Written by Dave Platter, Global PR Director

Japan’s property market has undergone a remarkable transformation over the past decade, shifting from years of stagnation to becoming one of Asia’s most appealing investment destinations. As highlighted by Juwai IQI Group CEO Kashif Ansari, Japan’s rebound is supported by a stable economy, low interest rates, major urban redevelopment and a booming tourism sector.

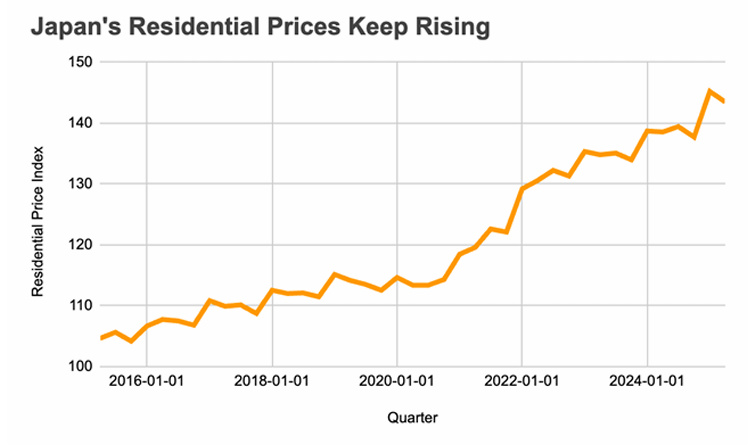

Residential land prices in key cities such as Tokyo and Osaka have been rising steadily since 2015. Foreign demand has also surged, especially from Greater China, Singapore and Western buyers, who are purchasing second homes, rental units and hospitality assets.

In 2024 alone, foreign investors poured nearly ¥740 billion (USD 5 billion) into Japanese residential real estate, driven by affordability, stability and stronger yields.

Investor appetite is expected to strengthen into 2026. Japan remains uniquely attractive due tofinancing costs that stay far below global norms, even with possible future rate adjustments. The Chinese yuan’s more than 10 percent appreciation against the yen has further boosted purchasing power, while Japanese residential assets offer rental yields around 4 percent, significantly higher than Singapore or Hong Kong.

Despite rising demand, new Tokyo condos remain roughly 80 percent the cost of similar units in China’s tier-one cities, reinforcing Japan’s value proposition. Although political discussions on foreign ownership are emerging, any restrictions are expected to remain limited, as Japan continues to rely on foreign investment to revitalise regional markets and support tourism.

With strong domestic demand and high-quality urban living, Japan’s property market is positioned for continued momentum heading into 2026.