PRIME RATE REDUCED BY 25BPS FOLLOWING RECENT US RATE CUT

Residential

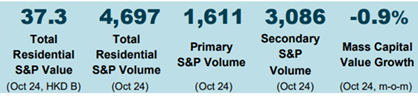

• In October, transaction volume in the primary market rebounded to 1,611 units, while the secondary market saw an increase to 3,086 units, resulting in an overall month-on-month (m-o-m) increase of 64.9%. Mass residential capital values declined by 0.9% m-o-m in October, following a 1.3% decline in September. Retail NELSON LI Head of IQI Hong Kong

• Following the US Federal Reserve’s rate cut in early November, major banks in Hong Kong reduced their Prime Rate by 0.25%, from 5.625% to 5.375%, exceeding market expectations. We anticipate that further Prime Rate reductions may be moderate, as the current cuts appear to be front-loaded. Notably, the HIBOR stood at 4.13% in mid-November, significantly higher than its level in November 2022, when the Prime Rate was raised to 5.375% and HIBOR was at 3.22%.

• Market sentiment improved in November, driven by the competitive pricing of new property launches. Cullinan Sky in Kai Tak sold 95% of its units in the first phase, with 895 units snapped up across four launches in a single day. Meanwhile, Echo House in Cheung Sha Wan sold all 198 units launched on the first day.

• Among major luxury transactions, a unit at Mont Verra in Beacon Hill was sold for HKD 260.0 million, equating to HKD 57,055 (~USD 7,300) per sq ft (saleable area). Source: 2024 Jones Lang LaSalle IP, Inc.

Retail

• Total retail sales showed signs of stabilizing, dipping by 6.9% year-on-year (y-o-y) in September, compared to a 10.0% decline in August. Most major retail categories experienced narrower sales decreases, with “jewelry, watches and clocks, and valuable gifts” moderating to a 17.9% decline, compared to the 24.4% drop in August. Meanwhile, online sales fell by 11.8%.

• Restaurant receipts in Q3 2024 declined by 1.3% y-o-y, translating to a 0.3% year-to-date drop. Among restaurant categories, bars recorded the steepest receipts decline at 24.5%, while fast food shops saw an 11.1% increase in receipts.

• Total inbound visitations in September approached 3.1 million, contributing to a 39.7% y-o-y year-to-date surge during the first three quarters of the year.

• Swatch is set to open a new outlet at a ground-floor (G/F) shop unit (1,781 sq ft) in Mira Place on Nathan Road in Tsim Sha Tsui, for a reported monthly rental of HKD 400,000, replacing Furla as the previous tenant. Meanwhile, French apparel retailer MARITHÉ FRANÇOIS GIRBAUD has leased a G/F shop unit (1,512 sq ft) on Pak Sha Road in Causeway Bay for their first store in Hong Kong. The reported monthly rental of HKD 320,000 represents approximately a 7% increase over the rent paid by the previous tenant, Basao Tea.

• In Wan Chai, several connected G/F shop units (totaling 4,300 sq ft) in the Wai Tak Building were sold for HKD 146.0 million by Allied Century Holdings Ltd to Hing Lung Properties Development Ltd at an estimated initial yield of 5.6%. The vendor is reportedly affiliated with the Tang Shing-bor family, and the property is currently tenanted by a mahjong entertainment operator.

Uncover key insights into Hong Kong’s December 2024 real estate trends. Find out what’s driving sales, prices, and listings- read the full update here!

Data extracted in December 2024