Entering H2 of 2022, all eyes are on global macroeconomic outlook. Food and energy prices are rising and so is the inflation rate. What can we expect from the global macroeconomic?

| Content |

Can recession take care of inflation?

The recession has arrived in many economies, including the USA, after knocking on the doors since April 2022. The market is asking: Can recession break the inflation cycle? And then commence Q.E. in the global markets. We have already mentioned in our newsletter in May, and June 2022 that 3 shocks are coming in the global financial markets, i.e. inflation shock, recession shock, and rates shock. According to the latest report from Bank of America: the coming recession has been mostly priced in by the market, and from lows on June 16, long-duration assets are up considerable: biotech 33%, China tech 31%, homebuilders 20%. All these serve to validate the bond rally.

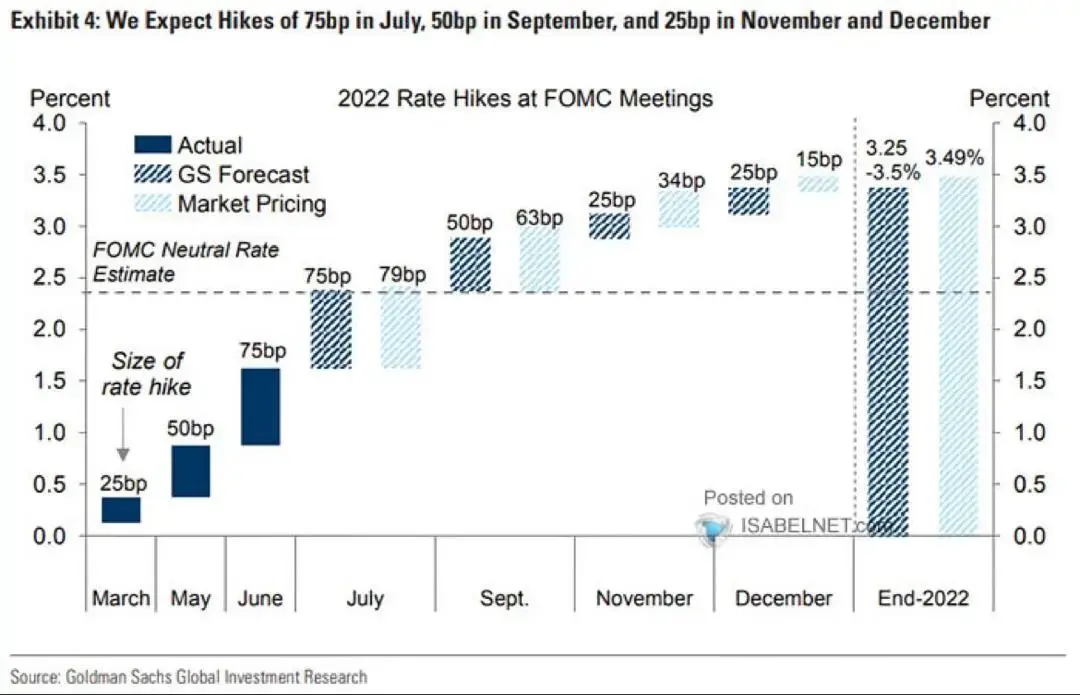

The bond market is back. Inflation remains sticky, and it is the dormant risk that Powell will do something unexpected when oil and gasoline return to all-time highs, prompting Powell to take out the heavy hawkish policy. A few points to consider: August 4, 2020, marked the lowest 10-year U.S. Treasury yield (0.5%) in the republic’s history; the past 2 years’ yield jumped 300bps to peak at 3.5% June 14. We expect the FED to hike interest rates like Goldman Sachs, Bank of America and JPM.

Rate hikes expectation in the coming months | Year-end call

| July | 75 bps | Done |

| Sept | 50 bps | Expected |

| Nov | 25 bps | Expected |

| Dec | 25 bps | Expected |

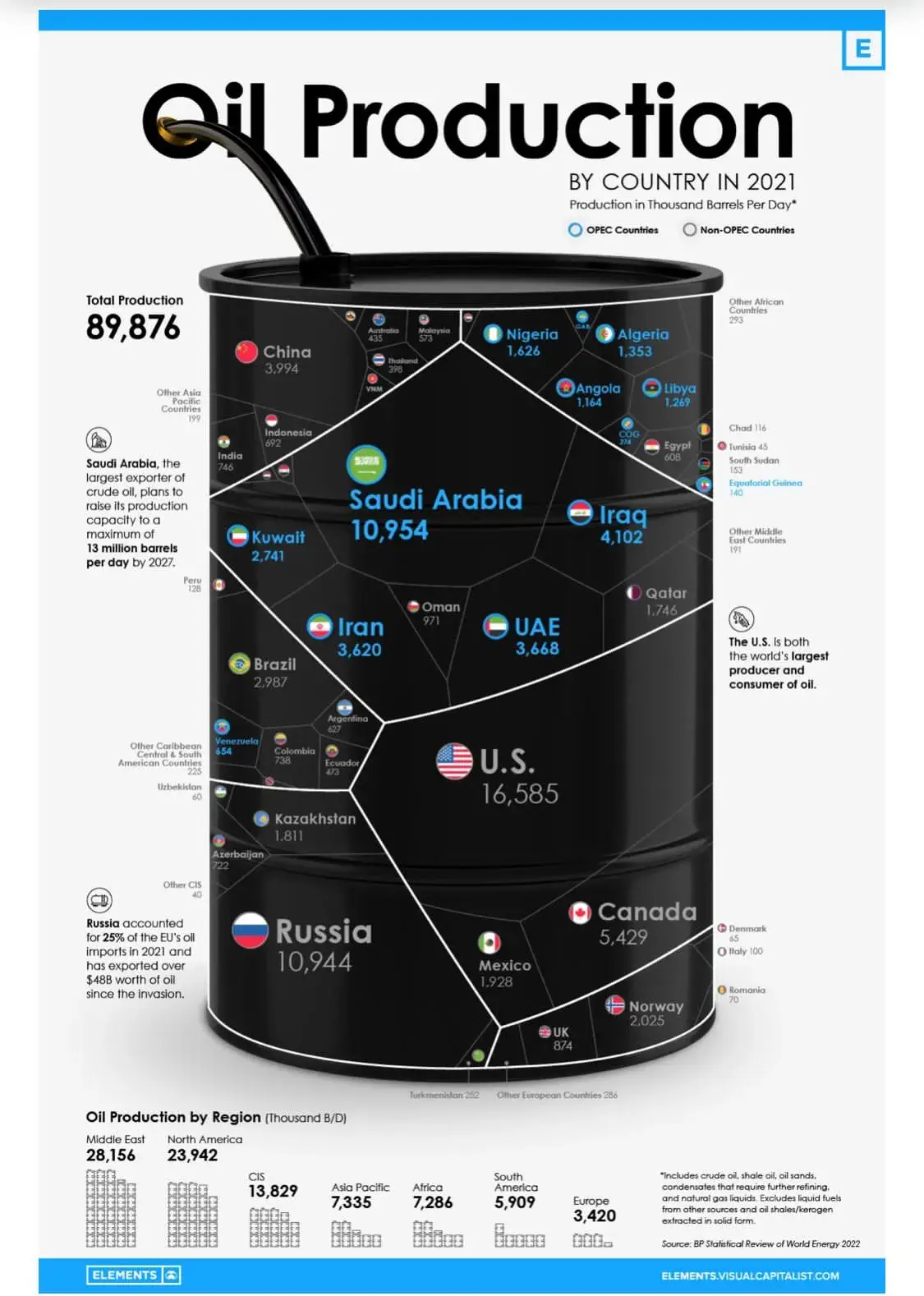

Oil Market Prices Pivot towards North | Still Bullish

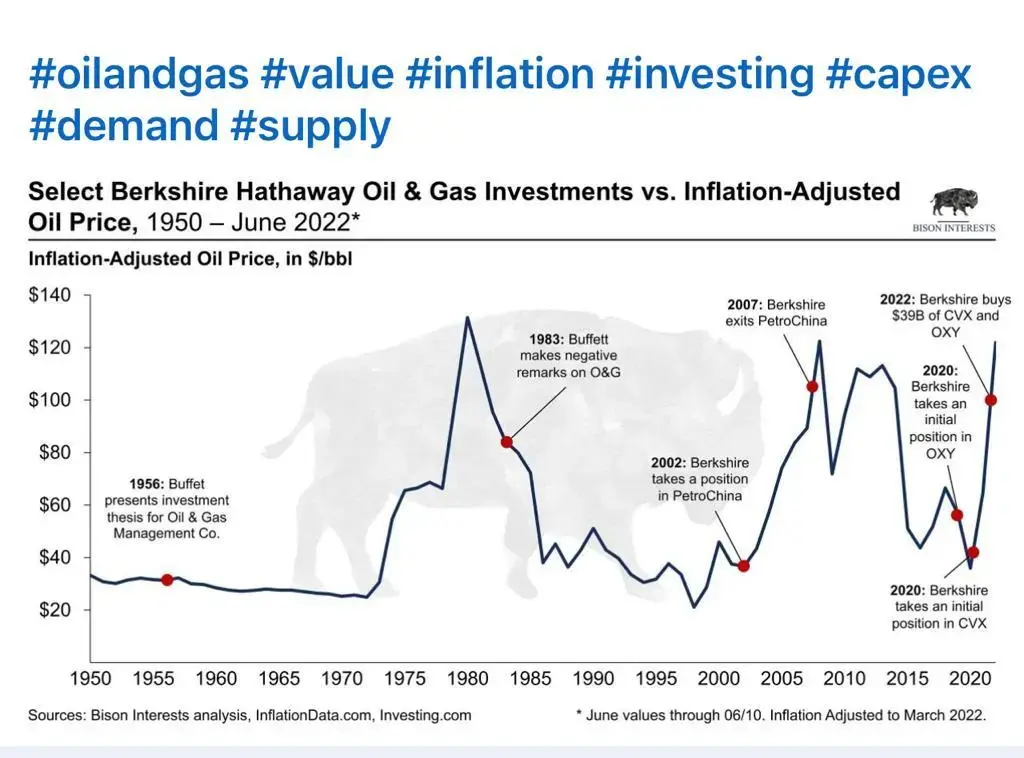

Warren Buffett is buying oil and gas stocks. According to Berkshire Hathaway’s latest 13F filing, he recently

purchased approximately $26B of Chevron (CVX) shares and $13B of Occidental Petroleum (OXY). As of the end of March, Berkshire owns about 24% of the outstanding shares of OXY and 8% of CVX. These aggressive purchases of significant stakes in large oil and gas companies indicate Buffett’s view on the sector. They are meaningful in the face of lagging sentiment and positioning in this oil bull market. The oil market is in normal backwardation, and the, i.e. Spot price is higher than the future price. Simply backwardation means a bullish trend. The oil market will meander around $110 to $150/ barrel by December 31-2022.

Mobile payment outlook

Digitalization of assets and finance is happening at a fast pace. The mobile payment market is on the upsurge. According to Statista: “China’s leading in the adoption of mobile payments. However, while the penetration rate beats all others, China’s far from leading in all things digital payments. The country’s average annual transaction value per user is still lower than a few others. The average Chinese consumer will spend roughly US$4,000 using payment apps in 2022, compared to nearly US$13,000 in the U.S. and more than US$14,000 in the U.K.

Real-time payment: 25.5 Billion

Regarding real-time payment transactions, India registered over 25.5 billion in 2020, 60% higher than China. The value of digital payments in India is projected to grow 3 times and touch US$1 trillion by 2026 compared to US$300 billion in 2021. UNQUOTE. Many other significant players in the Chinese tech scene have successfully rolled out their payment services, including J.D., Tencent and Huawei. Bestpay, meanwhile, was

launched by another state-owned actor, China Telecom. The only top brand in the list of top 8 was Apple, at a 19 percent penetration rate with mobile payment consumers.

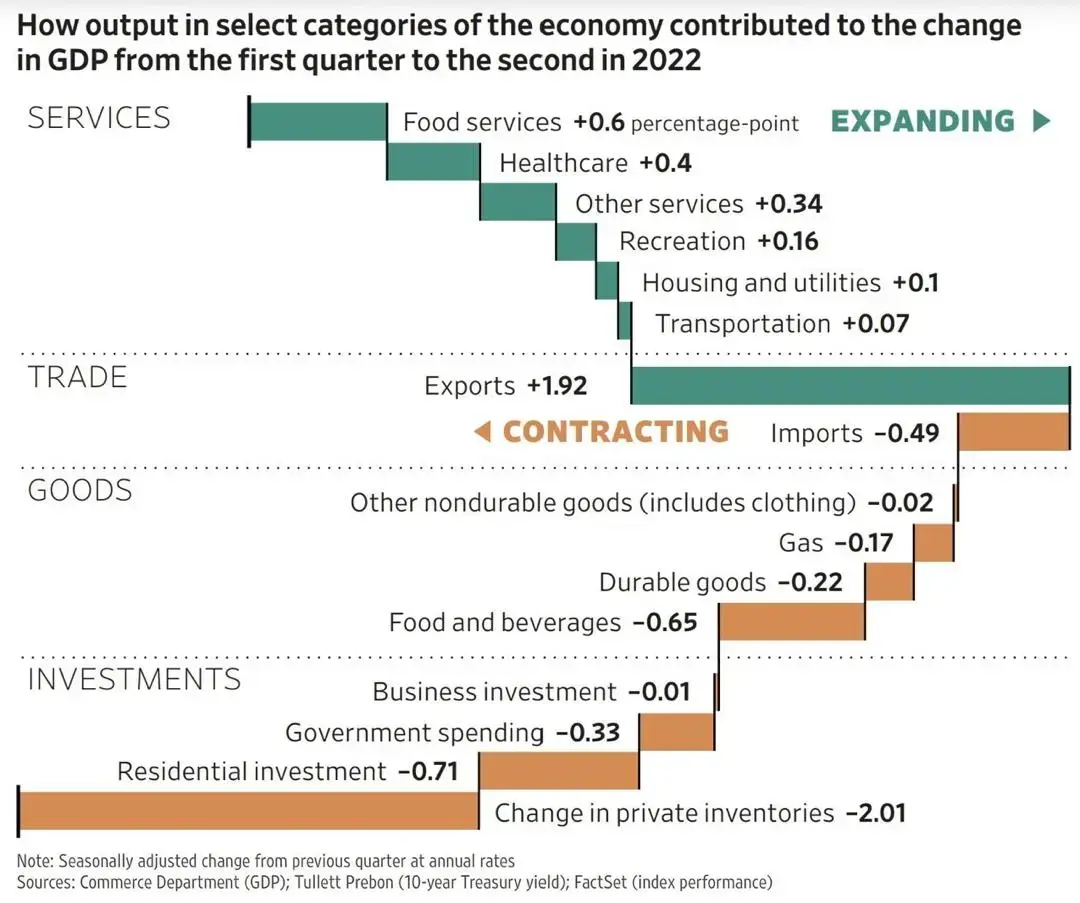

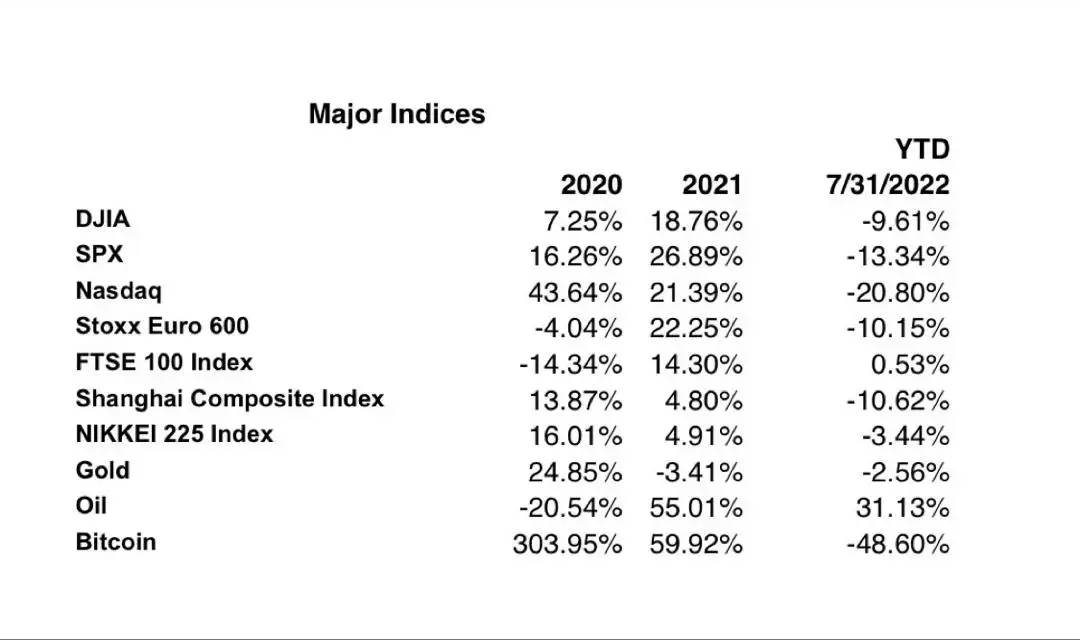

How economies & sectors are shaping up post Covid?

Selected categories of the economy contributed to the change in GDP from the first quarter to the second in 2022. Rate of return on various investments from January 1-2022, to July 31-2022. The usual monthly snapshot of financial returns for various investments.

The article is written Shan Saeed, Chief Economist at Juwai IQI.

The article is written Shan Saeed, Chief Economist at Juwai IQI.

Stay ahead of the economy news with IQI ! Interested to invest and step up your game? Leave your interest below!