Relaxing the CIES to Safeguard the Northern Metropolis

Hong Kong’s residential property market has endured a three-year downturn, marked by a structural oversupply of housing units. While lower housing costs and increased availability align with social objectives, this environment has created a critical challenge—a contraction in the future development pipeline and a sharp erosion of government

land revenue.

- The number of units on disposed sites (ready for imminent construction) plummeted by 33% year-on-year to about 12,000 units in 2024.

- Government land premium income collapsed to about HKD 4 billion in the first three quarters of FY2024/25—a fraction of both last year’s HKD 13.9 billion actual income and this year’s HKD 33 billion target.

If left unaddressed, relying on market self-correction risks perpetuating a downward spiral of asset devaluation, stalling urban renewal projects, and jeopardizing strategic initiatives such as the Northern Metropolis—a cornerstone of Hong Kong’s long-term economic and social development.

The Northern Metropolis, envisioned to house 2.5 million residents and generate 650,000 jobs, demands

unwavering commitment from developers. However, their participation hinges on confidence in future demand and returns. With demand-side headwinds intensifying—sticky U.S. interest rates dampening price recovery prospects and population growth lagging—developers are increasingly reluctant to commit capital to large-scale projects

This hesitancy creates a vicious cycle:

- Prolonged oversupply suppresses developer margins, reducing their capacity to invest in future projects.

- Falling land premiums strain public finances, limiting critical infrastructure investments for the Northern

Metropolis

Activating Demand-Side Mechanisms to Resolve Structural Oversupply

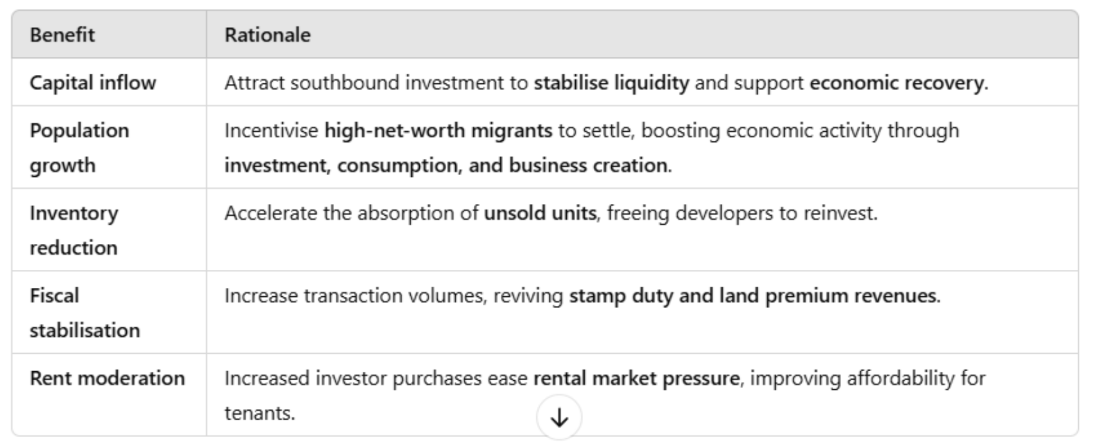

The solution to the current market stalemate lies in activating demand-side mechanisms. We propose the following targeted refinements to enhance the Capital Investment Entrant Scheme (CIES):

- Full recognition of residential property investments – Allow 100% of residential property investments to count

toward the HKD 30 million eligibility threshold under the CIES. - Remove price restrictions on residential property investment – Eliminate the HKD 50 million valuation

requirement for residential properties under the CIES.