Written by Shan Saeed, IQI Chief Economist

2025 begins amidst heightened geopolitical tensions, causing nervousness in equity and bond markets. Inflation is re-emerging in advanced economies, creating challenges for central banks. The debt market signals divergence, with the U.S. Federal Reserve cutting rates by 100 basis points since September, yet 10-year yields have risen from 3.60% to 4.60%, the highest since May 2024.

Richmond Fed President Tom Barkin highlights robust consumer spending and low job losses but warns of inflation risks due to wage and product cost pressures. Price-setters may pass costs along, posing challenges to inflation control.

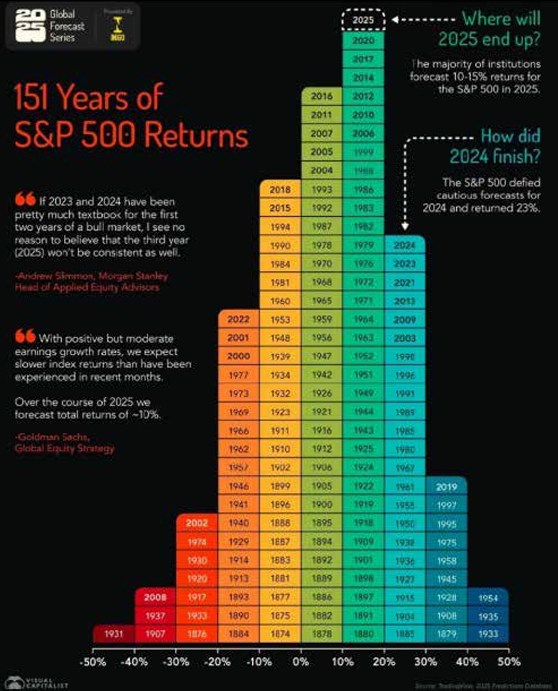

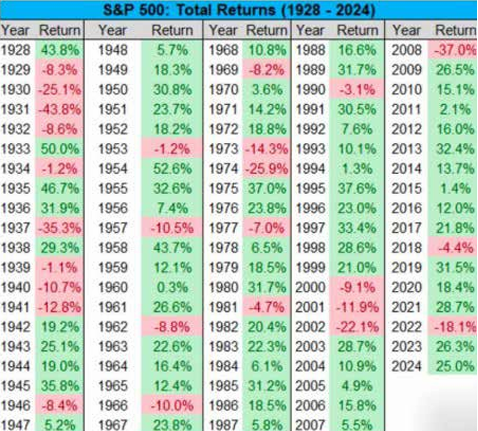

S&P global equity returns in 2024

Here’s how the S&P 500 has performed every year since 1874.

Commodities Market Outlook

- Oil: Prices forecasted at $83–$117/barrel, driven by geopolitical risks and supply constraints. Demand may reach 105 mbpd, with OPEC+ applying production cuts by mid-2025.

- Gold: Forecasted at $3000–$5000/ounce.

- Silver: Estimated at $33–$40/ounce. Geopolitical risks and supply constraints remain key factors influencing the oil market in 2025.

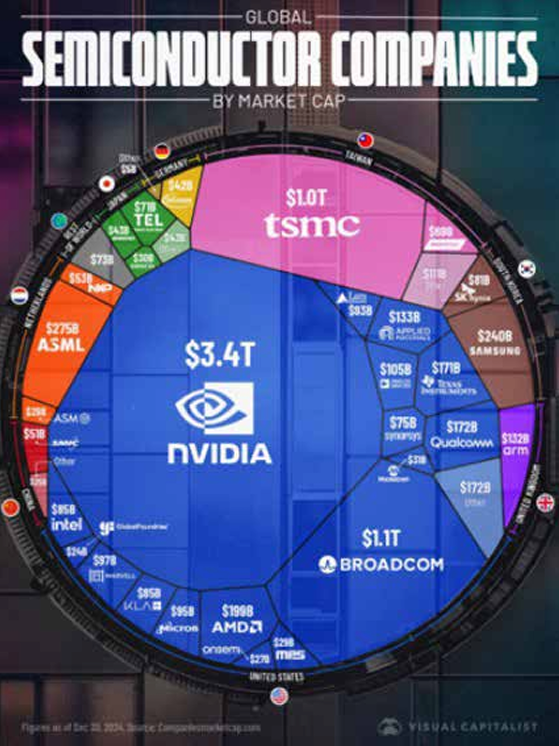

The semiconductor sector is transforming, driving global technological and economic growth.

Risks to the Global Economy in 2025

- Geopolitical Risks: Instability disrupts trade and investment.

- Climate Change Risks: Threatens agriculture and infrastructure.

- Food Security Risks: Supply chain issues impact availability.

- Cybersecurity Risks: Heightened digital threats demand protection.

- Market Adjustment Risks: Inflation and interest rate shifts pose challenges.

Investors must remain vigilant to navigate inflation and evolving risks in 2025.

Investors must remain vigilant to navigate inflation and evolving risks in 2025.