Version: BM

In today’s world, a full-time job is no longer the only option to earn a living.

Some say gig work is more freeing, others believe small businesses are more profitable, and some are confident with short-term project income.

But without EPF, SOCSO, and other employee benefits, can Malaysians really survive by depending solely on these alternative income sources?

Key Takeaways:

- Stability vs Freedom: Full-time jobs offer stability, while gig/freelance work offers flexible hours and potentially higher income.

- Hidden Risks: High income without savings and protection can expose people to financial instability and mental stress.

- Planning Is Key: It’s not about what kind of work you do, but how disciplined you are in planning finances through savings, insurance, and investments.

- Hybrid Model Growing: Combining full-time work + side income has become more popular because it offers a balance of stability and freedom.

Uncovering the Work Dilemma in Malaysia:

1. Can You Survive Without Full-Time Guaranteed Work?

The answer isn’t simply “yes” or “no.” The truth is many Malaysians can manage with alternative work like gig, freelance, or small business.

But what’s the difference between these and full-time jobs?

a) Full-Time / Permanent Jobs

These typically come with a fixed salary, EPF and SOCSO deductions, and additional benefits like paid leave or insurance protection.

However, there’s a trade-off: you are tied down to routines (e.g. 9 AM to 5 PM), and sometimes get caught in the politics of the office.

b) Part-Time / Gig Work

Gig or part-time work offers full freedom – no fixed hours; income depends on one’s own effort.

But on the flip side, there’s no EPF, no SOCSO, no paid leave. All of that must be arranged by yourself.

Some people even earn more than full-time salary earners. But long-term sustainability is another story.

2. Why Income Without Full-Time Work Can Be Higher

Even without formal contracts or fixed salary, many part-time workers and gig workers succeed in earning comparable — sometimes higher — income than full-time roles. Key reasons include:

- Flexible work hours: They may work more than the typical office hours. For example, e-hailing drivers drive 12–14 hours a day, which can result in larger returns compared to a regular salary job.

- Control over one’s own effort: Income depends on how many tasks or projects are completed. A freelancer can handle more than one client at once.

- High demand & fast-moving market: Certain industries — food delivery, content creation, e-commerce — always have demand. When there’s a surge (holiday seasons, trending topics), their earnings can spike.

- Less hierarchy, more output potential: Unlike permanent jobs which depend on annual raises, promotions, or internal competition, gig/freelance work allows someone to increase income quickly through more work or better clients.

Yet, without protections like EPF, SOCSO, or paid leave, every cent of income must be managed with much stricter discipline.

3. Long-Term Risks & Challenges

Yes, alternative work can be worthwhile… if there’s a strategy. But it becomes risky when one lives day-to-day without planning for the future.

Here are issues many don’t see when choosing to rely entirely on gig or part-time work:

- Mental health becomes fragile: long work hours, feelings of isolation, and lack of HR support make stress hard to avoid.

- No clear career path: after 5 or 10 years, what next?

- Fragile finances: income depends on external factors like health, vehicle condition, or market demand. One accident or long illness can immediately cut off income.

- Lack of long-term savings: without EPF or SOCSO contributions, the future becomes exposed to risk. Many might feel comfortable with large income today, but when age catches up and energy diminishes, no savings means little protection in later years.

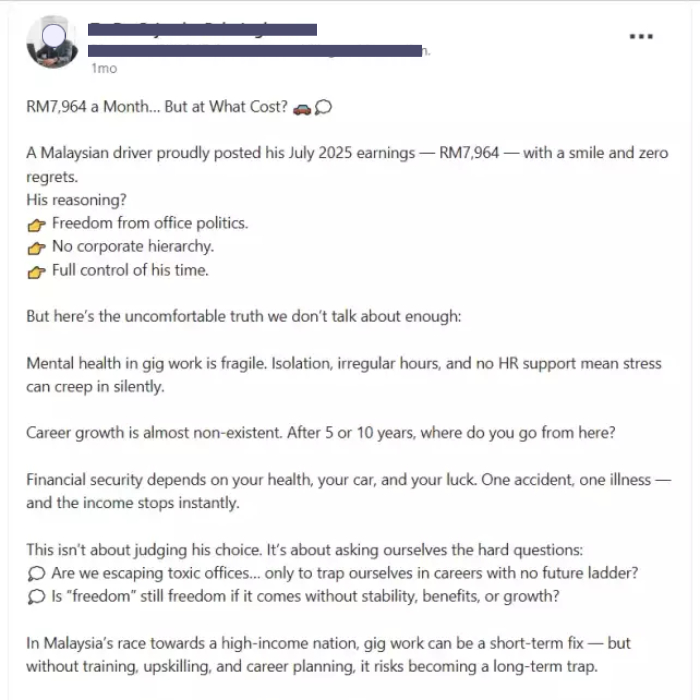

As shown in the article, gig work can look like a good escape from pressures of a fixed job… but without training, upskilling, savings, and career planning, that freedom can easily turn into a long-term trap.

To add to this argument, successful Malaysian content creator Khairul Aming has repeatedly reminded young people that even if they aspire to be content creators or choose freelance paths, a strong foundation in education and skills remains essential for their future.

@501awani "Sebagai content creator kita kena rancang 5 ke 6 tahun ke hadapan bukan hanya ikut trend," – @Khairulaming #TikTokAwardsMY ♬ original sound – 🇲🇾Astro AWANI🇲🇾

4. How Part-Time / Gig Workers Can Protect Their Future

While part-time work offers freedom and flexibility, it still requires smart planning so that today’s income can also ensure tomorrow’s security.

Here are some practical steps:

| Practical Step | How It Helps |

|---|---|

| Voluntary contributions (e.g. for pension/saving schemes) | Helps build savings & basic protection even if there is no official employer. |

| Emergency fund & consistent savings | Acts as a buffer when income drops or stops altogether. |

| Personal insurance | Protects against health or accident costs. |

| Upskilling & income diversification | Opens up new job opportunities and avoids dependency on a single income source. |

| Small & disciplined investments | Builds long-term assets even if you start with small amounts. |

5. So, Is Full-Time Work the Best Option?

Full-time work, as discussed earlier, comes with fixed salary, EPF, SOCSO, and other benefits that build long-term stability.

Key advantages include:

- Social protection: With EPF and SOCSO contributions, one doesn’t have to rely solely on physical ability or health to keep earning. There are retirement savings, medical benefits, and protection against accidents or disability.

- Clear career path: Even if raises are slow, most full-time jobs provide structure, promotion opportunities, and ways to develop skills. From this comes a sense of stability and progression.

- More sustainable life balance: 9–5 work allows people to plan life outside work more predictably — for family, education, or future planning.

But it also has costs: more tied time, limited flexibility, and sometimes office pressures make people feel burdened.

6. Is One Choice Better Than the Other?

Does that mean full-time work is better than gig work? The answer is: No, not at all.

In truth, no single type of work can be called the safest. What matters is how one plans for the future.

It’s possible someone working full-time has no savings because they don’t manage their finances well.

Meanwhile, a gig worker may have a more organized financial plan because they diligently save, invest, or build their own assets.

Ultimately, what defines success is not what job we choose, but how we manage and plan our future with it.

7. The Popular Middle Path

For many, the answer to the tension between full-time and alternative work is not choosing one, but combining both.

Many keep a full-time job for stability, while building side income through small businesses, freelancing, or content creation.

This hybrid model offers a sense of security, while opening room for extra freedom.

There are also alternative careers that sit somewhere in between — not purely the 9-to-5 routine, but not completely unpredictable gig work either.

For example, real estate work, which allows someone to manage their own time, potentially earn high income, and still benefit from training and supportive community.

Conclusion

So, returning to the article’s title question… Can Malaysians survive without a full-time job?

The answer: Yes! — as long as every step is accompanied by planning and discipline. Every choice comes with its own risks and opportunities.

In the end, what matters is not the type of job we pick, but how we manage, plan, and give meaning to that career for the future.

Frequently Asked Questions (FAQs)

1. What is the biggest challenge for gig workers aside from unstable income?

Besides financial concerns, many face mental stress from working alone without HR support. The future of their careers can feel unclear, contracts often change, and they constantly need to look for new projects.

2. How can gig workers apply for home or car loans without a fixed salary slip?

Many banks today are more flexible with self-employed/gig worker applications. They assess eligibility based on consistent bank statements, tax records, proof of stable cash flow, or official business registration.

3. What government assistance is available for gig workers in Malaysia?

The government, through PERKESO, provides the Skim Keselamatan Sosial Pekerjaan Sendiri (Self-Employment Social Security Scheme) for protection against accidents and illness. EPF also offers voluntary contributions (i-Saraan) to help gig workers make retirement savings.

4. Does gig work freedom guarantee better work-life balance?

Not necessarily. Although flexible, many gig workers end up working longer or at unpredictable times to maintain stable income. This can disrupt health and lead to burnout.

5. How long does it take to build stable gig income?

It depends on the industry, skills, and individual effort. Generally, it takes about 6 months to 2 years to build reputation, regular clients, and consistent cash flow.

6. How do you measure success in a gig career without a formal hierarchy?

Success is usually measured by increased pay rates, larger projects, a solid portfolio, recurring clients, testimonials, and continuous learning of new skills. Progress also comes as you grow your abilities over time.

Your work should fit into your life, not the other way around. Discover how you can grow your career while living the life you want by enquiring below now!

Continue Reading: