Residential property prices across Australia are expected to grow modestly by 3% in 2025, supported by potential interest rate cuts that could rejuvenate a cooling market, according to a survey by The Australian Financial Review.

As 2024 concluded, a slowdown in the market became evident, with national residential prices dipping by 0.1% in December — the first decline in nearly two years. Sydney saw a modest 2.3% rise for the year, while Melbourne’s prices dropped by 3%, reflecting challenges such as high borrowing costs and an abundance of properties for sale.

Diverging Market Dynamics

Jo Masters, Chief Economist at Barrenjoey, forecasts further declines in Sydney and Melbourne over the first half of 2025, with prices stabilizing and gaining momentum later in the year. “Rate cuts and real income growth will drive improvement in the second half of the year, though prices are unlikely to fall overall for 2025,” she said.

While the projected 3% national growth rate for 2025 marks a slowdown compared to last year’s 4.9% increase, smaller capitals like Perth, Adelaide, and Brisbane, which experienced growth of 19.1%, 13.1%, and 11.2%, respectively, are also expected to cool as affordability challenges mount.

Auction Clearance Rates as an Indicator

Auction clearance rates, which hovered just above 50% by the end of 2024, signal ongoing market weakness, especially in Sydney and Melbourne. High stock levels in these cities further contribute to subdued price growth, with borrowing constraints likely to persist until mid-2025 when the first rate cuts are expected.

Regional Variations and Buyer Behavior

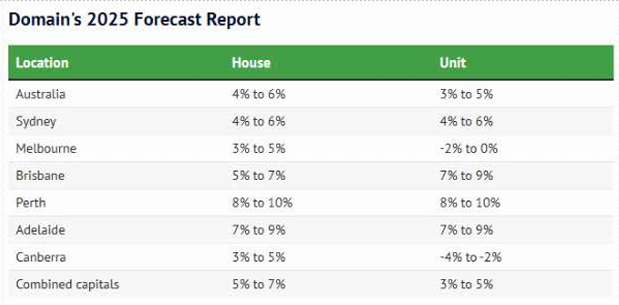

Predictions for 2025 reveal varied outcomes across the country:

- Perth: Forecast to lead with price increases of up to 10%.

- Sydney and Melbourne: Growth remains subdued, with Sydney expected to rise by just 0.6%, and Melbourne potentially seeing a slight decline of 0.5%.

- Brisbane and Adelaide: Moderate growth of 4% to 6%.

Experts, including Domain’s Chief of Research, Nicola Powell, suggest that even a single rate cut could spark renewed buyer activity, fueled by FOMO (fear of missing out) as affordability improves. This urgency may be particularly evident in areas with limited housing supply.

Challenges Ahead

However, economic uncertainties — including geopolitical tensions, a potential global recession, and subdued domestic business investment — may dampen confidence, especially in higher-end markets sensitive to volatility.

Long-Term Outlook

With affordability at its lowest level since 2008 and nearly half of gross household income required to service a mortgage, the market’s recovery will depend on how soon rate cuts occur and their impact on borrowing power. While Perth and Adelaide are positioned to benefit most, high-price capitals like Sydney and Melbourne may face

slower recovery due to existing affordability constraints.

Domain projects national price growth between 4% and 6%, with Perth leading gains and some regional markets, such as those in Victoria, potentially seeing declines of up to 5%. As the housing market enters 2025, it is poised to navigate a delicate balance of interest rate adjustments, affordability pressures, and varying local market conditions.