| TL;DR NAPIC Q3 2025 data shows the Malaysian property market is stabilizing, not booming. While transaction volumes dipped slightly by 3.5%, the total transaction value surged by 12.5%, proving that serious buyers are picking up higher-quality assets. However, the overhang (unsold units) remains a concern, especially for high-rise apartments in Johor and Kuala Lumpur, suggesting buyers need to be selective in 2025. |

Does looking at property market data make you feel dizzy? You are not alone. Whether you are thinking of buying your first home or looking for a solid investment, the numbers can be confusing. Are prices going up? Is the market crashing? Should you wait?

The data is officially out, and it paints a picture of a “selectively” strong market. While fewer people are buying, those who are are spending much more.

We analyzed the huge NAPIC Q3 2025 report so you don’t have to. Here is exactly what the latest numbers mean for your wallet.

Key Takeaways

- House Prices are Stable: The Malaysia House Price Index (MHPI) grew by a tiny 0.1%, to 229.1 points, with an average house price of RM494,384.

- Smart Money is Moving: Transaction volume fell 3.5%, but transaction value rose 12.5% to RM64.39 billion, indicating a shift toward premium properties.

- Overhang Alert: The number of unsold completed homes rose to 28,672 units, valued at RM17.25 billion, driven mainly by condos and serviced apartments.

- Affordability Help: The Overnight Policy Rate (OPR) is lower at 2.75%, making loan repayments slightly easier for new buyers.

NAPIC Q3 2025 Property Market Report

1. Is the Malaysian Housing Market Recovering in 2025?

The short answer is: Yes, but it is taking a “breather” rather than sprinting.

According to the NAPIC Q3 2025 Property Market Report, the market is currently in a “stabilisation” phase. This means we aren’t seeing crazy price spikes (which is suitable for buyers), but we also aren’t seeing a crash (which is ideal for homeowners).

Let me give you an example to illustrate this: Imagine the property market is a car. In 2024, the car was speeding up. Now, in Q3 2025, the driver has taken their foot off the gas and is cruising at a steady speed. It’s still moving forward, just not as aggressively.

The average house price across Malaysia is now roughly RM494,384. While this is stable, it varies wildly depending on where you look.

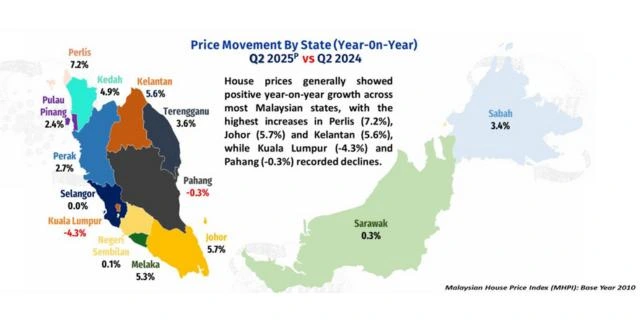

a. State-by-State Price Growth Comparison (Year-on-Year)

Here is a look at how different states performed according to the NAPIC MHPI Q1-Q2 2025 Report:

| State | Price Trend | Insight |

|---|---|---|

| Perlis | +7.2% | Highest growth due to local demand for affordable landed homes. |

| Johor | +5.7% | Strong demand driven by RTS link and industrial boom. |

| Kelantan | +5.6% | Steady local demand. |

| Selangor | 0.0% | Prices remained completely flat/stable. |

| Kuala Lumpur | -4.3% | Price correction in the high-rise segment due to oversupply. |

2. How Did Transaction Volumes Change in NAPIC Q3 2025?

This is where the data gets interesting. You might hear people say “the market is slowing down” when transaction volume declines. But that is only half the story.

According to NAPIC’s Q3 2025 Snapshots, the transaction volume (number of units sold) dropped by 3.5% to 108,250 transactions. However, the transaction value (total spend) increased by 12.5%.

a. What does this mean for you?

It means buyers are becoming pickier. Speculators who buy “cheap” units to flip quickly are exiting the market. They are being replaced by serious homebuyers and investors purchasing more expensive, higher-quality homes.

Think of it like this: Ali used to buy 10 cheap apples for RM1 each (Total RM10). Now, Ahmad buys 5 premium organic apples for RM3 each (Total RM15). Even though fewer apples were sold (volume down), the shop owner made more money (value up).

The takeaway? Malaysia property trends suggest quality is winning over quantity right now.

3. Why Overhang Property Numbers Matter to Buyers

If you are looking for a deal, pay close attention to the overhang property statistics in Malaysia.

“Overhang” refers to completed houses that have been sitting there with Certificates of Completion and Compliance (CCC) but remain unsold for more than 9 months.

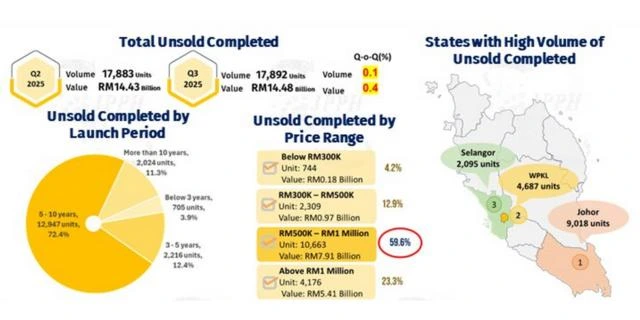

According to the NAPIC Q3 2025 Malaysia Property Market Report, the number of unsold residential units increased to 28,672. The scarier number is likely the Serviced Apartment overhang, which stands at 17,892 units.

a. Where are these unsold units?

If you are buying in these three states, you might have negotiation power because developers are desperate to clear stock:

- Perak: 3,300 unsold residential units.

- Johor: 3,293 unsold residential units (Plus a massive 9,018 unsold serviced apartments!).

- Sabah: 2,771 unsold residential units.

The data reveals that nearly 60% of unsold Serviced Apartments are priced between RM500,001 and RM1 million. This tells us that developers built too many fancy high-rises that the average Malaysian cannot afford or doesn’t want.

4. Commercial & Industrial: The Hidden Gems

While everyone is obsessed with houses, the real star of Malaysian real estate might be the industrial sector.

Based on NAPIC’s Q1, H1, and Q3 2025 snapshots, the industrial sector is stable and growing. Why? Because we all love shopping online. E-commerce requires warehouses, logistics hubs, and factories.

Industrial Supply Data (Q3 2025):

- Starts (Construction beginning): 2,747 units (huge jump from Q1).

- Completions: 2,292 units.

If you are an investor tired of residential tenants, this sector is where the growth is happening. Even shop lots are performing well, as traditional businesses like F&B and clinics continue to fill up ground-floor spaces in mature neighborhoods.

5. Should You Buy Property in Malaysia Based on NAPIC Q3 2025?

So, is 2025 the year to sign that Sales and Purchase Agreement?

The NAPIC Q3 indicators point to a safe, albeit slow, market. With the OPR at 2.75%, borrowing costs are reasonable compared to global standards.

Government initiatives mentioned by JPPH, like the Skim Jaminan Kredit Perumahan (SJKP) and tax relief for homes priced RM500k–RM750k are actively trying to help first-time buyers enter the market before Malaysia property outlook 2026 potentially sees prices rise again.

Tips:

- Buy for Own Stay: Yes. Prices are stable (flat), interest rates are decent, and you have plenty of unsold stock to choose from.

- Buy for Investment: Be careful. Avoid generic high-rises in KL and Johor unless they are near transit lines (RTS, MRT3). Look at landed properties in growing suburbs (like Perlis or the outskirts of Selangor) where demand is stripping supply.

Waiting too long might risk missing this “stabilization window.” Once surplus stock is cleared, prices usually go only one way—up.

6. Frequently Asked Questions (FAQ)

How does NAPIC Q3 2025 affect house prices?

According to NAPIC Q3 2025, house prices are stabilizing rather than rising sharply. The House Price Index grew by only 0.1%, meaning prices are effectively flat in many areas, creating a “buyer’s market.”

Which state recorded the highest house price growth in Q3 2025?

Surprisingly, Perlis recorded the highest year-on-year growth at 7.2%, followed by Johor at 5.7%. Meanwhile, Kuala Lumpur saw prices drop by 4.3%.

What is the current property overhang situation in Malaysia?

The overhang is rising. As of Q3 2025, there are 28,672 unsold residential units and nearly 17,900 unsold serviced apartments, mainly in the RM500k–RM1m price range.

Is now a good time to buy property in Malaysia?

Yes, primarily due to the stabilizing prices and the OPR being lower at 2.75%. First-time buyers can also benefit from government tax reliefs announced in Budget 2025.

What happened to transaction volumes in NAPIC Q3?

Transaction volumes dropped by 3.5%, but the total value of those transactions increased by 12.5%. This means fewer people are buying, but those who are are purchasing more expensive, higher-value properties.

Why are there so many unsold serviced apartments?

Developers overbuilt high-end units in the RM500,000 to RM1 million range in areas like Johor and Kuala Lumpur, exceeding local affordability and demand.

Are commercial properties performing better than residential in 2025?

In some segments, yes. Industrial properties (warehouses/factories) are seeing vigorous construction activity and demand amid the logistics boom, whereas high-rise residential units are facing saturation.

The market is stabilizing, meaning now is the time to spot the best deals. Don’t navigate the Malaysian market alone. Partner with IQI to find high-yield properties in growing hotspots like Johor and Perlis. Secure your future wealth, connect with an IQI today!

Continue Reading

- How to Avoid Buying an Abandoned House Project in Malaysia

- The 10 Best Affordable Housing Programmes in Malaysia

- Why Malaysia’s Tourism Boom is Creating Prime Investment Opportunities in 2025

Reference

- Fezili, F. (2025, November 19). NAPIC Q3 2025: Are Malaysian house prices rising or stabilising? Property Genie. Retrieved from

https://www.propertygenie.com.my/insider-guide/napic-q3-2025-are-malaysian-house-prices-rising-or-stabilising-K8QJZ3Z2ftMkPN4eCW2cAg - Fezili, F. (2025, November 19). NAPIC Q3 2025: Malaysia property market report & trends for homebuyers and investors. Property Genie. Retrieved from

https://www.propertygenie.com.my/insider-guide/napic-q3-2025-malaysia-property-market-report-trends-for-homebuyers-and-investors-EDbtihPQDE59kp2E3vo68F - Jabatan Penilaian dan Perkhidmatan Harta (JPPH). (2025, November 14). Siaran media: Pelancaran siaran pasaran harta Q3 2025 – pasaran harta tanah catat momentum pertumbuhan sederhana. Retrieved from

https://napic.jpph.gov.my/storage/app/media//3-penerbitan/Shahrul/Kenyataan%20Media/Q3%202025/SIARAN%20MEDIA%20LAPORAN%20PASARAN%20HARTA%20Q3%202025.pdf - Malay Mail. (2025, November 14). Malaysia’s property market posts moderate Q3 growth despite cautious sentiment. Retrieved from

https://www.malaymail.com/news/malaysia/2025/11/14/malaysias-property-market-posts-moderate-q3-growth-despite-cautious-sentiment/198323 - National Property Information Centre (NAPIC). (2025). Malaysian house price index Q1 – Q2 2025P. Retrieved from

https://napic.jpph.gov.my/storage/app/media/3-penerbitan/Shahrul/Bahagian%20Indeks%20Harta%20Tanah/Laporan%20Jadual%20MHPI/Q2%202025/Report%20MHPI%20Q1-Q2%202025P.pdf - National Property Information Centre (NAPIC). (2025). Property market Q3 2025 snapshots. Retrieved from

https://www.facebook.com/NapicJpph/posts/property-market-q3-2025-snapshotsvisit-our-portal-for-more-information-napicjpph/1427974072666227/ - Terra Group. (2025, November 15). Malaysia commercial property market 2025: Stabilising demand & new opportunities ahead. Terra Group. Retrieved from

https://terragroup.my/blogs/malaysia-commercial-property-market-2025-stabilising-demand-new-opportunities-ahead