Written by Irhamy Ahmad, Founder and Managing Director of Irhamy Valuers International

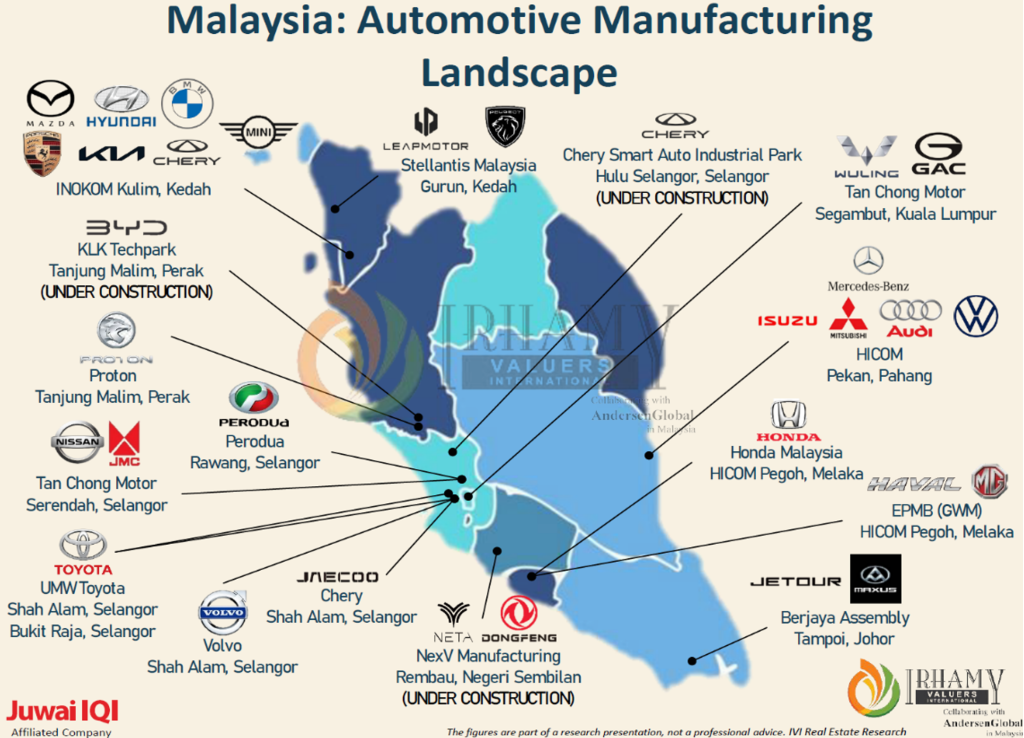

Malaysia’s industrial property market is accelerating as the automotive sector expands through rising domestic production and substantial foreign investment. Selangor remains the country’s most established hub due to its strategic access to Port Klang, while large-scale industrial growth is taking shape in Perak’s Automotive High-Technology Valley (AHTV).

Recent market data demonstrates this momentum clearly. Shah Alam industrial land now averages RM451 per square foot, with premium zones such as Shah Alam Technology Park reaching RM537 per square foot and recording more than 16 percent annual appreciation.

Figure 1: Malaysia’s Key Automotive Manufacturing Hubs

At the same time, Tanjung Malim is emerging as a fast-rising greenfield market, offering prices between RM15 and RM55 per square foot as investor demand increases.

The National Industry Master Plan 2030 has further intensified this growth, with new entrants strengthening Malaysia’s position as an automotive hub. BYD has confirmed a major CKD plant in Tanjung Malim, and both MG and Wuling are also beginning local assembly operations. This investment wave is creating a clear structural trend.

Mature industrial hubs maintain high premiums due to logistics advantages and limited land, while emerging regions like AHTV are gaining value from scalability and long-term development potential.

Together, these forces highlight how automotive momentum is directly translating into significant capital appreciation in Malaysia’s industrial land market.