Malaysia has emerged as Southeast Asia’s leading data centre hub, attracting US$34 billion in investment over the past four years.

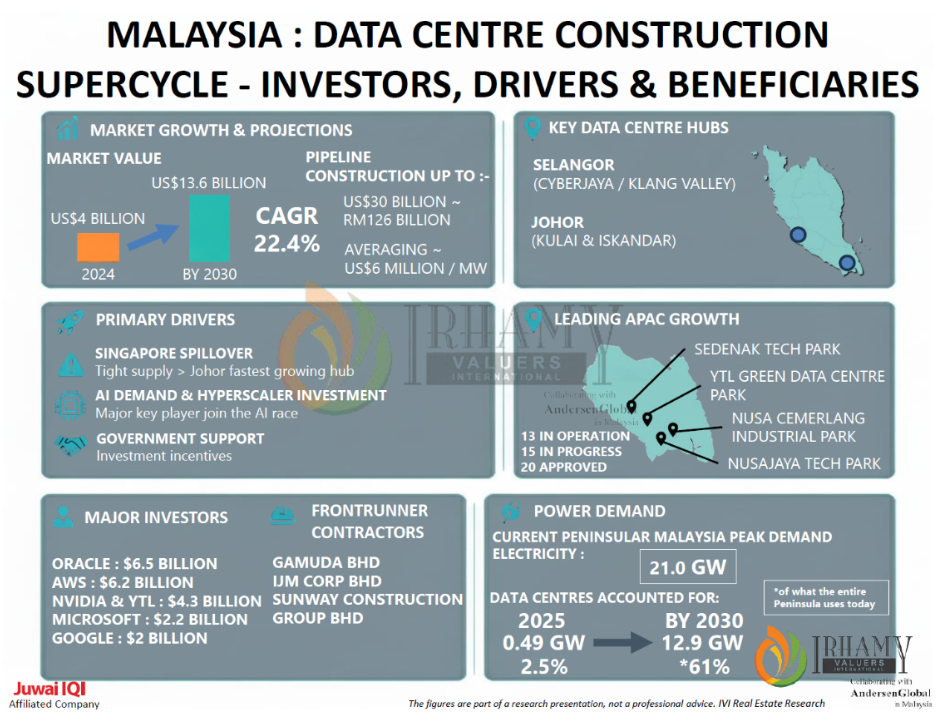

The sector is projected to more than triple from US$4 billion in 2024 to US$13.6 billion by 2030, driven by major AI hyperscalers including Google, AWS, Microsoft, Oracle and Nvidia via YTL Power.

This rapid expansion has sparked a RM126 billion construction supercycle, with contractors such as Gamuda Bhd, IJM Corp Bhd and Sunway Construction Group Bhd leading core infrastructure development.

Johor remains the epicentre, expected to account for 60% of national capacity by 2030.

Rising demand for land and clean energy has prompted plantation groups SD Guthrie, KLK and IOI Corporation Bhd to allocate estates for green industrial parks and solar farms, supporting Malaysia’s National Energy Transition Roadmap target of 70% renewable energy by 2050.

Figure 1: Drivers of Malaysia’s Data Centre Supercycle

National utility Tenaga Nasional Berhad (TNB) is accelerating grid readiness, targeting 5 GW of data centre demand by 2035 and rolling out its Green Lane Pathway, which cuts connection times from 36 months to 12.

Its 10 GW renewable energy commitment by 2030 further underpins the transition.

Data centres could account for 70% to 90% of Malaysia’s electricity demand growth in 2025 and 2026.

While this presents grid and energy security challenges, the boom is also creating new value chains and strengthening Malaysia’s regional technology position.

Realising these gains will depend on timely grid upgrades to meet rising demand.