Written by Shan Saeed, IQI Chief Economist

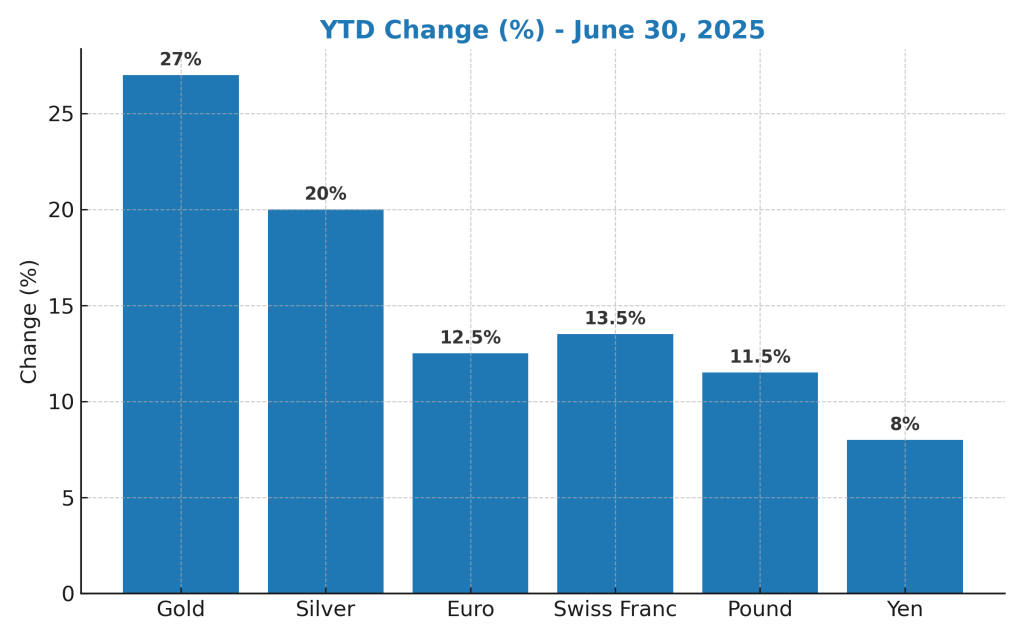

In early April 2025, President Donald Trump’s announcement of “Liberation Day” tariffs rattled global markets, with fears of a trade war driving volatility in equities, currencies, and commodities. While the initial levies caused a sharp sell-off, a quick de-escalation—reducing most tariffs to 10% by April 9 and extending similar terms to China in May—helped financial markets rebound swiftly. Although macroeconomic uncertainty eased, tariffs remain a central part of the U.S. administration’s strategy. This backdrop has influenced commodity and currency markets, with gold and silver leading strong year-to-date gains, while the U.S. dollar index has fallen sharply.

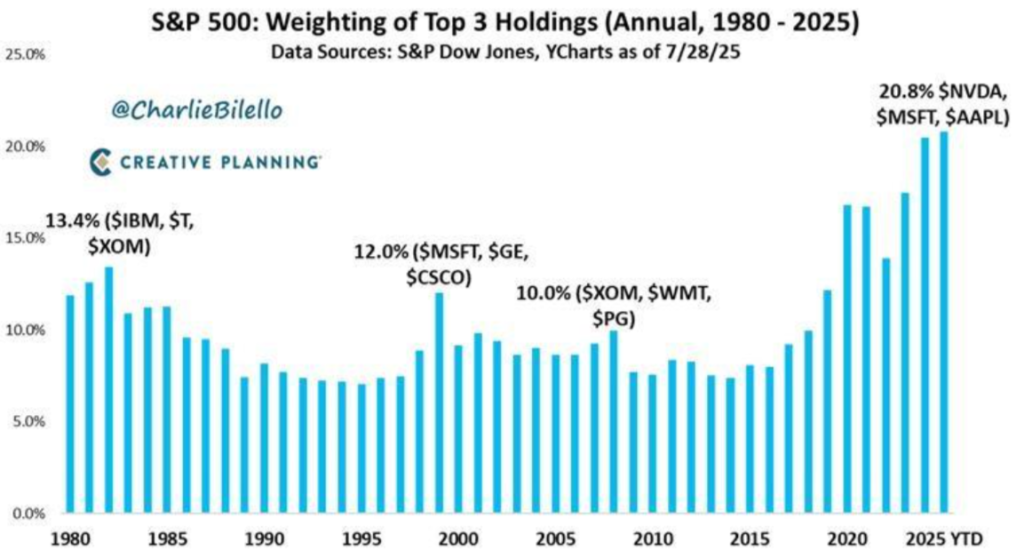

Equity markets tell a different story—market concentration in the U.S. has reached unprecedented levels, with the top 10 stocks comprising a record 40% of the S&P 500’s market cap, up from 27% at the height of the dot-com bubble. Yet, these companies contribute only 30% of total earnings, raising questions about sustainability. The world’s largest companies, led by Nvidia, Microsoft, Apple, and Amazon, dominate both investor attention and market value. Berkshire Hathaway’s record $344 billion cash position underscores a cautious stance amid “considerable uncertainty,” driven by trade policy shifts and macroeconomic headwinds.