Version: CN

Rental prices are on the rise! Is this a good or bad thing for you?

Well, look no further – make way for Malaysia’s first-ever Home Rental Index!

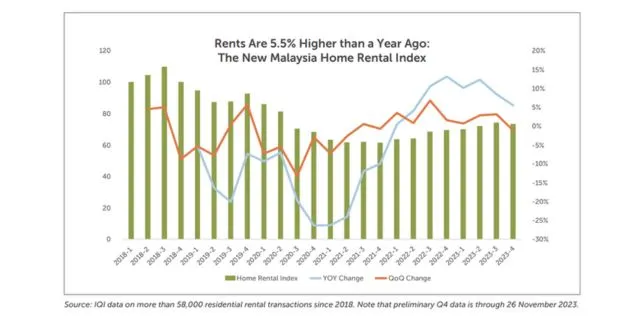

Our team at IQI presents you the Malaysia Home Rental Index, based on the analysis of more than 58,000 residential rental transactions involving condominiums, apartments, serviced residences, and flats since 2018.

This complements NAPIC’s Malaysia House Price Index, and is the country’s one and only comprehensive measure of trends in rents.

If you’re a homeowner, or you’re looking to rent, read on to find out whether buying or renting is the best choice for you.

Highlights From IQI’s Q4 2023 Rental Report

- 1. First of all, what makes the rental prices change?

- 2. Got it. What was the growth in rentals like in 2023?

- 3. Okay, but what does a higher index mean for us?

- 4. So… higher rental rates = good or bad?

- 5. But interest rates are getting higher too…

- 6. Perfect! What areas should I look into if I want to invest?

- 7. Give me another reason why I should invest in property now.

1. First of all, what makes the rental prices change?

Before you have a look at the (possibly complicated) graphs, you might first be wondering…

What factors affect the rental prices, actually?

The Malaysia Home Rental Index shifts based on factors such as:

- the balance between the supply of rental properties and the number of people looking to rent

- seasonal trends

- changes in the activity of the investors who buy properties to rent them out

In easier terms: when more people are looking for properties to rent, and if there’s a shortage of properties available, the price might go up.

If less people are looking for rentals, causing a surplus of available rentals, the price might go down.

Prices also change depending on the season such as holidays.

All of these factors play into how the Malaysian Home Rental Index rises and drops.

2. Got it. What was the growth in rentals like in 2023?

During pandemic times, rental prices saw a significant drop. The first quarter (Q1) of 2020 until the fourth quarter (Q4) of 2022 was the worst period for rents due to the COVID-19 pandemic.

However, 2023 was a year of recovery, with the index hitting its highest level since the second quarter of 2020.

The rental index today is 7.4% higher than the period of Q1 2020 through Q4 of 2022!

3. Okay, but what does a higher index mean for us?

“The performance of the Malaysia Home Rental Index in 2023 indicates increasing demand for rental properties and suggests potential further increases in 2024.”

What that means is, a higher index shows a higher demand for rentals. Which means better performance!

In Q4 2023, the Malaysia Home Rental Index was up 5.5% from the previous year, although it had fallen 1.2% from its third-quarter high.

And IQI believes that rental prices will be higher in the next 12 months, showing a continuing growth in rental demand.

4. So… higher rental rates = good or bad?

Higher rates make owning a home more expensive, which can lead to more Malaysians choosing to rent instead of buy.

That creates competition among renters for the available rental homes.

Which is great news if you are a homebuyer thinking of renting out your property!

5. But interest rates are getting higher too…

Of course, let’s not forget about the Overnight Policy Rate (OPR). The OPR has increased from 1.75% to 3% since May 2022, which contributed to higher prices.

But if you are an investor, you don’t have to worry about the higher interest rates, thanks to the rising rental rates that come with it.

Which means, the higher rental rates can compensate for the higher interest rates you have to pay.

6. Perfect! What areas should I look into if I want to invest?

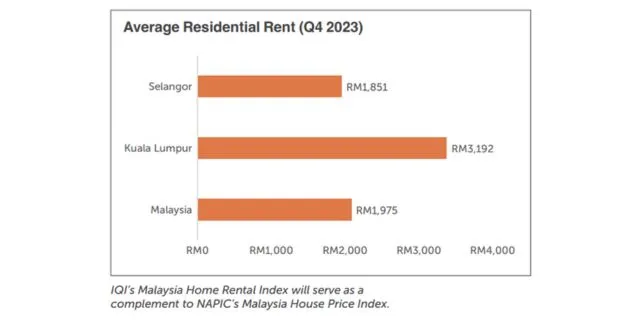

As of Q2 2023, the average gross rental yield in Malaysia is 5.16% according to IQI’s data partner, Global Property Guide.

The Malaysian rental market has proven to be very strong even amidst the challenges of the pandemic.

In 2024, expect to see increasing rental rates especially in these thriving metropolitan areas: Kuala Lumpur, Johor Bahru and Iskandar Puteri.

7. Give me another reason why I should invest in property now.

During the pandemic, one of the reasons rental rates dropped was because of the restriction of international travel.

Now that the borders are open and tourists are flocking to countries other than their own, more long-term residents, short-term tenants and international students are coming to Malaysia.

This will create a higher demand for rental properties. One of them could be yours!

This is an opportunity that you shouldn’t miss. And hey, it’s backed by data from your very own, very first Malaysia Home Rental Index. Trust the numbers.

Sign me up! I want to invest in Malaysian property now.

We’re here for you! Get in touch with one of our property professionals below, and let them guide you from start to finish.

IQI is one of the leading property agencies in the world – and the release of Malaysia’s first Home Rental Index proves so. Let us help you invest in a property by leaving your details below!

Continue reading:

1. OPR Remains at 3%: How Does This Affect Housing Loans?

2. Better Location = More Returns! 3 Strategies for Investing in Malaysian Property