Written by Somsak Chutisilp, Country Head of Thailand

CONSUMER CONFIDENCE AND ECONOMIC DRIVERS

The Consumer Confidence Index (CCI) fluctuated throughout 2024 but showed a strong rebound in Q4, signaling renewed optimism among consumers.

This rebound is supported by government economic initiatives and the continued recovery of the tourism sector, both of which are expected to positively impact the retail market in 2025.

Retail Expansion and New Supply

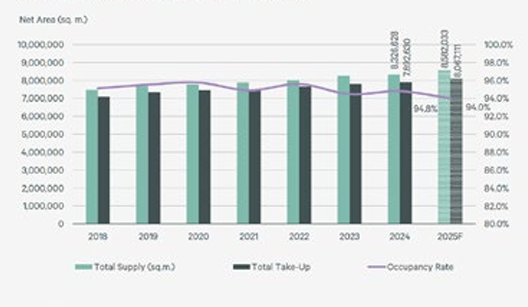

Investment in both existing and new retail centers continues to generate consumer interest and engagement. In 2024, several major retail center renovations were completed, and new openings added over 185,000 square meters of net new retail supply.

With tourism and retail closely linked, the rise in international tourist arrivals has especially benefited established enclosed malls in downtown Bangkok.

Looking ahead, the enclosed mall format is expected to contribute another 200,000 square meters of supply, which will test current occupancy rates amid growing competition.

Innovation and Consumer Trends

in a highly competitive retail landscape, both developers and brands are focused on delivering innovative products and exceptional customer experiences.

According to Oxford Economics, Bangkok consumers allocate up to 40% of disposable income to discretionary spending, with the largest share going toward food and beverage (F&B).

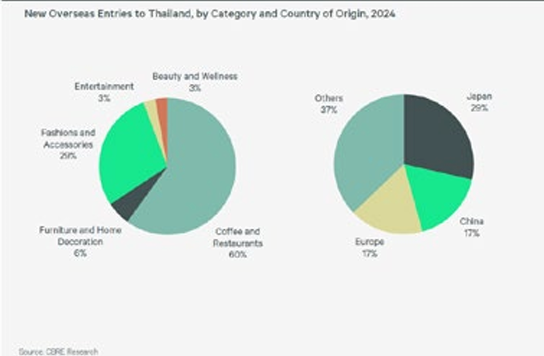

The F&B segment remains the dominant category for new international brand entries, with Japanese brands leading the way. Meanwhile, European brands continue to maintain a strong presence in the fashion and accessories segment.

With consumer demand expected to stay strong in core retail locations, many overseas brands are eyeing Thailand as a key growth market in 2025.