Markets Re-Enter an Age of Alchemy

The year has barely begun, yet the alchemy of global markets has already shifted. Rising geopolitical risk, the resurgence of AI-led capital expenditure, buoyant equity markets, and precious metals at stratospheric levels are rapidly reshaping the investment landscape.

Investors are no longer chasing growth at any cost. Priority has shifted to growth

with peace of mind, capital deployed with durability, visibility, and long term

sustainability, rather than fleeting momentum. Artificial intelligence has re

entered the cycle with conviction. This phase is infrastructure driven, capital

intensive, and productivity enhancing, positioning AI as a powerful GDP catalyst over the next three to five years, particularly across ASEAN, the GCC, and parts of Africa, where policy alignment and digital adoption are accelerating.

At the same time, history is reasserting itself. The 1970s are back in style. Inflation

sensitivity, geopolitical fragmentation, and currency debasement have restored real

assets to center stage. 2026 is shaping up to be the year of tangibility. Gold and silver are heading toward vertiginous levels, while real estate has evolved into a new global currency, offering inflation protection, yield resilience, and geopolitical optionality.

Markets evolve; technologies advance but history repeats. Those who grasp the convergence of innovation and real assets will be best positioned for the next phase of global economic realignment.

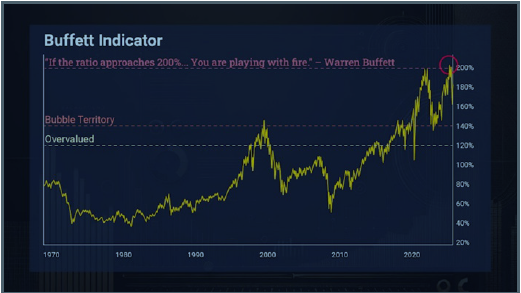

US EQUITY MARKET OUTLOOK: OVERVALUED AT PRESENT.

U.S. equities are at historic valuationextremes expectations elevated, risk

premiums compressed. The Buffett Indicator above 210% signals assets priced for perfection, driven by AI exuberance, mega-cap concentration, and excess liquidity. Buffett’s USD 330 billion cash pile says it all: at peaks, liquidity is strategy. History is clear—after valuation extremes, Real assets outperform through preservation, not speculation.

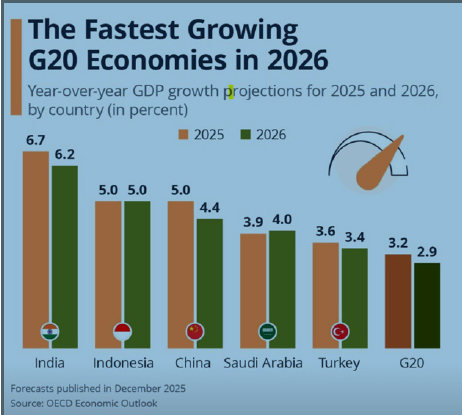

FASTEST GROWING ECONOMIES IN 2026 – OECD OUTLOOK

The latest OECD Economic Outlook (December 2025) revealed that the global economy has proved resilient last year, even though fragilities remain, with a range of risks including “elevated policy uncertainty and rising barriers to trade”. According to the organization’s forecasts, global GDP growth is projected to slow down from 3.2 percent in 2025 to 2.9 percent in 2026. As our infographic shows, among G20 economies (together accounting for around 80 percent of global GDP), some countries are expected to continue growing at a pace well above the average.

India tops the list, with a real GDP growth expected to exceed 6 percent again this year (6.7 in 2025; 6.2 in 2026), driven by robust domestic demand, digital transformation and

manufacturing growth. Indonesia follows at 5.0 percent (rate in 2025 and 2026), leveraging its young workforce and commodity exports. China, though facing structural slowdowns, remains a key player with 4.4 percent economic growth projected this year (after 5.0 percent in 2025). Saudi Arabia follows closely at 4.0 percent, buoyed by oil revenues and ambitious economic diversification efforts under the “Vision 2030” national plan

TOP COUNTRIES HOLDING RARE EARTH IN THE GLOBAL

World’s Largest Rare Earth Reserves. Rare earths are crucial for EVs, wind turbines, smartphones, batteries, and defense tech. They are heavily concentrated:

China holds nearly half the world’s known reserves and even more dominance in actual

mining and refining (~85–90% of processed rare earths). This concentration is a major

strategic vulnerability for the West, driving efforts to develop alternatives. Greenland’s

reserves are increasingly in focus especially with US interest in Arctic resources.