Have you heard of a bank that wants to reach underserved communities? From bad credit scores to the outskirts, digital banks are here to save the day!

GX Bank is the first to bridge that gap of the conventional banking system in Malaysia.

Shall we hop onto the bandwagon?

GX Bank: Worth it or not?

1. What is a digital bank?

It is not foreign to the banking world but is relatively new in Malaysia.

Essentially, digital banks operate fully online from setting up an account to customer service support.

This means there are no physical branches for walk-ins with an all-in-one app for all sorts of transactions. How convenient!

Sounds sus? Fret not, because Bank Negara Malaysia has given a license to a few applicants.

2. What is GX Bank?

GX Bank, by Grab, is the first fully digital bank launched in Malaysia.

It is a savings account and not Shariah-compliant.

The big question is should we transition? Here are my two cents.

3. Pros of GX Bank: What’s good?

Fees

There are no fees and no hidden fees! Even for overseas transactions!

Opening and closing an account costs nothing! There are so many fees waived, like ATM withdrawals and transfers.

Savings Account

Remember bank accounts that pay you a tiny bit of interest every 6 months?

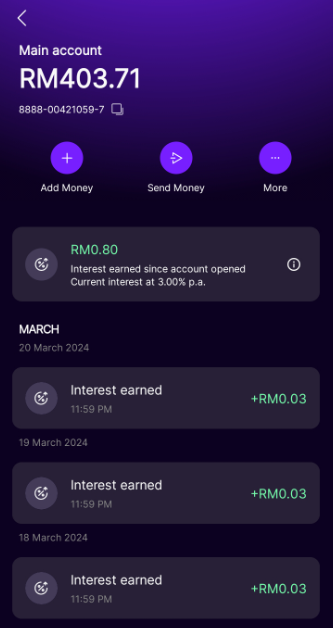

Gone are the days! GX account offers a daily interest of 3% per annum.

3% is certainly not inflation-proof but it’s better to park your funds here while you search for better investment opportunities to not miss out too much.

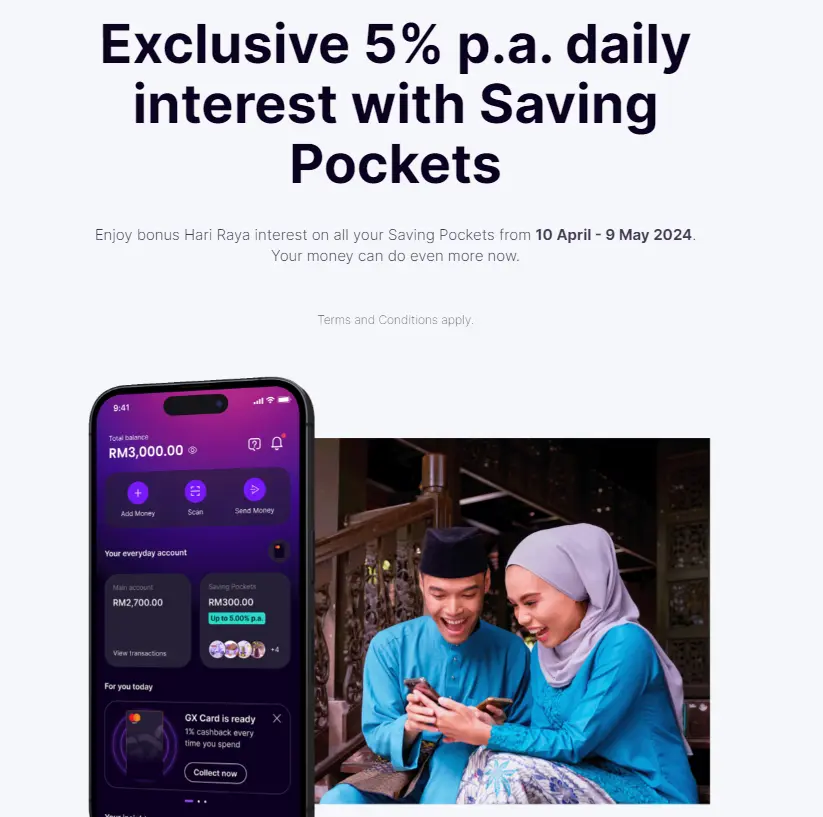

What’s even better is, GXBank is currently offering 5% daily interest this Raya from 10 April to 9 May in your Saving Pockets (more on it below).

If you’re thinking of signing up, better hop on it quickly!

Pockets

Similar to MAE’s tabung, GXBank has up to 10 pockets for different saving goals.

The major win for me is that you can still earn the 3% daily interest in the pocket and your pockets are separated from the main account.

So use this GXBank account to save up for your next trip!

Debit Card

Through the application, you can activate a virtual debit card with a card number and use it immediately for online transactions.

It’s easier than ever to order and receive your GX card. The estimated time needed to receive my debit card was a week but I got it after 3 days! Talk about efficiency!

In addition, the fee of RM12 for the card is waived (even the shipping)!

Spending

GX account requires no minimum balance.

Apart from using a GX card to swipe or wave at checkout, you can now use DuitNow QR payments!

This feature is similar to the familiar Touch ‘n Go, but you won’t be able to let the merchant scan your code upon payment for now.

Source: GXBank app

Cashback

The best part about the debit card is the UNLIMITED 1% cashback. Spend it wherever and get 1% cashback.

It takes a few days for the cashback to be credited to your account and you will be notified.

Even though 1% might not seem much, it’s still money that you’re saving, right?

Digitisation

Another great thing to love is that you can bid farewell to wasting time queuing at a bank for some minor errand. They offer 24/7 customer support via the app, hotline and email!

This has eliminated barriers, especially for people from the outskirts who do not live near any banks.

And the best part? Freeze and unfreeze your card anytime through the app!

4. What can be improved?

Navigation

The tech-savvy might find it simple to navigate, but for the elderly at home, it can be challenging.

They might need assistance to verify their identity through the e-KYC on the registration page.

Limitation

Bad news for Huawei users, it currently does not support the app.

Without it, you will not be able to sign up for a GXBank account.

For now, it only has Singapore’s version which does not apply to Malaysian phone numbers.

Unfamiliar Grounds

Since this is a whole new world for many Malaysians, the fear caused me to miss out on RM20 cashback in December 2023.

But, fret not, after some digging, this digital bank is regulated under Bank Negara Malaysia and each depositor is insured up to RM250,000 by Perbadanan Insurans Deposit Malaysia (PIDM).

If you too, missed out on RM20, you can still get RM16 if you sign up today! (Sidenote: You can get a GrabUnlimited subscription on Grab)

Here is how to get it:

- Download the app

- Sign up with your phone number, IC and record a video of your face

- Cash in RM88 and get instant RM8 cashback

- Register DuitNow and get another RM8 instant cashback

5. To recommend or not?

One thing we can expect in the foreseeable future is personal loans like Singapore’s version, GXS.

Another function is that foreign transactions are nothing like Wise yet, but it has the potential to offer comparative prices and services.

Additionally, we can compare with digital banks after the soon-to-be-launched Boost Bank and Aeon Bank this year.

Thus far, the experience has been friendly but GX Bank is still at its infancy stage. I have been spreading the word and recommending it to all my family, friends and colleagues.

Go get your instant cashback and use it to save more now!

If you’re looking for longer term investments, a rewarding career is the best choice to make! Invest in your future as a real estate negotiator with IQI. Join us now!