Version: CN

Prime Minister and Finance Minister Datuk Seri Anwar Ibrahim has unveiled the highly anticipated Budget 2024 at 4 p.m. on October 13 (Friday), shedding light on the government’s fiscal planning and policy direction.

Let’s delve into the highlights currently piquing everyone’s interest!

Malaysia Budget 2024:

Introduction to Budget 2024

Ekonomi MADANI: Memperkasa Rakyat

(ekonomi Madani: empowering the people)

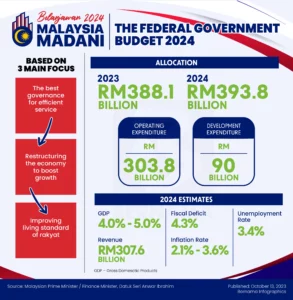

All the efforts drawn up will follow every priority and benchmark of the MADANI Economy which is broken down into three main focuses which are:

- Best governance for efficient service

- Restructuring the economy to bolster growth

- Improving the people’s standard of living

Budget 2024 is Malaysia’s largest-ever budget, at RM393.8 billion.

The increased allocation totals RM7.7 billion, representing a significant boost from the previous budget.

- Finance, Education, and Health: 42.3%

- Social sector: RM149.7 billion

- Economy sector: RM66.7 billion

- Security sector: RM40.1 billion

- General administration: RM16.9 billion

Prime Minister Anwar Ibrahim has stated that the government has taken on a debt and liabilities burden amounting to RM1.5 trillion, equivalent to 82% of the country’s GDP.

Budget 2024 Highlights

Real Estate Highlights

1. Advancement of PPR projects

An allocation of 546 million ringgit is dedicated to advancing 36 Public Housing Programs (PPR), including the initiation of a new project in Kluang, Johor.

Additionally, 15 PPR projects are anticipated to reach completion in the coming year, benefitting approximately 5,100 prospective residents.

2. Housing units under Rumah Mesra Rakyat

Under the Rumah Mesra Rakyat Programs, a total of 14 initiatives continue to progress, with an allocation of 358 million ringgit, focused on constructing 3,500 housing units.

3. Budget allocation for homes in rural areas

To assist approximately 65,000 underprivileged individuals in rural areas in building new homes or repairing existing ones, the government has allocated 460 million ringgit.

4. Allocation for maintenance and repairs

A sum of 100 million ringgit has been earmarked for the maintenance of low and medium-cost stratified public and private housing developments nationwide.

This encompasses critical repairs to water tanks, roofs, wiring systems, and the installation of closed-circuit cameras.

5. Enhancement of Skim Jaminan Kredit Perumahan (SJKP)

To benefit 40,000 borrowers, the government will enhance the Skim Jaminan Kredit Perumahan, allocating up to 10 billion ringgit for the SJKP program.

6. Flat rate for stamp duty

As a means to regulate real estate prices, the Government is proposing a flat rate of 4 percent for stamp duty on the transfer of real estate ownership by non-citizens and foreign-owned companies.

This excludes individuals who hold permanent resident status in Malaysia.

7. Revised stamp duty structure for ownership transfer

Commencing in 2024, the Government is introducing a revised stamp duty structure for instruments related to the transfer of real estate ownership involving beneficiaries who are renouncing their rights in accordance with a will, faraid, or the Partition Act 1958.

This adjustment will entail a fixed stamp duty fee of 10 ringgit, replacing the previous ad-valorem rate.

8. Relaxed requirements for Malaysia My Second Home (MM2H)

The government has also decided to ease the current requirements for Malaysia My Second Home (MM2H) applications in a bid to attract more foreign tourists and investors to Malaysia.

This enhancement of the MM2H program is anticipated to bolster investment activities within the Malaysian financial market and stimulate growth in the country’s real estate sector.

Other Major Highlights

1. High-value goods tax on luxury items

The Government is set to introduce new legislation that will impose a tax ranging from 5 to 10 percent on specific high-value items, such as jewelry and watches, depending on the value threshold of the goods.

2. Sales & Service tax (SST) increased to 8%

The government is considering a service tax hike from the current 6 percent to 8 percent. To mitigate the impact on the public, this increase will exclude services like food and beverages as well as telecommunications.

3. Mandatory e-invoicing

Starting from August 1, 2024, electronic invoicing becomes mandatory for companies with yearly revenues exceeding RM100 million. Smaller companies will adopt this gradually and will be fully compliant by July 1, 2025.

4. Sumbangan Tunai Rahmah (STR) increase

The allocation for Sumbangan Tunai Rahmah (STR) will be increased from RM8 billion this year to RM10 billion.

In the STR 2024 program, the initial payment will be raised to RM500 and will be distributed before the start of Ramadan.

5. Electricity bill rebate

Impoverished households will receive an electricity bill rebate of up to RM40 monthly, with a total allocation of RM55 million. Furthermore, the government has decided to exclude electricity bill account deposits under one’s own name.

6. PTPTN discounts

From October 14, 2023, to March 31, 2024, the government is offering PTPTN loan repayment discounts as follows:

- 10% off for full loan payments

- 10% off for payments of at least 50% of the remaining debt in one go

- 15% off for payments through salary deductions or scheduled debits

7. Continuation of LRT3 construction + My50 initiative

The government agreed to resume the proposed construction of five LRT3 stations that were canceled before, namely Tropicana, Raja Muda, Temasya, Bukit Raja and Bandar Botanik stations.

My50 initiative for public transportation will also continue.

8. Personal tax deductions

The government plans to continue offering income tax relief for EV charging expenses for four more years and tax deductions for EV rental costs for an additional two years.

They also propose raising the income tax exemption limit for childcare allowances from 2,400 ringgit to 3,000 ringgit.

Additionally, individuals or companies contributing to approved educational programs, including sports education, can now enjoy a tax deduction of up to 10 percent of their income.

To promote skill development and encourage individuals to explore new opportunities, tax deductions of up to RM2,000 for enrolling in skill-upgrading or self-improvement courses will be extended until 2026.

9. EPF & SOCSO contribution limit increase

The government will raise the monthly salary cap for SOCSO contributions from 5,000 to 6,000 ringgit. This adjustment will lead to a 20.2 percent boost in cash benefits for 1.45 million workers and their dependents.

The limit for the Government’s matching contribution under the EPF i-Saraan program has been raised to 500 ringgit per year, with a lifetime cap of 5,000 ringgit.

10. Introduction of EPF Flexible Account (Akaun Fleksibel KWSP)

EPF member accounts will undergo restructuring to enhance retirement savings. A new account, the EPF Flexible Account, will be introduced, allowing members to access their funds whenever needed.

Outlook for 2024

The 2024 budget will mark a pivotal moment for the nation’s economic development, with the government expected to introduce robust policies to provide substantial assistance to the people.

This budget is anticipated to fuel sustained economic development and contribute positively to the nation’s prosperity and the well-being of its citizens.

As we await the budget announcement, we look forward to witnessing the potential positive impact on the real estate sector and various key industries, paving the way for progress and growth.

If you’re interested in reviewing the specifics of the 2023 budget or staying updated on the upcoming 2024 budget, you can do so by visiting here.

Ready to level up your career? Join IQI and propel your success in real estate! Don’t miss out on fulfilling your dreams and become a real estate agent now!