Written by Shan Saeed, IQI Chief Economist

The world economy stands at a macroeconomic crossroads—a juncture where fragility and instability remain embedded in the global financial tapestry. The parallels with the 1970s stagflationary decade are striking. Then, as now, the interplay of energy shocks, monetary missteps, and fiscal profligacy created a volatile economic milieu that tested even the most seasoned policymakers. Today, we confront a similar mosaic of monetary dissonance and market ructions unseen in a generation. The monetary-policy innuendos across advanced economies are surfacing with unmistakable clarity: central banks, having over-stimulated liquidity post-pandemic, now risk steering their economies toward sub-par growth trajectories and structurally higher inflation over the next two to three years.

Financial repression is quietly becoming the lexicon of the decade. Both equity and fixed-income markets are bracing for seismic adjustments as the specter of a sovereign-debt recalibration looms large. Global debt ratios are hovering near vertiginous levels, while commodity prices—especially in energy and metals—continue their upward ascent, signaling that inflationary undertones remain far from transitory. If one were to meticulously regurgitate the 1970s playbook, the analogies are unmistakable: a world grappling with geopolitical realignments, tariff volatility, and policy contradictions, leaving investors increasingly discombobulated and convoluted in judgment.

Key Strategic Questions for Global Investors

1. What will be the epitaph of this economic cycle—renewal or reckoning?

2. How will central banks orchestrate the next phase of inflation management?

3. Why are institutional investors hoarding liquidity, preferring cash as a defensive moat?

4. Why has Dubai real estate emerged as a proxy global currency—a tangible hedge against fiat fragility?

5. How high could precious metals soar in the next 24 months as monetary credibility erodes?

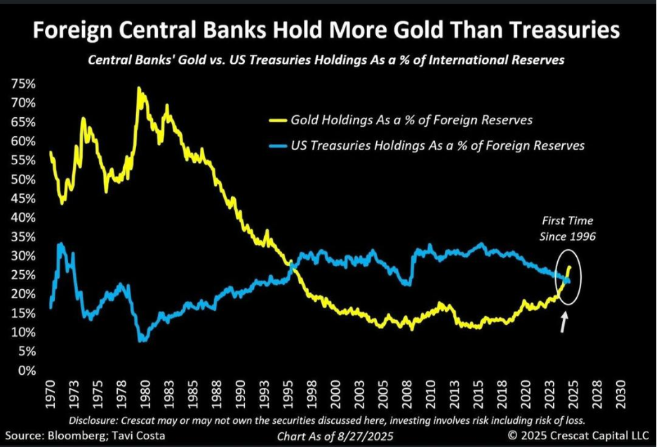

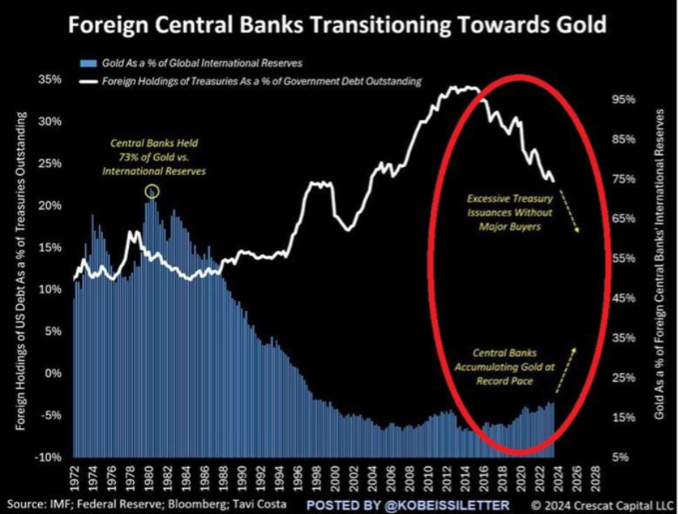

6. Why are central banks aggressively accumulating gold at a record pace?

7. Which technology giants will sustain valuation leadership in U.S. equity markets?

8. How will China leverage its dominance in rare earths and AI technology to shape the next phase of global economic leadership?

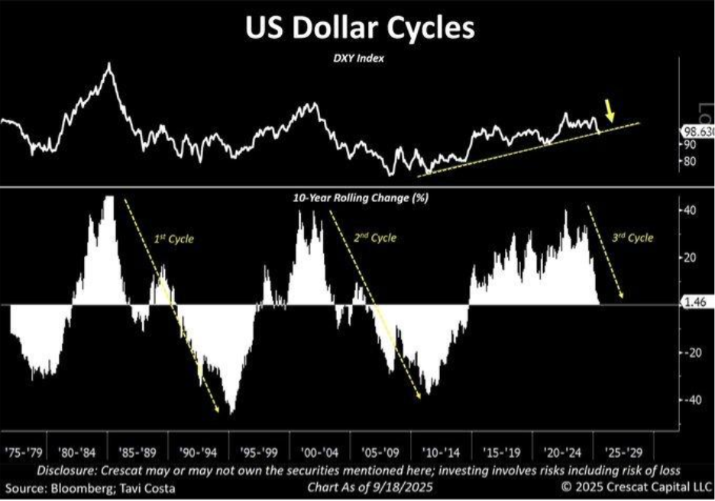

Dollar Index Outlook 2025: History Repeats — 1976–1981 Redux

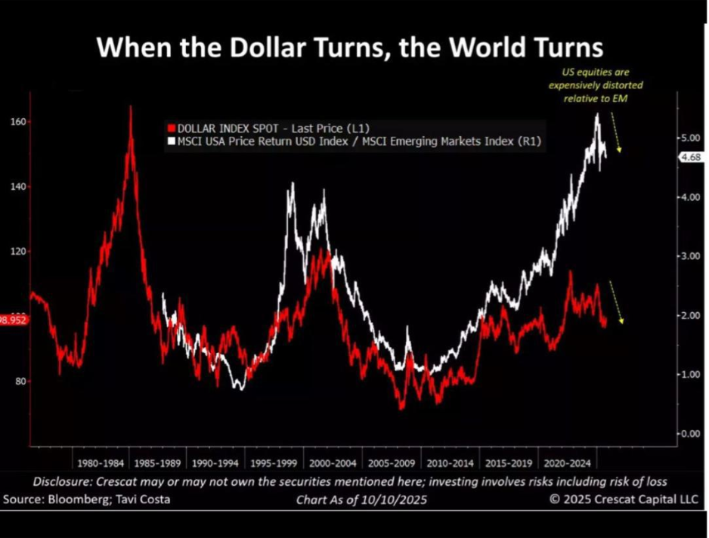

As my colleague Otavia Tavi aptly notes, conventional wisdom portrays a rising U.S. dollar as a flight to safety—a liquidity reflex in times of stress. While partially true, history suggests a deeper structural correlation: the dollar’s long-term cycles mirror the relative performance of U.S. assets versus the rest of the world.

When the dollar appreciates, U.S. assets dominate global capital flows; when it depreciates, emerging markets ascend. Yet the current macro configuration challenges the orthodoxy. Persistent twin deficits, combined with asset overvaluation and fiscal laxity, render a sustained strong dollar macroeconomically untenable. In essence, the U.S. cannot rectify chronic imbalances through a perpetually appreciating currency—quite the opposite. A weaker dollar increasingly appears to be the implicit, perhaps inevitable, policy choice to restore external balance and avert systemic dislocation. Viewed through that lens, a dollar retracement could well become the catalyst for a structural reconfiguration of global capital flows, as financial gravity gradually tilts from the West toward the Rest.