HONG KONG PROPERTY MARKET MONITOR

Residential

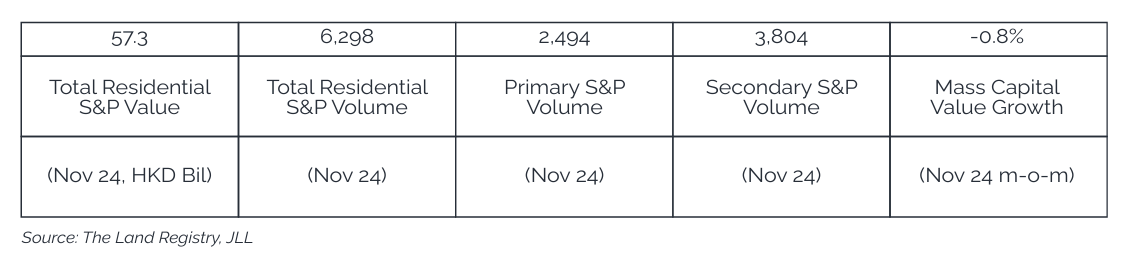

In November, the transaction volume in the primary market rose to 2,494 units, while the secondary market saw an increase to 3,804 units, resulting in an overall m-o-m increase of 34.1%. Mass residential capital values declined by 0.8% m-om in November, following a 0.9% decline in October.

In December, the HKMA issued guidelines to banks introducing a one-off special scheme to assist homebuyers who purchased uncompleted residential properties during 2021 to 2023 using stage payment plans. Under the scheme, which allows for a relaxation of supervisory requirements on the maximum loanto-value (LTV) ratio and the debt servicing ratio (DSR) limit for property mortgage loans, banks may offer mortgage loans with a maximum LTV ratio of 80% to eligible homebuyers, and the DSR limit is adjusted to 60%.

Market sentiment experienced an upswing in November, driven by the attractive pricing of new project launches. ‘101 KINGS ROAD’ in North Point sold 98 out of 157 units launched on the first day.

Among major luxury sales transactions, a unit at ’15 Shouson’ in Shouson Hill was sold for HKD 845.0 million or HKD 69,991 per sq ft, SA.

Retail

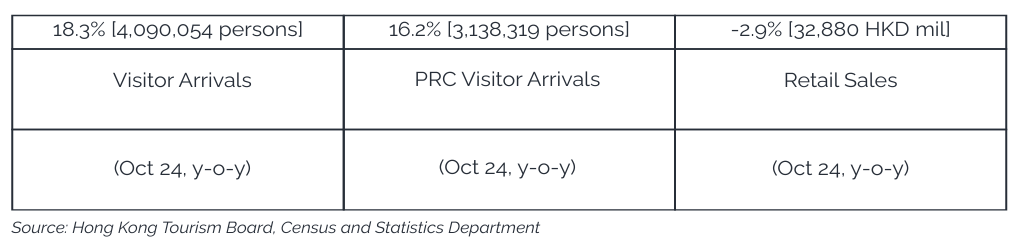

Total retail sales performance stabilized further in October, falling 2.9% y-o-y, and moderating from the 6.9% dip in September. Notably, sales of “consumer durable goods” rebounded by 4.9%, with “electrical goods and other consumer durable goods not elsewhere classified” registering a 17.1% surge. Meanwhile, online sales rebounded by 8.4%, after falling 12.1% in September.

Total inbound visitations in October rose by 18.3% to 4.1 million, resulting in a 37.0% y-o-y increase in the first 10 months of this year.

Luk Fook Jewelry plans to open a new outlet in Mong Kok’s Rex House, occupying several G-3/F shop units totaling 12,706 sq ft. The reported monthly rental is approximately HKD 600,000, representing a 40% discount compared to the rent paid by the previous tenant, Lao Feng Xiang Jewelry.

In Tsimshatsui, three G/F shops (2,580 sq ft in total) in Anson House were sold for HKD 73.98 million by Rich Capital Resources Ltd to Kanson Ltd at an estimated initial yield of approximately 4.9%, with the property currently tenanted by two eateries.