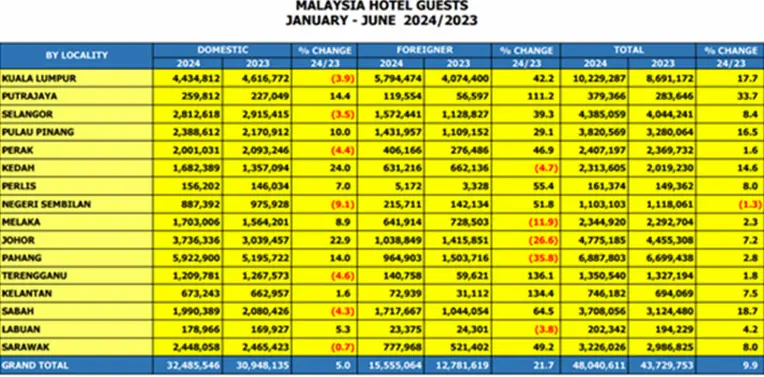

The Malaysian tourism industry is evolving, creating exciting opportunities for short-term rental investments like homestays. If you’re considering purchasing a property to transform into a profitable homestay, it’s crucial to look beyond surface-level data. Here’s an in-depth analysis of the latest data on hotel occupancy rates (AOR), guest volumes, and inventories from January to June 2024 to guide your decision-making process.

Data Analysis Findings:

1. High Occupancy Doesn’t Always Equal High Returns

Pahang recorded the highest average occupancy rate (AOR) at 74.6% during the first half of 2024. While this suggests strong demand, Pahang also has 504 hotels with over 34,000 rooms available. The high inventory means stiff competition, particularly in popular areas like Kuantan

Kuala Lumpur is another standout, attracting over 10 million hotel guests—a 17.7% increase from 2023—with an impressive balance of domestic and international travelers. However, the city is saturated with 455 hotels and 62,639 rooms. To succeed in this market, your homestay must offer something truly unique.

2. Low Supply Equals High Opportunity

Melaka, despite having a relatively modest AOR of 42.9%, presents a unique investment opportunity. With only 354 hotels and 19,997 rooms, competition is comparatively low. It’s rich heritage and steady tourist inflow suggest untapped potential, particularly for properties near key attractions such as Jonker Street or A Famosa.

3. Hidden Gems in the Data

Smaller states like Perlis (AOR: 40.8%) and Putrajaya (AOR: 55.4%) might not immediately catch your eye, but their low hotel inventories—just 44 hotels in Perlis and 12 in Putrajaya—could mean less competition and higher chances for success in niche markets.

Source: napic2.jpph.gov.my

4. How to Read Between the Lines

Investors need to understand that hotel occupancy rates are just one piece of the puzzle.

For example:

• High occupancy rates (AOR): Reflect demand but may indicate stiff competition if hotel inventories are high.

• Hotel guest volumes: Indicate tourist preferences, whether for business, leisure, or heritage travel.

• Hotel inventories: Reveal market saturation, directly impacting the success of homestays in

the area.

5. Example: Pahang vs. Melaka

• Pahang: A 7.2% increase in total guests may seem promising, but with so many hotels available, you’ll need a standout property to compete.

• Melaka: Although it experienced a smaller increase in guest numbers (2.3%), its lower hotel count creates a favorable environment for steady, long-term returns with less intense competition.

While Pahang and Kuala Lumpur may appear to be obvious choices due to their high demand, factors like competition, property prices, and unique selling points should guide your decision. Conversely, Melaka and smaller states like Perlis and Putrajaya offer opportunities for niche markets, especially for properties positioned near tourist attractions or designed with distinctive features.

Ultimately, the “best” location depends on your investment goals:

• Seeking high footfall? Explore Kuala Lumpur or Pahang.

• Looking for a quieter market with growth potential? Consider Melaka or Putrajaya.

Data should inform your decision, but understanding local trends, traveler behavior, and employing creative marketing strategies can make all the difference. Homestay investment isn’t just about picking the busiest location; it’s about understanding what guests want—and offering it better than anyone else.

To get the latest news and insights on real estate, click the image below and join our Whatsapp channel!