Written by Shan Saeed, IQI Chief Economist

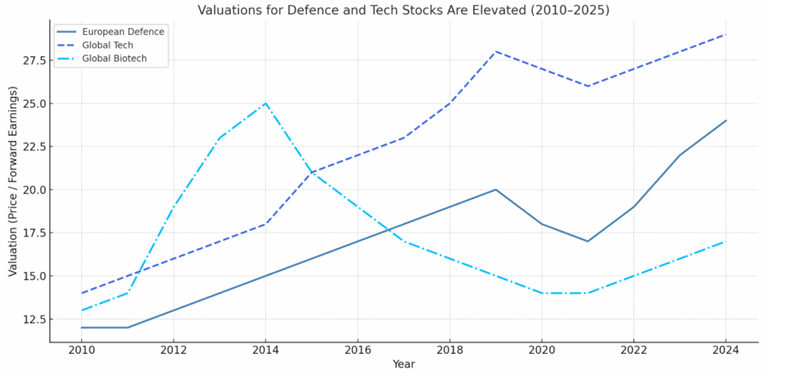

The global economic landscape in 2025 is marked by heightened uncertainty, driven by deepening geopolitical risks, volatile tariff policies, and mounting fiscal pressures—particularly in the U.S. While central banks are pivoting toward lower interest rates to sustain growth, market volatility has intensified, causing a disconnect between U.S. yields and the dollar. Despite 5% Treasury yields, the dollar has depreciated due to investor concerns over U.S. fiscal discipline and governance, especially after new tariffs and rising deficits. The “bro billionaire” tech stocks have surged 45% post-election, while small-cap “Main Street” stocks have lagged, revealing imbalances in market sentiment.

Investor focus is shifting toward tangible assets, echoing strategies from the 1970s. Weekly capital flows show major inflows into cash ($94.8bn), bonds ($15.8bn), and gold ($1.9bn), with emerging markets also gaining traction. Technology remains attractive, supported by innovation in AI, robotics, and climate tech. However, experts suggest a more selective approach to equities, favoring “growth at a reasonable price” and emphasizing real assets as protection against inflation and currency devaluation. Overall, while opportunities persist, the path forward demands careful diversification and strategic positioning in a rapidly changing global environment.