Written by Yousaf Iqbal, Head of IQI Canada

CANADA’S HOUSING MARKET – FEBRUARY 2025

In February 2025, Canada’s housing market showed mixed trends across regions. National home sales reached 41,118 in January, marking a 3.9% year-over-year increase but a 4.9% decline from December.

- New home listings surged by 11% month-over-month, the highest monthly increase since the late 1980s, excluding the pandemic period.

- Active listings rose by 12.7% year-over-year.

- The national average home price moderated to $670,064 in January, reflecting a 1% decline from December but a 1.6% increase from January 2024.

- The national benchmark home price stood at $709,200, showing a 0.5% month-over-month increase and a 0.2% annual increase.

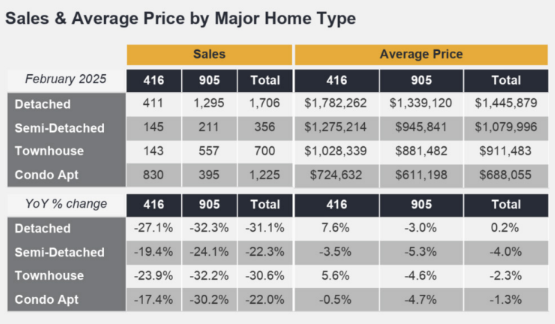

Greater Toronto Area (GTA)

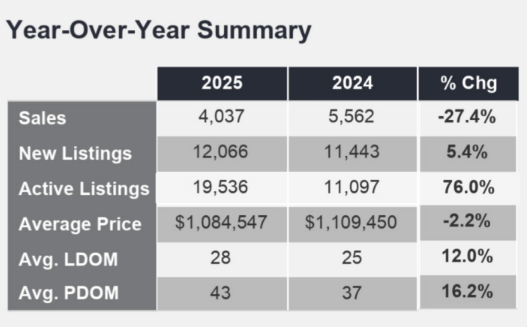

The Greater Toronto Area reported 4,037 home sales in February, down 27.4% from February 2024.

- New listings reached 12,066, a 5.4% increase year-over-year.

- The average selling price was $1,084,547, a 2.2% decline from the previous year, as high mortgage rates and economic uncertainties, including trade relations with the U.S., affected buyer confidence.

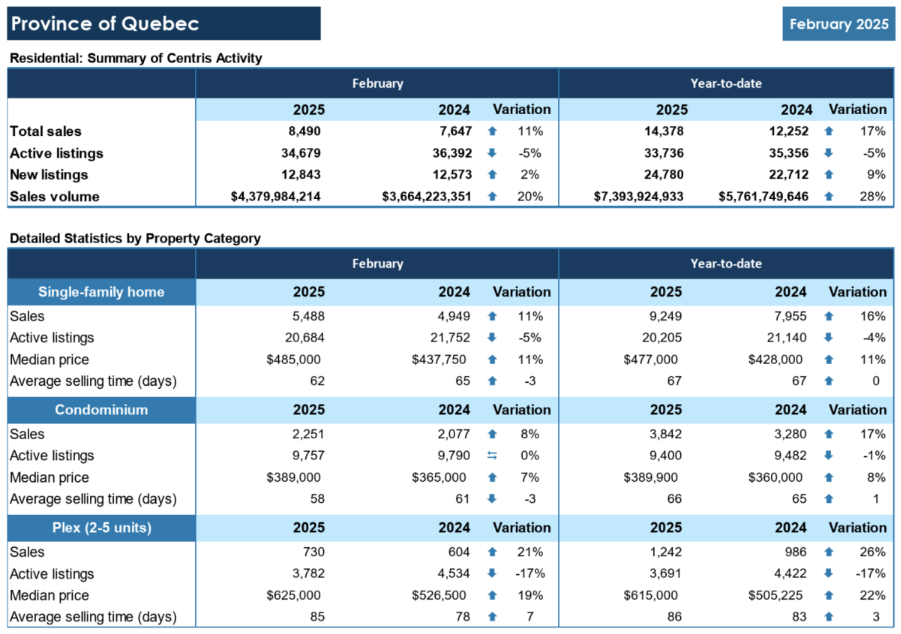

Quebec

- Quebec’s benchmark home price hit a record $501,300 in January, surpassing $500,000 for the first time.

- Montreal’s average home price rose 8.7% annually to $619,874.

- Quebec City’s average price increased to $440,495, up 0.9% month-over-month and 25% annually.

Ontario Rental Market Trends

- Ontario’s average asking rent for apartments dropped 4.7% to $2,332.

- Toronto rents fell 7.1%, averaging $2,632, driven by:

◦ Unsold condos entering the rental market.

◦ Increased purpose-built rental stock.

◦ Reduced demand due to new international study permit limits.

Bank of Canada’s Interest Rate & Housing Affordability

The Bank of Canada reduced its main interest rate by half a percentage point to 3.75% in November 2024—the fourth consecutive cut—as inflation returned to the 2% target earlier than expected. Despite these cuts, the housing affordability crisis is expected to persist for years, with high home prices and weak spending power keeping mortgage costs out of reach for many. While some regions, such as Quebec, are experiencing price growth, others, particularly Toronto, are seeing declining sales and prices due to economic uncertainty and affordability challenges.

Market Outlook

TORONTO, ON – March 5, 2025

GTA homebuyers had ample choices in February, as sales dropped 27.4% year-over-year, while new listings rose 5.4%.

- High mortgage rates and economic uncertainty, including U.S. trade concerns, dampened buyer confidence.

- TRREB expects lower borrowing costs in the coming months, which could boost affordability and sales.

- The average home price fell 2.2% to $1,084,547, while the MLS® HPI Composite declined 1.8% year-over-year.

- TRREB emphasizes the need for clear housing, trade, and economic policies to restore consumer confidence.

VANCOUVER, BC – March 4, 2025

Metro Vancouver’s housing market remained balanced in February, as new listings rose 10.9% year-over-year, following January’s surge.

- Residential sales totaled 1,827, down 11.7% from February 2024 and 28.9% below the 10-year average.

- The total number of homes for sale increased 32.3% to 12,744.

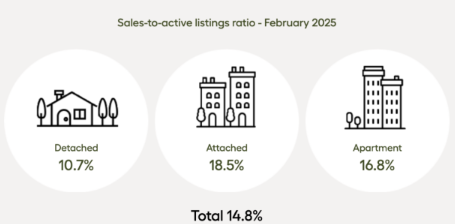

- The sales-to-active listings ratio stood at 14.8%, indicating stable prices.

- The MLS® benchmark price for all homes was $1,169,100, down 1.1% year-over-year.

With a potential Bank of Canada rate cut ahead, market activity could shift in the coming months

Quebec