Written by Lily Chong, Head of IQI Australia

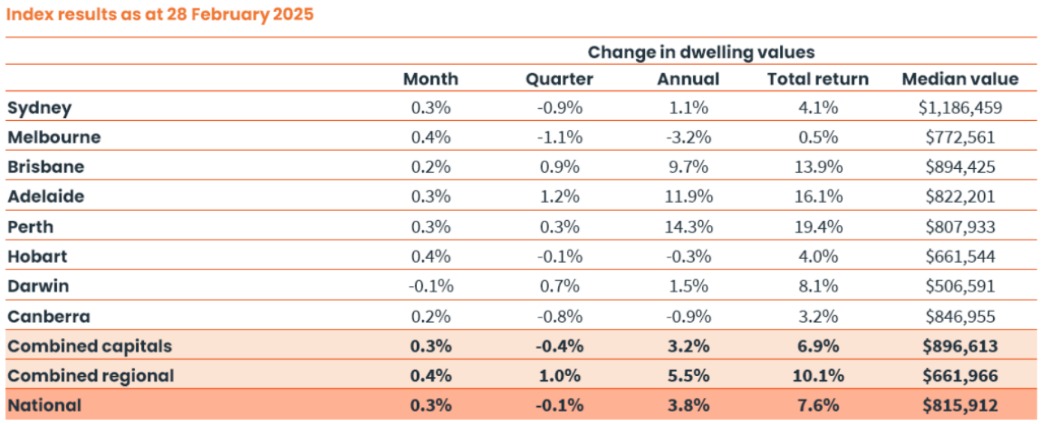

CoreLogic’s national Home Value Index rose by 0.3% in February, signaling an end to a brief three-month downturn that had lowered home values by 0.4%. While the increase was modest, it was widespread, with most regions except Darwin (-0.1%) and Regional Victoria (flat) experiencing growth.

Key trends include:

- Melbourne and Hobart lead gains: Both cities saw a 0.4% rise, reversing Melbourne’s ten-month streak of declining values.

- Mid-sized capitals slowing: Brisbane, Perth, and Adelaide, previously the strongest markets, recorded slower monthly growth (0.2%-0.3%). While Adelaide (1.2%) and Brisbane (0.9%) still lead quarterly gains, Perth’s growth has decelerated to 0.3%.

- Premium market rebound: Sydney and Melbourne’s upper-tier housing markets, which faced sharp declines, are now driving growth, consistent with past trends of high-value markets responding first to rate cuts.

CoreLogic’s research director, Tim Lawless, attributes the market improvement to rising buyer confidence, influenced by expectations of lower interest rates, rather than increased borrowing capacity. Auction clearance rates have also returned to long-term averages, further indicating improved market sentiment.

In February, national rents increased by 0.6%, marking the strongest monthly rise since May last year. However, this remains below the 0.9% increase recorded in February 2023 and the 1.2% surge in February 2021 during the rental boom.

Key trends:

- Seasonal influence: Rental growth typically accelerates in the first quarter due to seasonal patterns, rather than underlying market shifts.

- Annual growth slowing: Over the past 12 months, rents have risen by 4.1%, the slowest annual increase since early 2021. Despite this, the growth rate remains double the pre-pandemic average of 2.0%.

- Declining growth in key cities: Darwin saw the sharpest slowdown, with annual rent growth dropping from a peak of 25% during the pandemic to just 1.4%. Sydney, Melbourne, and Brisbane unit rents have also slowed significantly, with annual growth now at 2.7%, 3.2%, and 3.3%, respectively—down from peaks above 15%.

- Impact of migration and household changes: The easing of net overseas migration and a shift towards larger households have reduced rental demand, especially in major cities.

- Rental growth in some markets: Hobart, the ACT, and Darwin’s unit market have experienced slight rental growth improvements compared to last year, albeit from previously weak conditions.

CoreLogic’s Tim Lawless attributes the overall slowdown to normalizing migration trends and changing household sizes, which have alleviated some pressure on the rental market.