By Shaen Saeed, IQI Chief Economist

“You can’t fathom the modern world without putting chips at the center of the story. Advanced chipmaking will return to America in 2025, more than a decade after the country lost its edge in semiconductor manufacturing to TSMC. TSMC is making a huge investment of more than $100 billion in Arizona… The American government hopes that chipmakers will produce almost a fifth of all leading-edge chips domestically by 2030.”

The competition is intensifying. China and the USA are vying for the top position, and semiconductors play a crucial role in shaping the global economy.

Major Players in the Semiconductor Market:

- USA

- China

- Germany

- South Korea

- Malaysia

- Netherlands

New Entrants in the Semiconductor Market:

- India

- UAE

- Japan

- Vietnam

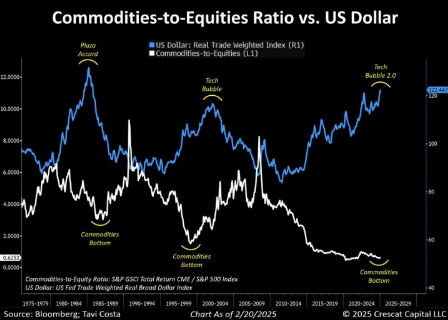

Global Re Balancing – Dollar At A Crossroad. History Repeats

Global Re Balancing – Dollar At A Crossroad. History Repeats

A graph showing the value of the stock market. In my view, we are

on the brink of a global rebalancing.

Historically, when the dollar enters a structural downtrend, hard

assets tend to significantly outperform U.S. equities.

What is the usual outcome of austerity combined with lower

rates? A weaker dollar

While fiscal consolidation is essential for restoring investor

confidence in U.S. Treasuries and reducing long-term interest

rates, one of the most immediate and effective ways to lower

government spending is for the Fed to cut interest rates itself.

This issue likely indicates that the U.S. dollar is at a critical

juncture in history, and the significance of the chart cannot be

overstated.

USA vs. Europe – Reordering Global Financial Markets

According to the Financial Times, fund managers have stated that

Trump’s Make America Great Again agenda has, instead, triggered

a Make Europe Great Again trade, which is reshaping global

financial markets.