Written by Irhamy Ahmad, Founder and Managing Director of Irhamy Valuers International

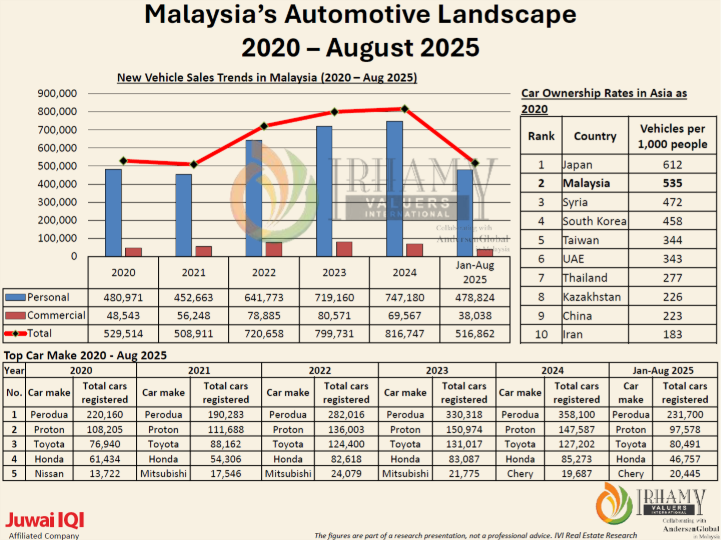

Malaysia remains one of Asia’s most car-reliant economies, with 535 vehicles per 1,000 people as of 2020—second only to Japan and well ahead of regional peers like South Korea and Thailand. The country’s Total Industry Volume (TIV) reached a record 816,747 units in 2024, a 2.1% increase year-on-year. As of August 2025, however, total registrations fell to 516,862 units, down 4% compared to the same period last year. Rising consumer costs and tighter credit conditions contributed to the dip, though Malaysia’s overall market fundamentals remain solid thanks to a growing middle class and limited public transport coverage in many areas.

Domestic brands Perodua and Proton continue to dominate, together capturing over 60% of national market share with 2024 sales of 358,100 and 147,587 units respectively. Foreign automakers such as Toyota, Honda, and Chery are also holding ground, particularly in the compact and SUV segments. While 2025 may close with slightly lower volumes, the broader trajectory for vehicle demand remains upward. Stable economic growth, rising incomes, and shifting lifestyle needs are expected to keep Malaysia firmly in the fast lane of Asia’s automotive landscape.