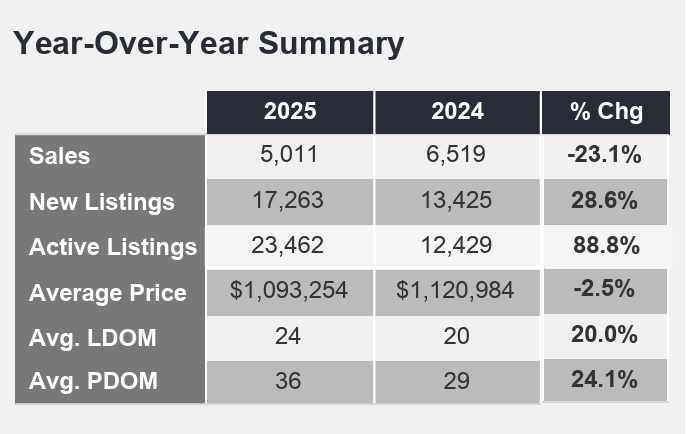

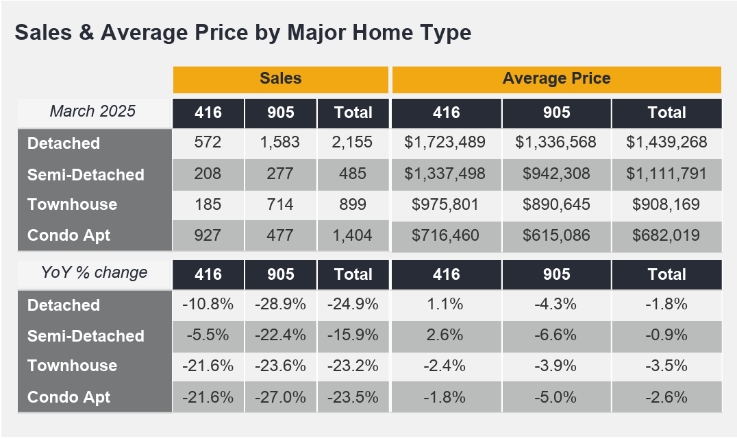

The GTA market saw a modest cooling in March, with home sales declining compared to last year. The average selling price dipped by 2.5% year-over-year to $1,093,254, while the MLS® HPI benchmark fell by 3.8%. Despite the slowdown, market watchers point to a potential rebound later in the spring, as more listings come online and borrowing conditions improve.

Vancouver

Vancouver’s housing market remained relatively balanced. While residential sales slowed slightly, increased listing activity and steady pricing indicate seller confidence. Inventory continued to build, giving buyers more negotiating room. The market is expected to maintain stability, especially as mortgage rates become more favorable.

Montreal

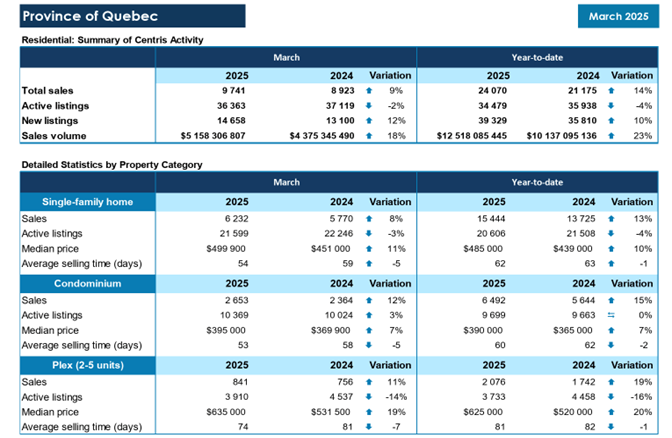

Montreal experienced a healthy uptick in activity, with home transactions surpassing seasonal expectations. The city’s relative affordability compared to other major metros, paired with supportive lending conditions, has kept buyer interest strong. Inventory levels are rising steadily, helping to meet demand.

Toronto

Homeownership in the Greater Toronto Area became more affordable in March 2025, with lower borrowing costs and declining home prices making monthly mortgage payments more manageable. According to the Toronto Regional Real Estate Board (TRREB), continued rate cuts and increased housing supply are expected to benefit buyers by boosting affordability and negotiation power.

However, economic uncertainty and the upcoming federal election are causing some households to delay purchasing decisions. TRREB officials noted that consumer confidence, particularly around employment stability, will be key to driving future home buying activity.

Vancouver

Metro Vancouver recorded its lowest March home sales since 2019, with 2,091 residential transactions—a 13.4% decline from March 2024 and 36.8% below the 10-year average. Meanwhile, active listings surged, reaching 14,546, up 37.9% year-over-year and nearly 45% above the seasonal average.

Despite political and economic uncertainties, market conditions have become increasingly favorable for buyers. Mortgage rates remain low, prices have eased from past highs, and inventory is at its highest in almost a decade. However, buyer activity remains muted, with a sales-to-active listings ratio of 14.9%, indicating a balanced market overall.

Benchmark prices showed mixed trends:

- Detached homes: $2,034,400 (↑0.8% YoY)

- Apartments: $767,300 (↓0.9% YoY)

- Townhomes: $1,113,100 (↓0.8% YoY)

New listings jumped 29% from last year, reflecting growing seller confidence. While attached homes are nearing sellers’ market territory, the overall market is experiencing slower momentum similar to early 2023, with potential for stronger activity in the coming months.

Quebec

Source: https://members.gvrealtors.ca/news/GVR-Stats-Package-Mar-2025.pdf

Source: https://trreb.ca/wp-content/files/market-stats/market-watch/mw2503.pdf

Source: https://com.apciq.ca/fsmi-stats/mensuelles/2025/stats-202503-en.pdf