Written by Lily Chong, Head of IQI Australia

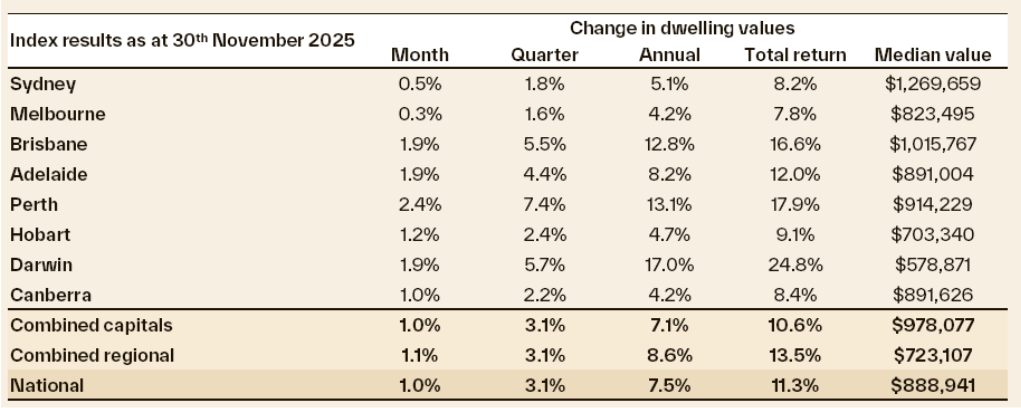

Australia’s housing market posted another month of solid momentum, with Cotality’s national Home Value Index rising 1.0% in November. This marks the third consecutive month where home values have climbed by one per cent or more. Although the pace has eased slightly from October’s 1.1% rise, the overall trend remains positive, signalling resilient buyer demand in the face of broader economic uncertainty.

Perth Leads the Nation

Perth continues to outperform all other capitals, recording an impressive 2.4% rise in dwelling values for November. Extremely low levels of stock—sitting more than 40% below the long-term average—combined with elevated buyer activity have created strong upward pressure on prices. This monthly growth alone added over $21,000 to the median dwelling value, equating to around $5,000 per week. Once again, Perth highlights the growing divergence between mid-sized capitals and Australia’s larger, more supply-balanced markets.

Mixed Results in Sydney & Melbourne

Sydney and Melbourne delivered more modest results, rising 0.5% and 0.3% respectively. These softer gains reflect increased affordability constraints, with prices already sitting at historically high levels, limiting further upward movement. Sydney’s supply levels are only slightly below its five-year average, meaning the city does not face the same supply shortages driving stronger growth elsewhere. Importantly, Sydney’s monthly growth rate appears to have peaked back in August at 0.9%, suggesting the city may be entering a more stable phase.

Affordability Pressures Continue to Build

Housing affordability remains a key challenge nationally. Cotality’s latest metrics show the median dwelling value is now 8.2 times higher than the annual household income—its most stretched level on record. At the same time, mortgage serviceability has climbed to 45% of household income, making it increasingly difficult for new buyers to secure finance. Auction clearance rates have also softened since mid-September, drifting below the decade average by mid-November, particularly in Sydney and Melbourne where clearance rates have held in the low 60% range.

Market Outlook

Looking ahead, the combination of persistent inflation and expectations that interest rates will remain elevated for longer is likely to influence buyer sentiment. With affordability challenges deepening, fewer buyers may be able to borrow at the levels required to keep pace with rising prices. Recent trends also indicate that lower-priced segments of the market are seeing the strongest value growth across most capitals, as buyers adjust to tighter lending conditions. Melbourne is the key exception, where the middle of the market is currently experiencing the fastest uplift.

For investors and homeowners alike, Perth’s property market presents exciting opportunities. Whether you’re considering selling, buying, or investing, now is the time to explore your options. Contact our team at sales@iqiwa.com.au to discuss your property goals today.

Source: Cotality Research, December 2025