Global Market Insight - Dubai

Dubai continues to cement its position as the luxury heart of the Gulf: a global investment hub defined by ambition, innovation, and enduring confidence. As we move through 2025, its blend of economic stability, visionary development, and world-class lifestyle keeps drawing investors from every corner of the world. This guide brings together trusted insights and market data to offer a clear, data-led view of Dubai's real estate landscape - from policy shifts and price movements to rental performance and investor sentiment. Beyond the numbers, Dubai's story is one of transformation and resilience. A city that bridges East and West, where luxury living meets long-term stability for those seeking both prosperity and permanence.

Table of contents

- What Will You Learn From This Country Investment Guide

- What Makes Dubai an Attractive Investment Destination?

- How Is the Economy in Dubai Performing Right Now?

- What's Happening in the Dubai Property Market in 2025?

- How Much Can You Earn From Property Investment in Dubai?

- Where Are the Best Places to Invest in Dubai Right Now?

- What Do Our Local Experts Say About the Market?

- Can Foreigners Buy Property in Dubai? What Are the Rules?

- Tools, Tips and FAQs for Foreign Buyers

- Frequently Asked Questions

Key takeaway

- The core economic strengths that make Dubai one of the most attractive destinations for global investors.

- A detailed look at the city's economic performance, including trade, tourism, and finance the three pillars driving sustained growth.

- The latest property trends and data shaping residential and prime real estate across key districts.

- Potential returns on investment, including typical gross rental yields and what drives them.

- Expert insights on where to invest right now, from luxury waterfronts to emerging growth corridors.

- A straightforward breakdown of foreign ownership rules and the steps to buying property in Dubai.

What Will You Learn From This Country Investment Guide

Get insights into Dubai's property and investment landscape, with a clear, data-driven look at the key factors shaping the market in 2025 and beyond.

- The core economic strengths that make Dubai one of the most attractive destinations for global investors.

- A detailed look at the city's economic performance, including trade, tourism, and finance the three pillars driving sustained growth.

- The latest property trends and data shaping residential and prime real estate across key districts.

- Potential returns on investment, including typical gross rental yields and what drives them.

- Expert insights on where to invest right now, from luxury waterfronts to emerging growth corridors.

- A straightforward breakdown of foreign ownership rules and the steps to buying property in Dubai.

What Makes Dubai an Attractive Investment Destination?

Dubai's appeal as an investment hub rests on strong economic fundamentals, forward-thinking policies, and a property market that continues to outperform regional peers.

Even amid global uncertainty, the emirate stands firm; powered by diversification, innovation, and investor confidence.

A. Global Magnet for Capital and Talent

Dubai has positioned itself as the financial and business gateway of the Gulf. The ongoing expansion of the Dubai International Financial Centre (DIFC) and a steady influx of high-net-worth individuals (HNWIs) are driving deep, sustained demand across both residential and commercial property sectors.

Its open economy, world-class infrastructure, and zero income tax regime make it a preferred base for entrepreneurs, professionals, and multinational firms seeking long-term stability and opportunity.

B. Tourism Flywheel Driving Demand

Tourism remains a key pillar of Dubai's economic strength, consistently feeding into population growth and real estate demand. The emirate welcomed around 19 million visitors last year, and airport capacity is set to rise toward 115 million passengers by 2032, according to official projections.

This seamless link between tourism, residency, and property ownership continues to convert visitors into residents and ultimately, homeowners, reinforcing sustainable end-user demand.

C. Policy Tailwinds and Innovation

Dubai's policy environment is built for investors. Programs such as the Golden Visa, which offers 10-year residency for qualifying investors, and the government's push for tokenised property transactions, have broadened access to real estate ownership.

These measures not only attract global capital but also modernise the market, allowing greater transparency, liquidity, and flexibility for investors at every level.

D. Record Liquidity and Transaction Growth

Dubai's property market continues to break records. In H1 2025, total transaction values reached between AED 268 billion and AED 431 billion, with quarterly volumes exceeding 50,000 sales.

This level of liquidity signals a mature, vibrant market with depth across multiple price segments, from affordable mid-tier housing to luxury waterfront penthouses.

E. Maturing and Disciplined Market Structure

Compared to the pre-2008 boom, Dubai's property market today operates with far greater discipline and financial prudence. Loan-to-value ratios average around 80%, and developers are now required to meet stricter payment and construction benchmarks.

This structure provides a stronger foundation for sustainable growth, reducing speculative risks and ensuring that the market continues to evolve in line with long-term investor confidence.

How Is the Economy in Dubai Performing Right Now?

Dubai's economy remains resilient, supported by strong performance in trade, finance, tourism, and steady population inflows.

The city continues to advance its D33 Vision (2033), with record-breaking tourism, expanding aviation capacity, and rising global influence, all of which directly fuel real estate demand.

| Residential sales volume (Q2) | Over 51,000 transactions, marking a new record. |

|---|---|

| H1 residential sales value | AED 262-268 billion, a 36-41% year-on-year increase, according to Cavendish Maxwell, according to Cavendish Maxwell. (cavendishmaxwell.com) |

| Citywide prices (Q2) | Averaging AED 1,809 per sq ft, up 3.4% quarter-on-quarter and 21.6% above the 2014 peak, based on data from Knight Frank AE. (Knight Frank AE) |

| Prime Segment (US$10M+) | Recorded US$2.6 billion in Q2 2025 transactions, the highest on record, reported by Knight Frank AE. (Knight Frank AE) |

Metric 1

Metric 2

Metric 3

What's Happening in the Dubai Property Market in 2025?

Dubai's property market continues to display remarkable strength and maturity in 2025.

Following a post-pandemic surge, momentum remains strong across all segments from mid-range to ultra-prime, supported by population inflows, favourable lending conditions, and investor confidence.

A. Demand

The post-2020 growth trend continues, with property prices up by around 70% since end-2019. Transaction volumes in 2025 are reaching fresh records, driven by both domestic and international buyers.

The upper-tier market (US$10M+) continues to set new highs, while the mid to upper-mid segments remain robust thanks to strong end-user demand and lifestyle-driven purchasing.

B. Supply

A significant development pipeline is underway. According to JLL, approximately 250,000 new homes are expected to enter the market over the next few years - an increase of roughly 30% in total housing stock.

This expanding supply will be an important factor to monitor as the market balances sustained demand with future completions.

C. Risk and Resilience

Dubai's property sector is entering a more disciplined phase. Tighter mortgage limits (~80% LTV) and stricter land-payment requirements have introduced financial stability and reduced speculative behaviour compared to earlier cycles.

While some forecasters caution that a mild price correction could occur as supply delivers into 2026, prime and well-located zones are expected to remain resilient due to limited stock and sustained end-user demand.

2025 Headline Table

| Metric | H1 2025 |

|---|---|

| Residential sales value | AED 268 billion, according to Knight Frank AE. (Knight Frank AE) |

| Residential sales value (Gov't update) | AED 431 billion across all real estate sectors, including land and commercial properties, reported by the Government of Dubai Media Office. (Government of Dubai Media Office) |

| Sales transactions | 91,800 transactions, a 22.9% year-on-year increase, based on data from Cavendish Maxwell. (cavendishmaxwell.com) |

| Avg citywide price (Q2) | AED 1,809 per sq ft, according to Knight Frank AE. (Knight Frank AE) |

Metric 1

Metric 2

Metric 3

Metric 4

How Much Can You Earn From Property Investment in Dubai?

Dubai continues to offer some of the most attractive yields in the region, supported by strong rental demand, transparent regulations, and steady capital appreciation.

Whether buying a ready property for immediate income or an off-plan project for future gains, investors benefit from a balanced mix of liquidity and growth potential.

Below is an illustrative guide to typical gross yields in 2025. Figures vary by location, property type, and payment structure.

(Entry fees: DLD 4%, agency ~2%, service charges vary by community)

| Strategy | Typical asset | Price band | Gross yield |

|---|---|---|---|

| Ready (income now) | 2-3BR in JVC / Dubai Hills / Downtown fringe | AED 1.8-3.2M | 6-7% |

| Off-plan (staged) | 2-3BR in Dubai Hills / Emaar Beachfront / Business Bay | AED 2.0-3.5M | 7-8% (post-handover) |

Metric 1

Metric 2

Guideposts compiled from IQI Dubai investor packs.

Where Are the Best Places to Invest in Dubai Right Now?

Dubai's property market offers a wide spectrum of opportunities, from established luxury neighbourhoods to fast-growing family hubs.

Each area caters to different investment goals, whether immediate rental income, long-term appreciation, or entry into the city's prestigious prime segment.

New Projects in Dubai

A. Prime and Near-Prime Locations (End-User Depth and Global Appeal)

The city's established cores such as Downtown Dubai, DIFC, Business Bay, Palm Jumeirah, and Dubai Marina continue to attract both global investors and high-earning professionals.

These areas benefit from strong inflows from the finance sector, consistent tourism conversion, and access to premium retail, dining, and waterfront amenities.

B. Growth Corridors and Family Hubs

Emerging master-planned communities including Dubai Hills, Jumeirah Village Circle (JVC), Creek Harbour, and Dubai Islands are leading 2025's launch activity. They offer diversified price points, modern design, and strong family-oriented appeal, making them ideal for investors seeking balanced rental demand and capital growth.

C. Ultra-Prime Segment

Dubai continues to dominate the global ultra-prime market, with properties priced above US$10 million setting new records in both volume and value. Limited stock, exclusive waterfront locations, and a truly international buyer base keep this segment highly resilient and prestigious.

What Do Our Local Experts Say About the Market?

A closer look from real estate tech group Juwai IQI reveals how investor trends and activity are evolving across Dubai's property landscape. The overall sentiment remains upbeat, driven by confidence in the city's long-term fundamentals.

Experts note that in 2025, the most strategic investors will be those who understand the nuances - recognising how each segment, from luxury villas to branded residences, is moving at its own unique pace within Dubai's fast-maturing market.

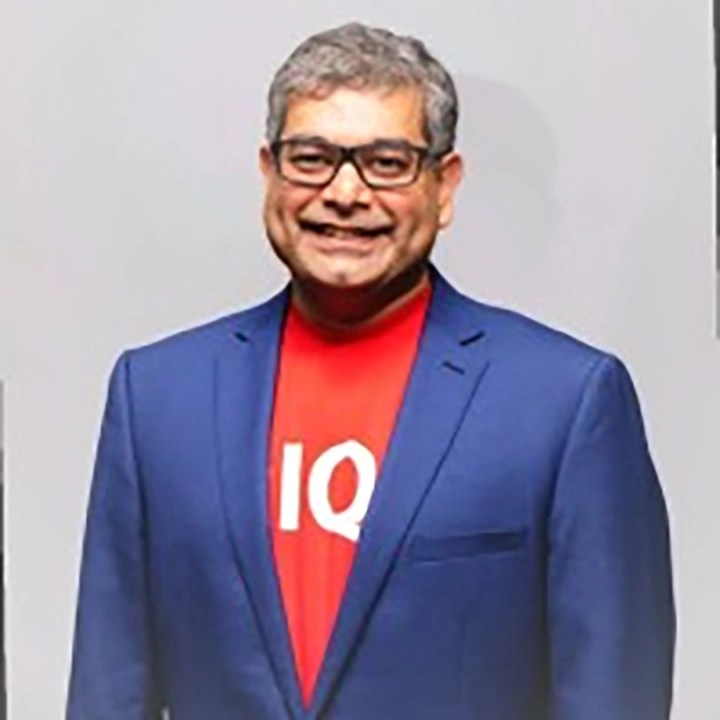

Kashif Ansari, Co-Founder and Group CEO of Juwai IQI, highlights that Dubai's real estate market has evolved into a "new global currency", one that offers unmatched stability, strong yields, and a luxury lifestyle that continues to draw investors from every corner of the world.

"Dubai and other Gulf cities are on track to surpass major global property hubs like Singapore and Hong Kong by 2030," says Ansari. "Their growing reputation as safe havens will continue to attract smart, long-term investors."

He explains that the city's rapid expansion in tourism and aviation is also driving real estate demand. "Airport and tourism growth are converting visitors into residents and homeowners," he notes, with Dubai's airports targeting a capacity of 115 million passengers by 2032.

Adding to the momentum, innovations like tokenised property and the Golden Visa scheme are widening access and fueling demand across a broader range of buyers.

Looking ahead to the final quarter of 2025, Ansari remains confident in Dubai's position. "Dubai stands out for its liquidity, high yields, and investor-friendly policies," he says.

"Three key forces will continue to power the market into mid-2026 — a rapidly growing financial hub, a robust tourism flywheel, and ownership policies that make property investment more accessible than ever."

Haroon Anwar, Managing Partner of IQI Dubai, shares why the city remains a global favourite for real estate investment. Blending ambition, comfort, and international connection, Dubai offers what few cities can.

"Over the last five years, we've seen Dubai truly booming," says Haroon. "It's shown the world that it's a dynamic, vibrant city — one that's built a sustainable lifestyle where people from Europe, Asia, and beyond can come together to do business, build great careers, and live in harmony."

He adds that Dubai's success is driven by its ability to evolve. "What was once a fast-growing market has transformed into a future-ready destination, built around sustainability, lifestyle, and global connection."

But the appeal goes beyond numbers. From luxury living to diverse, dynamic communities, Dubai delivers a lifestyle that speaks to everyone. A rare place where opportunity meets ease, and the world comes together.

For Haroon, Dubai's energy is unmatched. "That's why people choose Dubai. That's the place to be. That's the place where we want to be."

With strong investor confidence, world-class infrastructure, and policies that welcome global talent, Dubai's property market isn't just active; it's alive. And now more than ever, it's the place to be.

Can Foreigners Buy Property in Dubai? What Are the Rules?

Yes. Foreigners and non-residents can buy freehold property in designated areas of Dubai. The purchasing process is straightforward, transparent, and supported by the emirate's investor-friendly policies.

There is no personal income tax, and ownership rights are protected under well-established property laws.

Quick Rules of Thumb

Golden Visa (10-Year Residency): Available for investors with property purchases valued from AED 2 million and above. Eligible investors may also sponsor their immediate family members.

Purchase Costs: Buyers should expect Dubai Land Department (DLD) fees of 4%, an agency fee of around 2%, along with trustee or administrative charges and community service fees, which vary by development.

Off-Plan Purchases: Payment is typically structured in stages over the construction period, with handover taking place within two to three years. Liquidity tends to be lower before handover, so investors are advised to plan for a longer holding period.

Tools, Tips and FAQs for Foreign Buyers

Fast Checklist:

Investment goal

Before entering the market, start by defining your investment goal. Decide whether you are seeking immediate income through ready properties or long-term growth through off-plan developments with staged cash flow.

Neighbourhood

Focus on neighbourhoods that consistently attract tenants, such as DIFC, Downtown Dubai, and Dubai Marina, where proximity to workplaces, schools, and lifestyle amenities ensures durable rental demand.

Compare price-per-square-foot (psf) trends and absorption rates across different districts. As of Q2 2025, the citywide average stands at AED 1,809 psf, reflecting steady demand and capital resilience.

Market cycle

Lastly, monitor the market's development cycle and upcoming supply. JLL estimates approximately 250,000 new homes will be delivered over the next few years, making it essential to balance opportunity with awareness of future pipeline risks.

Frequently Asked Questions

Is it a bubble?

Dubai's market fundamentals are significantly stronger than they were in 2008. Current loan-to-value ratios average around 80%, and developers are required to make upfront land payments, creating a more stable structure.

While new supply remains substantial, some agencies anticipate a mild correction as additional projects are completed into 2026. Investors are advised to prioritise location quality, reputable developers, and a medium- to long-term holding strategy.

What yields should I expect?

Typical gross yields range between 6 to 7 percent for ready properties and 7 to 8 percent for off-plan units post-handover, before costs.

It is prudent to stress-test your investment by allowing for one to two months of potential vacancy and factoring in service charges specific to each community.

What is the average ticket size today?

The average transaction value among IQI's Dubai buyer cohort stands at USD 3.1 million in 2025 year-to-date, based on internal data.

Where can I find verified market references?

For cross-checking and deeper analysis, refer to Savills' Q2 2025 report and GlobalPropertyGuide's Dubai price history, which provide authoritative and regularly updated market data.

土地探し

理想的な土地を見つけるお手伝いをさせてください。

Disclaimer:

The information provided is for general market insight only and does not constitute financial, investment, tax, or legal advice. IQI does not solicit or compel any purchase or investment. Property values and rental returns may fluctuate; please conduct your own due diligence and consult licensed professionals before making any decisions.

References & Citations

- Where to Invest in 2025: Dubai, Southeast Asia & Global Safe Havens Report – Where to Invest in 2025: Dubai, Southeast Asia & Global Safe Havens

- Dubai 2025 Surge: A Window Into Its 2033 Report – Dubai 2025 Surge: A Window Into Its 2033

- Dubai: Global Education Leader 2025 Report – Dubai: Global Education Leader 2025

- Dubai Real Estate Market for Chinese Investors Report – Dubai Real Estate Market for Chinese Investors

- IQI Global Opens New Office in Dubai Report – IQI Global Opens New Office in Dubai

- 9 Things You Must Know Before Buying Property in Dubai Report – 9 Things You Must Know Before Buying Property in Dubai

- Juwai (Press): Dubai Real Estate Market for Chinese Investors Report – Juwai (Press): Dubai Real Estate Market for Chinese Investors

- Knight Frank: Dubai Residential Market Review (Q2 2025) Report – Knight Frank: Dubai Residential Market Review (Q2 2025)

- Knight Frank: Dubai's US$10M+ homes market (Q2 2025) Report – Knight Frank: Dubai's US$10M+ homes market (Q2 2025)

- Savills: Dubai Residential Market Report (Q2 2025) Report – Savills: Dubai Residential Market Report (Q2 2025)

- GlobalPropertyGuide: UAE House Price History Report – GlobalPropertyGuide: UAE House Price History

- GlobalPropertyGuide: Dubai House Price Index (REIDIN) Report – GlobalPropertyGuide: Dubai House Price Index (REIDIN)

- Dubai Media Office: Real estate transactions exceed AED 431bn in H1 2025 Report – Dubai Media Office: Real estate transactions exceed AED 431bn in H1 2025

- Dubai Media Office: Real estate transactions exceed AED 431bn in H1 2025 Report – Dubai Media Office: Real estate transactions exceed AED 431bn in H1 2025

- Reuters: Fitch sees potential price decline with supply surge Report – Reuters: Fitch sees potential price decline with supply surge (November 11, 2025)

- Financial Times: Market stretch & flipper risk piece Report – Financial Times: Market stretch & flipper risk piece (November 11, 2025)

Why Do Smart Investors Choose IQI as Their Real Estate Partner?

Get your financial planning right by using our simple mortgage loan calculator to find out estimates of monthly instalments, applicable interest rates and the principal amount that best suit your financial capacity

Exclusive market insights

powered by on-ground teams in 30+ countries

Data-driven strategies

using our proprietary IQI Atlas system for returns, yields, and forecasting

Award-winning agents

trained to serve local and international investors with integrity and expertise

Secure investment processes

with verified partners, legal guidance, and full transparency

Diverse project portfolios

across residential, commercial, and international markets